Global Outlook 2023

As investors near the end of a tough year, full of twists and turns, our bumper Outlook 2023 takes a look at prospects for financial markets next year.

Behavioural finance

14 November 2022

Alexander Joshi, London UK, Head of Behavioural Finance

After a tough year in financial markets, full of nasty surprises, 2023 may be another uncomfortable time to be invested. However, this is par for the course and part of the journey for long-term investors. After all, for those that can stomach the risk, the rewards can be worth it.

The decade after the global financial crisis and ensuing recession in 2007-2008, was a comfortable one in which to be invested. As the scars healed, central bank quantitative easing led to low rates, and market participants were supported by the belief that central bankers would act at almost all costs to protect the financial system.

The ensuing US stock market bull run was the longest in history, with only the outbreak of the coronavirus pandemic in March 2020 ending 11 years of gains. Surprisingly, the downturn was short-lived, with the market surging through 2020 and 2021 to end both years up at 16.3% and 26.9%.

However, the world is changing. Fears of inflation in the final three months of 2021 led to a sell-off in technology stocks, made worse by the outbreak of the war in Ukraine this year and the aggressive rate hikes from central banks to fight surging inflation.

Investors are now faced with meaningfully higher interest rates in the short term, at a minimum. Significantly, central bankers’ primary focus is getting to grips with surging inflation, and that clearly has implications for investors. The changing expectations of a ‘Fed pivot’ are driving significant short-term volatility.

While we remain constructive on the longer-term outlook for investors, as outlined in this publication, this environment will require investors to become comfortable with being uncomfortable, given current levels of market uncertainty.

Given the tumultuous year that investors have had, discomfort going into what looks set to be another challenging year is understandable.

The macro environment (see Global economy to keep its head above water) has changed substantially and remains very uncertain, with considerable risks on the horizon for 2023. On the other hand, positive developments after such dramatic drawdowns can lead to sharp bear market rallies. Therefore, irrespective of the overall directionality of markets, volatility is likely to remain elevated.

However, that shouldn’t cause investors in addition to panic, provided they have the appropriate investment solutions, that have been matched to their goals and tolerance to, and capacity to, bear risk.

Having the right asset allocation, however, does not necessarily mean that an investor will be immune to an uncomfortable investment journey to reach their goals. Volatility is part of the journey, and history shows that it won’t necessarily stop you from reaching your goals, if you can see it through.

For this reason, investors need to keep their composure. Not doing so can mean exacerbating behavioural biases, which can impair decision-making and lead to actions which are not in your long-term interest. Many investors unnecessarily change portfolio allocations during periods of market turbulence because they don’t want to regret not doing something.

As humans, we don’t like uncertainty, and many investors are wondering when the storms will pass to produce the ‘right moment’ to invest.

Timing markets is notoriously difficult. Attempting to do so against the backdrop of considerable market volatility, makes it even more difficult. Calling the absolute bottom of the market is near impossible.

We believe that value comes from focusing on building and following a robust investment philosophy. One that identifies strong companies capable of providing outsized gains through the various stages of the business cycle over the long term, including economic slowdowns or recessions. Attempting to time the market introduces additional biases and risk into the decision-making process, and can be a costly, futile endeavour.

