Global Outlook 2023

As investors near the end of a tough year, full of twists and turns, our bumper Outlook 2023 takes a look at prospects for financial markets next year.

14 November 2022

Damian Payiatakis, London UK, Head of Sustainable & Impact Investing

The inevitable transition to low-carbon energy will not only impact our daily lives, it should inform how we think about investing for the long term, helping us to look beyond the opportunities in uncomfortable market conditions.

In the current markets, investors might do well to heed the advice of sailors: if you feel unsteady, look at the horizon.

With many, often conflicting, dynamics expected next year, we expect it to be an uncomfortably, constructive 12 months. To steady your nerves and portfolios, it could pay to look at long-term opportunities on the horizon.

Confronting pressing social and environmental issues will take decades and trillions of dollars of investment to resolve. At the same time, therein lie some of the largest and fastest growing sectors of the economy.

Our fossil-fuel-based energy system is at the forefront of many pressing issues. Over the last few years, many have championed a transition to a low-carbon economy on environmental grounds. Now, high fossil-fuel prices and energy security demands are further fuelling the need for this change.

In this article, we present the rationale for private investors to develop an investment strategy for clean energy in 2023 – a case that is increasingly supported by government actions, economics, and demand drivers.

A cleaner energy system can help governments to address their environmental commitments, energy security, affordability, and transition challenges all at once.

Until recently, net-zero commitments were the primary driver of government activity around cleaner energy. Around 140 countries, covering 88% of global emissions, have net-zero commitments1. Energy usage (in buildings, transport, and industry) accounts for nearly three-quarters of greenhouse gas emissions2. Therefore, to meet these commitments a cleaner energy system is needed.

Now, governments face a more localised and visceral pressure – avoiding over-reliance on expensive and insecure sources of fossil fuels.

Governments are shouldering the increasing costs of fossil-fuel dependence. For example, as of mid-September, European policymakers had committed roughly half a trillion dollars to shield households and businesses from the energy crisis3. With future budgets more constrained, and a potential recession, they cannot maintain this fiscal spending indefinitely.

Compare this cash cost with a study that calculated existing renewables allowed the EU to avoid nearly €100 billion in fossil fuel imports during the six months to September 20224. Moreover, a recent model of a 2050 decarbonised energy system suggested it would save the world at least $12 trillion in net present value – and this was without factoring in the additional trillions of adapting to climate change and its physical impacts.

At the same time, governments are waking up to the risk of their dependence on petro-states for fuel imports. Europe’s reliance on Russia for 40% of its gas requirements provides the obvious example5. But 80% of the world’s population lives in countries which, as net importers of fossil fuels, face similar risks6.

Additionally, in a potential recession, governments will be looking to stimulate economic growth. Accelerating home-grown clean-energy industries will provide new jobs to local workers. In fact, clean energy now accounts for the majority of all energy jobs. In a 2050 net-zero scenario, 14 million new clean-energy jobs would be created by 2030, while another 16 million workers switch to new roles related to clean energy7.

Plans, such as the EU’s “Fit for 55” and RePowerEU, the US’ Inflation Reduction Act, or China’s 14th five-year plan, combine legislation and fiscal stimulus to accelerate this transition. For investors, governments are providing clear signals of ongoing commitment to the energy transition.

Even without government support, renewables are rapidly becoming the cheapest source of energy around the world. Both for new capacity and, with heightened fossil fuel costs, existing production.

Unlike fossil fuels, the renewables sector is profiting from “learning curves”. For example, every time over past decades that global supply of solar has doubled, additional capacity costs declined by almost 30%8.

