Digital assets

NFTs: the dawn of a new era?

09 May 2022

By Benjamin Hood, London UK, Investment Strategist; Nikola Vasiljevic, Zurich, Switzerland, Head of Quantitative Strategy; Julien Lafargue, London UK, Chief Market Strategist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

-

Summary

- Non-fungible tokens, or NFTs as they are more widely known, are one-of-a-kind digital assets – think of them like a piece of digital art

- NFTs burst on to the scene in 2021 and, like Bitcoin before it, have soared in value amid investor frenzy and celebrity endorsements

- The ownership is secured on a blockchain, which means they can be monetised and traded using cryptocurrencies. However, it’s still hard to say whether they will be a passing fad or a key part of our digital future

- For now, we believe that NFTs should only be viewed like luxury investments – such as fine wines, art or classic cars. And due to the market being highly volatile, in our view they might be better cherished for the joy of holding them

-

Full article

Non-fungible tokens have burst in popularity recently with many different well-known brands and celebrities getting in on the action. But what exactly are NFTs, why do they matter for investors, and might they offer portfolio diversification opportunities?

Cast your mind back to 2017, with the euphoric surge in popularity of cryptocurrencies. Bitcoin soared 1,318% by year-end, with XRP (known as Ripple) eclipsing that by zooming up 36,018% over 12 months1.

Arguably, the last 18 months have seen even more of a frenzy over blockchain-based non-fungible tokens (NFTs), with household names, such as Nike, and celebrities wading into the action.

In one instance, someone paid almost $3 million for an NFT of the first tweet. Before anyone can understand why such a deal makes sense, it is worth understanding the basics of digital assets and the broader NFT market.

The essentials

A blockchain is a decentralised and immutable ledger that records transactions and tracks assets through peer-to-peer verification. Many cryptocurrencies are based on blockchain technology because of the security it offers – it is difficult, if not impossible, to counterfeit or double spend digital currency, while the networks can be free from any central authority.

Blockchain allows for the “tokenisation” of tangible and intangible assets to occur. This is the conversion of something of value into a digital token which can then be used on a blockchain application. They are designed to be fungible or non-fungible depending on the purpose. Cryptocurrencies, for example, are fungible tokens that can be traded on a like-for-like basis. For example, one Bitcoin is considered to be worth the same as any other.

Non-fungible tokens represent unique digital assets that have their ownership secured on a blockchain. NFTs can be in the form of photos, digital artworks, GIFs, and audio clips to give just a few examples. However, by nature of being secured on a blockchain, NFTs can be traded using cryptocurrencies – with the blockchain holding irrefutable proof of an asset’s ownership through peer-to-peer verification of transactions.

As suggested, different blockchains can hold different NFTs with sources claiming 76%2 of the market operates on the Ethereum blockchain. However, our analysis suggests this could be over 95% with the majority of collections covered in this article being traded on the Ethereum blockchain.

Why do NFTs matter?

The implications of this technology being applied are potentially significant. Firstly, NFTs can embed “smart” contracts – a self-executing predetermined contract between buyer and seller – within their code. For instance, token creators can programme themselves a royalty each time their works are resold.

NFTs could also be tied to physical assets, such as real estate, which could revolutionise property transactions by mitigating trust-related market failures, and even reducing the costs of conveyancing. This is just one example of how the technology could modernise traditional markets.

