Market Perspectives May 2023

Welcome to our May edition of “Market Perspectives”, the monthly investment strategy update from Barclays Private Bank.

Quantitative strategy

09 May 2023

Lukas Gehrig, Zurich Switzerland, Quantitative Strategist; Nikola Vasiljevic, PhD, Zurich, Switzerland, Head of Quantitative Strategy

Please note: This article is more technical in nature than our typical articles, and may require some background knowledge and experience in investing to understand the themes that we explore below.

Strategic asset allocation is an investment approach that helps investors decide how to divide their money among different asset types like stocks, bonds, and real assets. Through diversification, they can balance risk and return and optimise their portfolio exposure to different financial markets.

The process starts with understanding an investor's goals, risk tolerance and investment timeline. An asset allocation plan is then developed, which is periodically reviewed and adjusted, based on the investor's changing needs and market conditions.

In addition to traditional asset classes, investors can broaden their investments by venturing into private markets and hedge funds. Although these two asset classes are often bundled together as illiquid alternatives, there are some key differences between them.

Private markets refer to investments in privately-held companies that are not listed on public stock exchanges. Investors typically provide capital to help finance the growth of these companies, often in exchange for equity or debt. Investments tend to be longer-term in nature, with a focus on company growth and value creation. They cannot be easily sold or transferred and may require a long lock-up period before investors can access their funds.

Hedge funds, on the other hand, raise capital from a smaller pool of individuals and institutions. They aim to generate high returns through an actively managed diversified portfolio of assets, including stocks, bonds, commodities and derivatives. They are typically more liquid investments than those in private markets but may still have restrictions on withdrawals or redemptions.

