Market Perspectives September 2020

Financial markets are in fairly upbeat mood. That said, sentiment appears fragile while the focus of investors is on pandemic developments.

04 September 2020

6 minute read

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

Bond and equity correlations have increased of late. As such, what role can bonds play in diversifying multi-asset portfolios?

Since the peak of the crisis in March this year the US 10-year yield failed three times to change direction: March (resistance 1.2%), June (0.9%), August (0.7%). Given seemingly more encouraging economic data in recent weeks and likelihood of more positive news on the vaccine front (more than 160 vaccines are in development with some at phase three or the approval phase) rates could spike again soon. However, such a move may not lead to a secular move upwards in yields.

We pointed out that more debt in response to the pandemic need not necessarily lead to higher rates, in August’s Market Perspectives. Furthermore, our conclusion was that the traditional role that bonds play in 60-40, equity-bond allocation strategies seems more questionable.

The following sections look at the diversification attractions bonds can still provide investors at such challenging times.

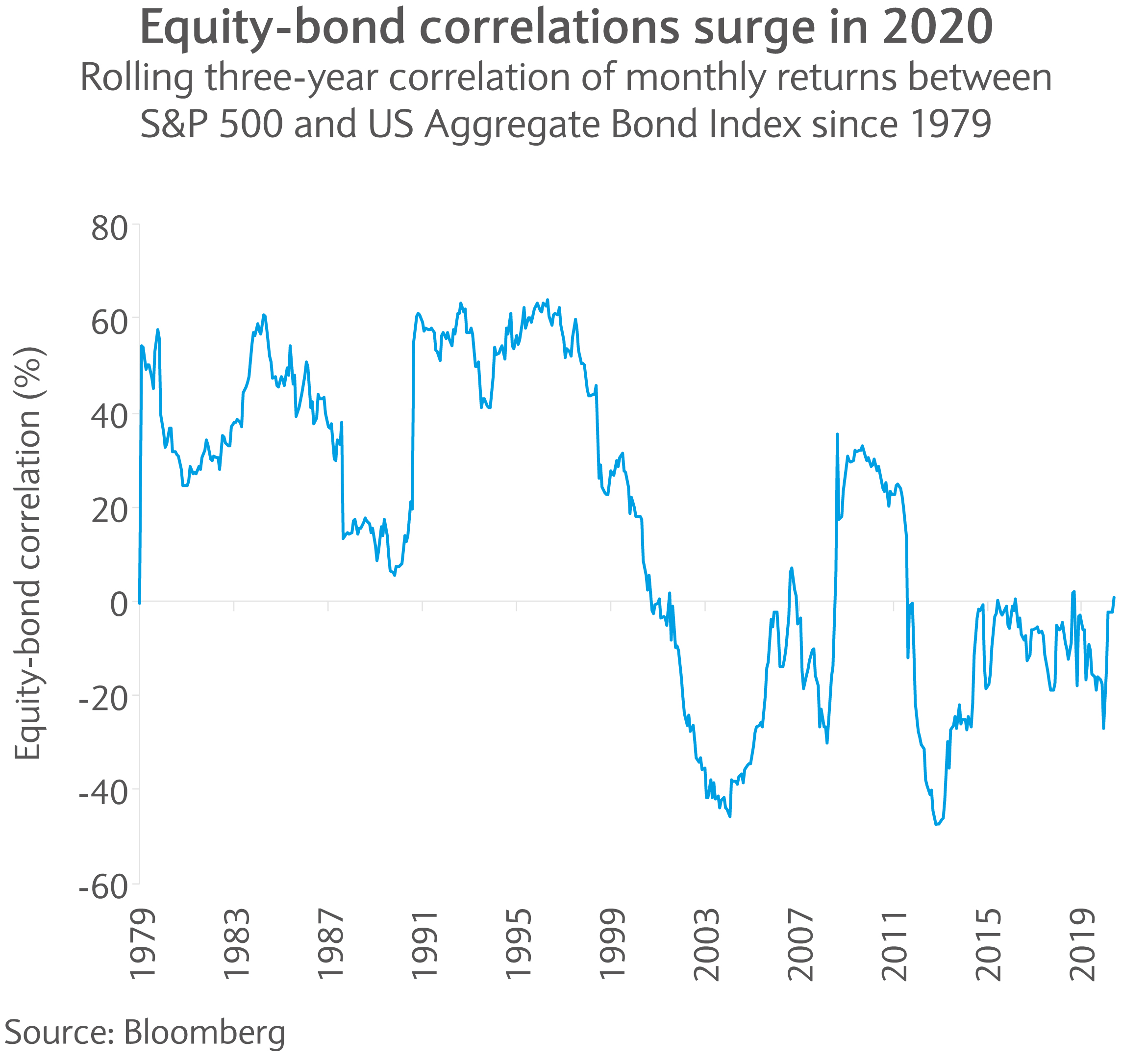

The correlation between bonds and equities has surged this year (see chart). This is a concerning situation given that bonds should ideally have little, or even negative, correlation in order to achieve better diversification effects in portfolios.