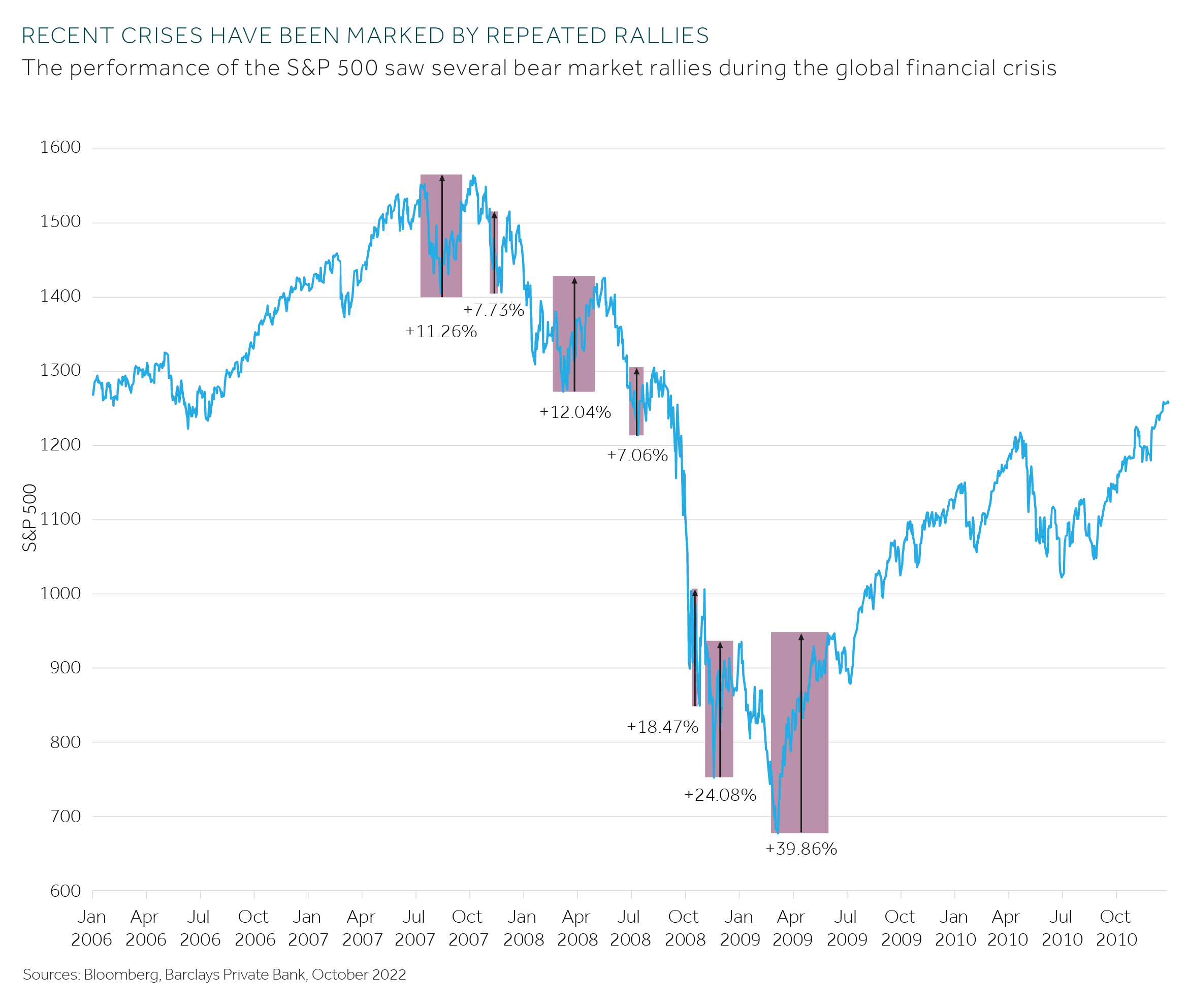

There have been many bear market rallies during recent downturns (see chart). This highlights the potential dangers of trying to time the market – in the short-term there can be rallies even as we get closer to the ultimate trough in a downturn.

Selling investments during a particularly uncomfortable period in the markets can be costly. Staying the course may require patience, discipline, and composure. But, investors who do so have historically been rewarded over the long term, compared with those trying to time the market.

