Outlook 2025

In the aftermath of the US election, our bumper “Outlook 2025” analyses what might drive financial markets next year.

Macro - US

15 November 2024

Julien Lafargue, CFA, London UK, Chief Market Strategist

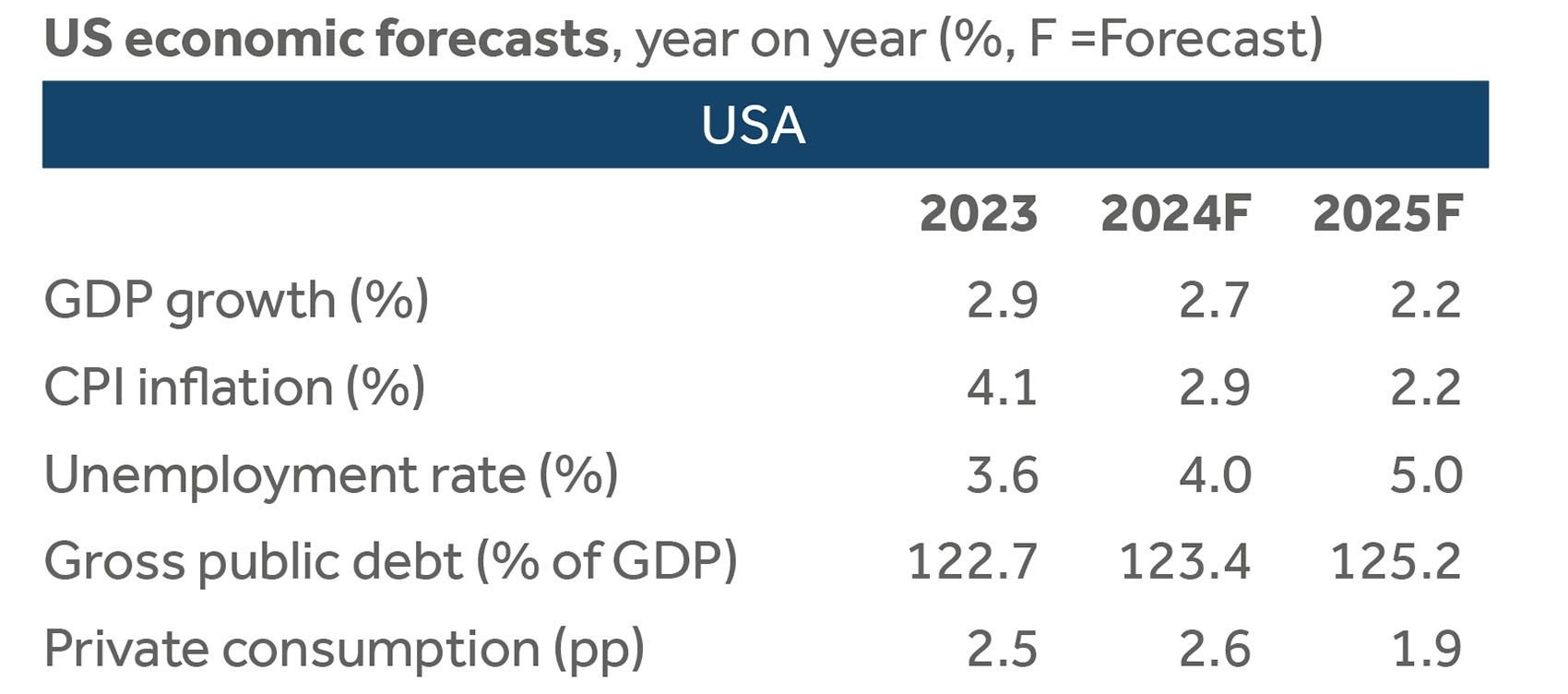

Once again, the US economy powered ahead in 2024. Indeed, the country is on track to expand the economy by 2.7%, in real terms, this year (see table). By contrast, the consensus among economists expected just 1% growth, back in November 2023.

Source: Barclays Investment Bank, November 2024

Sure, 2024 hasn’t been plain sailing, with market sentiment swinging between a ‘soft landing’ and a ‘hard’ one. While this debate is likely to resurface before long, the combination of supportive fiscal policy and retreating interest rates should underpin more of the same: we pencil in GDP growth north of 2% in 2025, as a base case. Importantly, though, 2024’s drivers of growth (the government and consumer spending) are anticipated to slow, with investment spending doing some of the heavy lifting.

One reason for this shift in the growth mix is that US consumers appear to be running on fumes, in particular at the lower end of the income distribution. Indeed, the savings rate remains relatively low (at 4.8%), pandemic-related excess savings have been depleted, and real income growth, although still positive, is likely to slow.

Beyond that, the outlook is rather clouded. Indeed, with a change in leadership at the White House, there could be important policy changes. Whether it’s tax cuts, deregulation or new tariffs being imposed, they could all significantly alter the US growth trajectory. It’s important to remember that any impact may not be felt in 2025, though.

When it comes to tariffs, president-elect Trump was pretty clear, saying ’tariffs’ is “the most beautiful word in the dictionary1” and, if he follows through on his promises, much higher import duties could be on the way in 2025. If so, their ultimate impact will depend on the scope and range of them, and any retaliation that may ensue. Companies, in their ability to pass on and absorb those additional costs, and consumers will also be key deciding factors.

Importantly, though, any tariffs-related inflation shock should be short-lived. Similarly, just as how companies and consumers adjusted after the ‘trade war’ in Trump's first administration, we would expect the US economy to “move on” within a few quarters, following the announcement of new tariffs.

Another key unknown is the future of existing stimulus packages, such as the Inflation Reduction Act. While some committed capital has already been spent, the majority of it remains to be allocated. Of that, only around a quarter, representing a few hundred billion US dollars, based on some estimates, is likely exposed to a possible roll back.

This is significant, when compared to the large US tech companies’ expected investments in artificial intelligence next year alone (close to $200 billion). However, it is relatively small in the context of US net domestic investments (close to $1.5 trillion2). Yet, this could have an impact on the country’s economic outlook, especially if additional tariffs are implemented.

In the meantime, the US Federal Reserve (Fed) will probably keep banging away about it being focused on the data, and the data alone, in setting policy. On that note, the uncertainty around US trade relationships could lead to a short-term boom in activity, to pre-empt higher tariffs. Unfortunately, the subsequent hangover may not be pleasant, resulting in lower growth from late 2025.

Meanwhile, employment may slow in the immediate aftermath of the election. Indeed, companies may prefer to adopt a ‘wait and see’ approach, further compounding the recent declines in in real-time measures of demand for workers. Beyond that, a stricter stance on immigration may ‘artificially’ support employment, by preventing the labour force from expanding, but also put upward pressure on wages. Overall, however, the Fed is likely to lower interest rates further, at least initially.

In this highly uncertain environment, economists and investors alike should remain open-minded, acknowledging the wide range of possible economic outcomes. Importantly, as was seen in Trump’s initial presidential term, the most obvious consequences of the election result (in this case, the “doomsday” predictions of some, and hopes by others that the oil sector will outperform) may not happen. With that in mind, and while everyone seems convinced inflation will rise; it’s tempting to assume that it may, in fact, fall faster than expected in 2025.

In the aftermath of the US election, our bumper “Outlook 2025” analyses what might drive financial markets next year.

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

The Guardian, Trump vows to impose tariffs as experts warn of price hikes and angry allies, 15 October 2024Return to reference

The St Louis Fed, Net domestic investment database, October 2024Return to reference