Market Perspectives October 2023

Read our latest round-up of the global themes, trends and events influencing investors.

Fixed income

09 October 2023

Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

Please note: This article is more technical in nature than our typical articles, and may require some background knowledge and experience in investing to understand the themes that we explore below.

In a similar vein to the maxim that if the American economy sneezes, the rest of the world catches a cold, when the US central bank ramps up rates, emerging market (EM) investors in US dollar-denominated bonds suffer (the converse also being true). After one of the fastest surges in interest rates seen from the US Federal Reserve (Fed) since the start of 2022, at last some relief appears to be in sight for global bond markets.

Central banks had a few surprises in store at their rate-setting meetings in September. The European Central Bank (ECB) kicked off by hiking rates once more, to 4%, against market expectations of a peak rate of 3.75%. As such, rate markets adjusted accordingly, with 2-year German bunds reaching for last October’s high at 3.3% (the most seen since 2008). The Bank of England, by contrast, shocked investors by not lifting the base rate, taking UK 2-year gilt yields down by half a point to 4.8%.

The good news is that peak rates have likely been reached, or are very close to being hit, by leading central banks. As such, the risk of excessively higher rates seems to be small.

The Fed might not have surprised bond markets by leaving rates unchanged. That said, the rate-setters’ projections for the fed funds rate caused a stir. The Federal Open Markets Committee’s ‘dot plot’ hinted that rate cuts will not be as fast as many had expected, and that higher rates are here to stay for many months: a common pattern among all three central banks mentioned here so far.

Indeed, the pricing of the rate curve has probably been too optimistic this year, as the path of inflation moderation will be anything but a straight line. Still, higher-for-longer does not necessarily mean forever, even if the theoretical neutral level of rates, or the level that allows the economy to operate at full employment while not boosting or shrinking economic growth, may potentially lie slightly above where it has been in the last decade.

US dollar-denominated emerging market bonds, and US investment grade bonds, have only nudged up by 1.73% and 0.78% respectively so far this year. The negative contribution from duration was the main driver of this performance, while spreads remained relatively stable and compressed to 310 basis points (bp) from 350bp, trading 20bp below their 20-year average level.

How might higher rates eventually impact EM bond performance in the coming months, remembering that such effects take time to filter through to the real economy?

Two factors in how changes in interest rates are transmitted to the economy come into play when trying to show how US-rate dynamics might influence prospects for EM bonds.

First, higher American rates usually spark repatriation flows from emerging markets, given the declining relative attractiveness of EM bonds against US alternatives. This pattern was evident in 2022 and for most of this year. As much as $21 billion of liquidity has been withdrawn from EM bond funds between February and September (blended and dedicated funds, and between local- and hard-currency debt), according to EPFR Global. With higher US-rates, global investors prefer the relatively safer option of US bond markets.

Second, funding costs usually increase for EM borrowers, be it through the higher costs of respective US dollar hard-currency debt, or via increased rates for local-currency bonds and weakening reserves due to local-currency devaluation. Furthermore, the increased uncertainty over the outlook for local-market rates has pushed back much debt issuance and weakened liquidity inflows of late.

EM sovereign borrowers have raised $85 billion from international debt markets so far in 2023. This was up from over $60 billion over the same period last year, but still well below the pre-pandemic annual average of $ 150 billion (2016-2019), according to data from the Institute of International Finance1.

Overall, a further $23 billion of issuance seems reasonable over the remainder of this year. While lower supply may be positive, a more desirable backdrop should occur when healthy EM debt supply also meets with upbeat demand.

For now, the backdrop for EM bonds remains patchy and a selective approach appears justified. That said, a rerun of the sharp devaluation of EM bonds seen in 2013 on the back of much higher US rates is more unlikely today. While some re-pricing in the US dollar curve is still on the cards, it should be more limited at this stage of the cycle.

Still, EM bond assets may well lag the immediate impulse created from lower-trending US rates in a higher-for-longer era. A look at previous EM-spread trends suggests that the move in 10-year yields seems warranted.