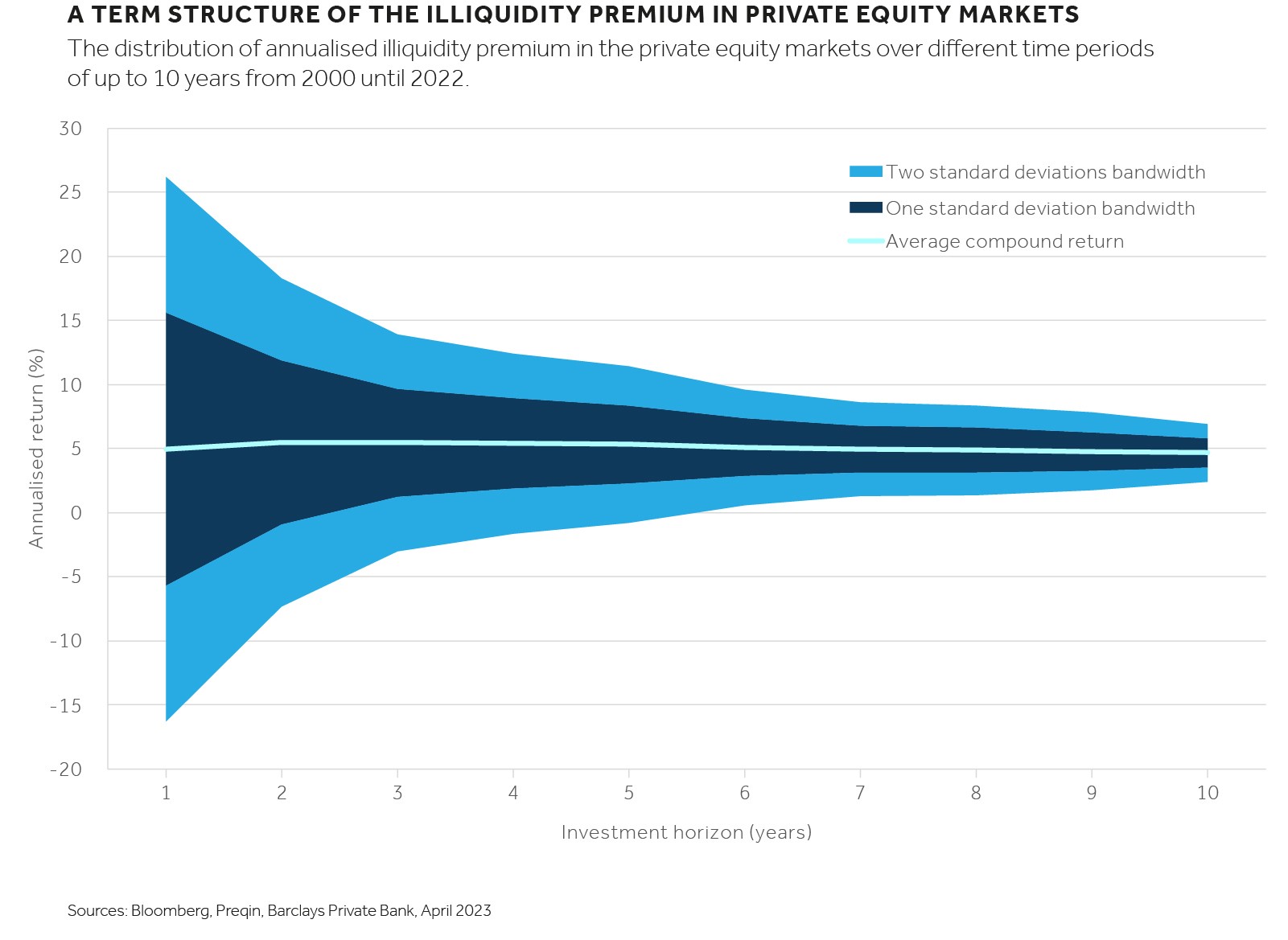

Estimating the illiquidity premium in private markets can be challenging, as private market investments are less liquid and more secret than public market investments. Therefore, any estimation procedure is subject to uncertainty and should not be taken at the face value.

Taking that into consideration, historical private equity return data can be used to estimate the illiquidity premium. The difference in annualised cumulative returns between private equity investments and publicly traded equities can be used as a proxy of the illiquidity proxy of the illiquidity premium (see chart).

We calculate the illiquidity premium for different investment horizons, ranging from one to ten years. This approach allows us to analyse the term structure of the distribution of the illiquidity premium.

The results indicate that – over the last two decades – the illiquidity premium for investments with holding period of up to five years has varied substantially. At a 95% confidence level, the short end of the curve has swung between -16% and 26% over the last twenty years.

During this period, longer-term private equity investors have been consistently rewarded with a positive illiquidity premium. Those who stayed in the market for ten years enjoyed returns of 2-6% per annum (with an average return of 4.3%). Therefore, allocating a significant portion of the portfolio to private equity can boost investment returns.

Nevertheless, investing in less liquid alternatives has risks, especially during a sell-off in the equity market. During such times, investors might make impulsive decisions that harm their portfolio's long-term performance.

In his famous book 'A Treatise on Money' published in 1936, John Maynard Keynes wrote: “There is, clearly, no absolute standard of "liquidity" but merely a scale of liquidity – a varying premium of which account has to be taken ... in estimating the comparative attractions of holding different forms of wealth. The conception of what contributes to ’liquidity’ is a partly vague one, changing from time to time and depending on social practice and institutions.”

Surprisingly, if we fast forward to 2023, liquidity remains an elusive concept that is difficult to capture entirely, even with modern economic theories and quantitative tools.

However, certain operational measures of liquidity have been developed over the last couple of decades. The most common approach is to distinguish between two different types of liquidity risk.

