With yields on government bonds anchored to ultra-low levels, is it time to consider investing in private credit markets to obtain higher yield along with less risky returns?

Private markets have performed remarkably well in the last two years, despite the impact of the COVID-19 pandemic. The combination of accommodative fiscal and monetary policy, lower-for-longer interest rates and the fast-paced recovery in equity markets, have been key factors behind this.

The boost to sentiment is particularly apparent in buyout and venture capital strategies, with one-year horizon net internal rate of returns (IRRs) of 45% and 56.4% respectively in March 2021, according to private market researcher Preqin.

Buyout funds to the fore

Driving the performance in buyout funds, in particular, is the recovery in equities, which has reduced the uncertainty around exit values. According to private market researcher Preqin’s survey, covering the second half of 2020, 45% of respondents cited concerns over the exit environment going into this year.

However, a general receptiveness to initial public offerings (IPOs) and strong merger and acquisition (M&A) activity have played their part in supporting exit values. Furthermore, special purpose acquisition companies (SPACs) have enhanced the pool of buyers. As a result, the same survey for 2021 sees only 16% of investors concerned about exit values next year.

Technology prospers from venture capital activity

Within venture capital strategies, technology has seen significant growth since the outbreak of the pandemic. Intuitively, this makes sense as COVID-19 has accelerated the trend towards a more digitalised world, where software and cloud computing become the norm as opposed to hardware.

As we highlighted in Time to consider private market technology in March, technology companies staying private for longer, and offering the potential to access innovation and technology in a more disruptive fashion compared to large-cap tech firms, are noticeable tailwinds for the strategy.

Differing performance of strategies

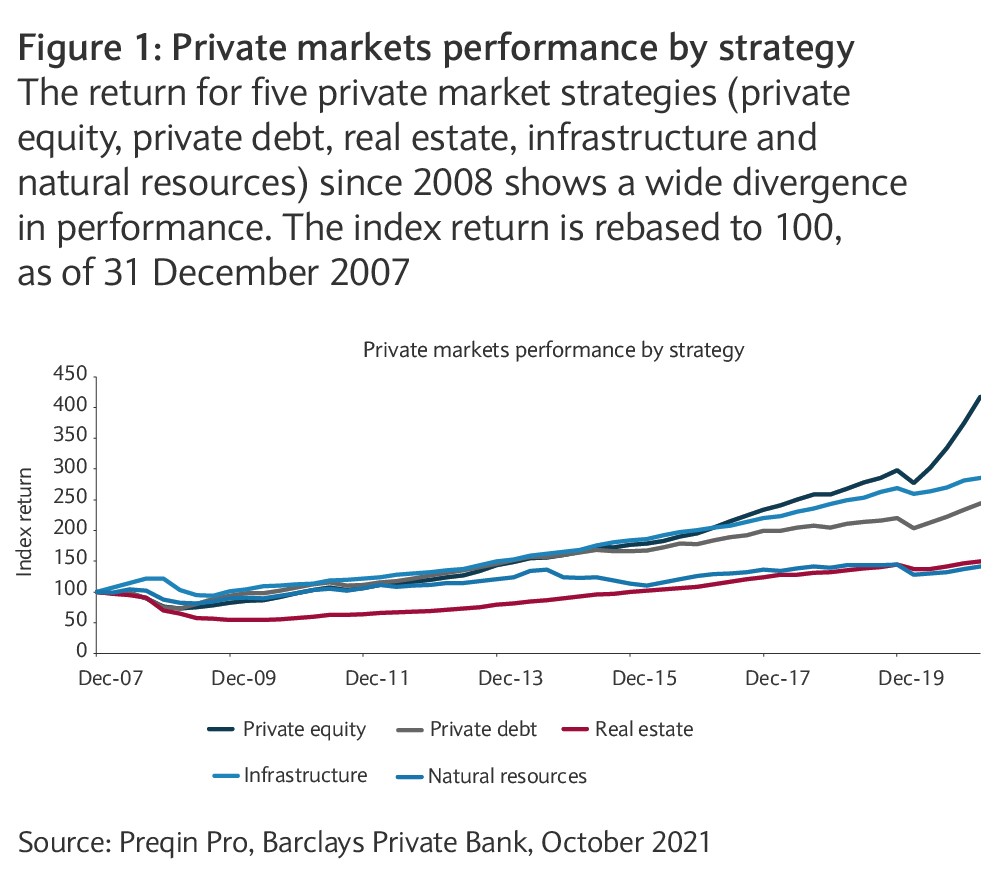

Private debt can have huge importance in complementing traditional credit markets, given a combination of higher leverage and lower yields in this area. Figure 1 illustrates the strong performance of these three strategies.

The prospects for private markets

As we approach 2022, this article explores whether valuations are stretched, the impact potentially higher interest rates might have on private credit, and other avenues may want to consider within private markets given the likelihood of inflationary pressures remaining.