A snapshot of the market

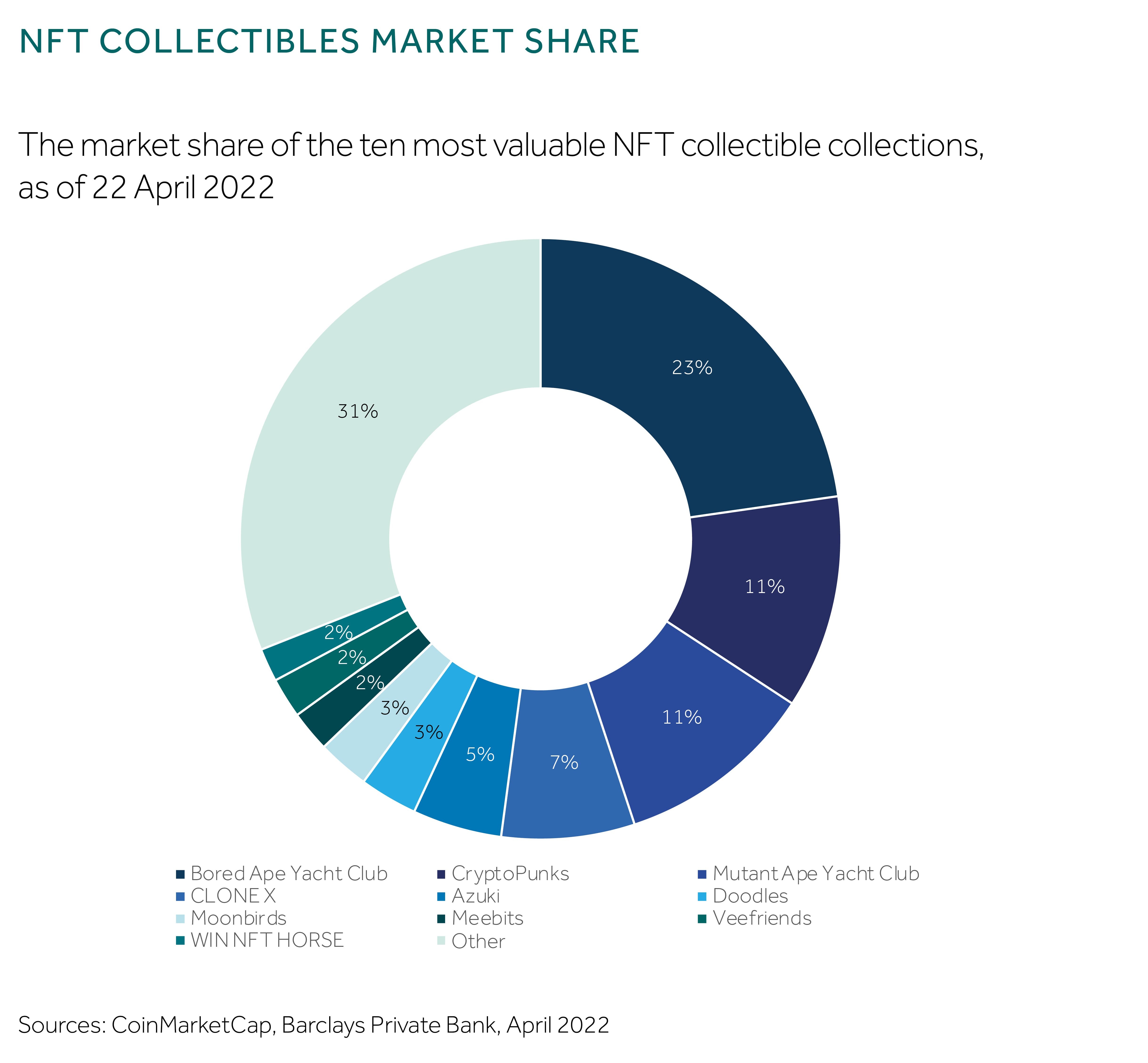

However, more recent transactions relate to “blue-chip” NFTs – or collections of NFTs that are particularly desirable – such as CryptoPunks and the Bored Ape Yacht Club, which are essentially collections of 10,000 unique and algorithmically generated images. Collectible NFTs are thought to be worth over $16 billion. These two blue-chip collections make up over a third of this value (see pie chart).

![""]()

Since their creation, the values of these collections have increased, despite the market’s volatility. CryptoPunks were free to claim when initially created in 2017. At the time of writing, the cheapest Punk available trades at 62ETH ($188,000) with Punk #5822 having sold for $23.7 million in February 20223.

Similarly, Bored Apes, which initially cost the equivalent of around $190 when released, now consistently have average prices of 120ETH ($366,000)4.

In fact, 90% of the total market value is made up by just 5% of collectible NFTs.

Venturing into the NFT world

At present, NFTs broadly fall into five categories: collectibles, gaming, art, utilities, and the metaverse. Of these, collectibles make up the largest part of the market, and will be the focus of the rest of this article5.

Due to the clear desirability of these collections – as demonstrated by the 2021 NFT craze – many have compared blue-chip NFTs to alternative asset classes, such as classic cars, fine wine, and fine art. This suggests that the tokens are perceived as a viable alternative investment opportunity or as a store of value. Consequently, the question arises whether NFTs should form a part of a digital asset portfolio or ultimately be part of investor portfolios.