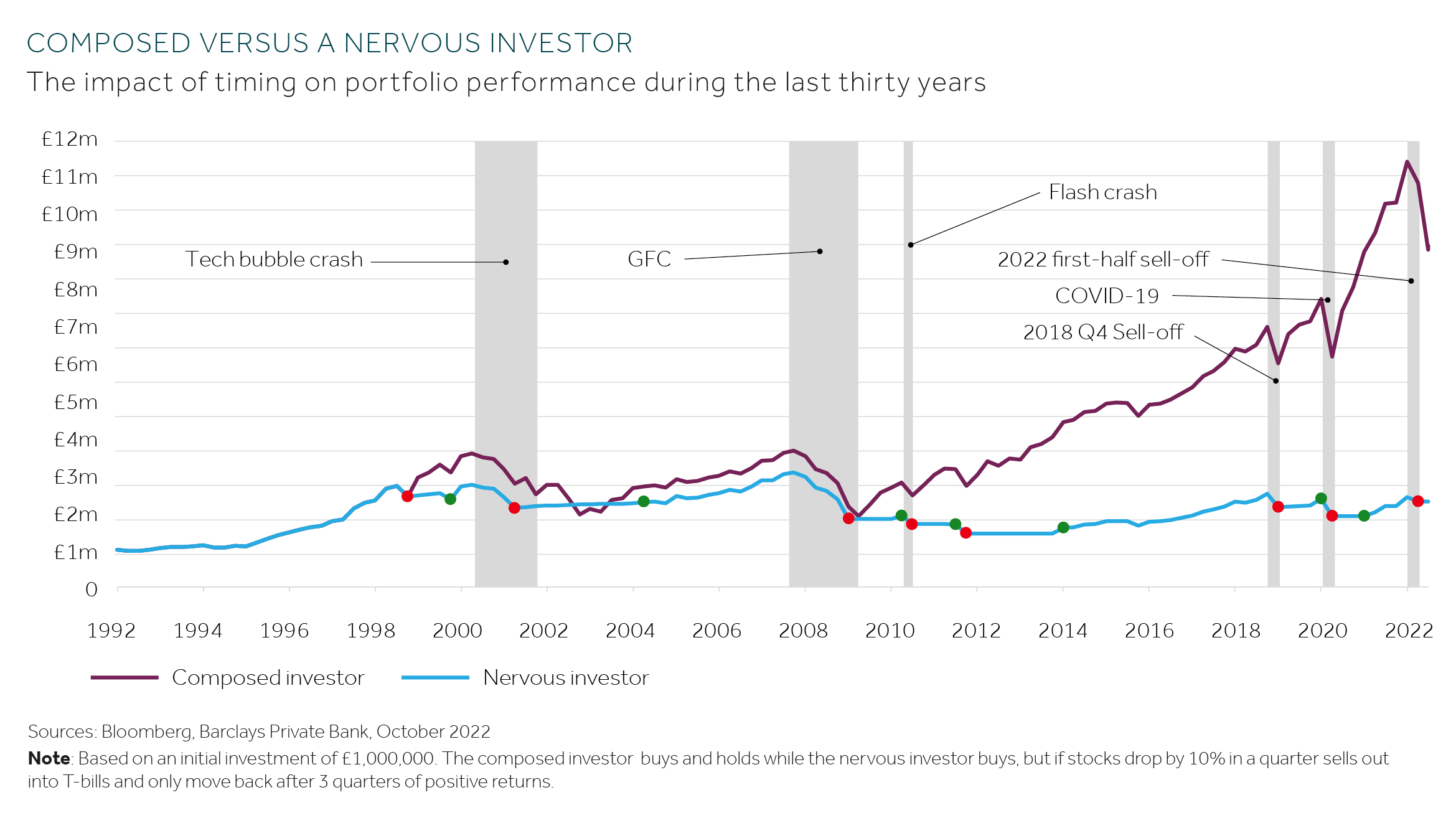

A hypothetical example (see chart) of a composed versus nervous investor illustrates this point.

Both invested £1 million in the S&P 500 30 years ago. The composed investor held the portfolio regardless of market conditions, whereas the nervous investor sold out the whole portfolio into T-bills following any 10% fall in the index, and only bought back into equities after three consecutive quarters of positive returns. The net result is the nervous investor’s portfolio is worth under a quarter of the value of the composed investor’s portfolio.

