Market Perspectives September 2020

Financial markets are in fairly upbeat mood. That said, sentiment appears fragile while the focus of investors is on pandemic developments.

04 September 2020

7 minute read

By Julien Lafargue, CFA, London UK, Head of Equity Strategy

Although choppy markets appear to lie ahead as the pandemic rages on and a US election nears, quality companies seem the investment of choice with supportive central bank policy set to buoy valuations.

It took the S&P 500 only five months to recoup its pandemic-related losses and reach new all-time highs. On the other hand, global economic activity remains considerably below pre-crisis levels. This divergence is unlikely to last forever. However, a sustained, sharp correction may not be on the cards for the time being.

While stock prices have swung dramatically between February and August, the same can’t be said about earnings expectations. Indeed, 2020 estimates shrank to $122 at their trough in July, from $172 at the beginning of the year (see chart). They stand at $128, having barely moved despite stellar second-quarter results. For 2021, the earnings per share for the S&P 500 are expected to reach $165, broadly in line with the $163 reported in 2019.

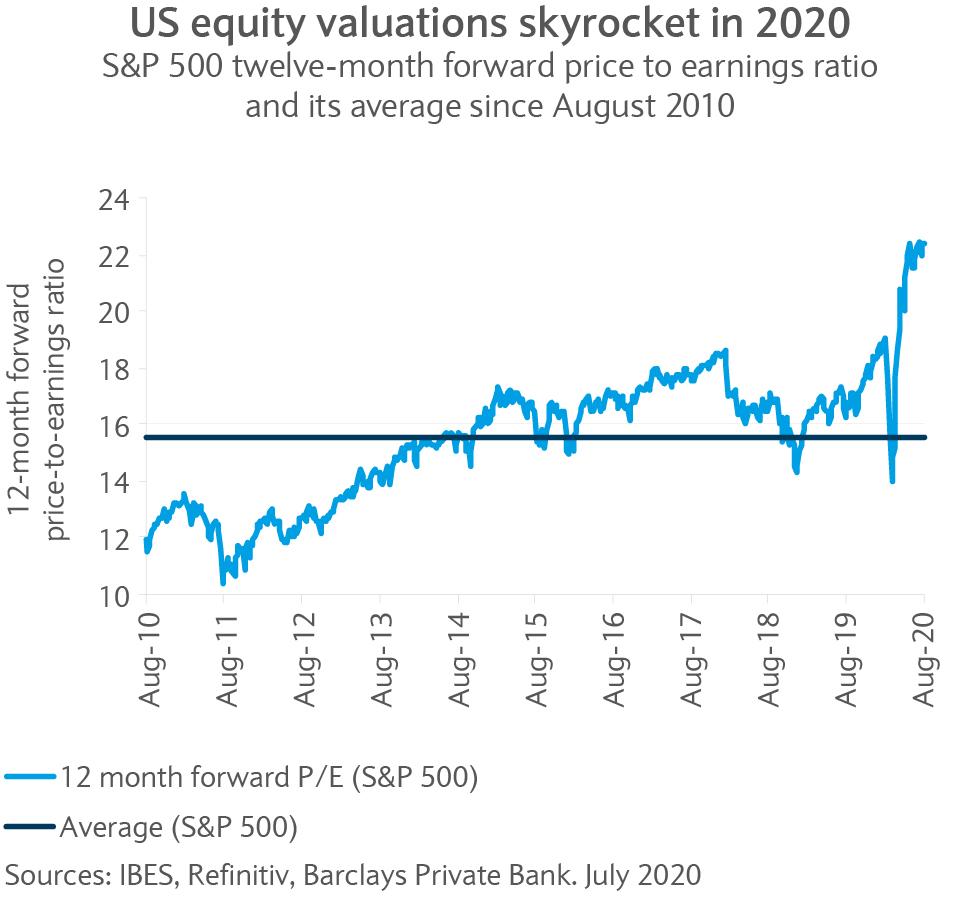

With earnings expectations well anchored, the main driver of the stock market’s rally has been the expansion of valuation multiples. The S&P 500 is trading at 22 times, on a 12-month forward price-to-earnings ratio basis, significantly above historical averages. Despite equities move higher during earnings season in July and August, this number has been relatively stable as the next four quarters now include a period, between April and June 2021, when consensus expects profits to jump by 40% year-over-year.

While it’s fairly easy to rationalise changes in earnings expectations, explaining gyrations in valuation multiples is subject to interpretation. Price-to-earnings ratios typically lead earnings revisions and collapse in anticipation of contracting earnings while expanding ahead of a recovery.

As such, it should not be surprising to see elevated valuation multiples when earnings expectations are depressed and about to be revised higher (see chart). However, as we have established above, the consensus already expects 2021 earnings to be back to 2019 levels, leaving limited room for additional positive revisions.

The reason behind the recent dramatic increase in valuations seems to lie outside of earnings expectations or valuations. But where?

One likely explanation could be the unprecedented injection of liquidity from central banks. While some of the measures announced during the pandemic were solely designed to help financial markets function normally, the ramp up in quantitative easing, coupled with the unconditional commitments from the European Central Bank (ECB) and US Federal Reserve (Fed) to do “whatever it takes” to support their economies, have made the institutions buyers of last resort. This has removed some of the risks investors would normally bear, reducing the premium needed to cover these risks and allowing valuations to expand.

If central banks’ supportive policy actions are indeed responsible for inflating equity valuations, then any sustained and meaningful fall in valuations looks unlikely while liquidity remains plentiful.

With both the Fed and ECB appearing far away from reducing asset purchases, valuations can hold for now, allowing an upward reversion to the mean on the back of gradually recovering earnings. At the same time, markets tend to respond most directly to the flow rather than the stock of monetary easing. With the pace of accommodation likely to slow in coming years, further multiple expansion is improbable.

Whether it is US-China trade tensions, the US presidential election or simply the pace of the recovery, the road ahead appears bumpy

If equity valuations are to hold, a repeat of March’s severe selloff is unlikely. Yet, uncertainty remains elevated. Indeed, whether it is US-China trade tensions, the US presidential election or simply the pace of the recovery, the road ahead appears bumpy.

As such, we would not dismiss the possibility of a five to ten percent correction, especially should governments fail to maintain a high degree of fiscal support or should a COVID-19 vaccine be elusive this year.

Timing a possible entry point will be difficult if not impossible. This is why staying invested may be an appropriate course of action. However, diversification is likely to be key to successfully navigate equity markets this year.

Even though, at the index level, price moves should be rather limited, investors should prepare for higher volatility and dispersion at sector and stock levels. In particular, the over dominance of “growth” as an investment style, spearheaded by tech this year, may temporarily come under pressure should the health crisis recede if and when a vaccine becomes available.

Yet, investors should not completely rotate away from growth (technology, internet or healthcare for example) and into value sectors (such as banks or energy). Instead, “quality” remains the main characteristic worth considering when investing, whether its within growth or value.

Financial markets are in fairly upbeat mood. That said, sentiment appears fragile while the focus of investors is on pandemic developments.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.