Markets Weekly podcast

7 Apr 2025

A perfect cocktail for inflation to finally take off

23 July 2020

6 minute read

Central banks are increasing their balance sheets to make sure liquidity in the economy is plentiful. This also happened in 2008/2009, but there are two differences this time. First, central banks increased their balance sheets in a faster, and more meaningful way, than in the global financial crisis. Second, banks and financial institutions already have large buffers in place compared to the previous crisis. This should limit any tightening stemming from capital reserve requirements that are already elevated.

Central banks overestimated inflation in the previous recovery. It is likely that they will let inflation run above target for a while before acting, should inflation reach those targets. A few central bankers have expressed the need to have inflation at a higher level for a while for the sake of symmetry in meeting their target.

After reaching a peak at the beginning of the last decade, globalisation has subsided in the past couple of years. US-China trade tensions and Brexit are the most visible events underlying the reversion globalisation is facing. This shift, alongside technological improvements, has played an important role in the disinflation trend seen in the past 30 years. A move to higher tariffs, partial on-shoring of supply chains and more confrontational relationships between large economic areas is likely to contribute to higher prices overall.

While the output gap will be wider in the post-pandemic world, notably with unemployment likely to settle at a much higher level than at the beginning of the year, the policy support found on the demand side could prove to be inflationary. This is especially true when coupled with the aforementioned policy-driven constrains on supply.

As we wrote in our article in May’s Market Perspectives, the current crisis creates short-term headwinds for inflation while also potentially stoking higher inflation in the next few years.

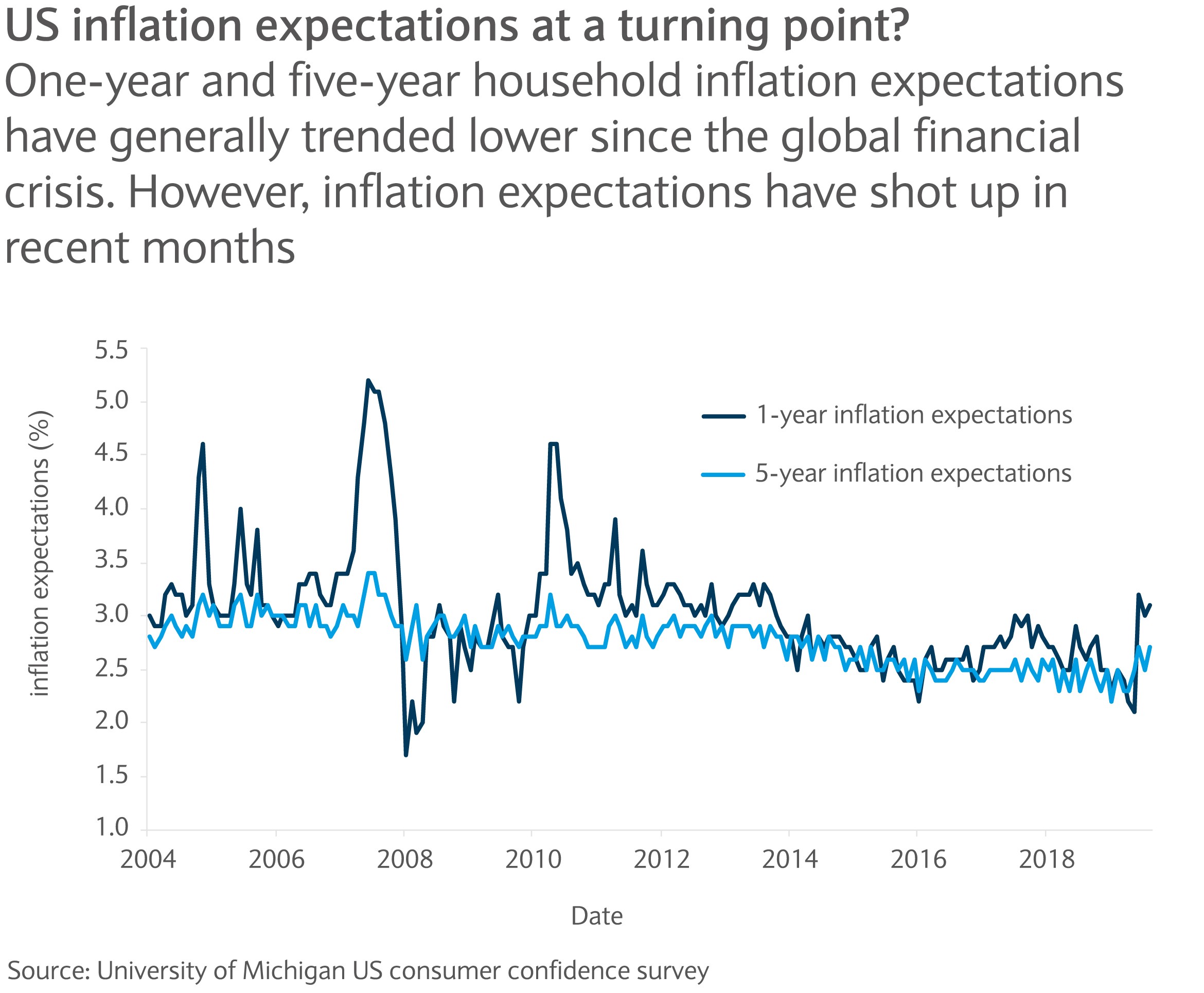

Back in May, most data indicated that markets and households were pessimistic about inflation in the short and long term. Since then, households have started to adjust their expectations slowly. To assess household expectations, we rely on the University of Michigan survey, a monthly US consumer sentiment index. The index is based on a nationally representative survey and assesses inflation expectations for the following 12 months as well as the next five years.

The latest survey, released on 17 July, shows that both 12-month forward inflation expectations and 5-year inflation expectations are at their highest levels in five years, at 3.1% and 2.7% respectively.

While US households have started to adjust their inflation expectations, the market remains of the view that inflation is unlikely to move higher in the next few years. The five-year, five-year forward inflation measure for the US, which measures what the market expects the inflation outlook to be over a five-year period, in five years’ time, reached an all-time low in March.

While the market quickly bounced back from those lows, expectations currently sit around 1.8% and remain well-below what they were at the start of the year. And when comparing the market’s expectations with the household survey, current levels are well away from those of 2014/2015, when the market was pricing future expected inflation at around 2.5%-3%.

The uncertainty around the inflation path remains high, and the gap opening up between household expectations and what the market is pricing highlight this uncertainty. We continue to believe that inflation risks over the next couple of years is probably higher than what the market is currently pricing and we see value in hedging inflation risks with real assets exposure.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.