Six sustainable investing insights from UHNW investors

As part of a new series supporting the latest edition of ‘Investing for Global Impact: A Power for Good’, we introduce the report and six insights from the ultra-high-net-worth (UHNW) investors surveyed1. For more information, please see the links at the bottom of this page.

Please note: This report’s findings do not constitute investment advice and past performance experienced by other investors is no guarantee of future performance. This article is intended to be informative. Any specific views or opinions expressed in this article are based on the insights provided in the ‘Investing for Global Impact: A Power for Good’ 2022 report, which is developed by Campden Wealth, in partnership with Barclays Private Bank and Global Impact Solutions Today. This article does not intend to express any views or opinions of Barclays nor its directors, officers, employees, representatives or agents.

The sustainable investing megatrend is firmly underway, as investors increasingly recognise the opportunities for both financial returns and societal impact. And with urgent environmental and social challenges moving up the global agenda, it looks set to endure, even if there are still big challenges to overcome such as ‘greenwashing’ risk.

Investing for Global Impact – new report out now

The latest edition of ‘Investing for Global Impact: A Power for Good’ surveyed around 150 UHNW investors, with an average portfolio of $730 million2.

Developed by Campden Wealth, in partnership with Barclays Private Bank and Global Impact Solutions Today (GIST), the report provides valuable insights into the attitudes and actions of some of the world’s wealthiest individuals, families, family offices, and their foundations, with regards to generating positive impact with their capital.

The report also reveals why and how these investors are making changes to their portfolios as well as the themes and strategies they’re targeting. It’s a thought-provoking read for anyone interested in investing for impact, irrespective of experience.

Below are six takeaways which showcase the unique perspectives of the report’s respondents, many of whom are at the forefront of the sustainable investing movement:

1. Investors plan to increase exposure to sustainable investments

Each year, the report asks UHNW investors about the proportion of their portfolios held in sustainable investments, and how they see that evolving in the future.

According to the latest report, respondents’ portfolios start from an average of 32% allocated to sustainable investments at the end of 2021, and they expect that to grow to half their portfolio in five years’ time. Already today, around one-fifth said they allocate 80-100% of their portfolio to sustainable investments, and 37% expect to do so by 2028.

