Market Perspectives May 2023

Welcome to our May edition of “Market Perspectives”, the monthly investment strategy update from Barclays Private Bank.

09 May 2023

Julien Lafargue, CFA, London UK, Chief Market Strategist

Although the fallout of Silicon Valley Bank’s collapse in March has been largely contained and a financial crisis averted, investors still face potential repercussions that should be monitored closely. In particular, the availability of credit is starting to worsen significantly as US banks, especially smaller ones, are both less willing and able to take on risk at this stage of the cycle.

Small businesses are experiencing this phenomenon first-hand and an increasing proportion of them are flagging the challenges being encountered when trying to get new loans. With smaller banks (less than $250 billion in assets) responsible for roughly half of commercial and industrial American loans, according to Federal Deposit Insurance Corporation data, the risk is real for small- and medium-sized businesses. This has implications for broader economic growth, monetary policy and financial markets (see Tighter credit conditions points to increased selectivity for more details).

While negative at face value, tighter credit availability could be a blessing for investors. Indeed, by reining in debt levels, commercial banks are doing some of the work for their central banks, allowing them to take their foot of the brake and stop hiking interest rates. This could be good for both stocks and bonds.

It might not feel it, but volatility has trended down this year, at least according to the “fear index” (or the Chicago Board Options Expiry Volatility Index, known as the VIX). Indeed, outside a brief spike following the collapse of Silicon Valley Bank in March, the VIX has fallen towards 20, a level that is usually consistent with a benign risk environment.

This discrepancy between how we fell and what the VIX shows may be down to technical factors and demand/supply imbalances. Indeed, the VIX is supposed to measure the expected volatility of the S&P 500 over the next 30 days, relying on options prices to do so.

However, recent months have seen a surge in trading in short-dated options and in particular, the so-called 0DTE options which expire within a day. The significant demand for these options means that more “traditional” tenors see less trading activity and therefore may not be as good of an indicator for market sentiment.

So, while the VIX may send signals of relative calm, many investors seem far from serene. As such, we would refute the argument that complacency is far from returning.