Can private equity and venture capital continue their strong performance given higher valuations? With exit values being supported by equity markets and SPACs, investors continuing to invest capital into private markets, and cash reserves rising significantly, valuations are a key talking point.

However, data from private market researcher PitchBook shows that, at least for buyout investors, opportunities remain. Indeed, the median private equity buyout has taken place at an enterprise value (EV) to earnings before interest rates, depreciation and amortisation (EBITDA) multiple of 13.5 times this year, on a par with 2020 and below 2019 levels.

The median non-financial US company is trading a multiple above 13.5. In other words, buyout private equity firms are still able to find relative bargains in the current environment

This also compares favourably to public markets’ valuations where, according to DataStream data, the median non- financial US company is trading a multiple above 13.5. In other words, buyout private equity firms are still able to find relative bargains in the current environment.

Fundamentals supportive

What’s more, fundamentals still appear constructive. There seems to be consensus that, other things being equal, the recovery should continue next year, albeit at a slower pace than in 2021. This may help private equity’s performance, while the longer-term dynamics of continued technical advancement should still be a tailwind for capital strategies.

Interest rate risks

How may private debt respond with the risk of potentially higher interest rates? With inflationary pressures persisting, central banks seem ready to reduce policy support in 2022. On paper, this may increase the opportunity cost of private debt and lead to more defaults, especially if the economic momentum weakens. However, there are three limitations to consider.

First, private debt investors tend to be more insulated from rate rises thanks to floating rates being used in many credit agreements. Second, when thinking about the impact of rising rates on portfolio companies, default risk should be mitigated by a still supportive macroeconomic backdrop. Finally, it is likely that the interest rate hiking cycle will be slow, as policymakers will want to avoid jeopardising what remains a fragile economic recovery.

Therefore, we expect investors to still be able to source businesses/entrepreneurs and provide bespoke lending solutions, in exchange for a higher yield than that achievable in public markets. However, the current environment requires increased scrutiny when selecting direct lending strategies and suggests a focus on higher quality, rather than distressed, debt.

Hedging inflation risk in private markets

While returns from the aforementioned strategies can provide a positive real return, they are not necessarily considered “real assets”. In other words, they may not have a physical inherent worth.

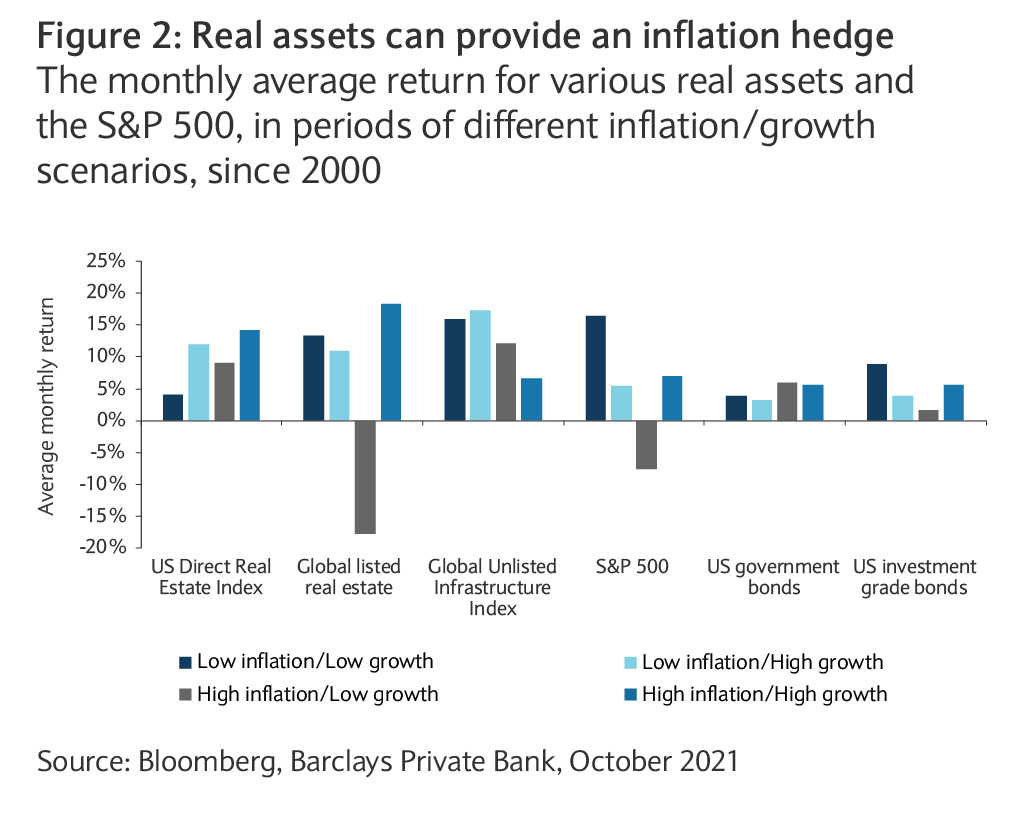

An investor chasing real assets might consider real estate and “smart” infrastructure through private markets as a more direct inflation hedge. Indeed, both have historically performed well during periods of higher inflation and stronger growth (see figure 2).

