Climate change and carbon risk premium in Switzerland

27 June 2022

By Nikola Vasiljevic, Head of Quantitative Strategy, Zurich, Switzerland; Sophia Gläser, ESG Quantitative Strategist, Zurich, Switzerland

With persistently high temperatures, public interest in global warming has been steadily increasing, as have the regulatory requirements for businesses to report on these issues. Is investing in green stocks the future?

Soaring world populations, rapid growth in the global economy, and the aggressive use of fossil fuels during the past two centuries have led to unprecedented greenhouse gas emissions. At the dawn of the 21st century, humanity awoke from the “carbon dream” to realise the imminent danger of climate change.

Increases in temperature are considered the most important indicator of climate change. However, scientific research has shown that climate change also entails a higher frequency of events such as extreme cold, storms, and floods.

The effects of global warming in Switzerland

The Alps have undergone tremendous change as a result of global warming. Climate change has affected the volume and quality of snowfall and the Swiss glaciers have lost approximately 60% of their volume since 1850. The risks of floods, landslides, and forest fires have increased, and biodiversity has been threatened. The average temperature in Switzerland has also increased by about 2°C since 1864, which is more than 1°C above the global average1.

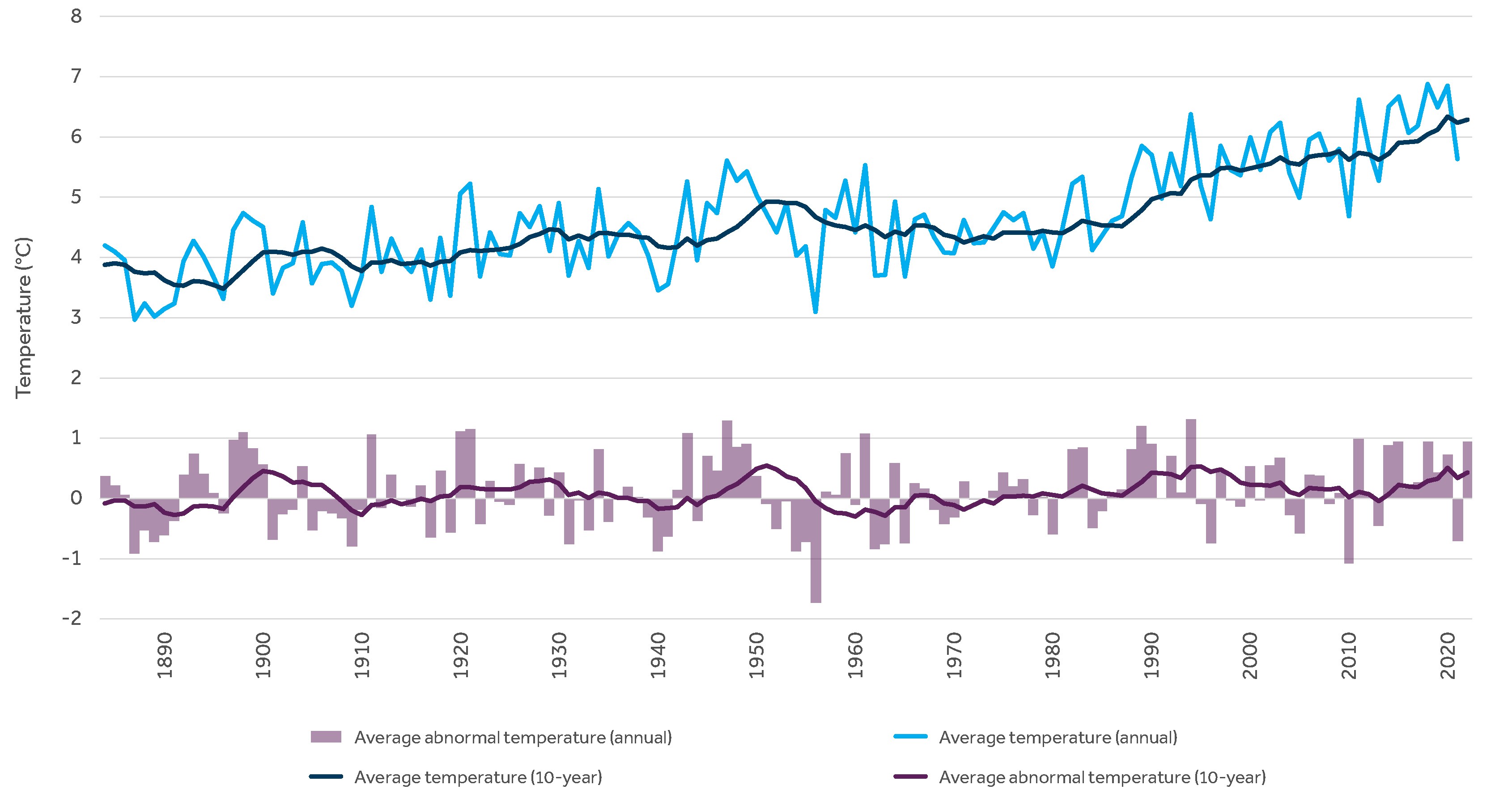

To study how global warming affects public and investor attention in Switzerland, we have analysed the local temperature according to three categories: long-term trend, seasonal, and abnormal.

