How to manage your portfolio’s climate impact

This is the third article in our series supporting the release of the latest edition of ‘Investing for Global Impact: A Power for Good’. For more information, please see the links at the bottom of the page.

Please note: This report’s findings do not constitute investment advice and past performance experienced by other investors is no guarantee of future performance. This article is intended to be informative. Any specific views or opinions expressed in this article are based on the insights provided in the ‘Investing for Global Impact: A Power for Good’ 2022 report, which is developed by Campden Wealth, in partnership with Barclays Private Bank and Global Impact Solutions Today. This article does not intend to express any views or opinions of Barclays nor its directors, officers, employees, representatives or agents.

The world’s window of opportunity to prevent climate breakdown is narrowing. Tangible progress is needed. Progress isn’t abstract. It’s quantifiable through carbon, climate, and environmental data.

For investors looking to play a role in tackling climate change, knowing how close, or far, you are from your climate ambitions is critical for your investments, and your portfolio’s contribution to the global effort. This is the role of impact measurement, reporting and monitoring – collectively called impact management.

In the final instalment of our series on transitioning to a greener portfolio, we discuss factors to consider when managing your portfolio’s climate impact. Having first looked at setting your climate ambitions and then turning them into portfolio action, quantifying the impact your portfolio is, and will be, making is a useful final step to help you assess progress against your goals.

As previously, our aim is to provide general explanations of how impact management works and its potential value to you.

Defining impact and impact management

Impact essentially describes a change, positive or negative, intended or unintended, on the real world. Impact management is an ongoing and iterative process of measuring, assessing, and improving your portfolio’s impact on people and planet.

Still new to many private and institutional investors alike, the impact management field is evolving, and improving, rapidly. According to the 'Investing for Global Impact: A Power for Good' 2022 report, 71% of respondents see impact management as a significant challenge, but encouragingly, 87% have seen progress, with 29% seeing “significant progress” 1.

There is not yet a universal approach to impact. But, by convening over 3,000 practitioners in a global forum, the Impact Management Platform developed a consensus around five dimensions of impact2. These are a useful framework when thinking about impact:

- What (outcome occurs?)

- Who (experiences it?)

- How much (of the outcome occurs?)

- Contribution (how much would have happened anyway?)

- Risk (of the outcome not occurring as expected)

Here we outline how you might think about measuring, assessing and improving the climate impact of your existing holdings or future investment selection.

1. Understand the climate metrics on offer

For most private investors, the starting point is generally to understand the available metrics and data to assess the impact that:

- climate is making on their portfolio and,

- their portfolio is making on the climate

To support this, companies and investment managers are increasingly providing data on environmental and social metrics. Within the climate field, there are multiple ways to quantify exposure to carbon risk, at both the company and portfolio level. Each will give you a slightly different perspective.

Some metrics focus on current carbon emissions, the most direct being absolute terms (e.g. tonnes of CO2 produced), which can help investors understand how much carbon a company/project is adding to the atmosphere3. Alternatively, using an economic carbon intensity (e.g. tonnes of CO2 per million dollars of revenue) can help investors make comparisons between companies in the same industry or across a portfolio. Or using a physical intensity measure for specific activities/companies (e.g. CO2 per megawatt-hour of power) can allow an investor to assess the real-world climate impact of potential investments.

Others are forward-looking, such as an implied temperature rise metric, which gives an indication of a portfolio’s current trajectory in relation to meeting the Paris Agreement goals. Based on present and projected carbon emissions, this metric aims to indicate what the level of global warming would be if the world had the same emissions profile as the portfolio4. As a final example, climate value-at-risk seeks to provide a forward-looking and return-based valuation of an investment portfolio5.

