Market Perspectives September 2020

Financial markets are in fairly upbeat mood. That said, sentiment appears fragile while the focus of investors is on pandemic developments.

04 September 2020

6 minute read

By Alexander Joshi, London UK, Behavioural Finance Specialist

As the summer holiday season heads towards its end for many, certain investment behaviours are worth bearing in mind ahead of what may be an eventful end to 2020.

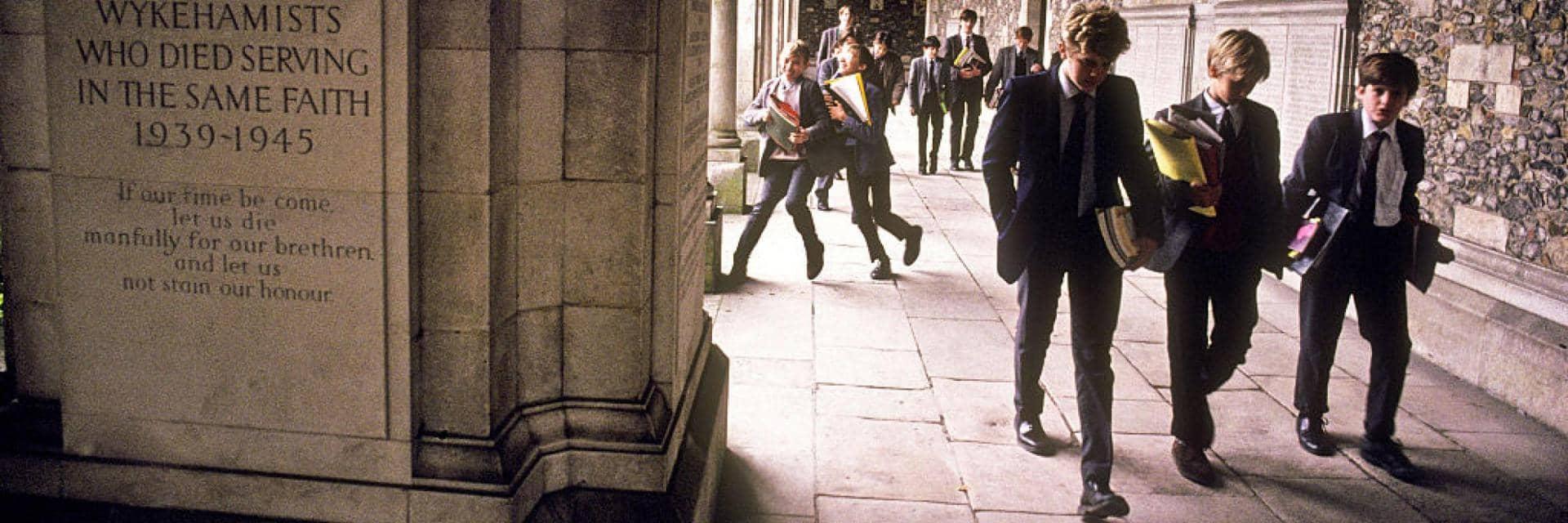

September marks the return to school for many in the northern hemisphere after the summer holiday provided a chance to unwind and switch off, despite the pandemic interfering with life. While a break can help to recharge the batteries, it can take time to get back into the routine and relearn old habits.

With the rest of 2020 likely to be eventful, this article provides a refresher on what good investment discipline looks like. Significant events that lie ahead this year include the US presidential election and the Brexit trade negotiations. Both are likely to affect markets against the backdrop of a pandemic about which much still remains unknown. This will provide both risks and opportunities for investors.

As the impact of COVID-19 reverberated through financial markets, we shone a spotlight on the behavioural challenges to investing to help investors in these testing times. This article brings some of these key points together, to help investors try to best navigate the rest of the year.

Finances and investments are in many cases the facilitators of many aspects of our lives. A first step may be to review your finances and ensure that they are aligned with your objectives, both for the investments themselves and the reason for seeking to protect and grow wealth. A clarity in your holistic objectives, agreed with or communicated to a trusted adviser, can make it easier to align investment decisions with it.

Having a goal in mind is important, but having a specific plan helps with achieving it. Even better is a plan that sets out the actions to be taken in the case of different eventualities and one that is designed in a way that makes the plan drawer accountable.

A good investment plan may include rules and timelines for getting invested. A plan can be particularly useful when taking actions during difficult market conditions, when investing can become difficult emotionally. In these situations, the natural tendency can be to take actions which provide short-term comfort, potentially at the expense of long-term returns, like selling out or reducing risk in the midst of a downturn.

The sharp rally seen in equities and credit since March might suggest that a V-shaped recovery is fully priced into the market. At these levels, the market leaves little cushion for negative surprises. Investment processes and portfolios should always be prepared for negative shocks, because swings in sentiment, and market moves themselves, can occur extremely quickly. This was demonstrated perfectly earlier this year with the speed at which markets unravelled and then rebounded.

The outlook certainly seems more uncertain given so much of the virus and its consequences remain to be seen. Rather than making the world more uncertain, unexpected events show us how uncertain the world already was. While there are degrees of confidence in the likelihood of events occurring, the reality is that there are no crystal balls in investing.

A good way to prepare for the unexpected is by following a robust investment process. One that leads to a diversified portfolio geared for the long term, investing in quality assets and built to perform across different market conditions. Putting in place a process which is resilient in the face of changing conditions is the best protection and should make it easier to stay invested and reap the benefits of time in the market.

Periods of market turbulence and downturns can induce stress in an investor, perhaps leading to poor long-term decision-making. It is when markets look most precarious that our behavioural proclivities can lead us astray.

Periodically reviewing past decision-making objectively to assess the quality of decisions made, and ways to refine them, can be an important first step to improving them. Building a process which is systematic and is built around identified biases can help to reduce the impact of said biases. Delegating decision-making to experts with tried and tested processes and good track records may be advisable.

Time in the market is usually far better than trying to time the market. While active management can help to maximise investment returns, behavioural studies show that investors may harm performance through overtrading.

To increase the likelihood of success when investing, it can make sense to follow a robust process which strikes a balance between long-term thinking, to generate the core investment returns, and the more reactive and opportunistic short-term tweaks, to maximise overall returns. This can help temper a tendency to act during emotive market events where a fear of doing nothing can induce actions more harmful than staying with the status quo.

When an event occurs which is vivid and affects us personally we understandably attach great significance to it. This is an evolutionary trait which was designed to protect us from predators; in the face of uncertainty we use rules of thumb (heuristics) which have provided us with rapid and effective decision making throughout our evolution.

Unfortunately, this can lead to biased decisions if information which is more vivid and easily recalled is overweighed at the expense of other information. There is a risk that investors focus fully on the post-pandemic recovery and give less attention to events such as US-China trade tensions and the upcoming US elections and Brexit trading relationship.

For those seeking to protect and grow their wealth, active investment strategies that focus on quality and the potential winners coming out of the COVID-19 crisis appear to offer much hope. While 2020 is proving to be an unprecedented year, for economies and financial markets, every year provides risks but also opportunities to be capitalised on by investors looking beyond the headlines.

Financial markets are in fairly upbeat mood. That said, sentiment appears fragile while the focus of investors is on pandemic developments.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.