However, before being blinded by the sheer size and potential of the market, some points are worth looking at. In particular, potential investors should be mindful of a number of risk factors that could create strong headwinds for broader implementation and wide adoption of NFTs.

Fighting the carbon footprint

The environmental impact of cryptocurrency is well known. Bitcoin is estimated to use around the same amount of energy annually as Egypt6 and Ethereum uses roughly the same as Finland7. This is due to the computational power required in ‘proof of work’ networks to mine blocks – odds of success increase as more powerful equipment is used. With most NFT transactions occurring on energy-intensive blockchains, the related carbon emissions are directly attributable to the tokens.

However, Ethereum is soon due to transition its entire network to a ‘proof of stake’ model which will allow the network to scale while using 99% less energy and reaching 100,000 transactions per second. It remains to be seen when exactly this will happen and the effects for decentralised finance more broadly.

Bringing cybersecurity to the fore

Other issues worth considering with NFTs relate to security, crime and the nature of decentralised networks. There have been many reported instances of scam releases and cyberattacks which have led to people either losing money or having their digital assets stolen.

In a sense this is similar to the risks associated with alternative investments such as art, wine, and classic cars. However, the decentralised nature of blockchain complicates this somewhat as there is no central authority to handle transactions and thus police the system. But rather, it is all based on peer-to-peer networks spanning multiple jurisdictions.

In banking, if a fraudulent payment is made on an account, or even human error is made on a trading floor, it is common practice for banks to recompense fraud victims and for beneficiaries to acknowledge such errors.

In the cryptoworld there is no bank or code of ethics on which to rely and so counterparty risk can be high. There have been many cases of people pricing NFTs for much less than they intended, for them to be snapped up by purchasing bots before they have chance to realise their mistake.

Exorbitant risk and return

The cryptocurrency boom in 2017, followed by the bust the following year, is still fresh in the minds of many investors. Interestingly, the fifteenfold increase in the price of Bitcoin during 2017 is nothing compared to its mindboggling return of 8,400% from 1 January until 30 November 2013.

Following the footsteps of the early-stage Bitcoin market, NFTs repeated a similar pattern last year. Our quantitative analysis shows that the 20 largest crypto coins and tokens used for NFTs – for which data has been available since the start of 2021 – have seen an average maximum year-to-date return of 10,000% (in some cases reaching even 50,000%) in 2021.

Although the market has retracted about 60-90% in the last six months, depending on the crypto coin or token, the performance remains exceptional compared to more mature and established cryptocurrencies (such as Bitcoin, Ethereum, XRP, Litecoin, and Monero) and especially traditional asset classes like equities and bonds.

