How to start your journey to a greener investment portfolio

This article is the first in a three-part series supporting the release of the latest edition of ‘Investing for Global Impact: A Power for Good’. For more information, please see below for additional articles and podcasts at the bottom of the page.

Please note: This report’s findings do not constitute investment advice and past performance experienced by other investors is no guarantee of future performance. This article is intended to be informative. Any specific views or opinions expressed in this article are based on the insights provided in the ‘Investing for Global Impact: A Power for Good’ 2022 report, which is developed by Campden Wealth, in partnership with Barclays Private Bank and Global Impact Solutions Today. This article does not intend to express any views or opinions of Barclays nor its directors, officers, employees, representatives or agents.

Climate breakdown is one of the greatest challenges of our time, and private investors’ capital can play a critical role in addressing it. Here we discuss some factors an investor may consider when designing a strategy to try to help protect the planet and their portfolio.

The need for climate action is increasingly urgent, with UN Secretary-General António Guterres warning at COP 27 that “the global climate fight will be won or lost in this crucial decade”1. According to the latest UN Environment Programme Emissions Gap Report, global emissions must be cut by 45% by 2030 if we are to limit global warming to 1.5 degrees and avoid the most catastrophic impacts2.

According to the UNEP report, the Paris Agreement goals can now only be achieved with “urgent system-wide transformation” to a low-carbon economy, which calls for investments of at least $4-6 trillion a year. For individuals, families and family offices, this may mean their portfolios will also need to be adapted sooner to be ahead of the colossal changes that will be required (on a wider scale).

Good intentions and good options

The good news is that the latest edition of ‘Investing for Global Impact: A Power for Good’ suggests that many of the world’s leading ultra-high-net-worth (UHNW) investors and family offices have already started taking action. The report revealed that 76% of investors surveyed factor climate change into their decisions, and 43% of all respondents said they are actively targeting investments that support the transition to a low-carbon economy3.

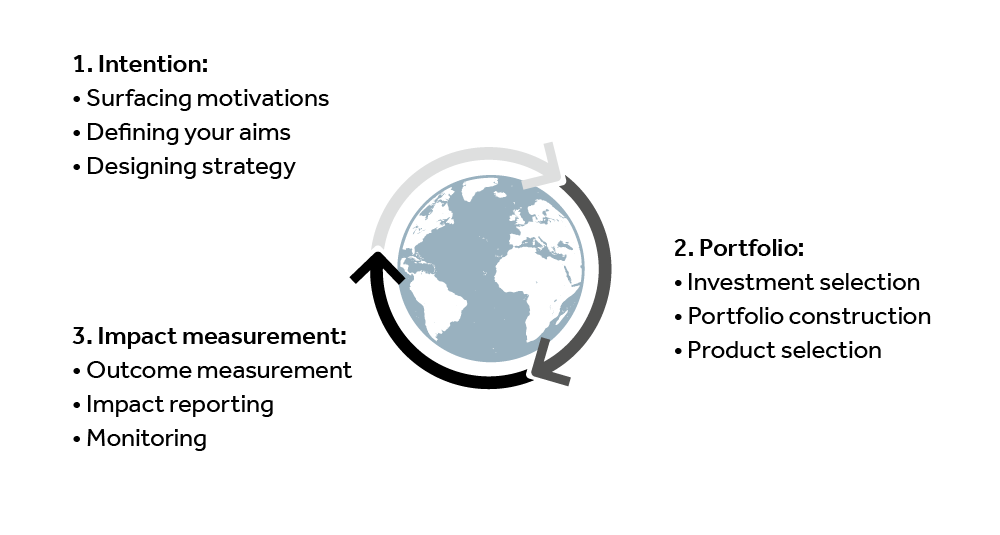

Constructing or changing an existing large and diverse portfolio to account for the risks and opportunities of climate change might feel like a major undertaking, but it doesn’t have to be. One approach is to break down the journey into three stages, starting with establishing your aims, then updating your portfolio, and finally, measuring and managing its impact.

This is the first of three articles focusing on how to adapt your portfolio to make it greener. Here we discuss how you can start your journey by setting out your intentions and aims.

The sustainable investing cycle

Source: Barclays Private Bank, January 2023

What are my and my family’s unique ambitions?

The process starts by defining your destination: if you don’t know where you want to go, you’re unlikely to get there. It’s a simple but important question of deciding, in the context of climate breakdown, what impact you want your wealth to have.

