What the Swiss franc means for your portfolio

27 June 2022

By Nikola Vasiljevic, Head of Quantitative Strategy, Zurich, Switzerland, and Lukas Gehrig, Quantitative Strategist, Zurich, Switzerland

The Swiss franc is equally important for domestic industry and investors. But there is also a risk of home equity bias in the portfolios of Swiss investors, which can potentially bring an opportunity cost in the long term.

Recent geopolitical events have pushed the Swiss franc to historic highs against the euro, which is the currency of Switzerland’s main trading partner. The importance of this currency pair is undeniable, as demonstrated by Swiss firms’ transactions. A recent study1 revealed that the euro is the most-used currency in purchases. While less prevalent than the Swiss franc in sales, 50% of firms still use the euro in these transactions.

Swiss franc strength – bane for the economy

During times of uncertainty, many factors make the Swiss franc a sought-after currency. Switzerland is very stable politically, public finances are sound, inflation is low, the labour market is robust, and defensive stocks are prevalent in the equity market.

This appeal has led the Swiss National Bank (SNB) to take some extreme measures, including the introduction of an exchange rate floor to euro from 2011 to 2015, and making significant FX interventions. As a result, the SNB’s balance sheet grew by 286% to become 140% of Swiss GDP (US Federal Reserve and European Central Bank balance sheets measure 38% and 70% of GDP, respectively). Such interventions also temporarily “earned” the SNB a spot on the US government’s list of currency manipulators. Given the importance of exports, dampening the Swiss franc’s appreciation has helped domestic industry buy time to adapt.

Boon for the investor

While past performance is never a guarantee of future performance, investors have nonetheless often profited from surges in the Swiss franc. To demonstrate, we applied a well-known concept from economic theory. Uncovered Interest Rate Parity (UIP) postulates that future exchange rate changes are determined by today’s differences in interest rates between currency areas. We then augmented UIP with a local currency effect (how the Swiss franc performed against other currencies, excluding the one being analysed) and a global risk factor, for which we used the option-implied volatility index (VIX) from the Chicago Board Options Exchange.