The devil is in the detail

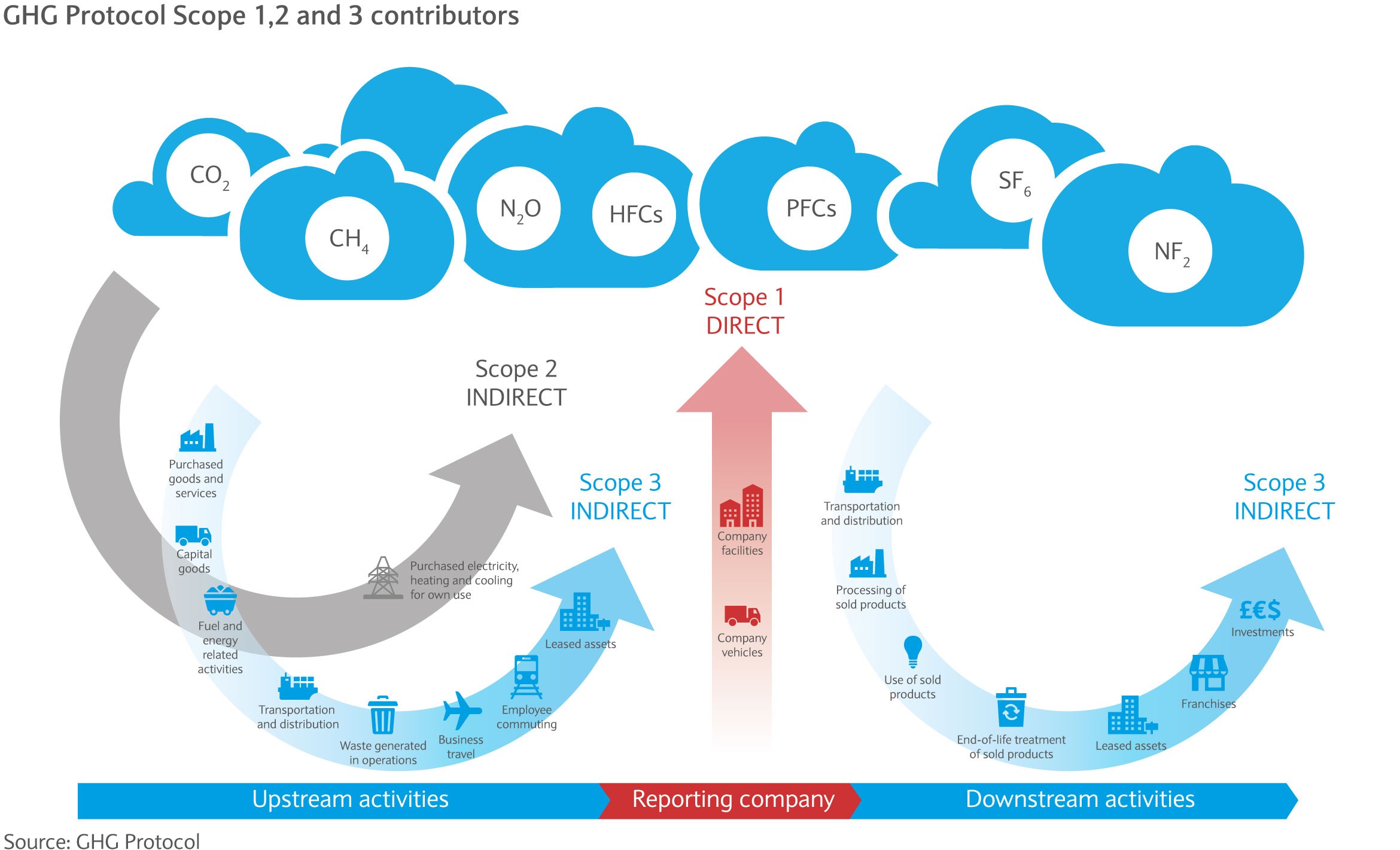

It’s also important to know the scope of the emissions included in the calculation i.e. direct and indirect, as discussed in our article ‘How green is your portfolio’. Most carbon calculations only include Scope 1 & 2 emissions (from direct activities and power usage) as these are within a company’s control and easier to report. But Scope 3 emissions (from the value chain, including emissions from upstream and downstream activities), while more challenging to calculate, can be a significant proportion of a company’s emissions.

Source: Greenhouse Gas Protocol 2011

Ensure you understand which climate calculation methodologies your investment manager is using and why, as well as how they’re being used to inform investment decisions.

2. Assess the data and reporting for your investments

Impact reporting is the process of collecting and presenting (climate) metrics and data in an informative way to be able to take action. It could be as simple as a rating or score from a data provider about a company’s climate risk, or summarised as the carbon footprint across a range of investments, or presented through the annual impact report of a fund or strategy.

At a portfolio or fund level, impact reporting is still largely voluntary, and there are no global approaches or standards as to what must be included. However, the EU and other jurisdictions are developing and launching classification systems, or taxonomies, for environmentally sustainable economic activities.

By defining and standardising what can be considered “green”, it should help investors understand and compare different investments, but what is included or excluded, such as gas or nuclear energy, has been contentious and will likely evolve.

