As the COP26 gathering of world leaders approaches to tackle climate change, how can investors can not just avoid climate risk, but start to play their role by investing in climate-change solutions?

As we enter the final weeks before the United Nations COP26 starts in Glasgow on 1 November, media coverage and conversations will intensify around governmental actions to address climate change, and efforts to prevent its breakdown.

Many topics may feel distant to observers – how to price carbon emissions, mobilising an already committed $100 billion per year from developed nations to help less developed countries transition, or improving collaboration between governments and non-state actors.

Global warming: code red

However, the potential implications of these COP26 discussions are enormous. As the UN released the latest Intergovernmental Panel on Climate Change (IPCC) report in August, the Secretary General stated simply that it is “a code red for humanity”.

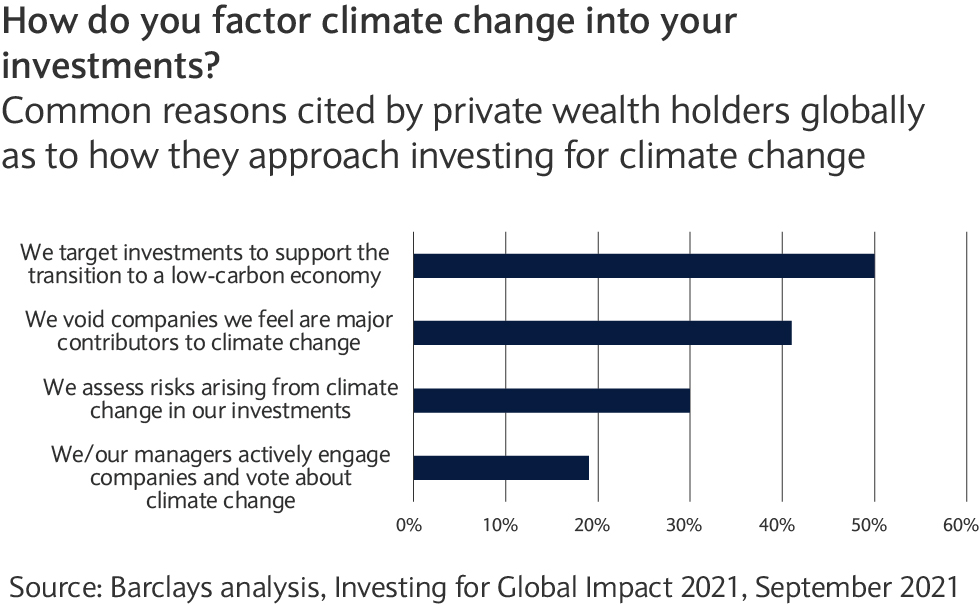

But as the vast majority (86%) of global private wealth holders in our Investing for Global Impact 2021 research confirmed, we can’t rely solely on governments, or charities and corporations, but well-invested private capital will be essential to address climate change.

Investors, either personally moved or financially astute, may wonder what specific actions they can take in their family portfolios to promote positive change to address climate change.

Setting the framework for action

In April, the Institutional Investor Group for Climate Change published a “Net Zero Investment Framework Implementation Guide” to support institutional firms seeking to align their or their clients’ portfolios, with the goals of the Paris Agreement. Like other similar industry initiatives, it is not focused on, nor wholly applicable to, private individuals and family portfolios.

However, many aspects remain relevant and useful. Notably, they all broadly propose a net zero investment strategy should focus on achieving two objectives:

- Decarbonise investment portfolios through use of science-based assessment and pathways that align with achieving global net zero greenhouse gas (GHG) emissions by 2050.

- Increase investment in the range of “climate solutions” that will support the Paris goals.

For private wealth holders these objectives remain valuable to structure thinking and take action. Decarbonising existing portfolios is a critical element for investors to prepare for the implications of both transition and physical risks on existing and future holdings.

Given both a need and desire to drive change with capital, we focus here on the latter, so opportunities to increase capital allocations to companies providing climate solutions as a more proactive and catalytic approach. Notably, this aligns with the foremost approach of the leading sustainable investors from our research, where 50% said they were “targeting investments to support the transition to a low-carbon economy” (see chart).

Deploying capital to innovative opportunities

The International Energy Agency notes that of the technologies that are needed to achieve net zero by 2050, almost half are currently only at demonstration or prototype phase. This means that most of the companies generating solutions to climate change will be seeking early- and growth-stage capital.

As ever, investing in early-stage and growth companies presents particular risks, so is not appropriate for all investors. However, looking again to the research, 70% believe the transition to net zero economy presents “the greatest commercial opportunity of our time”, in agreement with Mark Carney’s view as expressed at the launch of the COP26 Private Finance Agenda on 27 February 2020.

Don’t let scale of options overwhelm

As a systemic problem, many investors may be overwhelmed when trying to decide where best to start deploying capital. But, climate change is not a single issue that will be addressed through a single sector or single investment.

Today there are a range of sectors, geographies and asset classes where climate investments have the potential to generate attractive returns and catalyse solutions. To help investors’ frame the landscape, we previously provided a structure around three broad outcomes in Greening the Economy in our Outlook 2021.

Direct investments have a particular appeal where an investor has strong conviction or time and appetite to support the growth of a company. However, sometimes not having a specific focus may be better for investors at the earlier stage of their journey.

Both funds, and baskets of companies, provide investors with an opportunity to access fast-growing, climate-related companies, and benefit from the selection expertise of the manager, as well as the diversification benefits of holding many companies. In addition, they often provide familiarity with a range of sectors to allow learned experience to dictate further interest and deeper knowledge.

Leverage your own family’s expertise and role

Many investors have existing family businesses that also require “green” technologies to mitigate their emissions or adapt to the physical effects of climate change. Here existing family and business knowledge can be used to identify issues and potential winners in the businesses with leading solutions.

For example, hoteliers will be looking at improving the energy efficiency of their stock or resilience to extreme weather. Those in the auto industry may bring knowledge of where manufacturers are headed with battery technology or charging infrastructure. Agricultural families may be considering precision or regenerative agriculture.

By linking investment opportunities to family interests both the process and, hopefully, the result of the investment will have positive benefits.

Considering the alternative of inaction both on portfolio and planet level, acting to catalyse solutions can be a way not simply to invest for tomorrow, but influence it

Taking action

As we know from our behavioural expert, taking investment decisions can be challenging when facing considerable uncertainty, especially when the options are both numerous and complex. However, considering the alternative of inaction both on a portfolio and planet level, acting to catalyse solutions can be a way not simply to invest for tomorrow, but to influence it.

For those interested to learn more about how the leading investors referenced in this article are repositioning their portfolios for climate change, a copy of the Investing for Global Impact report is available to download.