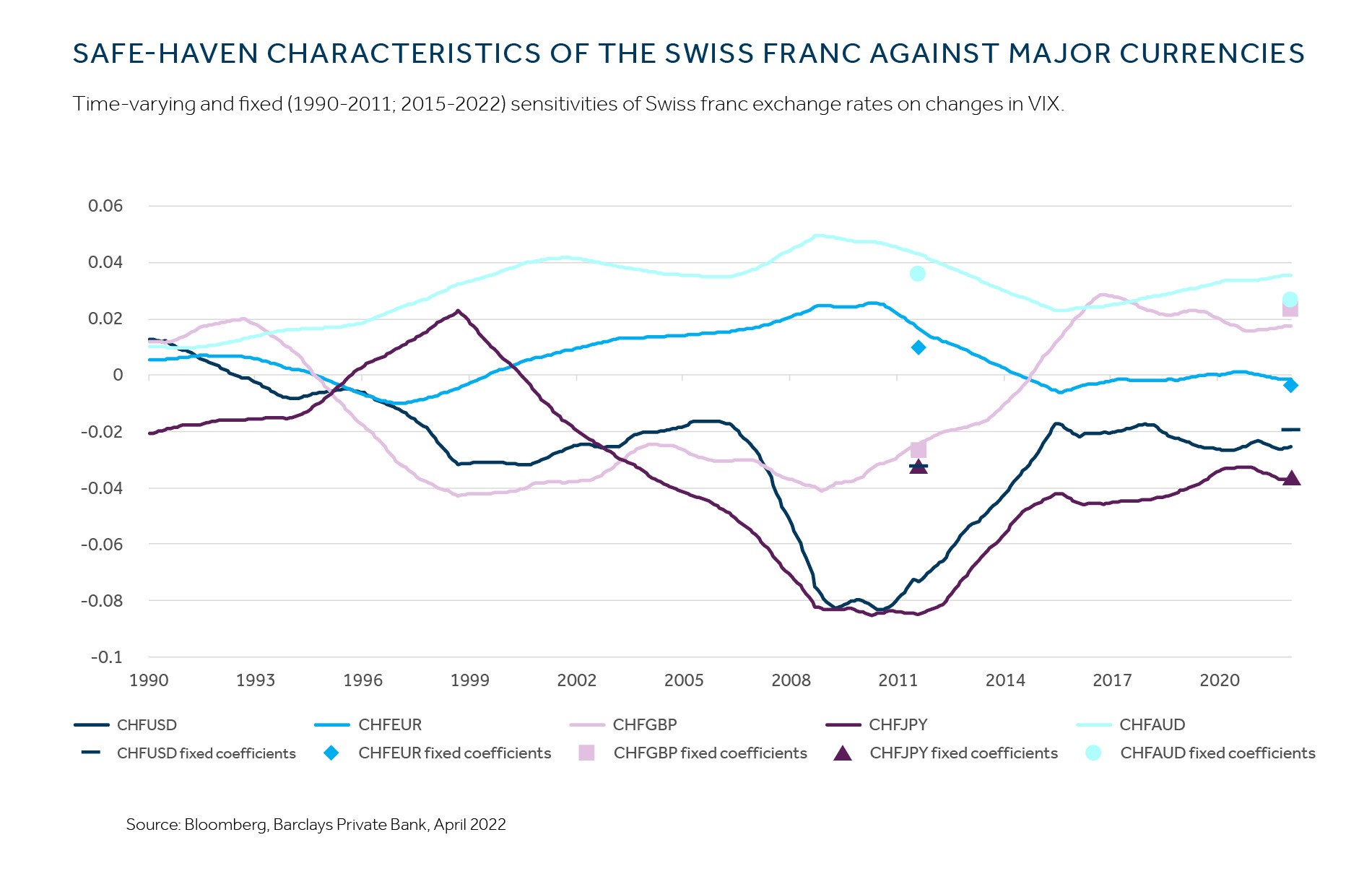

Unsurprisingly, our analysis shows that the Swiss franc is a perceived ‘safe haven’ for euro investors and investors from other areas with cyclical currencies, such as Australian or Canadian dollars. Our analysis shows that, against the Australian dollar, a 1% increase in VIX was accompanied by a Swiss franc appreciation of approximately 0.03%. For investors in US dollars or Japanese yen, however, investing in the Swiss franc put them at a disadvantage vis-à-vis their home currencies between 1990 and 2022.

Not the biggest of havens

Safe-haven benefits vary over time. In fact, the SNB’s foreign exchange intervention policy may be responsible for these fluctuations. To study this variation, we ran the same model in a way that allows time-varying sensitivities.

With the exception of the 1990s in Japan, the Swiss franc consistently failed to act as a safe haven for US dollar and Japanese yen investors, which was most extreme during the financial crisis. However, its hedging characteristics against global shocks for cyclical currencies remained particularly prominent during this crisis. Most interestingly: while pound sterling has traditionally offered more protection against volatility shocks than the Swiss franc, there has been a change of direction since 2015. This may be the result of the increased volatility in pound sterling following Brexit.

The lure of home equity bias

Lifting the lid on Swiss investors’ portfolios reveals an extremely Swiss franc-centric asset mix. Based on the International Monetary Fund’s coordinated portfolio investment data and the Neue Zürcher Zeitung’s quarterly strategic asset allocation review, Swiss investors allocate about 40% of equities in their home market. In contrast, a hypothetical global investor would hold only about 2.5% of Swiss equities, according to the MSCI All-Country World Index.

Generally, investors feel more comfortable with familiar investments. Such a preference is typically rooted in past experience, perceived competence and optimism regarding domestic equities. Picking a single country or sector can be the right choice over tactical investment horizons. Nevertheless, systematically overweighing any given equity market is not bullet-proof. Equity returns significantly fluctuate over time, and consistent outperformance is possible only with exceptional selection skill (and luck).

Investors could argue that the largest Swiss companies operate on a global scale, and therefore offer some inherent international diversification. Nevertheless, the Swiss equity market exhibits strong sectoral and factor tilts. Our quantitative analysis indicates that the Swiss equity index is about 20 times more concentrated than the global index (as measured by the normalised Herfindahl index).

The home equity bias conundrum

Home equity bias can (at least partially) be explained by exchange rate considerations, especially when the home currency has a safe-haven status.

To investigate, we considered a strategic-investment horizon over five years. Our results indicate that global equities in local currencies have consistently outperformed Swiss equities since 2013 (see chart two), sometimes by as much as 6% per annum. These figures can be interpreted as the opportunity cost of home equity bias. That said, this is a purely theoretical result. In practice, currency exposure is either unhedged or hedged.

To hedge or not to hedge?

Activity from 2008 to 2016 explains some of the reluctance Swiss investors feel about investing in global equities – investing in the Swiss equity market during these years would have been more profitable than unhedged investments in the world equity portfolio. However, the results are inconclusive as the unhedged world equity portfolio consistently outperformed the Swiss market in the following years.

Hedged foreign exposure fared better in our analysis. Despite a cost of up to 2% annually since January 2008, the hedged global benchmark outperformed the Swiss market 65% of the time and generated a median excess return of 1% per annum.

Still, hedging was not better per se. As chart three demonstrates, periods during which unhedged exposure outperformed the hedged global portfolio were characterised by a strong US dollar. Due to its superior safe-haven status, the US dollar has historically appreciated against the Swiss franc, which is especially true during times of recession. Therefore, it may be prudent for Swiss investors to keep US dollar exposure in their portfolio when turbulent times are expected.

Selective hedging to overcome home bias

With the home bias of Swiss investors remaining difficult to justify based on long-term performance data, partial hedging of foreign exchange risk might be the most sensible approach for Swiss investors. Historically, we have seen that hedging most currencies associated with the MSCI World index (except US dollar and perhaps the Japanese yen) seems to have benefitted Swiss investors. This approach could improve portfolio diversification, potentially boost long-term performance, and allow for a broader set of investment opportunities over tactical horizons.

Please note: This does not constitute investment advice or a recommendation with respect to any particular investment strategy. Past performance is not an indication of future performance. The value of investments, and any income can fall, as well as rise, so you could get back less than you invested. Neither capital nor income is guaranteed.

Related articles

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Important information

-

Credit Suisse press release, January 2022: ‘Swiss firms expect slightly stronger euro and stable US dollar in 2022’, (https://www.credit-suisse.com/about-us-news/en/articles/media-releases/swiss-firms-expect-slightly-stronger-euro-and-stable-us-dollar-i-202201.html)Return to reference