For companies not yet in alignment to the Paris Agreement or a net-zero trajectory, the question is whether they have an established plan, not just an announcement, to achieve alignment over time, generally called a transition pathway.

An imperfect but valuable exercise

When framed as an opportunity to inform investment decision-making, rather than an attempt to perfectly quantify climate impact, the exercise of reviewing climate reporting can be highly valuable.

For example, it can highlight which company in a particular industry may be most at risk of assets being stranded – and devalued – with a change in governmental policy. Or which company may be better positioned over the medium to longer term, compared to competitors, because it’s already investing to lower its carbon footprint in anticipation of shifts in consumer preferences.

Impact metrics can be useful indicators, but be mindful of vanity metrics – where metrics are presented to sound good on paper, but don’t have any relationship to investment aims or to inform decision-making.

3. Take action to improve your climate impact

This final step is about managing the climate risks and opportunities in your portfolio more proactively. Again, multiple strategies exist, so here we review a few common ones:

Reducing carbon exposure

Firstly, a simple and direct strategy is to exclude the highest carbon emitters, and/or divest of existing ones, from your portfolio. This strategy may be driven by an ethical view, a personal desire not to fund the worst contributors, or from an investment perspective that these companies are exposed to the highest levels of transition risk.

Another strategy would be to tilt your portfolio away from higher-emitting companies and towards lower emitters, rather than making automatic exclusions. This could be between industries, or within them, if you wish to maintain wider sector exposure.

The implications of both strategies are very similar: they would likely lower your portfolio’s exposure to climate risks and reduce its carbon footprint. However, simply avoiding higher emitters does not support broader efforts to decarbonise the economy, nor does it provide the ability to influence them as a shareholder. You could also miss some potential upside from companies who are higher emitters today, but effectively make the transition.

Voting and engagement

Secondly, voting and engagement can be a way to contribute as an investor by expressing your rights as a shareholder, or for the investment manager to do so on your behalf, along with their other clients. Engaging with companies on climate issues, and voting on their proposals, can be a powerful tool for investors to drive real-world impact.

Looking at how an investment manager votes and engages on climate issues will help you gauge their commitment to tackling them – and what kind of action they’re trying to influence. Engagement is a long-term tactic, often taking place over several years, and so managers should have clear objectives, as well as shorter-term targets to measure their progress.

Investing in solutions

Finally, beyond decarbonising your portfolio, your investments can also help decarbonise the real economy. Many investors seek to allocate capital to companies and projects providing climate solutions. Selecting successful ones can be valuable both to global climate ambitions and your financial goals.

Again, impact measurement can inform these decisions. For example, by analysing how much of a reduction in carbon emissions a technology can provide, relative to existing processes or alternatives. Or calculating emissions across all scopes or using a total lifecycle approach to products can indicate which business model will be more attractive.

It’s essential to consider the wider context before making any portfolio changes (as well as your financial goals, time horizons and risk appetite of course).

What’s next?

Impact management should be woven throughout an investor’s journey for their portfolio to become, and remain, ready for climate change. It’s a complex, approximate, and improving field, but using any approach is better than none. For the simple reasoning that if you don’t know where you are today, then how do you know you’ll end up where you want to?

Measuring, assessing, and improving your portfolio’s climate impact is essential to help set and stay on course to meet your climate ambitions and, more importantly, for your portfolio to make a positive contribution in the wider efforts to protect our planet.

Visit our dedicated Investing for Global Impact hub for more related content, or download the full report to find out more.

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Important information

-

‘Investing for Global Impact: A Power for Good’ 2022, Campden Wealth, Barclays Private Bank and GISTReturn to reference

-

Impact management norms, developed by the Impact Management Project 2016-2018, and now part of Impact FrontiersReturn to reference

-

These metrics are based on historical data, which may not always be complete and/or may be estimated. Additionally, as they are backward-looking, they do not account for operating changes the company may make to reduce emissions.Return to reference

-

The Implied Temperature Rise metric uses emissions reduction targets to predict future cumulative emissions and warming potential. Such temperature metrics are based on projections and so are indicative only, may be sensitive to change, and are based on estimates, which may not be accurate or complete.Return to reference

-

Climate Value-at-Risk (VAR) provides a single aggregated number, which estimates the potential financial gain or loss in a portfolio under various climate change scenarios. As a forward-looking and returns-based valuation assessment, it is based on projections so is indicative only, may be sensitive to change, and is based on estimates, which may not be accurate or complete.Return to reference