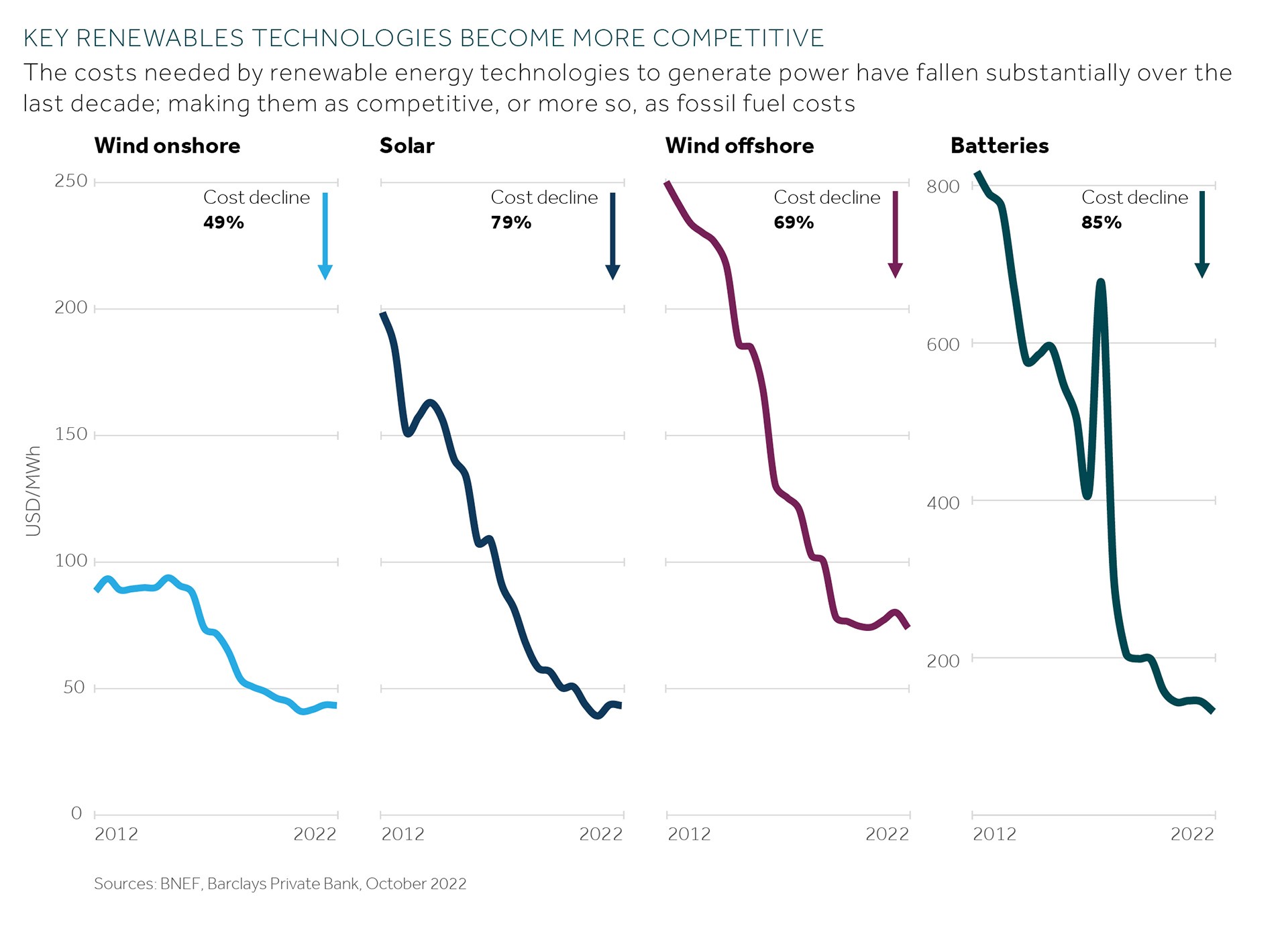

Amazingly, the cost of key clean-energy technologies – onshore wind, offshore wind, solar, batteries – has fallen between 60% and 90% over the last ten years (see chart). In the last twelve months while costs have notched up, due to global supply-chain challenges, these are seen as temporary issues9.

And these costs will continue to fall. Renewables are likely to be deployed at larger scale, and less expensive incremental and newer technologies will emerge. Based on new models, this could mean the so-called “levelised costs” of energy decrease by 23% for wind and 47% for solar in the period to 203510.

The shift to renewables based on their cost advantage means the investment case does not only need to be made on environmental benefit, but also on a solid economic interest too.

The surge in demand for clean energy is a warning for carbon-intensive investors. Indeed, in some geographies, demand for fossil fuels has already peaked11.

Clean energy is following a traditional tipping point growth pattern. Initially, new technology adoption starts slowly, and then very rapidly once a tipping point is reached, as exemplified by wind and solar generation or electric vehicle sales (see chart). The tipping points for clean energy vary between 1% for solar and wind to 10% for electric vehicle (EV) manufacturers.

Today, 87 countries generate at least 5% of their electricity from wind and solar. Looking at the case of the US, renewables languished for a decade with only 5% of electricity produced in 2011, before then surging past 20% by 2021. If it follows the fastest growth rates, American wind and solar could account for half of its power generation capacity in next ten years12.

Similarly, related technologies for EVs, heat pumps, or grid-scale batteries also adhere to tipping points. Consider the electric car market. In 2019, 2.2 million EVs were sold, or 2.5% of global car sales. Two years later and the number has tripled to 6.6 million, representing nearly 9% of all new car sales13.

As individuals and companies shift to these new technologies, demand will quickly flip from fossil fuels to clean energy. For investors, this accelerating demand points to high-growth opportunities for companies and projects aligned to the theme.

For investors, there isn’t a single way to access this clean energy theme. There are many of them.

Renewables are at the core of the clean-energy transition. But, it is not the sole option for investors. Even established technologies are being advanced and challenged. Wind generation started onshore, then moved to offshore; and next generation technologies are evolving for floating windfarms and rooftop wind. Additionally, there are emergent sources of renewables, such as geothermal, wave, or tidal, which have not yet reached tipping points.

