Time to consider private market technology?

10 March 2021

6 minute read

The technology market has expanded significantly and seems poised to keep growing. However, with public market valuations expensive and big tech likely to face increased regulatory scrutiny, could private markets provide the solution?

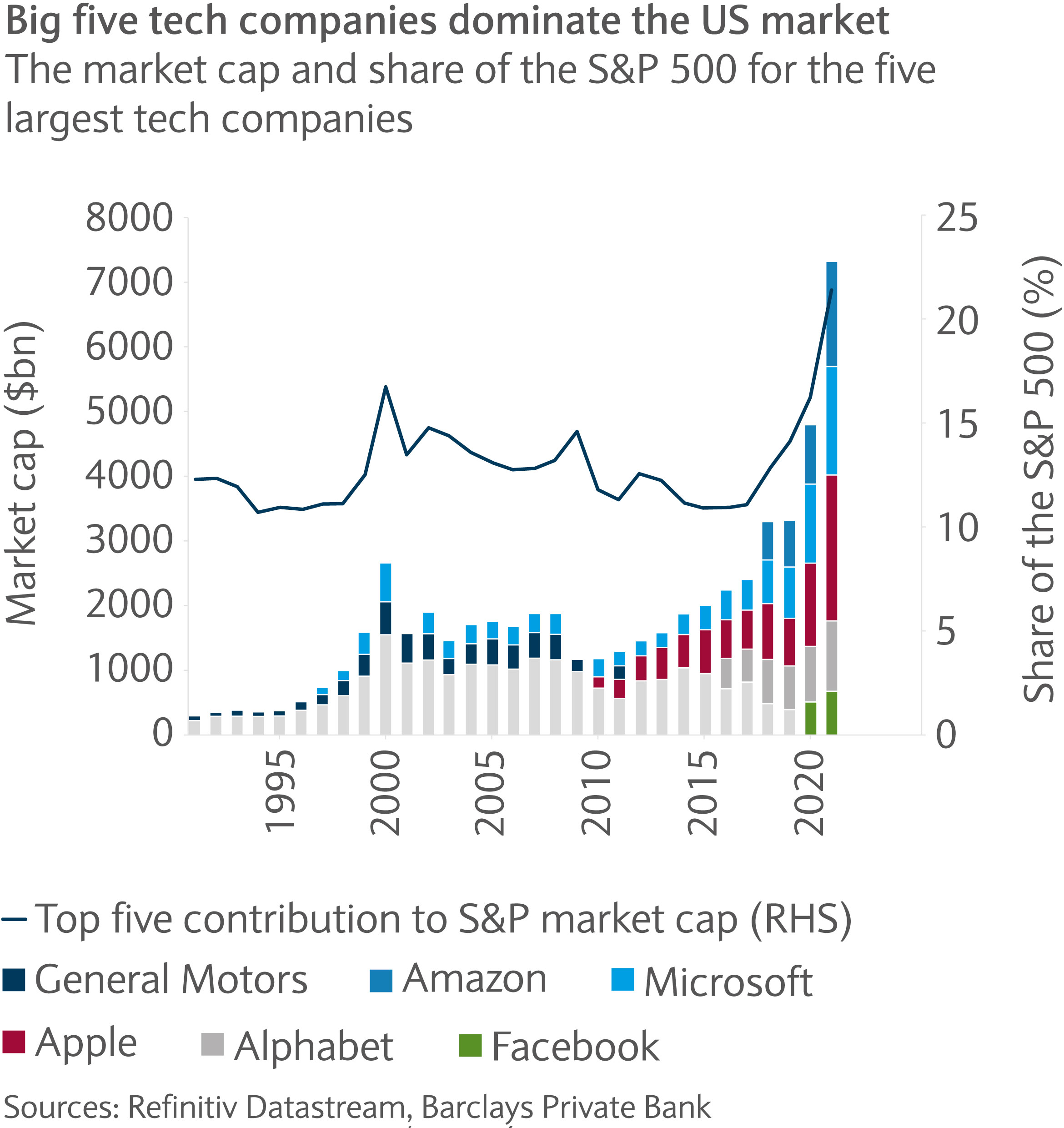

Technology has been one of the most significant drivers of business growth in the last 20 years. The S&P 500, an index comprised predominantly of industrials three decades ago, has seen a significant step change.

Last year was the first time in 42 years that the top five components of the S&P 500 represented 20% of the index and all five members belonged to the technology sector.

With increased scrutiny on the sector, big tech has continued to enhance market performance, cementing itself at the heart of the composition of many portfolios and is arguably not done yet.

New world opportunities

With next generation technology such a 5G broadband happening, a “new world” could already be here. But it is crucial that the technology is made widely available in order for the Internet of Things (IoT) to become reality.

Furthermore, big data and cloud computing is more and more becoming the norm as opposed to the hardware servers seen in the past. Another key trend is electronic components, like semiconductor chips, getting smaller and allowing them to integrate in every object from washing machines to clothes.

Going private

While accessing technology through public markets could be a way to tap into this longer term growth profile, high and volatile valuations make it harder for investors to pick companies.

Also as companies get larger, the impact of their innovation tends to fall significantly. However, a solution which could accommodate getting access to innovation and technology in a more disruptive fashion and at an earlier stage is private markets.

By accessing companies in these sectors early on and through quality managers with experience in identifying and managing target companies, investors could play a vital part of the innovation process.

What’s more is that the opportunity set ranges from venture capital, growth and more mature private equity strategies, meaning investments can be more closely aligned to risk preferences.

Key trends

There are two key trends that appear to be forming and make investing in technology through private markets attractive.

Firstly, the opportunity set appears to be more favourable. Companies seem to be staying private for longer with around 80% of the value creation accruing to private investors, according to Carlyle1, a private equity house. In fact, the average median age of tech companies filling for initial public offerings (IPOs) has grown from about 5 years to 12 years a decade later and valuations at the IPO stage have consistently been higher.

Secondly, whilst public market opportunities are arguably expensive, valuations in private markets still remain attractive. Data from Pitchbook and Bloomberg show that the 2021 estimated median EV/EBITDA multiple for private markets is 13.9x. This is notably lower than the 15.5x multiple for tech companies in the NASDAQ 100.

Private market valuations are also usually less affected by market volatility and direct exposure to target companies helps mitigate the issue of valuing intangible assets.

Potential risks

As with any investment opportunity, there are some risks to consider. Private market funds can be locked up for a significant period of time with restrictions on the transfer of shares. Also, investing in unquoted and unregulated investments requires further due diligence than quoted investments.

Finally, underlying investments may be highly illiquid/immovable making valuing it for sale and realising the fair value it records from time to time harder to obtain. Therefore, investors must be aware of the illiquidity premium that comes with investing in private markets and be willing and able to commit to investing for the longer term and locking up capital. This also stresses the importance of manager selection to make such a commitment worthwhile.

Portfolio diversifier

Investing through the private market appears to offer an affordable way to access technology disruptions. Disruptions that are likely to continue infiltrating all aspect of daily activities, allow greater access to target companies and innovation benefits early on, and act as an important diversifier in a balanced portfolio.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This communication:

- Has been prepared by Barclays Private Bank and is provided for information purposes only

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department

- All opinions and estimates are given as of the date of this communication and are subject to change. Barclays Private Bank is not obliged to inform recipients of this communication of any change to such opinions or estimates

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays Private Bank

- Has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.