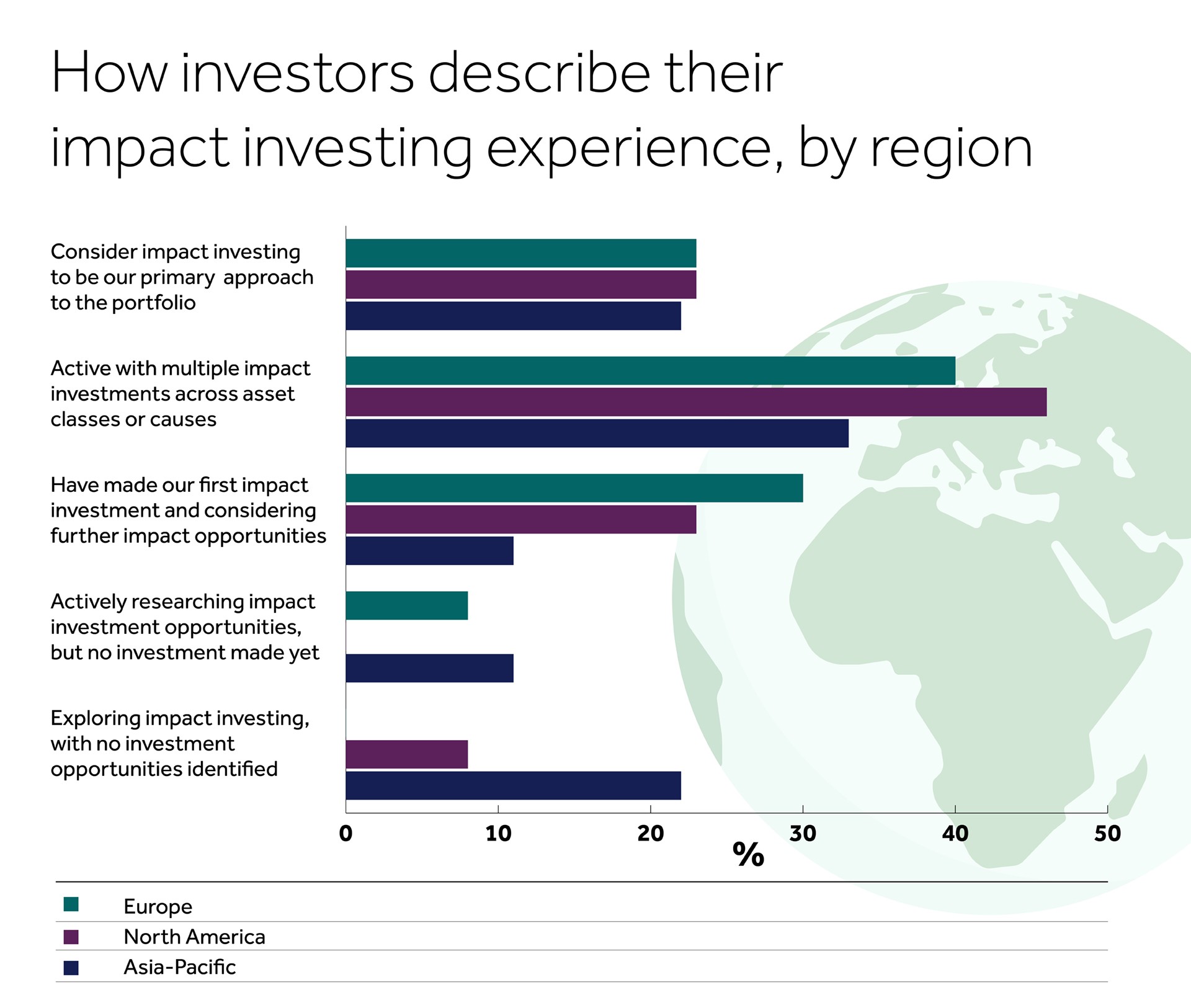

The report suggests the shift from traditional to sustainable investing continues to take hold, although the pace appears to have eased following tremendous growth during the global pandemic. There are some regional variations, however, likely reflecting different market maturity. In Asia Pacific, for example, the adoption curve is less advanced than in Europe and the US, with an even split of early adopters where impact investing is their primary approach (22%), and those who have yet to start their journey (22%).

Base: Respondents active in impact investing (85)

Source: Campden Wealth / GIST Initiatives / Barclays Private Bank, ‘Investing for Global Impact’ 2022

Note: Figures may not add up to 100% due to rounding

For your reflection

What percentage of your portfolio is invested sustainably today? How much would you like this to increase, and by when?

I have always said, impact is when you create jobs, so people can feed themselves, pay their mortgage, send kids to school, and cover their medical bills. Today, we are linking impact with the environment and ESG. This has become a real movement (…) What has changed now is that people care about values and ethics. They openly say, 'We are looking for investors who share our values’. This is a new and fantastic development because you get involved in deeper discussions with your partners.

Hirth family foundation, ‘Investing for Global Impact’ 2022

2. They expect sustainable investment performance to match or exceed traditional investment returns in the longer term

Historically, investors haven’t been certain about the relationship between returns and impact. In this survey, however, four in five believe you don’t have to give up returns for impact. And for 80% of respondents, returns on impact investments met or exceeded their expectations in 2021. This was higher (85%) for those who consider impact investing to be their primary investment strategy than for those just starting out with their first impact investments (76%).

They are also positive on the longer-term outlook for returns. Eighty-one percent of those active in impact investing expect sustainable investments to match or exceed traditional investment returns in the next five years (37% expect them to outperform, and 44% expect them to perform in line). Only 19% expect traditional investments to outperform impact longer term.

Base: Respondents active in impact investing (85) and traditional investing (100)

Source: Campden Wealth / GIST Initiatives / Barclays Private Bank, ‘Investing for Global Impact’ 2022

For your reflection

What factors do you think could drive investment performance in the next five years? How well is your portfolio positioned to capitalise on these longer-term trends?

3. The mainstream is moving towards sustainable investing

Sustainability is increasingly a consideration in investor decision-making – even for those who don’t see themselves as “sustainable” investors.

More than seven in ten (72%) respondents identifying as “traditional” investors say they include environmental, social and governance (ESG) factors in their investment decisions (a clear increase from 60% in 2021). This appears to suggest a growing acceptance that non-financial risks can have a material impact on investment returns, and perhaps also a fear of being ‘left behind’ peers who may be seeing an information advantage of incorporating this data.

As the wider shift towards sustainable investing continues, the report revealed that more investors are rethinking their approach to investing. Half of traditional investors surveyed said that the rise of impact investing is changing the way they make investment decisions (up from 43% in 2021), and 30% of respondents not yet active in impact investing said they expected to change their investment approach in the near term.

Base: Respondents not active in impact investing (64)

Source: Campden Wealth / GIST Initiatives / Barclays Private Bank, ‘Investing for Global Impact’ 2022

For your reflection

How do you incorporate sustainability factors in your investment portfolio? What ESG risks could you face, and could you be missing out on new opportunities?