To answer that question, it’s imperative to look within, rather than outwards, to consider why climate change matters to you and your family, and how you want the world to look in the future. Are you looking to mitigate risk and behave responsibly, or to be involved in shaping that future and actively make a difference you can measure? On a tangible level, do you want to invest in low-carbon businesses, or in innovative companies that are counteracting environmental damage?

Using the Impact Management Platform’s ABC model4 can help you frame your intentions. Consider whether your aims are broadly to “A”void harm, for example, by excluding fossil fuel companies and high carbon emitters; or “B”enefit stakeholders, by investing in companies proactively seeking a positive climate impact; or “C”ontribute to solutions by investing in green projects or companies directly involved in tackling climate change.

Climate change is a large and complex issue, so spending time considering your ambitions and goals will help to clarify your next steps. It’s an issue that engages both younger and older generations, so could help unite your family around a cause and help intergenerational wealth transition. According to the ‘Investing for Global Impact’ 2022 report, 53% of respondents said impact investing helps bridge the gap between generations, and 80% said involving the younger generations will help prepare them to take on family responsibility5.

Defining your aims

Having determined your broad ambition, the next step is to solidify it into changes to be made to your investment portfolio. You may also want to consider how these changes could be implemented in your philanthropy or family business, if applicable, to increase your potential impact.

For example, are you looking to reduce carbon exposure across your portfolio to mitigate climate risk? Or are you looking to achieve a ‘net-zero’ portfolio that aligns with the Paris Agreement, like nearly two-thirds of respondents in the Investing for Global Impact 2022 report? If you are looking to make a more active contribution to tackling climate change, you might prefer to invest in earlier stage companies or projects that target specific, measurable climate outcomes to achieve your goals.

Other considerations are whether to change your portfolio in increments, and whether to reduce or eliminate fossil fuel exposure. Having a timeline in mind can also help you to benchmark your objectives and progress.

The latest ‘Investing for Global Impact: A Power for Good’ report provides a unique insight into the views of wealthy private investors on sustainable investing. In the report, Chris Bonehill explains why he believes it’s important for investors to take a long-term view, and be open to collaboration, to help companies and industries become more sustainable.

Moving towards decarbonisation requires investments for the longer term (…). The (shipping) industry needs investors with a time horizon of at least 10 years. We can achieve a lot in that time (…). Solving the climate crisis requires collaboration amongst consortiums of partners. No single person or entity can achieve this alone. While it is important to achieve a return, investors also need to share these values and be vision-mission aligned.

The Norstar Group, ‘Investing for Global Impact’ 2022

Designing your strategy

Once you have envisaged broad goals for your investment strategy and refined these into specific areas targeting climate change, it’s time to think about the best ways and options to implement them – and to consult with an independent adviser if required.

The goal here is to codify your ideas on paper, ideally in the form of a statement of investment principles, or perhaps more formally in an investment policy document. This can provide your investment managers with clear expectations, whether you’re asking them to review how your existing holdings align with your ambitions, or you’re creating a new portfolio from scratch.

It’s also an opportunity to emphasise specific sectors, topics, or themes of interest if you want to go beyond building a general climate-ready portfolio, and target areas closest to your heart, such as clean energy, sustainable agriculture, or the ocean economy.

Advisers can counsel on the practicalities of your ideas and important consequences that might arise, including potential changes to your risk profile. They can also provide feedback on putting your plan into action, including the timeline. Not everything needs to happen immediately, as traditional considerations, such as liquidity requirements, should also be factored into the decision-making process.

How can I learn more?

Ultimately, it’s about setting out a strategy and then deciding where to start. While the world needs to accelerate its efforts to combat the rapidly-rising threat of climate change, it doesn’t mean the investor response has to be hasty. Taking the time to establish a clear direction and aims is worthwhile in the pursuit of long-term returns and positive impact.

You can read the next article in our climate series, ‘How to manage your portfolio’s climate impact’, visit our dedicated Investing for Global Impact hub, or download the full report to find out more.

Related articles

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Important information

-

UN Secretary-General’s opening remarks at COP27, 7 November 2022 Return to reference

-

UN Environment Programme, Emissions Gap Report 2022Return to reference

-

‘Investing for Global Impact: A Power for Good’ 2022, Campden Wealth, Barclays Private Bank and GISTReturn to reference

-

‘Investing for Global Impact: A Power for Good’ 2022, Campden Wealth, Barclays Private Bank and GIST. For the purposes of the survey, impact investing was defined as ‘investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. More broadly called sustainable investing, investments can be made with different investment approaches, across asset classes depending on investors' strategic goals.’Return to reference