In particular, infrastructure addressing climate change concerns is likely to be in high demand over the next decade. With the sector’s rental incomes often tied to inflation, it also provides a natural hedge against inflation. Although real estate struggled last year, due to COVID-19 uncertainty around property usage and deal delays around travel restrictions, the worst appears to be over.

As always, there is no such thing as a “free lunch”, and investors in private markets must be prepared to forgo liquidity and commit to their investments for a relatively long time. Nonetheless, an allocation to private markets should benefit investors in 2022 and beyond. With rising correlation between equities and fixed income, this exposure has the potential improve diversification, while enhancing yields and dampening volatility.

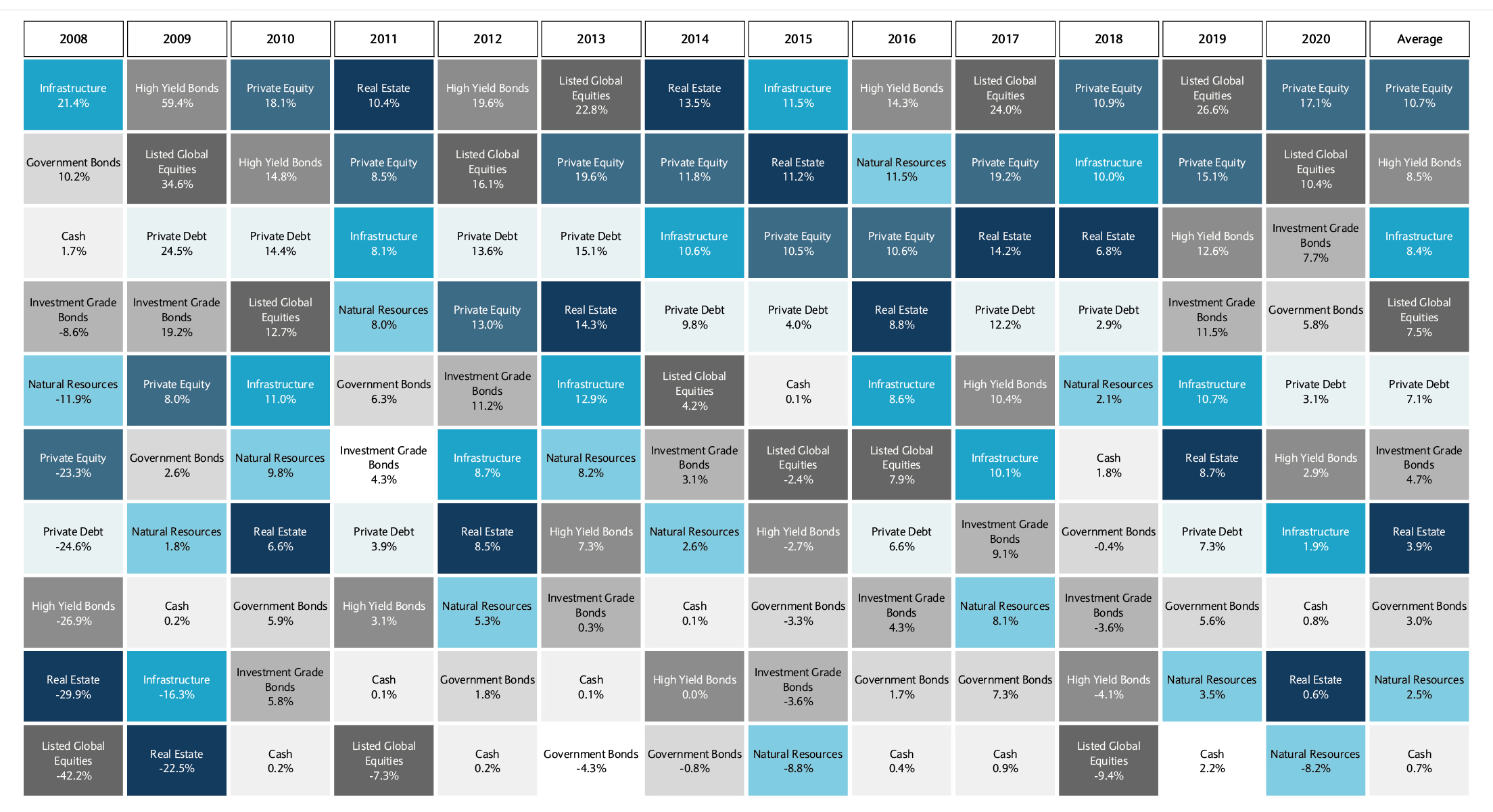

Although past performance can’t be seen as an indication of future results, the table below shows this quite clearly. By asset class, private market returns have been some of the best since the global financial crisis (see table).

Asset class returns since 2008