4. They are managing climate risk to their portfolio AND investing in climate change solutions

As the world is impacted by climate change, it’s also influencing investment decisions – 86% of impact investors and 75% of traditional investors think climate change is relevant to their portfolio, and around six in ten (59%) are looking at aligning their portfolio with at least a 2-degree scenario of the Paris Agreement, according to the report.

Many respondents are already taking action to reduce climate risk in their portfolios. While only 16% knew the carbon footprint of their portfolio, nearly half (47%) of those who did are actively managing it down. Over a third (35%) avoid companies that are major contributors to climate change, and around a quarter (24%) actively engage with companies and vote about climate change.

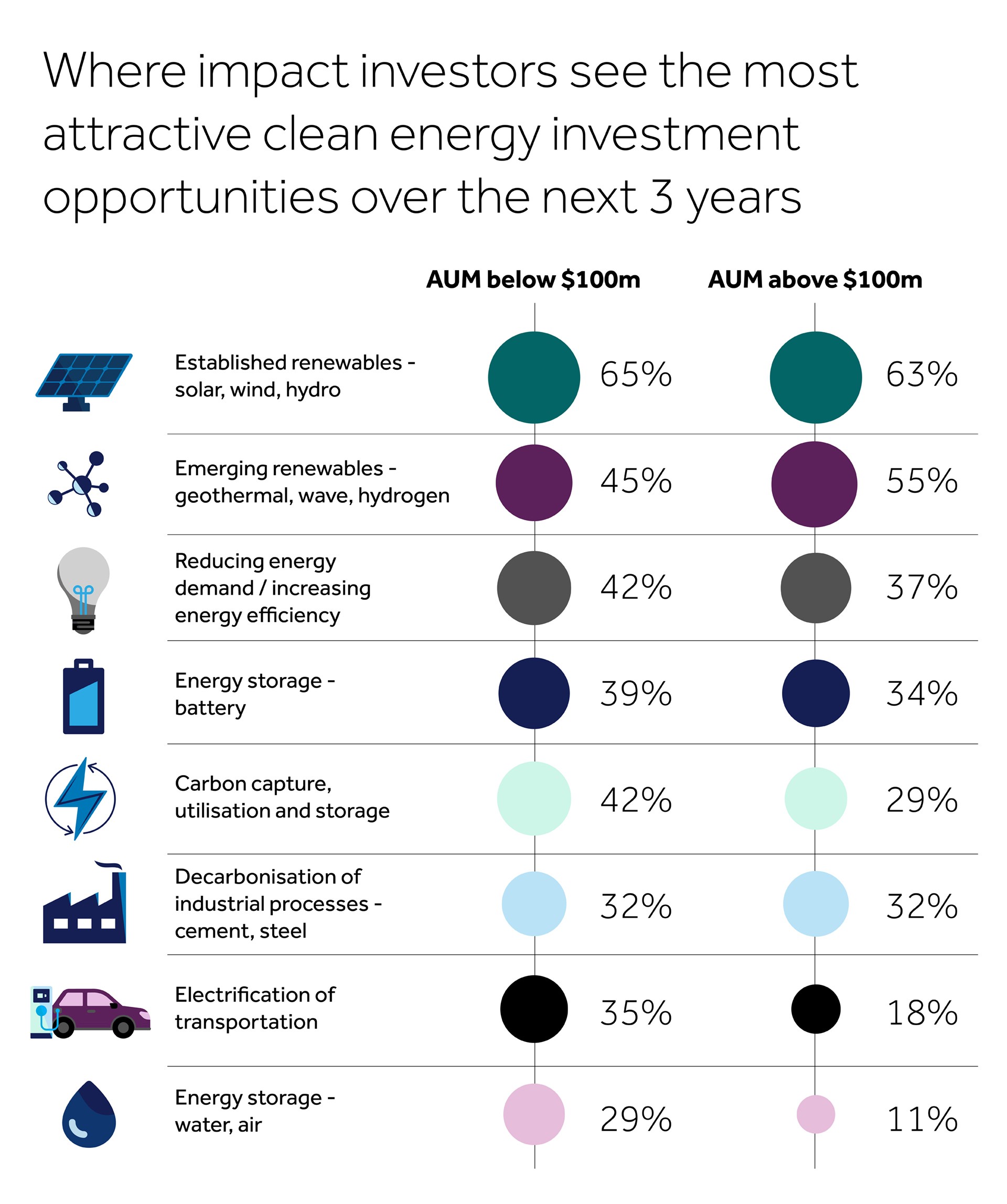

They are also seeking attractive climate-related opportunities, with 43% targeting investments to support the transition to a low-carbon economy, such as clean energy. More than half see renewables as an attractive investment over the next three years – most prominently in established solar, wind and hydro solutions (64%) and emerging geothermal, wave and hydrogen solutions (51%). They also see potential opportunities in energy efficiency (39%), battery storage (36%) and carbon capture (35%) technologies.

