Second-quarter earnings shot the lights out, encouraging us to lift our base and bull case scenarios for the S&P 500. Valuations might be expensive by some measures. However, the equity risk premium is far from flashing red. US equities remain most appealing, though valuations face several headwinds in the short term, with COVID-19 infection trends and central bank policy high among them.

After an encouragingly strong second-quarter (Q2) set of earnings figures for American and European companies, our bull case appears to have played out. In addition, revised earnings estimates point to modest upside potential, though overall valuations continue to leave no room for error.

A strong earnings season

In the US, 87% of S&P 500 companies beat consensus estimates, delivering year-over-year earnings growth of around 94% in Q2, according to data provider Refinitiv.

As expected though, this earnings season wasn’t as strong as the first quarter with a surprise factor of 16% versus 22% of reporting companies. The result is an equity market that has grinded higher but not to the extent that some may have imagined given the earnings growth produced.

Bumping up our base case scenario

On the back of these better-than-expected results, the “bottom-up” aggregate earnings per share estimates for the S&P 500 have moved up significantly. The consensus now expects earnings of $197 compared to $164 (+20%) at the beginning of the year and, for next year, this number rises to $215 from $191 (+12%). This is slightly higher than our initial bull case scenario ($185 and $213, respectively).

We are therefore revising our base case earnings estimates to $195 and $216 for 2021 and 2022, respectively, corresponding to a year-over-year growth rate of 45% and 10%. In our new bull case scenario, 2022 earnings could reach $225, a year-over-year progression of 15%.

Multiples are likely to contract further

From a valuation standpoint, we continue to struggle justifying higher multiples. On a twelve-month forward basis, US equities currently trade above 21 times earnings. There seems no room for expansion and valuations may, in fact, contract to a still elevated, but more reasonable, 20 times.

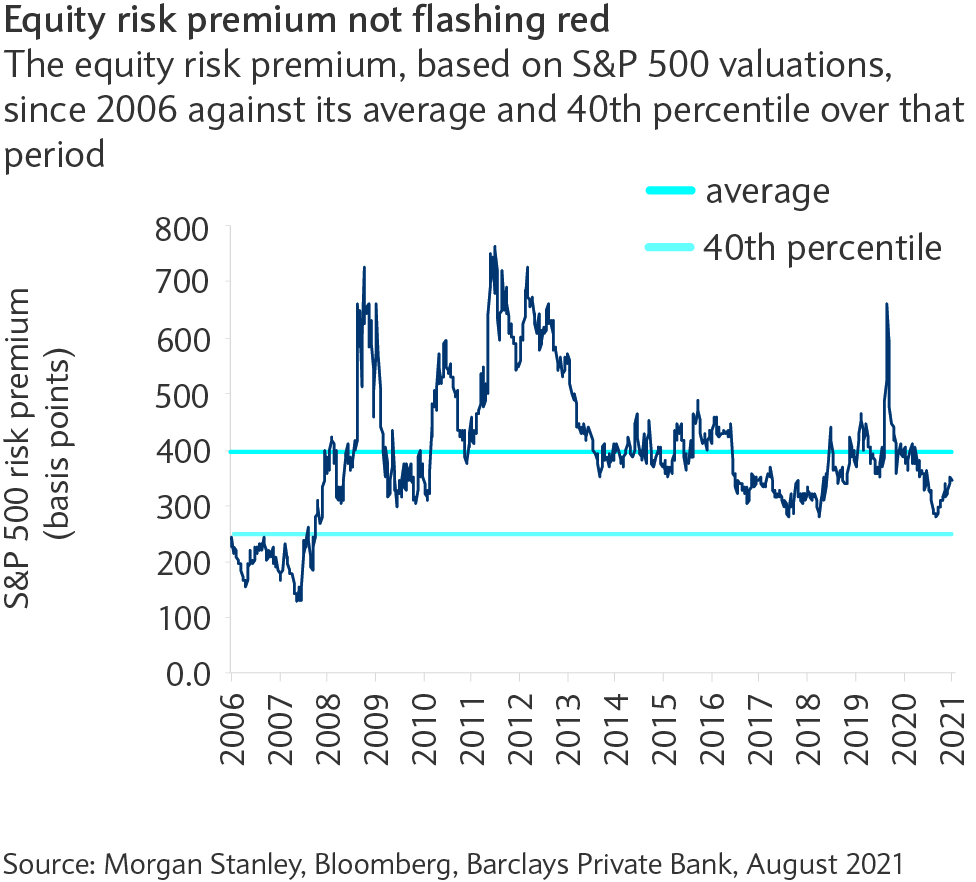

While a valuation multiple on US equities of 20 times stands out as expensive by historical standards, our alternative valuation methodology using equity risk premium is not flashing red (see chart).