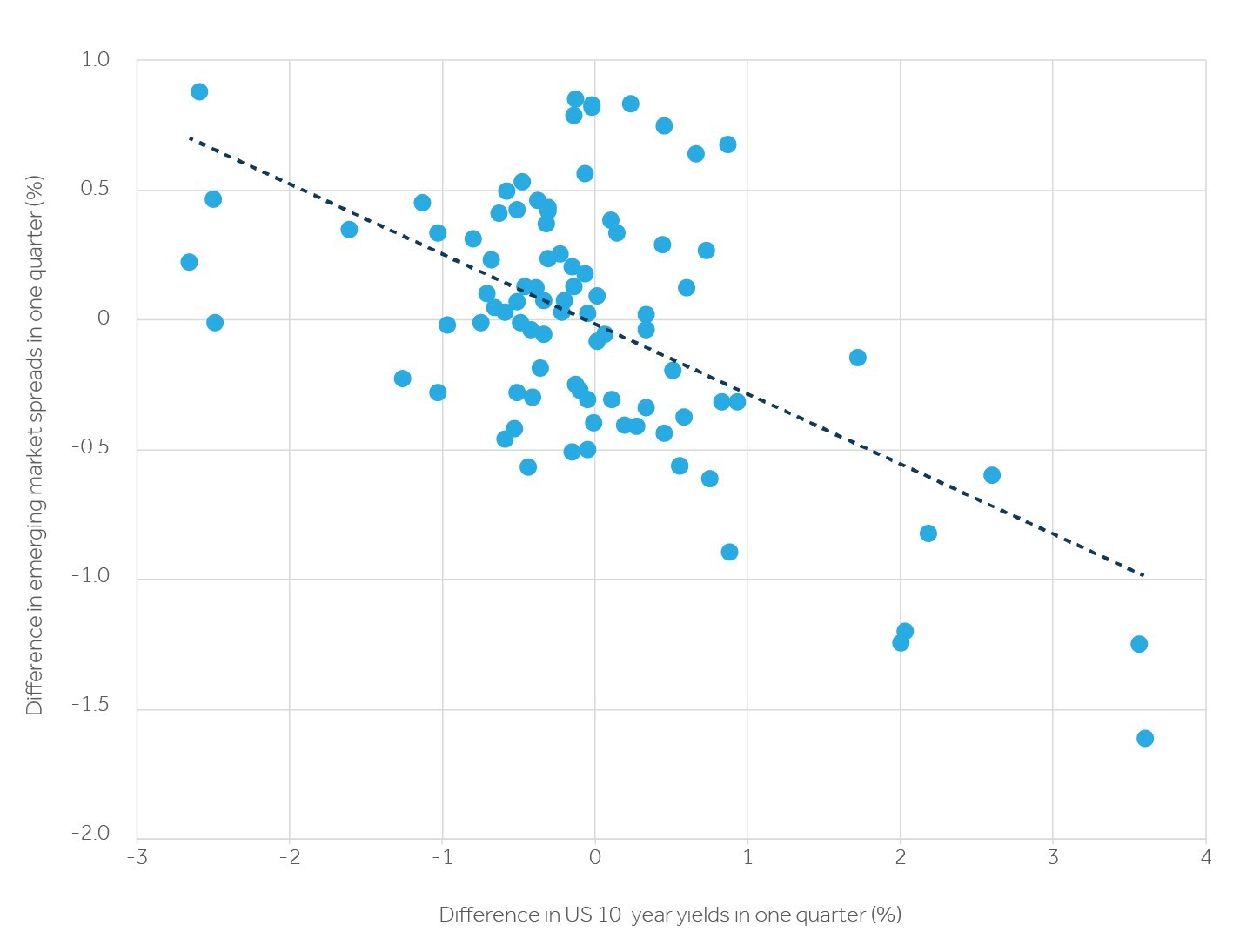

EM bond spreads and US rates have been negatively correlated (lower US yields met with wider trending spreads and vice versa) this century, if not by much (see chart). In light of the above discussion, this may come as a surprise. But EM spreads behave in a similar way to global corporate-bond spreads.

Lower trending yields, in particular the severe drops in rates seen in 2008, 2001 or in 2020, go hand-in-hand with a deteriorating growth environment. This in turn lifts the yield premium for risk assets, such as EM bonds, leading to underperformance. At the same time, EM spreads have often tightened during phases of moderately higher trending rates.

The difference in EM spreads over one quarter, versus that of US 10-year yields over the same three-month period, as measured by the respective index, since 2001

Source: Bloomberg, Barclays Private Bank, September 2023

The change in spread only tells half of the story. For absolute-return bond investors, rate trends, spread change and carry returns also matter. The latter is likely to play a particularly important role. This is especially true as the room for spreads to compress further appears to be limited, given that they are below their long-term average.

With US interest rates possibly at their peak now, the article When the race is on during cycles shows that corporate bonds have averaged a return of around 12% when locking in yields at the peak of policy rates in the subsequent two years. But, what about the outlook for EM bond investors at such times?

While history is never a guarantee of future performance, it is interesting to note that EM bonds have returned 25% on average in the subsequent two years of the last five hiking cycles, stretching back to 1993. The average is skewed to the upside by the period since 1995, a year that saw the index soar by a remarkable 83%. Still, even without this reading, EM bonds returned roughly 11% on average in the respective post-hiking cycle period.

While this performance may lag that of US government bonds during the same periods, EM bonds have returned an average of 8.07% per annum since 1993, compared to the 4% average annual performance of US government bonds over the same spell. This timeframe includes the many EM financial crises that erupted and covers various rate environments.

Encouragingly, carry helped to smooth the return profile. For EM debt, that meant that following hiking cycles, the bonds, on average, did not show negative returns in the subsequent two-year period.

The outlook for EM bonds seems mixed. Historical trends support the medium-term outlook for the asset class. Subdued global economic growth is likely to hit EM countries of lower credit quality and higher leverage in particular. Meanwhile, investment-grade and double-BB rated countries within the segment should do relatively well. In addition, the dispersion in returns among various regions and countries is likely to increase.

In China, high-yield bonds, especially those issued by the real-estate sector, are likely to face further headwinds given the country’s lower-growth prospects and the troubled property market. It remains to be seen if the government’s recent efforts to provide liquidity and boost growth in the sector will be sufficient to lift the mood.

India, on the other hand, should be supported by the positive growth backdrop seen this year. The inclusion of India’s bond market into the JPMorgan Emerging Market Bond indices should also help to attract more international buyers. That said, higher oil and food prices remain a risk, something which affects the broader Asian bond market.

While a drag on predominantly oil-importing markets, higher oil prices should support bond prices in commodity-exporting countries, such as issuers in the Gulf states or Latin America. While the first area might only offer a limited yield pick-up, issuers in the latter area could be challenged by higher budget deficits, a situation evident in Brazil and Mexico.

EM security selection remains vital, at a time of higher rates and subdued growth prospects. The potential for a performance boost through further spread compression seems to be limited. Carry and duration are likely to be the main drivers of bond returns.

If rate volatility intensifies globally, good entry points to the market for investors should emerge. The greatest risk for bond markets seems to be a sharp global slowdown, which is not a base case, rather than rate spikes. By contrast, the best opportunities for EM debt might emerge in a scenario of more resilient global growth.

Read our latest round-up of the global themes, trends and events influencing investors.

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Weekly insight: pickup in EM sovereign debt issuance, Institute of International Finance, 7 September 2023Return to reference