Base: Respondents active in impact investing (85)

Source: Campden Wealth / GIST Initiatives / Barclays Private Bank, ‘Investing for Global Impact’ 2022

Note: Figures may not add up to 100% due to multiple answers permitted

For your reflection

Do you know the climate risks your portfolio faces? Or where to find investment opportunities? What ambition have you set to ‘green’ your portfolio?

5. They remain concerned about greenwashing

As sustainability has become more prominent, “greenwashing” has become a significant issue. The report revealed that worries about greenwashed investments have increased, with 75% of all respondents saying they had concerns (52% indicated strong concerns, up from 30% in 2021). While greenwashing was not cited as the leading issue for the industry overall, 64% see it as a significant challenge.

Respondents felt various factors could help alleviate their concerns. Foremost included trust in a company or investment leadership (57% agree), quality and robustness of impact measurement and reporting (57%), and impact track record (54%). While they have seen progress in some of these areas – for example, 87% reported progress in the sophistication of impact measurement and management practice (29% saw significant progress) over the last 10 years, there is still clearly a way to go.

Regulators are taking steps to address the challenge, including the introduction of sustainable investment labels, but these are new and still evolving – which perhaps explains why only 26% of respondents currently felt they would alleviate greenwashing concerns. We discuss how investors could use these regulatory labels to guide them in our article, Generating value from sustainable regulatory labels, as well as other actions they might take to avoid greenwashing in this piece, Greenwashing: caveat investor.

Base: All respondents (149)

Source: Campden Wealth / GIST Initiatives / Barclays Private Bank, ‘Investing for Global Impact’ 2022

Base: All respondents (149)

Source: Campden Wealth / GIST Initiatives / Barclays Private Bank, Investing for Global Impact Report 2022

Note: Figures do not add up to 100% due to multiple answers permitted

For your reflection

If you are concerned about greenwashing, how does it influence your investment thinking? What information or action would help alleviate your concerns?

6. Impact investing is bridging intergenerational gaps

Younger generations remain at the forefront of sustainable investing and actively engage in causes that matter to them, according to this latest survey. Nearly seven in ten (68%) say impact investing is being driven by the younger generations and, at the same time, 79% report that the generation in charge of the family's wealth is embracing it.

Sustainable investing is seen as having a positive impact on family relations and supporting the transfer of family wealth – over a third (36%) of respondents say they engage with it to show that family wealth can be invested for positive outcomes, up from 23% in 2021. What’s more, 53% say it helps bridge the gap between generations, and 80% say involving the younger generations will help prepare them to take on family responsibility.

With trillions of dollars expected to transfer between generations in the coming decades3, sustainable investing could be a valuable tool to help families find common ground, unite around a cause, and ultimately smooth that transition.

Base: All respondents (149)

Source: Campden Wealth / GIST Initiatives / Barclays Private Bank, ‘Investing for Global Impact’ 2022

For your reflection

How engaged is your family in managing wealth across the generations, and how aligned are you on your expectations and goals? Could sustainable investing help your family navigate the wealth transfer?

The next generation faces absurd challenges such as pandemics, the co-existence of obesity and malnutrition, and the depletion of the environment. The time has come to give power and voice to young activists. They rightfully demand creating a better future for themselves.

Slow Food International, ‘Investing for Global Impact’ 2022

What now?

These six key findings provide just a small selection of the insights contained in the latest ‘Investing for Global Impact’ report. Each chapter provides further details from these UHNW investors on their strategies, portfolios and performance, together with six in-depth case studies and discussions with experts and innovators.

To support the report’s release, we’ve refreshed our series of articles exploring how you could make your portfolio more prepared for risks and opportunities from climate change, from setting your strategy, to building your portfolio, to measuring your impact. We’ve also created new content on how sustainable investing could complement philanthropy to help increase the potential for positive impact.

Visit our dedicated Investing for Global Impact hub, or download the full report to find out more.

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Important information

-

For the purposes of the survey, respondents were asked to state whether they were involved in impact investing, philanthropy and/or traditional investing. Those active in impact investing, which is more broadly called sustainable investing, self-identified that they used one or more of the following investment approaches – ethical, responsible, or impact. Further detail can be found in the ‘Investing for Global Impact: A Power for Good’ 2022 reportReturn to reference

-

Investing for Global Impact: A Power for Good 2022, Campden Wealth, Barclays Private Bank and GISTReturn to reference

-

Kings Court Trust, Passing on the Pounds report, April 2021, https://www.kctrust.co.uk/wealthtransfer or Cerulli Associates, January 2022, https://www.cerulli.com/press-releases/cerulli-anticipates-84-trillion-in-wealth-transfers-through-2045Return to reference