All the articles published in Market Perspectives are also available to download here as a PDF:

Market Perspectives September 2020

04 September 2020

Welcome to the September edition of “Market Perspectives”, the monthly investment strategy update from Barclays Private Bank, which is also available to download as a PDF [PDF, 1.7MB].

Fresh highs for US equity indices and gold price in August reflect the mood of financial markets, which frequently remain more beholden to COVID-19 related news than to company fundamentals or geopolitical tensions.

The gold price breached $2,000 an ounce for the first time in August and may have higher to climb. Fears of a second wave of the coronavirus, skyrocketing debt levels and November’s US presidential election are among the reasons why demand for the precious metal seems assured. The metal’s appeal as a diversifier looks solid. An appropriate weighting in gold allows investors to maintain higher exposure to equities, an asset class that is likely to outperform in the medium term, while hedging downside risk.

The S&P 500 recouped its pandemic-related losses in only five months. While a repeat of March’s selloff seems unlikely this year, valuations look elevated. Furthermore, the surge in market valuations has largely been driven by a few growth stocks. More volatility between sector and stock performance seems likely, even if masked somewhat at the index level. Rather than focusing on “growth” or “value” stocks, selecting quality companies, irrespective of industry, remains appealing.

With US equity markets at an all-time high, diversification remains more important than ever. This goes beyond a simple mix of equities and bonds. Indeed, correlations have surged this year as an elevated period of uncertainty took hold. Tighter asset correlations increasingly question the attractions of bonds in multi-asset portfolios, especially with little sign of a sustained upward move in treasury yields. However, bonds remain a key part of a well-diversified portfolio. The addition of corporate bonds and of alternative assets, like gold or hedge funds, can provide additional diversification effects, especially in periods of excessive inflation.

Sustainable investing seems to be coming of age. As geopolitical uncertainty is likely to increase from already high levels in the next few months, a post-pandemic world which strives to be more sustainable seems to be a reasonable conviction to have. More investors are investing in sustainable funds this year. Encouragingly, the funds have outperformed their traditional peers too, reinforcing that trying to make the world a better place can go hand in hand with superior performance.

Jean-Damien Marie and Andre Portelli

Co-Heads of Investment, Private Bank

Golden opportunity

The gold price has surged by 30% since March, topping $2,000 an ounce for the first time. Prospects for the economy during a pandemic and with a US election nearing look highly uncertain. Add in skyrocketing government spending and an expanding universe of negative yielding debt and the precious metal’s rally may have more to run.

Valuing quality stocks

Equity markets are likely to be choppy with notable geopolitical uncertainties to the fore: a pandemic-induced slowdown, bubbling US-China tensions and November’s US presidential election. That suggests a focus on quality companies, whether of the value of growth persuasion. Despite a surge in valuations since March, the risk of a sustained selloff appears slim.

The diversification appeal of bonds

With bond correlations with equities surging this year and yields low, have bonds lost their appeal as a portfolio diversifier? Probably not. By adding corporate bonds, providing higher income, to them with alternative safe-haven assets, like gold and hedge funds, the asset class can improve diversification effects, especially in periods of excessive inflation.

The attraction of co-investment funds

With elevated volatility in public financial markets likely for some time amid the pandemic, a weighting to private markets may add diversification benefits. In doing so, investing in co-investment funds can provide access to unlisted companies in an easier and faster way than many traditional approaches to private equity investing.

Getting to the bottom of ESG

The increased popularity of sustainable investing seen in a period of extreme volatility this year could mark a turning point. Outperformance against traditional peers helps. But what marks this form of investing out and why should environmental, social and governance practices be considered when constructing their portfolios?

Alpha hunters love dispersion

Asset correlations spiked at the outset of the pandemic. High equity correlations and low cross-sectional performance dispersion make stock selection very difficult. Since, though, US equity correlations have trended down. Coupled with increasing performance dispersion, this should create more opportunities for skilled stock pickers. But, are equities still attractive for alpha hunters?

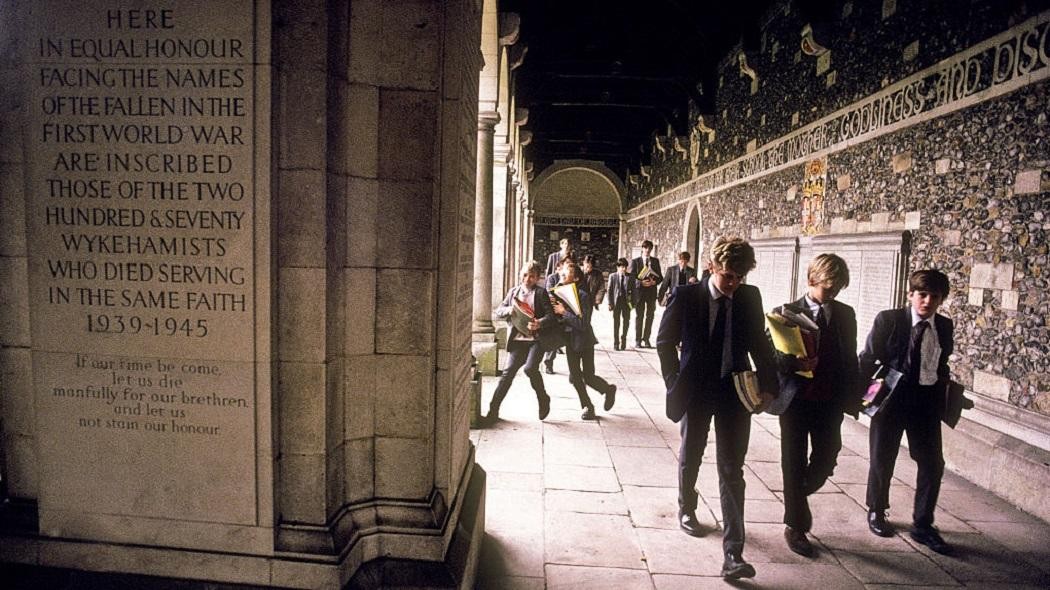

Back to school investment lessons

The risk of stress and emotion interfering too much in long-term investment planning can be particularly real in a financial market selloff, as in March. Since the subsequent bounce, many equity markets are looking rich, seemingly leaving little cushion for surprises. Investment processes and portfolios should be prepared for negative shocks, not least as market sentiment can shift quickly.

Multi-asset portfolio allocation

A long period of sub-trend growth and low interest rates seems likely as COVID-19 infection levels climb. In fixed income, developed market government bonds appeal. Dovish policy should underpin developed market equities and gold, despite US equities and gold hitting highs in August. We remain cautious on high yield bond prospects.

We give you versatility and a choice of services

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.