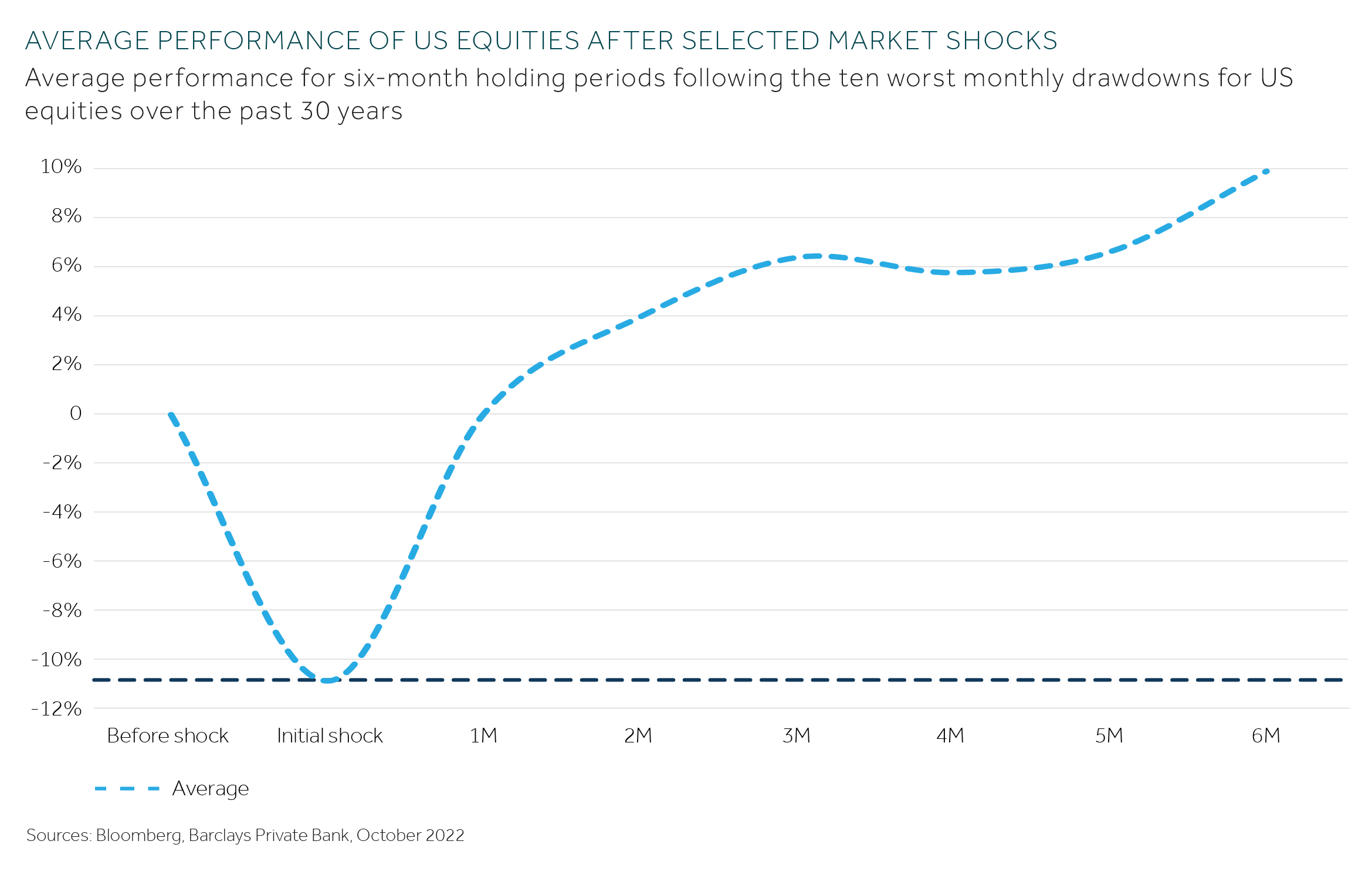

In large part, this cost from reacting in the short-term stems from the speed of recoveries after significant drawdowns. Investors can be caught out and end up re-entering the market at a higher market level (see chart).

We begin by reminding investors that a recession doesn’t necessarily mean a crisis.

While it may not be comfortable, it is important for investors to recognise that when the situation looks at its worst and sentiment is at its lowest, in many cases the dawn is not far off. Opportunities do arise, the situation can change. So, it is important to remain calm.

For others, being uncomfortable is not necessarily bad – of late the market has been looking oversold, and there are signs that we may be close to the capitulation stage in markets. Indeed, in the macro world, global growth expectations are already near all-time lows. An improving economic picture could spark a rebound, for example, if China relaxes its zero-COVID containment strategy.

However, the macro situation doesn’t need to fully rectify itself for investment opportunities to pop up.

As a result of the changing landscape, asset classes that may have been a ballast for portfolios in the past are already providing opportunities, such as in in fixed income (see The road to normalisation for bond investors?). While holding cash over the long term can be a risky strategy, especially in a world of runaway inflation, short-term cash rates have also risen. For investors considering phasing into markets, this can be supportive.

We believe that three factors are worth bearing in mind for next year and beyond in order to keep calm and composed on your investment journey.

Elevated geopolitical tensions, a slowing growth outlook, and central banks in a rate-hiking mood suggest that the year ahead is likely to be another particularly volatile one. However, the secret is to be comfortable with that happening, rather than letting it affect your investment decisions. For those who can stay the course, history has shown they have been compensated for it.

As investors near the end of a tough year, full of twists and turns, our bumper Outlook 2023 takes a look at prospects for financial markets next year.

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.