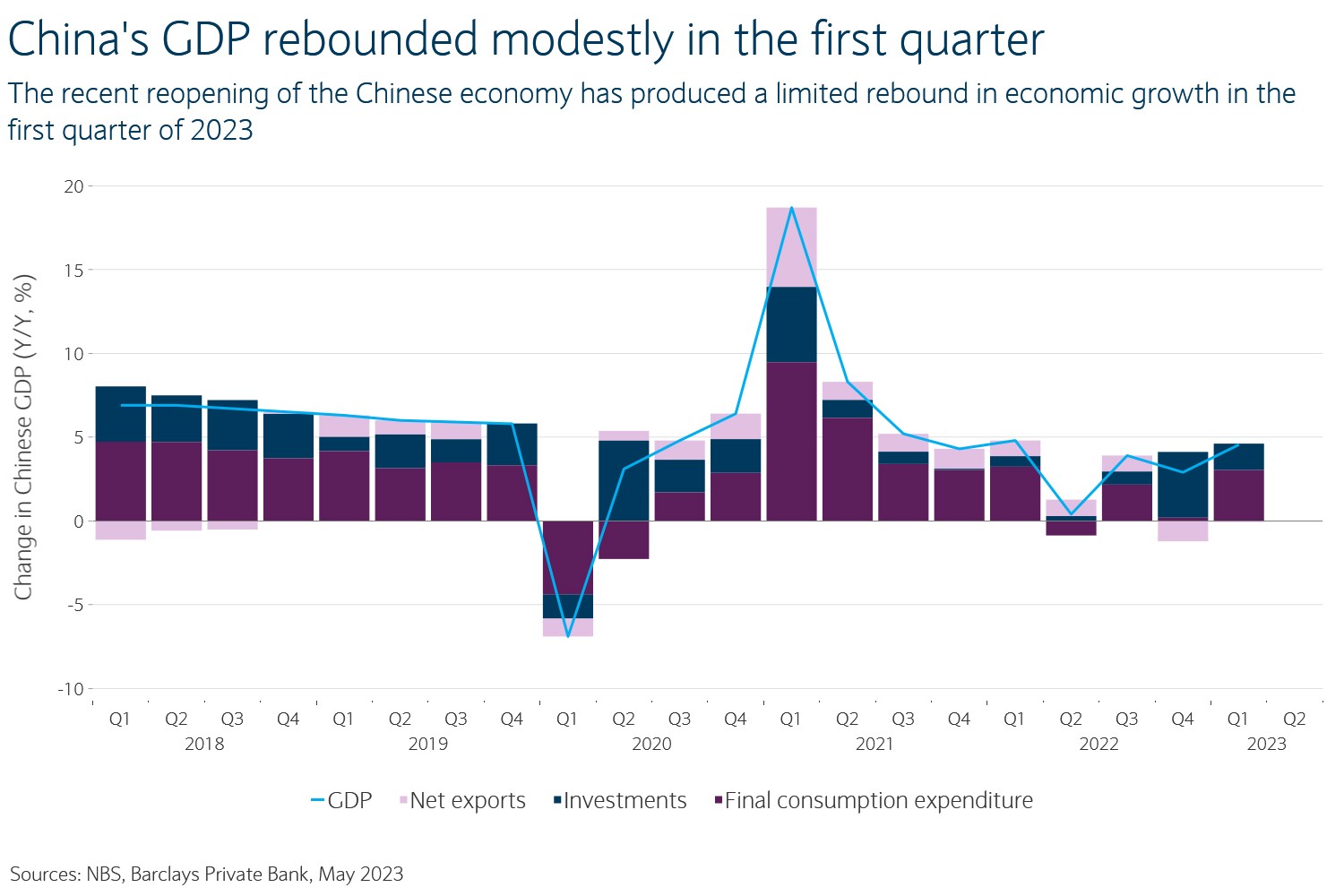

China’s economy grew 4.5% year-on-year (Y/Y) in the first quarter of this year. While this is better than expected (consensus was around 4%) and a sharp improvement compared to the 2.9% registered at the end of last year, it’s hardly a strong rebound.

Indeed, pre-COVID-19, the country was targeting and delivering real gross domestic product (GDP) growth of over 5%. In this context, seeing China’s economy expand by only 4.5% following its reopening might seem low. One easy explanation is that while in Europe and the US, economies were repeatedly shut down during the pandemic (remember US GDP fell by 8.4% Y/Y in the second quarter of 2020), the country lived under some sort of restrictions for the best part of the last three years. As such, any rebound on the back of the “grand reopening” was likely to be limited.

That being said, it would be wrong to say that China is not reaccelerating. First, Y/Y GDP growth should mechanically accelerate in the second quarter, as a year before the economy almost ground to a halt (+0.8%). Second, a few companies heavily exposed to the Chinese consumer have made clear that this segment of the economy is doing well. Luxury behemoth LVMH, for example, indicated that it is “seeing a rapid improvement in revenue in Asia with a 14% increase in Q1 of this year compared to the year ago period, fuelled by mainland China, Hong Kong and Macau”.

Luxury is only part of the picture, but these comments suggest that the Chinese economy is getting back on its feet.

While fixed income markets have seen yields rise substantially in the past 12 months, the asset class isn’t providing substantial income yet.

Indeed, as the COVID-19 pandemic hit and demand for “safe” assets skyrocketed, most companies took advantage and were able to refinance, or issue, new debt with very low coupons in 2020 and 2021. As central banks turned their attention to inflation and started hiking interest rates last year, debt issuance slowed. So far in 2023, less than $500 million-worth of US corporate debt has been issued, almost 15% lower than the same period last year.

Investors can now achieve higher yields because the price of outstanding bonds has fallen dramatically. But because so little new debt has been issued with coupons reflecting the current interest rate environment, getting much income from a bond portfolio can still be challenging.

