Why just invest for the future, when you can help create it? At Barclays Private Bank, we connect global family offices to the fastest growing private companies shaping today and tomorrow. We hand-pick investment opportunities based on our deep understanding of your interests and long-term objectives, whether that’s to create a more sustainable world or safeguard wealth for future generations.

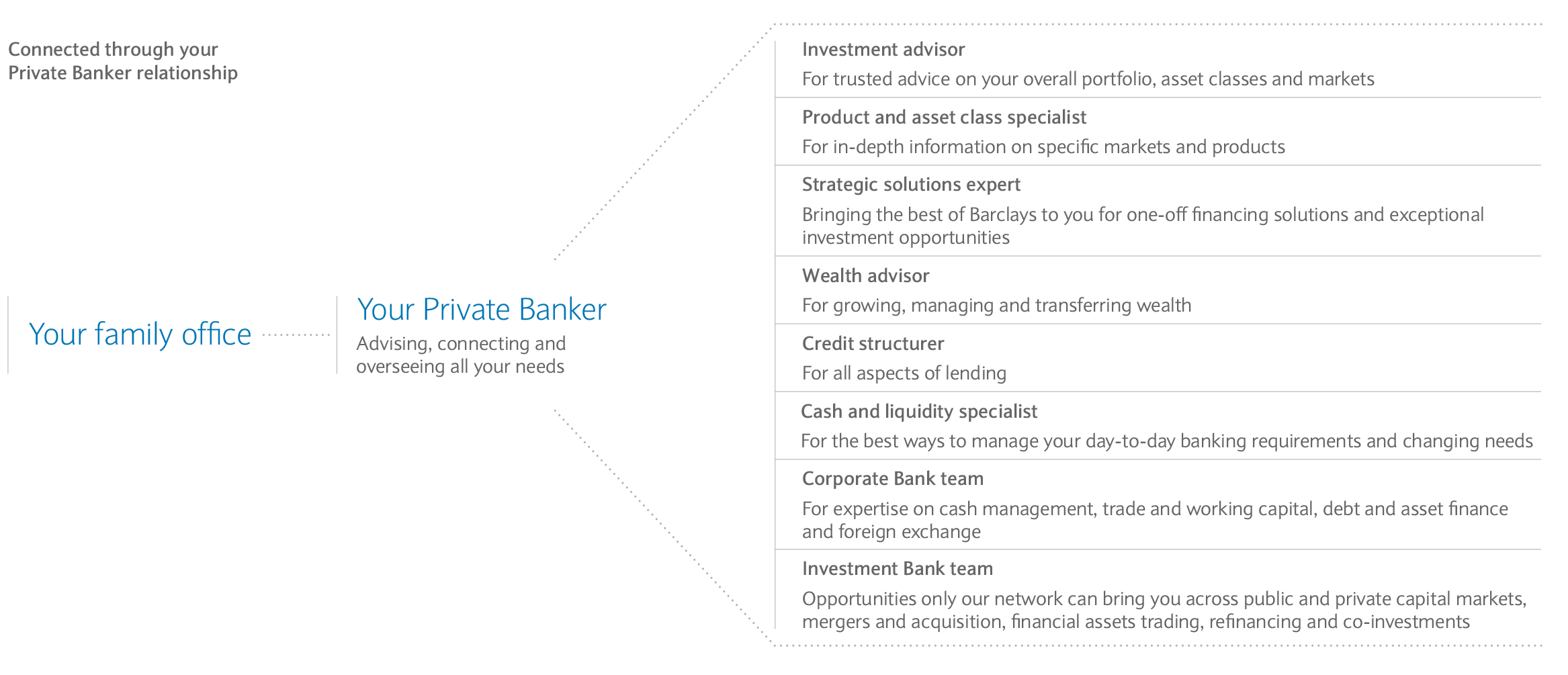

Alongside exclusive investment opportunities across public and private markets, our clients have access to international private banking, wealth advisory and philanthropy services.

At every step of our relationship, you’ll experience the benefit of working with a strong and stable partner. To your office, we’ll bring our operations in over 40 countries, as well as access to our network across the Barclays Group and beyond, including our award-winning Investment and Corporate Bank.