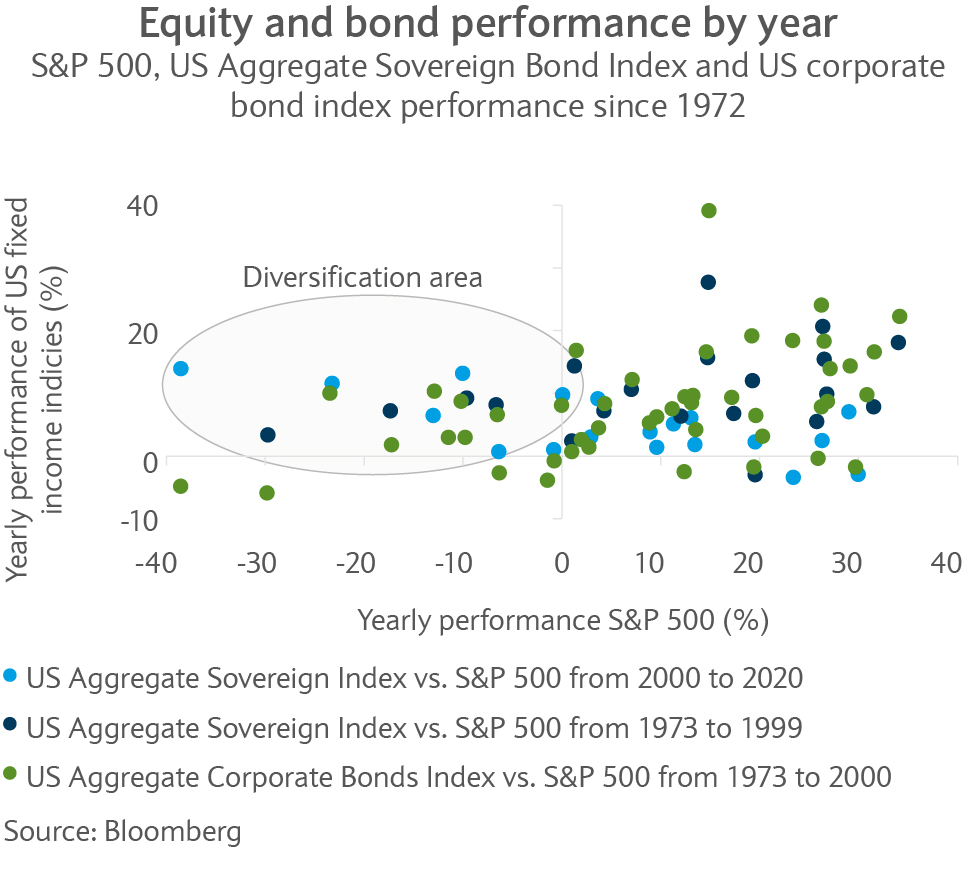

But the correlation between equities and bonds has varied substantially from year to year since 1972. The next chart plots the discrete performance of the US treasury bond index against the performance of the S&P 500 for each year going back to 1972.

The chart shows that a positive correlation between equities and bonds regularly occurred in years when both asset classes deliver positive returns (dots on the upper right). Positive correlation in these years should not be a cause for concern.

The left hand segment of the chart is probably more important when looking at equity-bond diversification: as bonds ideally provide positive returns when equities face losses. As confirmed by the blue dots in the left segment except in 1994 (-3.3%) bonds every year delivered positive returns in equity bear markets confirming the theory that in distressed times capital goes into safe-haven bonds.

The light blue dots in the chart show the performance in the years from 2000, when rates rapidly declined towards 4% or lower. As can be seen on the right part of the chart, bond returns, as a result of lower yields, have been significantly lower as a result when comparing to returns when yields were high prior 2000.

Given the low level of yields today it is unlikely that safe-haven bonds provide high returns compared to the past. Still, even in the lower yielding period from 2000 bonds delivered a positive performance during equity bear markets. We believe safe-haven flows into sovereign bonds in times of distress will not disappear in the future.

With yields close to zero, the hedging characteristics of sovereign bonds come at a high cost. Furthermore, the zero mark may act as a lower bound for yields. Corporate bonds do act as a more effective proxy over the longer term in our view.

Investment grade corporate bonds (green dots) produced negative returns in the equity market crashes in 1974 (a time of oil embargoes and the collapse of Bretton Woods) and 2008 (great credit crisis). However, corporate bonds have provided higher returns compared to government bonds throughout the period from 1972, helping to build a bigger cushion over time while performing in years when equity returns were negative in most cases.