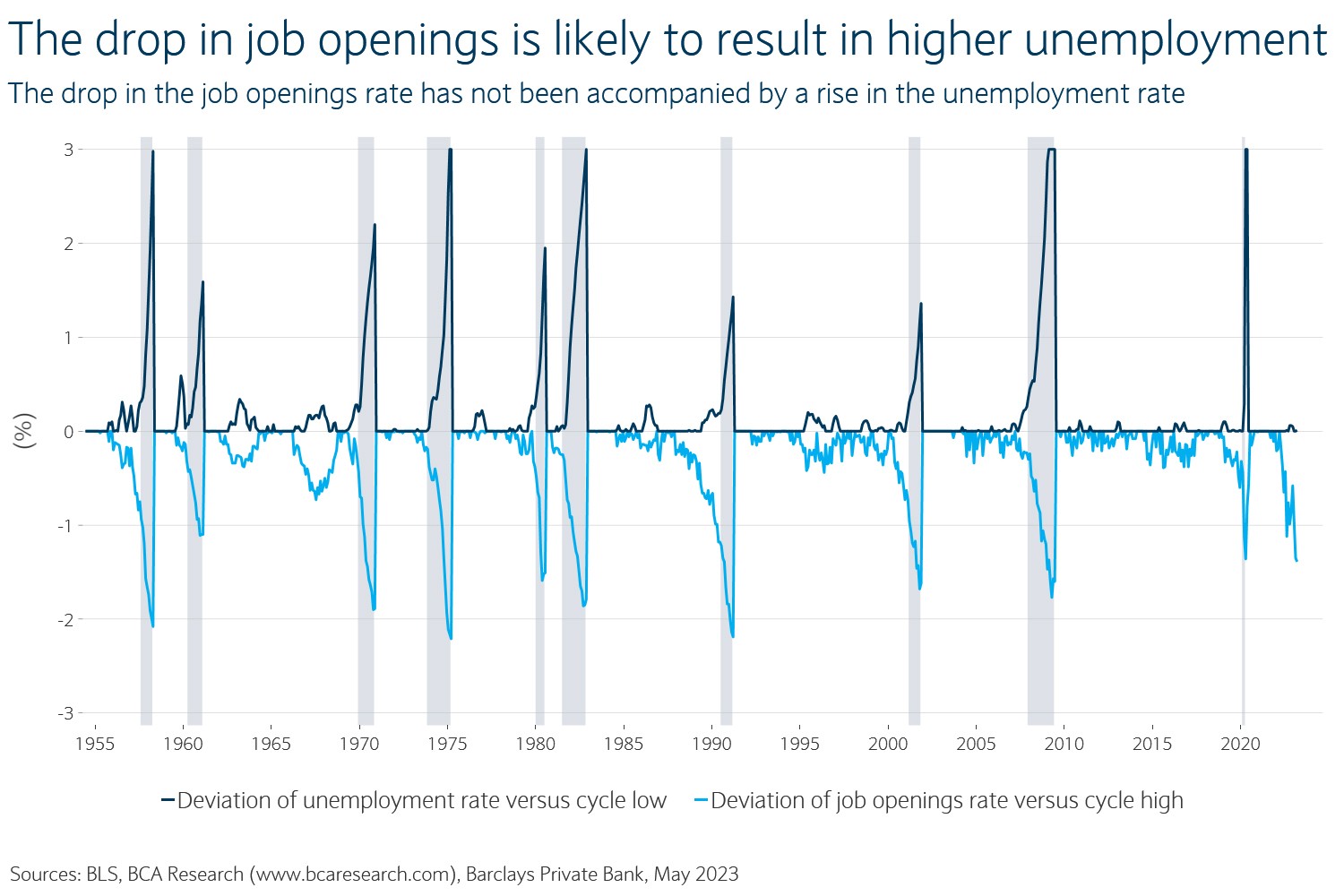

The US Federal Reserve (Fed) is determined to cool the local job market in order to quell inflation. So far, very little progress has been made: there are still some 10 million jobs available and the unemployment rate is stuck at around 3.5%1.

Yet, some cracks are appearing. For example, the job openings rate has declined from a high of 7.4% last March to 6.0% in February. In addition, the number of US jobs available came down from 11.6 million from 9.9 million over the same period2, according to the Job Opening and Labor Turnover Survey (JOLTS) data, issued by the Bureau of Labor Statistics.

Interestingly, this decline in hiring intentions hasn’t been matched with a deterioration in the unemployment rate. One explanation can be found when looking at the disconnect between supply and demand of labour, as the US labour force has not fully recovered yet.

This disconnect may last for some time but should eventually resolve itself. At some point, job openings will normalise, helped by the Fed’s effort to slowdown the economic momentum. With fewer opportunities to switch jobs, workers will lose their bargaining power. At this stage, wage growth should slow and the unemployment rate will probably rise. This might happen in the next six to twelve months.

Welcome to our May edition of “Market Perspectives”, the monthly investment strategy update from Barclays Private Bank.

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Employment News Release Bureau of Labor Statistics 7 April 2023 https://www.bls.gov/news.release/empsit.nr0.htmReturn to reference

Economic News Release Bureau of Labor Statistics April 2023 https://www.bls.gov/news.release/empsit.nr0.htmReturn to reference