All the articles published in Market Perspectives are also available to download here as a PDF:

Market Perspectives August 2020

07 August 2020

Welcome to the August edition of “Market Perspectives”, the monthly investment strategy update from Barclays Private Bank, which is also available to download as a PDF [PDF, 792KB].

With continued spikes in infections reported in US and European regions and some quarantine measures reintroduced, financial markets remain focused on the risks of a second wave of COVID-19. This uncertain environment saw the dollar weaken against a basket of currencies in July, while gold hit a fresh high.

To support economies, governments are turning on the spending taps, pushing public borrowing levels to levels last seen in the 1940s. Returning government finances to sustainable levels could be tough and whether such largesse can prevent long-term economic scarring from the effects of COVID-19 remains to be seen.

After rebounding sharply, equities have been relatively range-bound in the last couple of months. Sentiment seems to be supported by hopes of a vaccine to COVID-19. Such enthusiasm looks questionable. Furthermore, the market’s concentration around a few growth stocks can be interpreted as a warning sign. Yet, hope can be a strong market force. With volatility likely to remain elevated, we continue to rely on active management and private markets to extract alpha.

On the other hand, bond markets appear eerily calm. Despite substantial fiscal and central bank stimulus packages of late, inflation and rates seem set to remain low for some time. As government bond supply climbs and default rates seem likely to rise, risks mount. In searching for carry in such an environment, we focus on investment grade bonds, selective high yield bonds or inflation-linked debt.

Taking a step back from short-term considerations, globalisation reversion, demographic shifts, “smart everything” and building a sustainable world are four long-term, structural themes set to transform society and the economy. In uncertain times, thinking thematically can help shape investment decisions and portfolio construction.

Jean-Damien Marie and Andre Portelli

Co-Heads of Investment, Private Bank

COVID-19: let’s get fiscal

Governments have responded to the pandemic by turning on the spending taps and assuming record debt levels. Some have endorsed green commitments in doing so. But can such largesse prove successful or is it a risky last throw of the dice?

Thematic thinking

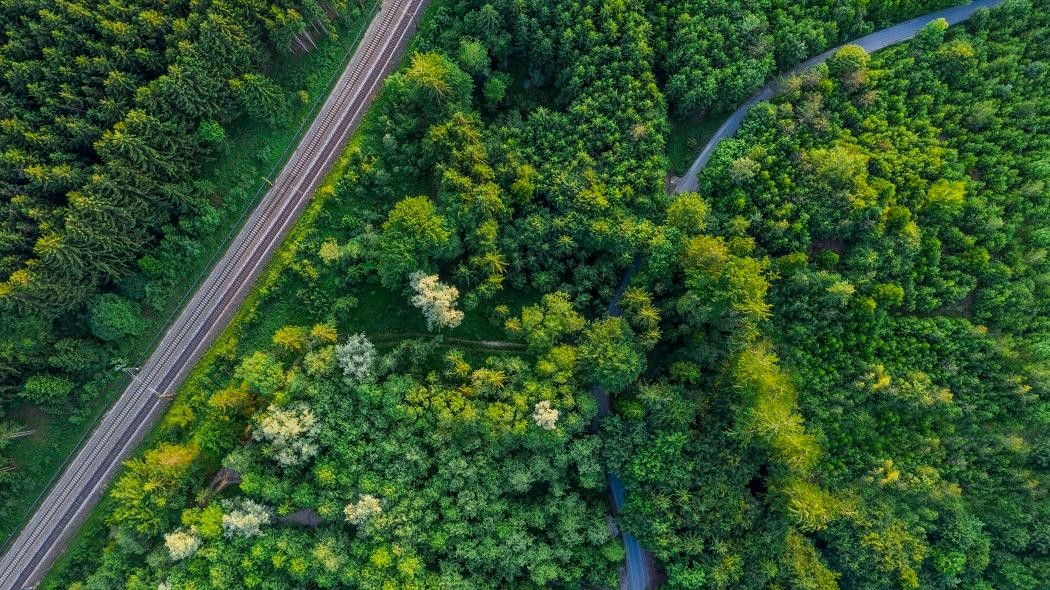

Identifying the structural trends transforming society and the global economy, and investing in these themes early, is key to positioning portfolios for long-term growth. How might aging populations and other demographic shifts, globalisation reversion, a more interconnected and “smarter” world and more sustainable living change economies? All these themes seem to offer compelling long-term opportunities for investors.

When hope trumps experience

Equities have been relatively resilient in the face of the impact of the pandemic on health systems and economies since March. But with infection spikes being seen and so much hope placed in a vaccine, risks are rising. As such, diversification and focusing on quality assets to produce returns looks increasingly appealing.

When higher debt doesn’t lift yields

The cards seem stacked against yield-hungry investors. As central banks pump more bonds into financial markets and weakening economies seemingly keep a lid on inflation expectations, where next? Large treasury supply in isolation is unlikely to translate into higher yields. But with yields likely to remain low for some time, what bonds may have most to offer investors?

Oil recovery hinges on second wave, gold and equities shine

Economies reopening, sentiment improving and positive supply cut news bodes well for oil. Risks of another round of COVID-19 infections could be a headwind for the lubricant. By contrast, after hitting a high in July, downside coronavirus risks, geopolitical tensions and low real interest rates could be a boon for gold.

60/40 portfolios: the end of the road?

Has the traditional 60-40 equity-bond allocation split had its day? The asset allocation strategy seems to have been less effective in delivering the desired returns for many investors at a time of low rates and eroding diversification attributes. How might investors allocate portfolios in such a world?

Looking on the bright side, cautiously

Financial markets seem to expect a quick economic recovery despite COVID-19 infection risks. As some markets near their highs, such optimism may be misplaced. While asset values appear elevated, volatility remains high. With consensus expecting next year’s earnings to bounce back to 2019 levels, any sign that recovery may take longer than is expected may hit sentiment.

Multi-asset portfolio allocation

Investors face worrying signs of fresh COVID-19 outbreaks in North America and Europe and a probable long period of sub-trend growth. In fixed income, we favour developed market government bonds. Dovish policy should underpin developed market equities and gold, despite the latter hitting a high in July. We are cautious on high yield bond prospects, with default rates rising.

Other editions of Market Perspectives

We give you versatility and a choice of services

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.