The long-term trend is defined as the 10-year rolling average temperature. The seasonal trend is calculated as the difference between the 10-year rolling average temperature for a given month, and the long-term trend. The abnormal temperature is the deviation of a month’s temperature from the seasonal trend in the same month. We define the long-term abnormal temperature trend as the 10-year rolling average of monthly abnormal temperatures.

Chart one shows long-term trends and abnormal temperature, as well as their counterparts for a given year. The long-term abnormal temperature in Switzerland has been consistently increasing since 1974 (with the exception of 2012), with a strong upward trend over the past 10 years.

Average and abnormal temperatures in Switzerland since 1885

Annual and 10-year average, and abnormal temperatures in Switzerland from 1885 until 2022. The temperature is measured as the spatial average across various altitudes over the entire area of Switzerland.

Source: MeteoSwiss (Federal Office of Meteorology and Climatology), Barclays Private Bank. Data accessed in April 2022, last observation point March 2022

The spotlight on climate change

Although extreme temperatures can be unrelated to global warming, unseasonably high or low temperatures often direct attention towards climate change. For example, abnormally cold temperatures in the north-eastern United States in 2015 and 2017 have been used by sceptics to challenge the existence of climate change2.

To understand the public’s interest in climate change, we looked at the relationship between abnormal temperatures in Switzerland, European print media coverage of climate change, and the volume of searches for this topic on Swiss Google.

Abnormal temperatures during a single month do not affect the public’s interest in climate change. However, there is a much stronger correlation between abnormal temperatures, news coverage, and online searches on an annual basis. (see chart two).

This result is likely driven by behavioural forces. As the public learns about temperature dynamics, the attention to climate change typically tends to increase three to six months after the beginning of a heatwave (a prolonged period of abnormally warm temperatures).

Swiss blue-chip companies through the carbon lens

Increased awareness and calls for action around global warming have put businesses in the spotlight. Reporting of environmental, social and governance (ESG) information has also accelerated over the past 10 years, largely driven by legal requirements in many jurisdictions.

As of January 2022, amendments to the Swiss Code of Obligations have meant that large companies of public interest face a mandatory requirement to disclose non-financial information in annual ESG reports.

To measure the climate-risk exposure of Swiss companies, we examined their carbon footprint and environmental impact. We then ranked the most important equity sectors and industry groups based on the equally weighted average of MSCI’s carbon emissions and environmental pillar scores.

As expected, the leaders are the telecommunication services, financials, and healthcare sectors, while consumer discretionary, information technology, and materials fared less well.

However, sector-level rankings should be taken with a pinch of salt. Most sectors are heterogeneous as carbon exposure varies substantially across industry groups. Therefore, putting the sectors under a microscope is a more sensible choice (see chart three).