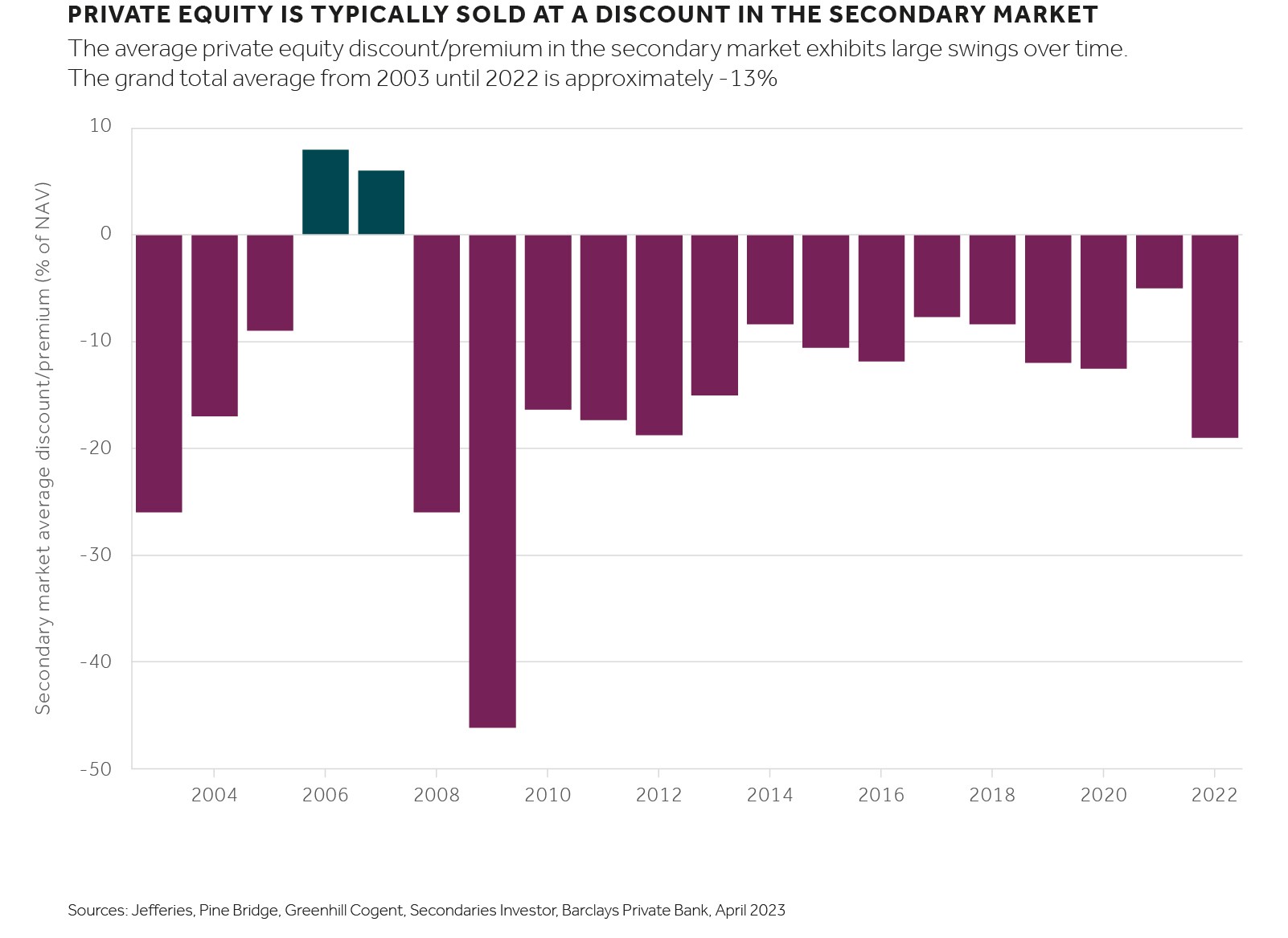

One is the market liquidity risk, which is related to the ability to liquidate assets relatively quickly and at minimum cost. For example, if there is a sudden increase in market volatility or a decrease in market depth, investors might not be able to sell their holdings quickly or at a fair price due to a lack of buyers in the market (see chart).

The other is the funding liquidity risk, which is associated with the ability and the cost of generating cash in order to meet financial obligations as they come due. This can occur when an investor has difficulty obtaining short-term funding, such as loans or lines of credit, or when the cost of borrowing becomes too high (see chart).

In the absence of access to external financing, a portfolio of liquid assets and illiquid alternatives has market and funding liquidity risks that become mutually reinforcing, and an investor could default on their obligations. For example, financing capital calls with listed equities during a sell-off would be very costly and inefficient.

Hope for the best, plan for the worst

To counteract such pessimistic scenarios, adhering to a well-planned and systematic investment strategy is the most effective approach. In particular, investors need to judge the degree of illiquidity their portfolios may encounter during a future economic downturn. In turn, they should assess which asset allocation policy would provide sufficient flexibility in terms of spending.

This can be achieved in three steps. First, investors should evaluate the liquidity of private markets and hedge funds by analysing the lock-up periods, redemption terms and provisions, expected cash flow dynamics (or capital calls and distributions) and other relevant factors. For example, if an investor has a short-term investment horizon, it might be best to avoid investing in long-term illiquid assets that could lock up their capital for several years.

Second, investing in a diversified portfolio of private assets can help manage liquidity risk. A well-diversified portfolio can reduce the impact of the illiquidity of individual holdings during periods of market stress.

In the third step, investors should determine the adequate level of liquidity reserves that are necessary to meet cash flow needs in the short term. This could involve keeping some portion of the portfolio in liquid assets such as cash or short-term bonds. A prudent approach would be to run a stress test, identify potential vulnerabilities and make portfolio adjustments accordingly.

