With yields on government bonds anchored to ultra-low levels, is it time to consider investing in private credit markets to obtain higher yield along with less risky returns?

Investors face a predicament when it comes to sourcing high-quality companies that offer an attractive return profile in traditional credit markets, which is an asset class that remains an important component in a diversified portfolio.

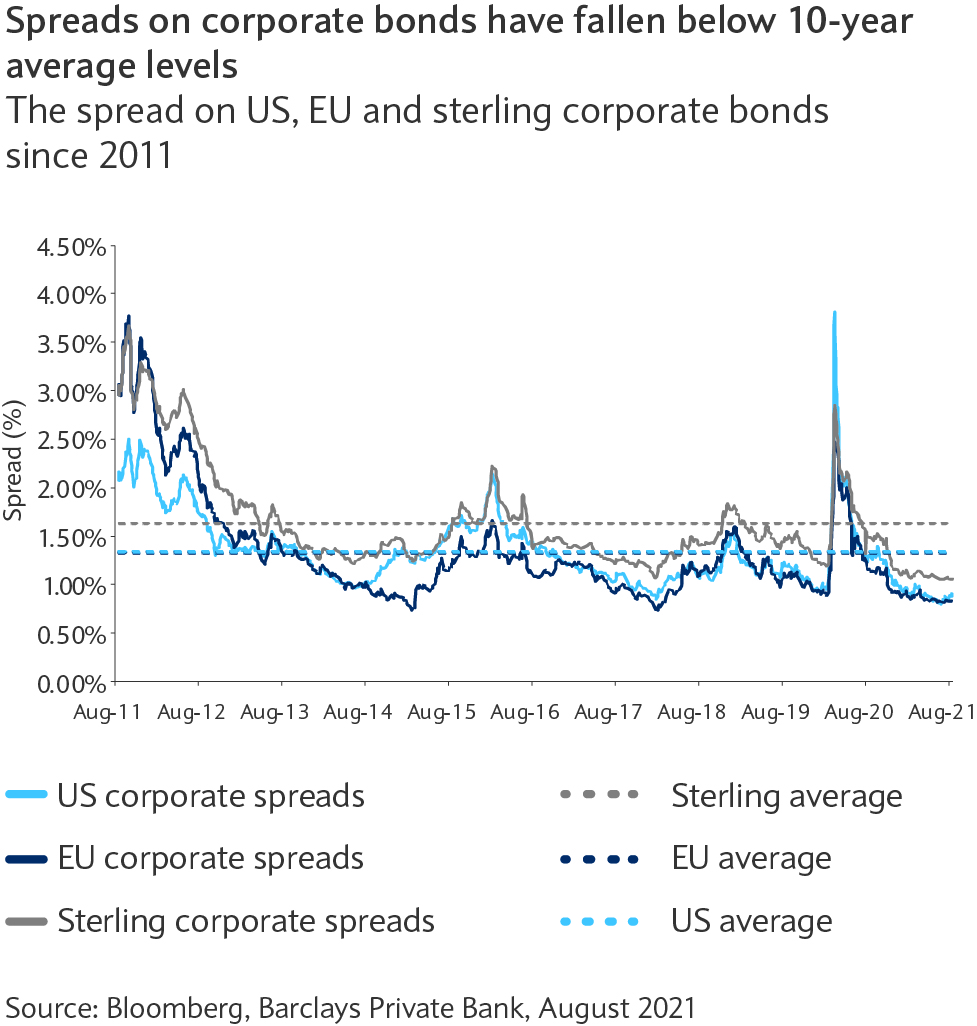

Lower for longer interest rates are keeping government yields anchored (albeit with spikes in volatility) and the search for yield is driving down spreads on both investment grade and high yield credit (see chart).

Attractive opportunities

Despite the volatility and change in market sentiment in public credit markets, there remain attractive opportunities. First, the reopening of economies, as they continue to emerge from the pandemic and global growth should boost corporate revenues. Second, in the first half of this year, default volumes fell to their lowest levels in decades which could be viewed as justifying tighter spreads.

It’s also worth pointing out that there is still carry to be had in both investment grade and high yield debt, especially when evaluated against government bonds. However, the importance of active management and selection remains paramount.

This is particularly relevant given bank lending and merger and acquisition (M&A) volumes. Throughout the past two decades, and even more so after the financial crisis, banks have reduced lending to small and medium-sized enterprises. Even with sentiment anticipating a significant recovery, M&A activity has leaned towards large institutional borrowers who have previously accessed capital markets.