A hypothetical NFT portfolio

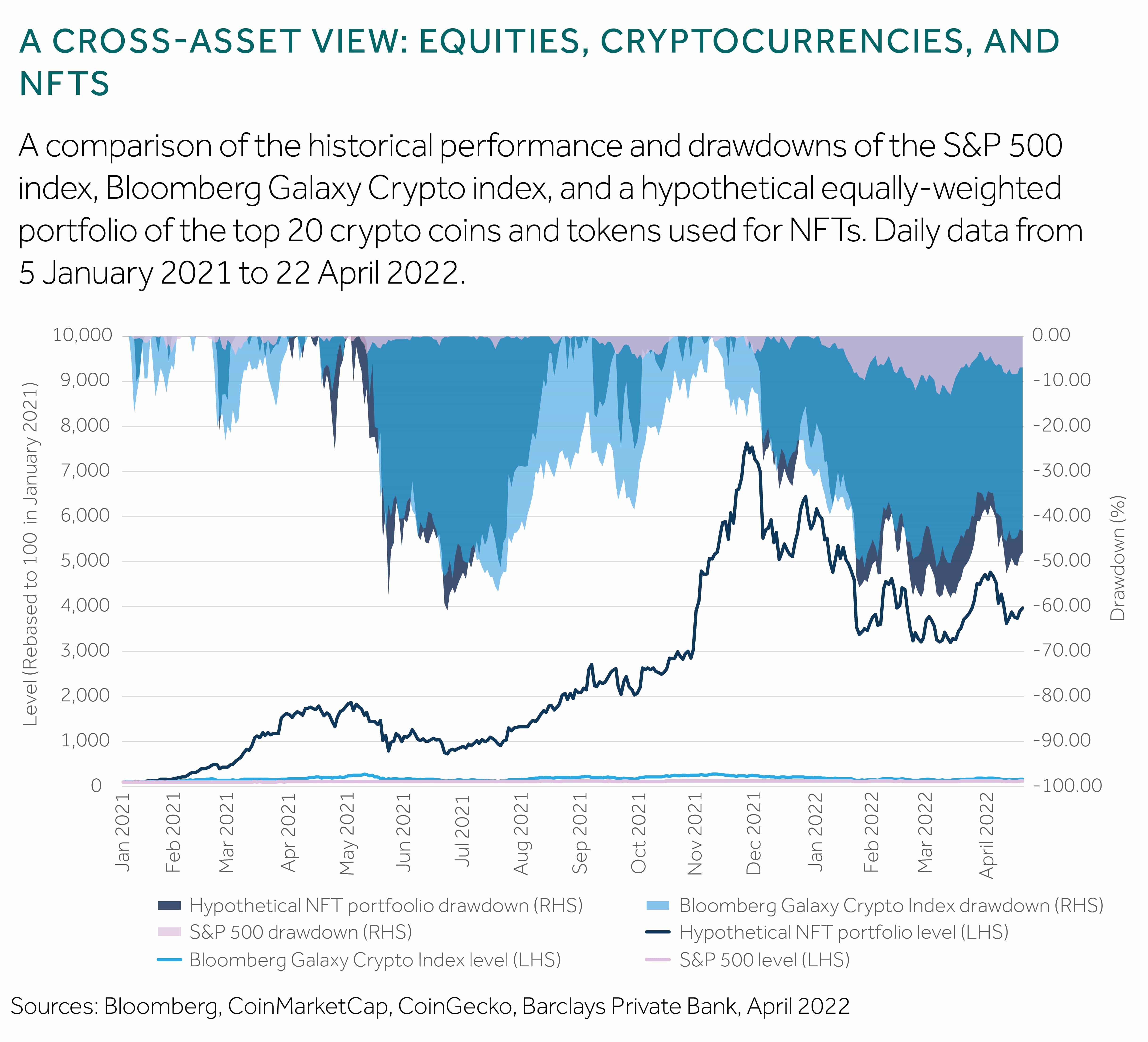

To make an impartial comparison between US equities, cryptocurrencies, and NFTs, we constructed a hypothetical equally-weighted portfolio that comprises the 20 crypto coins and tokens mentioned earlier. The following chart compares the performance and historical drawdowns for the S&P 500 index, Bloomberg Galaxy Crypto index, and our synthetic NFT portfolio (referred to as equities, crypto, and NFTs respectively).

![""]()

The results are stunning. In terms of performance, equities and crypto pale into insignificance compared to NFTs. The historical drawdowns of crypto and NFTs are rather correlated and of similar magnitude, reaching -60% during the worst episodes. However, the annualised volatility of NFTs is 120%, while crypto volatility was “only” 76%. Furthermore, some of the constituents in our synthetic NFT portfolio exhibited volatility of 350%. This threefold reduction in volatility shows the power of diversification across the NFT domain.

The cherry on the top is that equities witnessed volatility of 14% and the maximum drawdown of -13% between January 2021 and this April.

It is important to note that the total market capitalisation of our selected NFT universe was around $26 billion as of 22 April 2022, compared with the S&P 500’s capitalisation of $36 trillion and Bloomberg Galaxy Crypto’s $1.2 trillion. Consequently, one has to account for the investment capacity of NFT strategies and scale their investment quota accordingly, if they are to be considered in institutional portfolios.

The market is learning fast

So, what are the key drivers of NFT returns? Based on our regression analysis, the Bloomberg Galaxy Crypto index explains about 30% of the return variation of our hypothetical NFT portfolio. However, beside the exposure to major cryptocurrencies, any other potential drivers are difficult to spot.