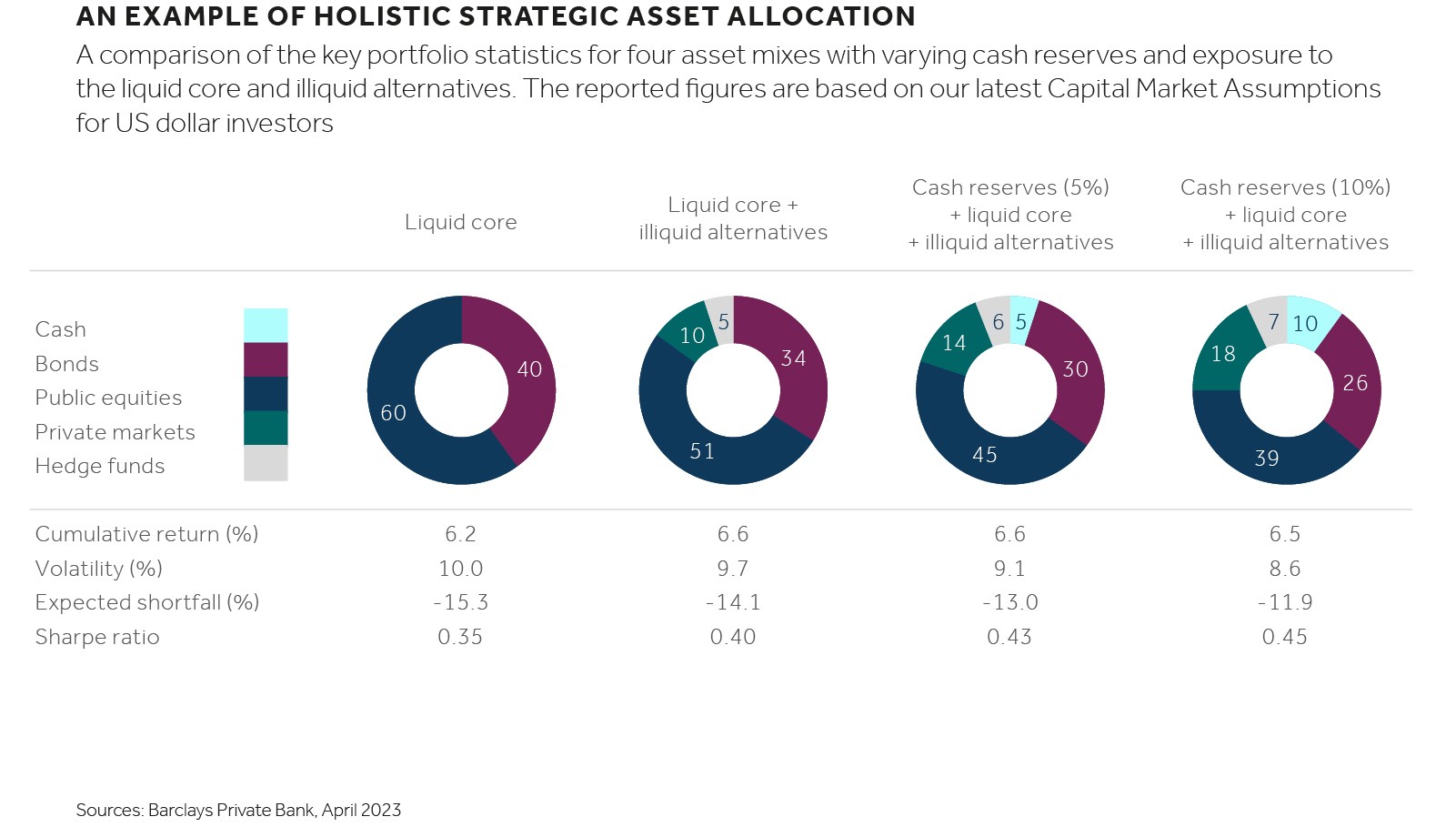

To illustrate the impact of the including private market and hedge fund investments in a portfolio, the starting point is the traditional 60-40 equity-bond portfolio that constitutes the liquid core (see chart).

The main goal of our analysis is to understand the impact of illiquid alternatives on the key portfolio statistics, along with the interaction between potential cash reserves and the total allocation to liquid core and illiquid alternatives in the portfolio.

Based on Preqin’s data for assets under management for private markets and hedge funds, a sub-portfolio of illiquid alternatives is used with an asset mix that consists of private equity (42%), private debt (11%), private real assets such as real estate, infrastructure and natural resources (17%) and hedge funds (30%).

As discussed already, the key determinant of the optimal asset allocation mix with illiquid alternatives is the investor’s ability to finance capital calls during market stress. In particular, we consider a stress-test scenario to be one in which equities lose about 50%, which is approximately the level observed during the Global Financial Crisis.

To limit the market and funding liquidity risk, we assume that investors are required to maintain sufficient exposure to liquid assets and to cover capital calls, on an annual basis, for about 20% of their total exposure to private markets (see earlier capital-calls chart).

Considering the fact that over the last two decades the longest peak-to-trough period for equities was about 2.5 years, we impose a somewhat conservative restriction that the total allocation to liquid assets (the cash reserves and the liquid core) can finance stressed levels of capital calls for three subsequent years.

Given the set of stress-test conditions discussed above and our What might stagflation mean for long-term return forecasts analysis, the expected risk-adjusted returns of a traditional balanced portfolio can be substantially improved by incorporating illiquid assets.

In the absence of cash reserves, our analysis indicates that the overall exposure to illiquid assets for private wealth investors should not exceed 15% in the portfolio.

Indeed, every additional percentage of cash allocation – coupled with an identical increase in the illiquid alternatives and two percent cut in the liquid core – will actually preserve the expected portfolio return and lower the volatility and expected shortfall.

Welcome to our May edition of “Market Perspectives”, the monthly investment strategy update from Barclays Private Bank.