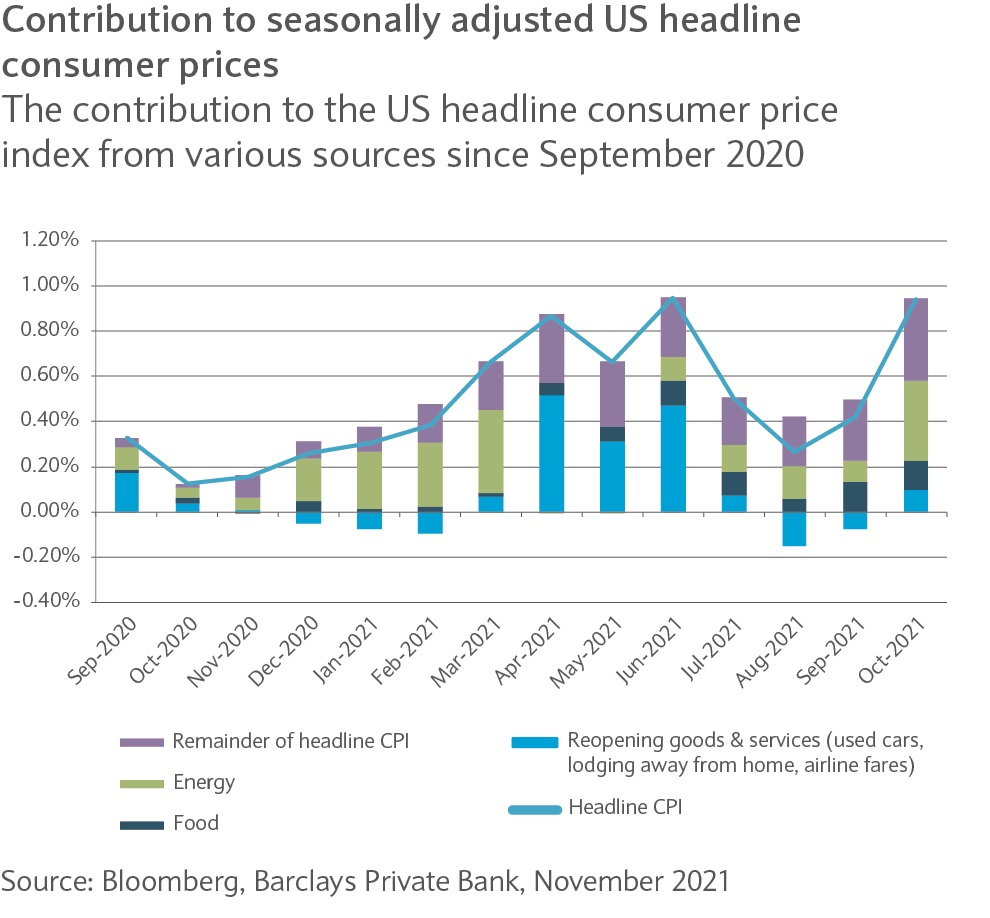

Inflation is a hot topic and will likely define 2022 in capital markets. Investors are gradually realising that “transitory” is a matter of quarters rather than months. While many initial contributors to the recent spike in consumer prices show signs of moderation (for instance, airfares, used cars and lodging away from home), other pressure points have emerged, especially in commodities and energy.

In addition, supply-chain disruptions are pushing transport costs higher and creating supply-driven inflationary dynamics. Encouragingly, wages and rent, the stickier components of the inflation basket, haven’t been subject to the same year-over-year increases.

This supports the view that, once disruptions ease and supply/demand imbalances dissipate, inflationary pressures should abate. However, comments from companies suggest that they are keen, when possible, to pass on higher inputs costs to their end customers, which would contribute to keep the consumer price index elevated. At the same time, the longer inflation persists, the more likely it will influence consumer behaviour and hurt their confidence. It may also create additional incentives for workers to push for higher salaries, especially if labour participation remains subdued.

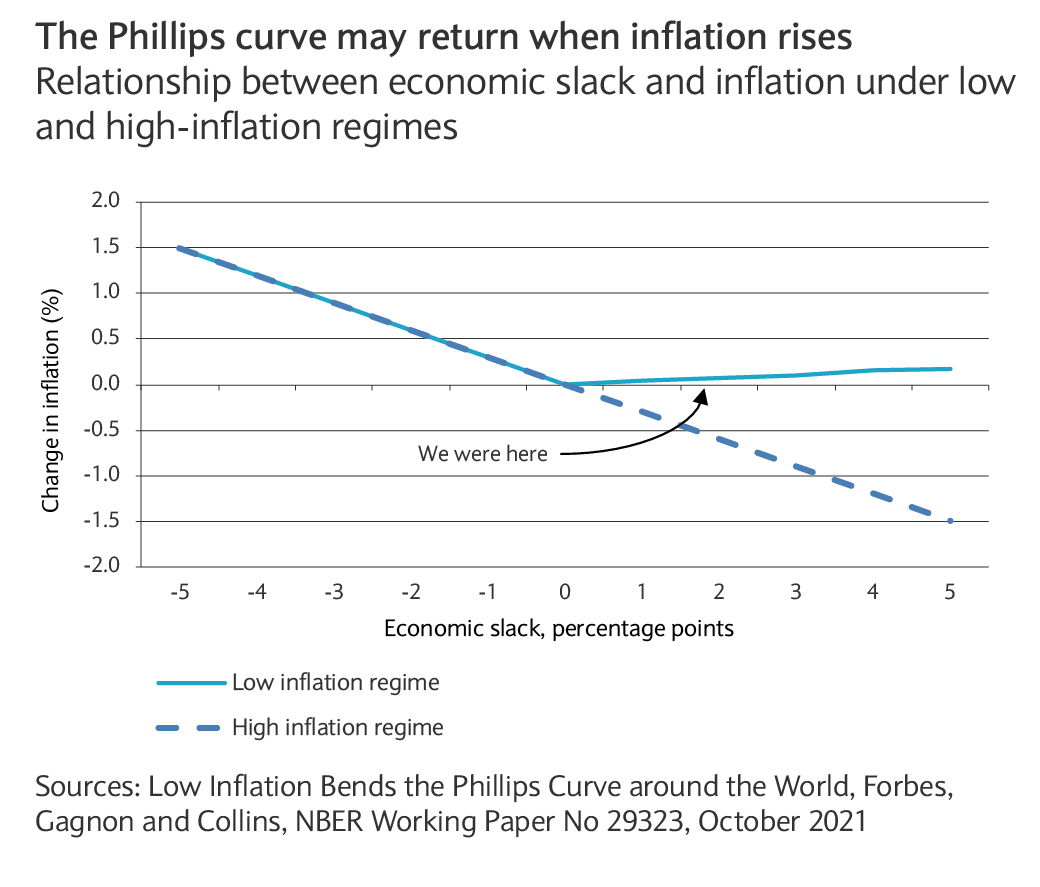

If this negative feedback loop occurs, then central banks might be forced to act in a bid to avoid losing control over their price stability mandate. This is not our base case but a clear possibility, and certainly something markets will worry about in early next year.