Measuring the carbon-risk premium

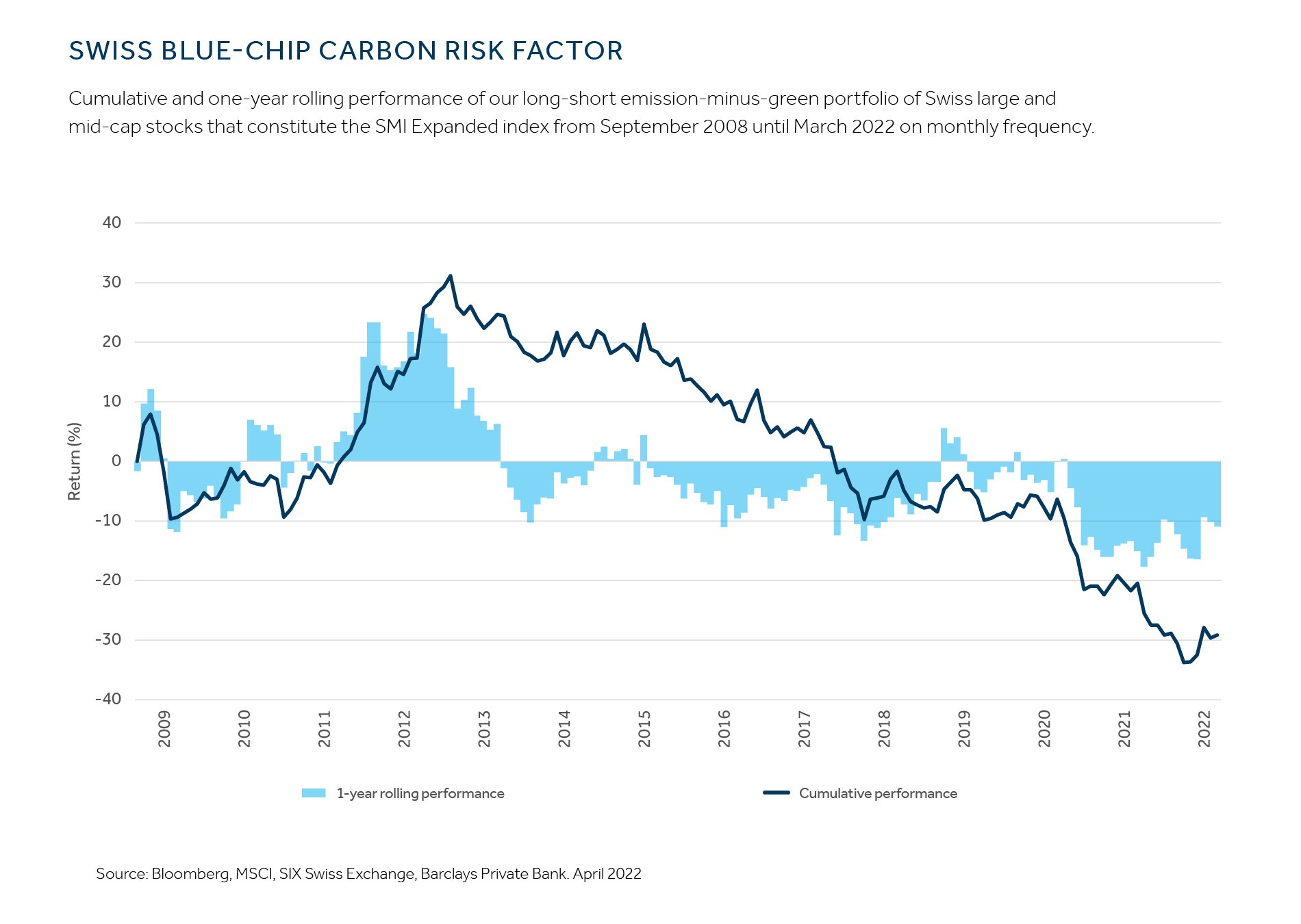

To explore the impact of carbon exposure on portfolio performance, we constructed a carbon risk factor for the Swiss equity market. Starting from the SMI expanded index, we examined the carbon risk factor as a long-short emission-minus-green portfolio in a two-step procedure. Hence, a negative risk factor reading implies outperformance of green stocks.

First, stocks are ranked using our bespoke environmental score described earlier. Second, the long (emission) and short (green) legs are designed to minimise and maximise the environmental score, respectively. To isolate the carbon exposure effect, we impose the constraint that both sub-portfolios must match the equity sector exposure of the overall market index.

Our analysis reveals that the realised carbon risk premium was positive between March 2009 and August 2012, and has exhibited a negative (green outperformance) trend thereafter (see chart four). Green outperformance accelerated since the onset of the COVID-19 pandemic. Over the full sample, the green sub-portfolio has rewarded climate-aware investors with a premium of 1.7% per annum.

Our findings are closely aligned with other academic and industry research. Since other studies typically focus on the US or EU, it would suggest global drivers are behind the historical dynamics of the carbon risk premium in developed markets.

Do green stocks outperform when it is warm?

A green sub-portfolio does not necessarily outperform during abnormally warm months. In fact, the correlation between the carbon risk premium and abnormal temperature in Switzerland is zero.

However, the carbon risk factor performance and printed media coverage index are inversely related. Higher media coverage of climate change coincides with outperformance of green stocks and vice versa.

When the level of attention on global warming increases, investment funds tend to flow into green stocks. However, when climate change drops off the news radar, a reverse effect is typically observed as carbon-intense stocks rally.

Green is the colour of the future

The transition towards green economies is irreversible and for the foreseeable future, funds will likely keep flowing into green stocks. Consequently, it is reasonable to expect that green stocks will outperform carbon-intense stocks.

However, this does not mean that carbon risk premium will remain negative forever. The asset pricing theory tells us that in a new, green-investments-driven equilibrium, the carbon risk premium is expected to become positive. Investors will demand a compensation for taking carbon risks, hence demand-supply forces might eventually turn the tide.

Related articles

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Important information

-

Federal Office for Environment (FOEN) in Switzerland, 2020: Climate Change in Switzerland, Management Study. Temperature data obtained from MeteoSwiss (see chart one)Return to reference

-

National Weather Service – National Oceanic and Atmospheric Administration. Further reference can be found here: https://www.weather.gov/iwx/20150214_blizzard and here: https://www.weather.gov/okx/RecordCold_Dec17Jan18Return to reference