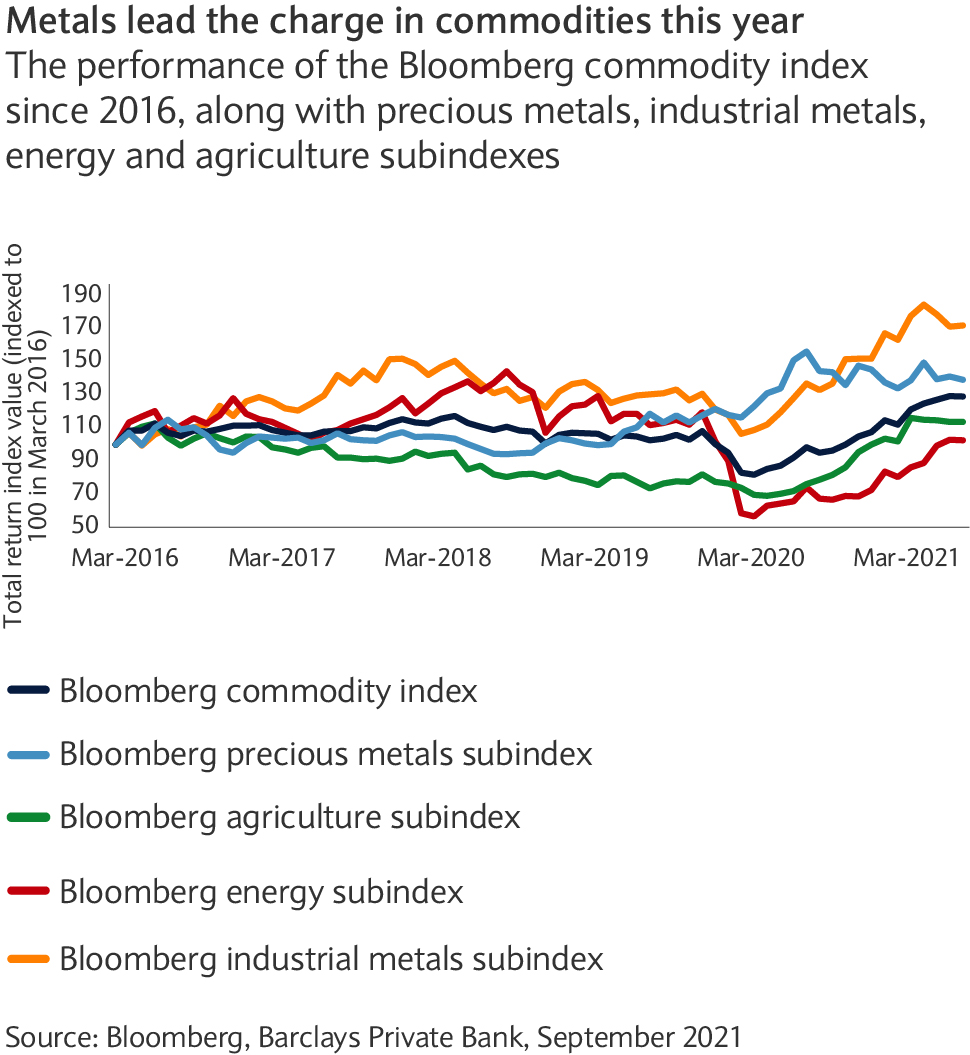

Calls for a supercycle emerging in the first quarter of the year, and commodities staging a comeback in the third quarter, keep many investors evaluating the effects of mounting price pressures. Can investors help to hedge portfolio return by investing in commodities?

Charging inflation and factory gate prices have dominated the headlines of late. Although the pace at which prices are rising is slowing, commodities continued to appreciate in the third quarter. This pushed producer prices to a nine-year high in China despite Beijing’s best efforts to cool them.

As discussed in previous Market Perspectives, commodities are a big part of the inflation basket for many countries.

As such, the recent rally needs to be evaluated against longer term inflationary implications. This helps to better understand whether its impact on inflation might catch investors and central banks off guard and how best investors might be positioned. To answer these questions, we must analyse the drivers behind commodity prices.

The impact of green initiatives

Somewhat paradoxically, although producing aluminium is not climate friendly, the metal itself is used in technologies such as electric vehicles and solar panels. With green demand therefore rising at the same time as supply is declining, it’s unsurprising the metal is soaring past the $3,000 ton mark.

Green demand has also accounted for a lot of the rise in nickel and lithium, largely down to electric vehicle batteries, with demand particularly rising in China. Simultaneously, depleting stocks of lithium battery materials in China and nickel supply falling short despite a 300,000 ton increase of Indonesian nickel supply this year, have supported both metals.

Energy plays its part

On the energy front, oil is recovering strongly this year, natural gas has hit seven-year highs and coal also set a new record.

While the transition to cleaner energy is underway and regulation makes using all three energy sources less favourable, demand remains strong. This even applies to coal, with China and India accounting for 65% of coal use.

Both oil and natural gas supply have been affected by Hurricane Ida in the US. The International Energy Agency estimates that once losses are fully tallied, the events may have cut 30 million barrels of US offshore oil output. Three quarters of natural gas production in the Gulf of Mexico has also been lost.

Natural gas prices already had a boost from weather conditions and technical supply shortages in Russia. A warmer than anticipated summer increased demand through air conditioning. Going into the hurricane, supplies were already stretched in the US, and the prospect of limited additional supply from Russia has led to significantly higher gas prices in Europe.

Oil has also seen support as a result of OPEC+ standing strong against pressures to increase production at its September meeting, in addition to regulatory pressure and increased demand with the vaccination helping economies to reopen.

Soft commodity sectors

In the softs sector, weather has dominated the narrative and resulted in shortages and lower crop yields. Extreme weather conditions in Canada, Europe and Russia have driven wheat and corn futures higher, feeding through to soybean prices breaking record highs. Hurricane IDA restricted production in 118,000 acres of sugarcane crops in Louisiana, with sugar reaching a four-year high.

Has the rally got more legs and what does this mean for inflation?

Commodity price rises are likely to keep translating into inflationary pressures for some time. Historically, commodities have illustrated their effectiveness as an inflation hedge and could be used to dampen inflationary pressures in a portfolio context.

Our cross asset article shows each commodity subsector positively correlated to rising inflation and positive inflation surprises. However, longer term, there are some drawbacks to the whole commodity complex seeing further uplift.

Output cuts and supply shortages

Restrictions in Chinese output of aluminium will encourage new capacity in other parts of the world. Countries such as Russia, Malaysia and India, along with the Middle East region investing in new capacity, might alleviate price pressures. Also, the production of aluminium can be made greener, which would limit the regulatory constrained output of the metal.

Supply shortages arising from adverse weather conditions tend to be temporary as opposed to a permanent phenomenon. We have seen this historically, especially in the softs sector.

Effect on economic recovery

The potential impact of commodity prices on the health of the economic recovery is a clear risk. That said, further oil price rises seem limited in the short term due to the likely dent in the economic recovery it would cause. Also, higher oil prices may incentivise both members of the wider Organisation of the Petroleum Exporting Countries grouping (OPEC+) like Russia to deviate from the production agreement with other members of the group. Non-OPEC producers such as the US may come back online too.

The knock-on effect of more COVID-19 cases sparking further economic restrictions also hovers in the background.

We anticipate that price pressures may remain, and demand is unlikely to fade for commodities that will be essential for the green revolution and renewable energy. Metals such as lithium, nickel and copper fall into this category.