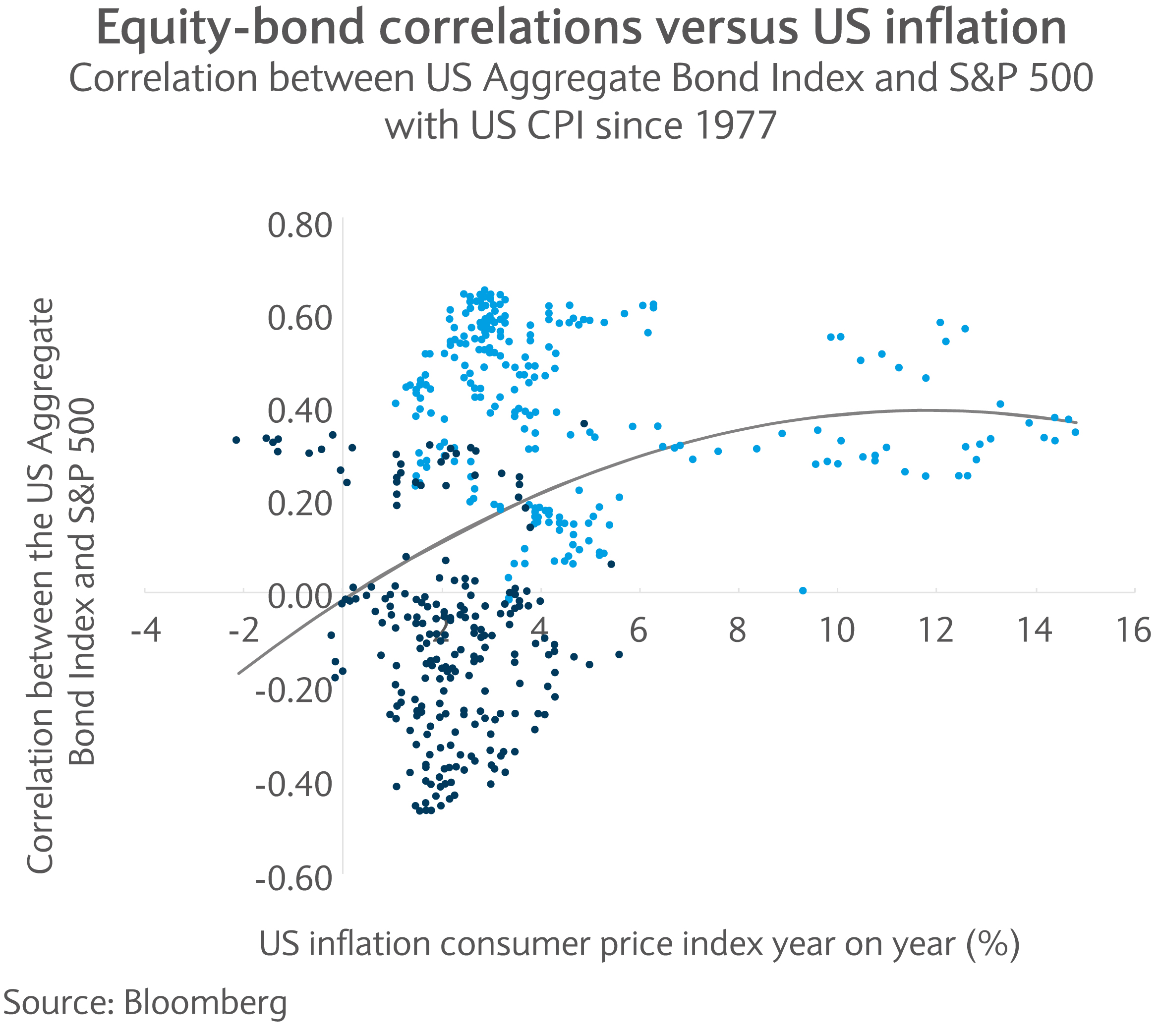

Years with positive correlation and negative correlation between the equity and bond market were quite balanced in periods of moderate inflation. But the diversification effects seemed not to work in times of very high inflation (see chart). In periods of excessive inflation (higher 5.5% for example) the correlation was always positive which resulted in low or no diversification contribution from bonds.

Despite the surge seen in equity-bond correlations this year, bonds are unlikely to lose their diversification benefits. Indeed, the addition of corporate bonds, providing higher income, and of alternative safe-haven assets, like gold, can provide additional diversification effects, especially in periods of excessive inflation.

Financial markets are in fairly upbeat mood. That said, sentiment appears fragile while the focus of investors is on pandemic developments.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.