Beyond this core, there are adjacent sectors – for example, heat pumps, batteries and energy storage, and grid infrastructure. Similarly, there are opportunities in the “picks and shovels” for the industry, such as, electrolysers for hydrogen production, fuel cells for batteries, photovoltaic modules for solar, and digital technologies to manage these systems. Additionally, renewables rely on rare earth commodities that provide further opportunities; as well as their own social and environmental challenges.

Along with sectors, investors can deploy capital into various asset classes. In public markets there are options to finance the transformation of individual companies through green bonds. Or sovereign bonds for country transitions. Investors can also directly access specific companies in the utilities sector and “pure-play” clean-energy companies. For those wanting to play the theme without the selection challenges, specialists have established clean-energy funds.

Private markets also offer various options for investors. Investment vehicles span from seed to venture to growth, and even private equity. Also, infrastructure funds have emerged to benefit from existing, steady state clean-energy assets. Finally, for more sophisticated investors, direct access to early-stage companies can provide higher risk-reward opportunities.

Importantly, while constructive on the growth of clean energy and range of asset classes, this does not necessarily mean all investment opportunities are compelling. Here timing and market conditions may be helpful, though.

During 2019 and 2020, valuations for renewables were buoyant. In 2021 they faced pandemic-related issues, cost-push inflation, and supply-chain limitations that slowed deployment rates and damaged valuations. In 2022, as growth-oriented industries, they have been hit from sector rotation and interest rate rises. Collectively, these have depressed prices from recent peaks. Conditions during 2023 may exacerbate these headwinds.

However, the argument for clean energy is not fundamentally a short-term trade. It is a belief in the long-term trend and its investment opportunity. Here, advisers can counsel on picking the right options and considerations for your portfolio.

The shift to a clean-energy system is inevitable. It does not necessarily mean it will be simple or easy. However, 2023 can be a timely moment for investors to seek entry points into this structural trend.

Investors able to see beyond the current markets will find opportunities to build positions in clean energy. In doing so, they can commercially benefit from the long-term energy transition and make a positive contribution to our planet through their additional capital.

As investors near the end of a tough year, full of twists and turns, our bumper Outlook 2023 takes a look at prospects for financial markets next year.

CAT net zero target evaluation; Climate Action Tracker, October 2022

https://climateactiontracker.org/global/cat-net-zero-target-evaluations/Return to reference

Historical GHG emissions, Climatewatch, 20 May 2022

https://www.climatewatchdata.org/Return to reference

National policies to shield consumers from rising energy prices, Brueghel, 21 September 2022

https://ember-climate.org/press-releases/eus-record-growth-in-wind-and-solar-avoids-e11bn-in-gas-costs-during-war/Return to reference

EU’s record growth in wind and solar avoids €11bn in gas costs during war, Ember, 18 October 2022

https://ember-climate.org/press-releases/eus-record-growth-in-wind-and-solar-avoids-e11bn-in-gas-costs-during-war/Return to reference

REPowerEU: Joint European action for more affordable, secure and sustainable energy, European Commission, 8 March 2022 https://ec.europa.eu/commission/presscorner/detail/en/ip_22_1511Return to reference

A New World: The Geopolitics of the Energy Transition, International Renewable Energy Agency, 2019 https://www.irena.org/-/media/files/irena/agency/publication/2019/jan/global_commission_geopolitics_new_world_2019.pdfReturn to reference

World Energy Employment Report, International Energy Agency, September 2022 https://www.iea.org/news/global-energy-employment-rises-above-pre-covid-levels-driven-by-clean-energy-and-efforts-to-strengthen-supply-chainsReturn to reference

Clean Energy Has a Tipping Point, and 87 Countries Have Reached It, Bloomberg, 18 October 2022 https://www.bloomberg.com/graphics/2022-clean-energy-electric-cars-tipping-points/?leadSource=uverify%20wallReturn to reference

Cost of New Renewables Temporarily Rises as Inflation Starts to Bite, Bloomberg New Energy Finance, 30 June 2022 https://about.bnef.com/blog/cost-of-new-renewables-temporarily-rises-as-inflation-starts-to-bite/Return to reference

Levelized cost-based learning analysis of utility-scale wind and solar in the United States, IScience Journal, 17 June 2022 https://www.sciencedirect.com/science/article/pii/S2589004222006496Return to reference

The Energy Transition Narrative, Rocky Mountain Institute, October 2022 https://rmi.org/wp-content/uploads/dlm_uploads/2022/10/energy_transition_narrative_1.1.pdfReturn to reference

Clean Energy Has a Tipping Point, and 87 Countries Have Reached It, Bloomberg, 18 October 2022 https://www.bloomberg.com/graphics/2022-clean-energy-electric-cars-tipping-points/?leadSource=uverify%20wallReturn to reference

Electric cars fend off supply challenges to more than double global sales, IEA, 21 June 2022 https://www.faistgroup.com/news/electric-car-sales-2021/#:~:text=An%20interesting%20report%20published%20by%20IEA%20-%20The,understand%20the%20dimensions%20of%20the%20electric%20car%20phenomenonReturn to reference