After a dire start to the year for investors, equity markets have seen a significant rebound. Having bottomed out in June, is history on the side of those that believe the recovery in global equities has more legs?

As the second quarter’s earnings season comes to an end, we remain of the view that expectations for this year and possibly next need to come down. This is often pointed to as a reason why equity markets haven’t bottomed yet. However, history suggests that investors don’t need to wait for the last earnings downgrades to see stocks rebounding.

Earnings drama avoided

Companies in the S&P 500 have delivered close to 14% revenue, and 10% earnings, growth in the second quarter, according to Refinitiv. At face value, this looks impressive, given the weakening economic growth and stubbornly elevated inflation at the time. However, focusing on these headline figures can mislead. The energy sector contributed much to overall earnings growth, thanks to soaring oil and gas prices. Excluding energy, earnings growth for the S&P 500 was slightly negative in the second quarter.

The story is broadly similar in Europe. However, with close to half of companies reporting earnings on a bi-annual basis and several currencies to account for, interpreting numbers is always more challenging in the region.

With many base effects from last year still at play and companies and consumers still finding their footing after the COVID-19 pandemic, it’s hard to judge whether this earnings season was good or bad. Our initial take is that low expectations meant a drama was avoided, but the overall picture is one of deteriorating fundamentals.

Expectations still too rosy

As we have argued before, earnings forecasts look too optimistic and are likely to be downgraded later in the year, primarily driven by margins expectations.

Global earnings are still expected to rise by 11% in 2022 and by 6% in 2023, according to consensus forecasts by IBES. The comparable numbers in the US and Europe are +8% and +17% respectively in 2022, and +8% and +2% in 2023. Despite the worsening macro data, those estimates have actually risen in the past six months, mainly driven by the commodity sectors (energy and basic materials).

Business surveys already suggest much lower earnings in coming months (as shown by the ISM Manufacturing New Orders component and the US CEO Business Confidence Survey). Our top-down earnings model is consistent with broadly flat global earnings growth in 2022.

Equity markets generally trough before activity and earnings

Some market commentators have argued that we won’t see a sustainable rebound in the equity market until earnings estimates are reset lower. We disagree for two reasons:

- On our numbers, the equity market is already discounting a 9% decline in global earnings in 2022

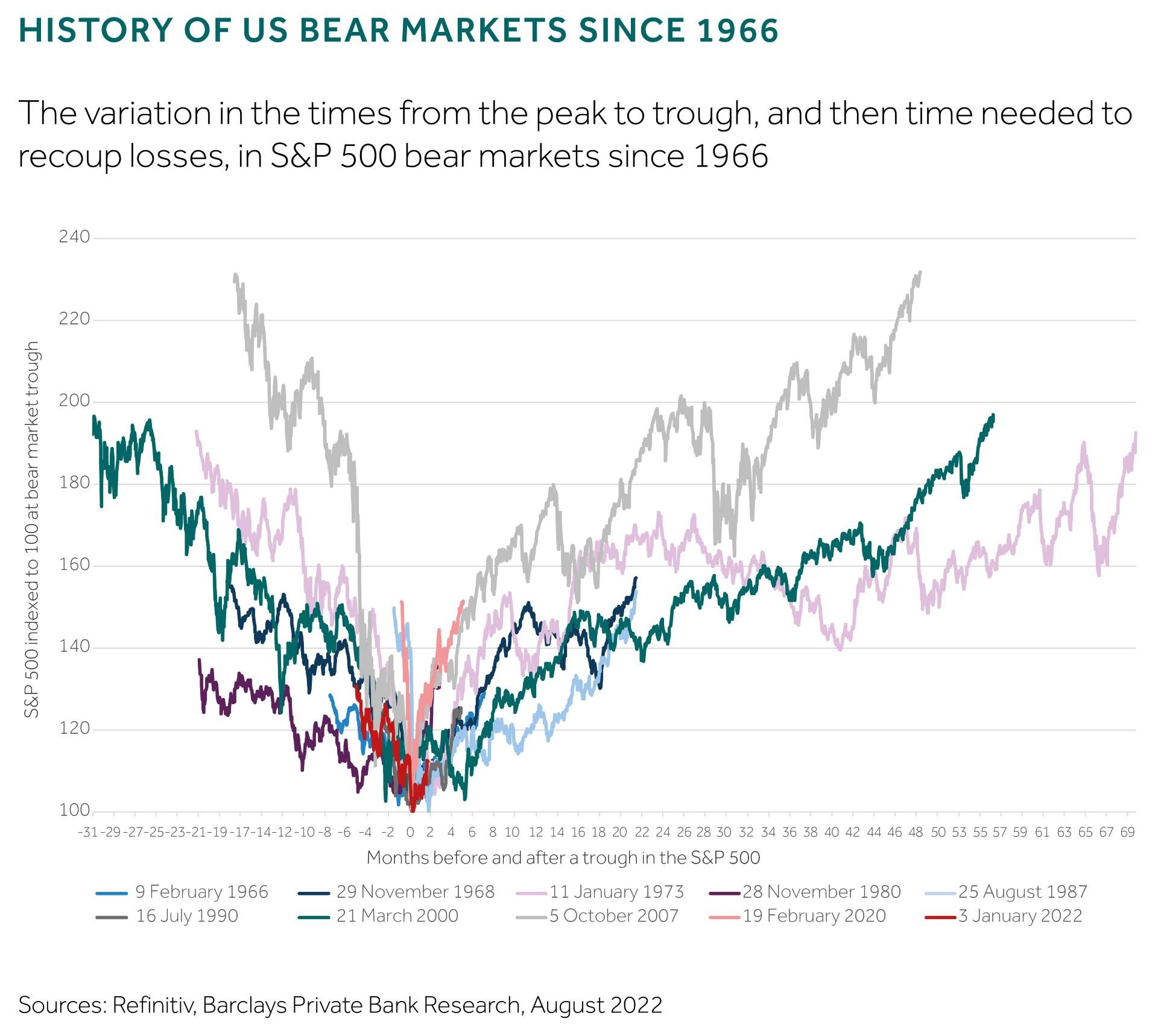

- We looked at the past nine equity bear markets in the US, going back to 1966, and found that equity markets generally trough several months ahead of economic activity and corporate earnings

The table shows that the S&P 500 has tended to bottom five months before a trough in the ISM Manufacturing index, on average, within a range of 22 months before and three months after the trough. Only on two occasions did the equity market hit its low after the ISM index did, those being in August 1982 and March 2009.