Default levels suggest spreads may be overvalued

Consequently, corporates in traditional debt markets may be over-levered. Although default volumes may not reflect this, spreads are arguably rich in light of this. Back in April, we discussed this risk in terms of analysing credit cycles in the 19 April Markets Weekly podcast.

It therefore makes sense for investors to consider other avenues of accessing credit, where they can lend to high-quality businesses and earn returns that adequately compensate the risks taken. There is increasing evidence to suggest that accessing the private credit market is an attractive and complementary solution.

Obtaining more stable balance sheets

Many smaller businesses or entrepreneurs unable to access credit the traditional way may have much more stable balance sheets without being highly levered. What these organisations require is more specific lending to unlock their growth potential.

As a result, the concern for these companies is more around the certainty of execution as opposed to the cost. Therefore, private credit managers that select the right firms and arrange bespoke solutions are likely to be rewarded with noticeably higher yields for the same given level of risk in public markets.

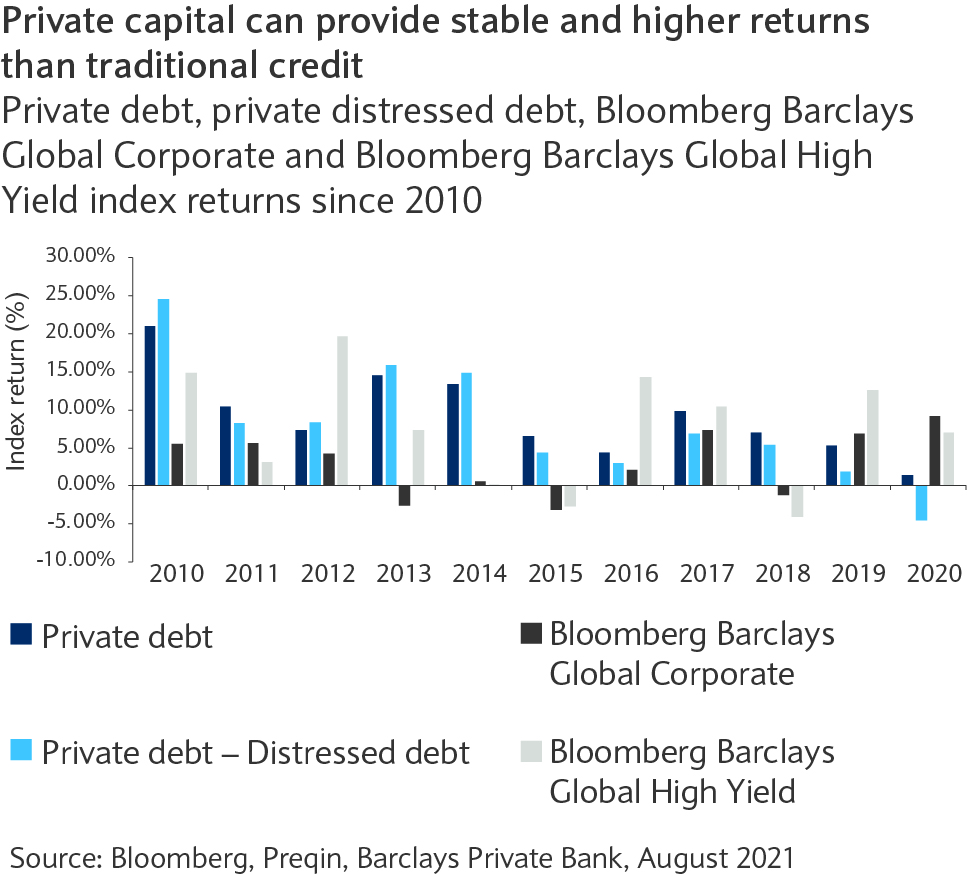

These returns (see chart) might outweigh the risks of investing in private markets. Such risks include the illiquidity premium, the idiosyncratic risk given the more firm-specific solutions provided and the “backstop” risk as a result of private managers not being protected to the same extent as banks are by policymakers.

Complementary solutions

Ultimately, investing in private credit can provide a complementary solution to traditional credit markets, and achieve a higher return and diversify portfolios. However, manager selection is undoubtedly a key pre-requisite.

Managers with the ability to thoroughly evaluate their investments, given the “backstop” risk, perform due diligence and source stable businesses or entrepreneurs and a platform allowing for tailored lending solutions are likely to have the most success.