Earnings growth needed to push stock prices higher

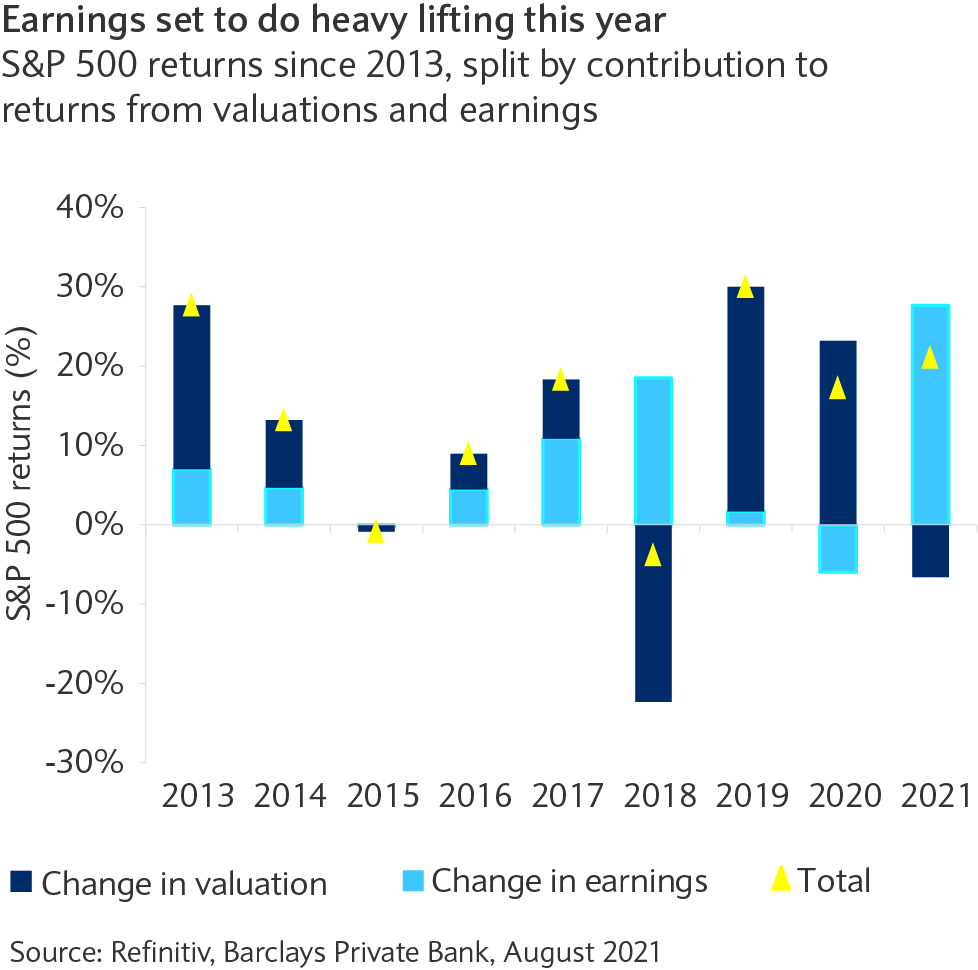

As a result, earnings growth (and increasingly dividends) will need to do the heavy lifting when it comes to generating upside from current levels (see chart). While growth has been plentiful in the wake of the pandemic, it looks set to be harder to find in coming quarters. This reinforces our preference for higher quality companies. We see them as being well placed to deliver on, or even surpass, earnings expectations, likely key in ensuring upside potential.

Downside risks remain

There appear to be two main downside risks to our base case scenario for US equities. On the earnings side, the evolution of the COVID-19 pandemic overshadows the outlook. While we don’t expect a return to widespread and broad-based lockdowns, the “return to normal” will probably be uneven across sectors and geographies. This may put pressure on earnings, especially next year when comparable earnings growth will be much tougher.

On the valuation side, the unprecedented amount of liquidity injected by central banks has been key in supporting equity markets. As this stimulus fades, there is a risk that multiple contraction will accelerate, negating earnings growth.

Walking a fine line

Central banks are in a precarious situation, trying to balance the need for continued support to secure the economic recovery while preventing inflationary pressures from getting out of control. This environment may encourage increased volatility as market sentiment swings from recovery optimism to slowdown pessimism.

However, we remain of the view that central banks will err on the side of caution and favour overstimulating to undue tightening. This should help avoid any long-lasting economic and market weakness.

US still our preferred market

In a world of scarcer growth, geographically, we maintain our preference for the US and emerging markets. That said, we acknowledge the latter may take longer to recover given the current regulatory pressure coming out of China.

Sector-wise, we see no reason to change our constructive stance on technology (in its broad definition), healthcare and parts of industrials. Opportunities also remain in consumer-oriented stocks, in our view. That said, fundamentals are starting to worsen with retail sales growth stalling in the US and consumer confidence weakening as COVID-19 cases rise.