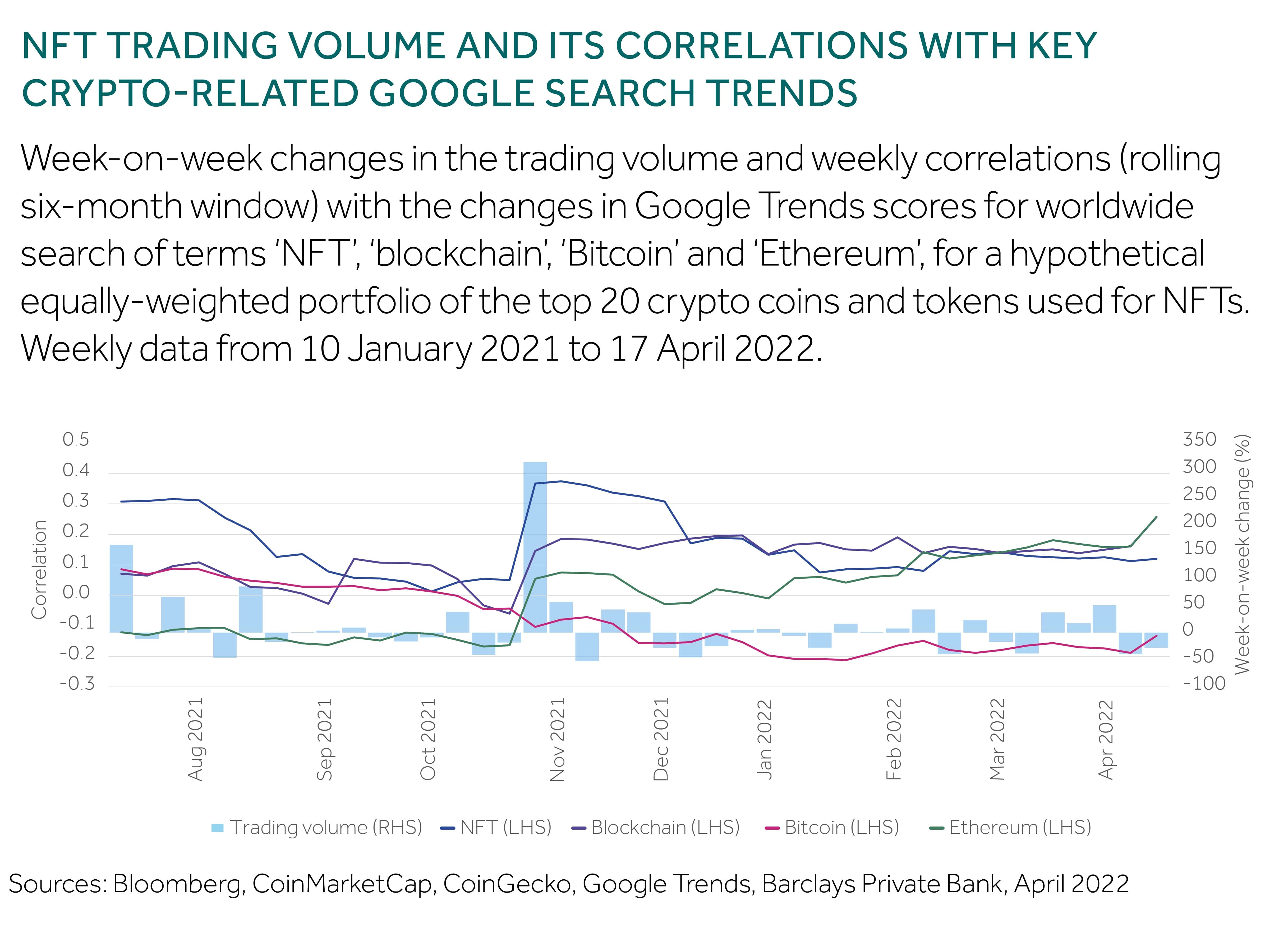

Furthermore, we have investigated if the changes in trading volume for our selected NFT universe are related to worldwide Google search trends for key terms such as NFT, blockchain, Bitcoin, and Ethereum (see chart), and to what extent they might have changed over the last 16 months.

![""]()

The correlation between the changes in trading volume and the changes in Google Trends’ score is highest for the terms NFT and blockchain. This is not surprising, as both are fundamentally related to NFTs. However, it provides empirical evidence of the intuition behind this exercise.

A more interesting, and thought-provoking, finding is that the correlation between the changes in trading volume and those in the Google Trends score for Bitcoin and Ethereum started in very different positions in January 2021, and has moved steadily in an opposite direction since. The former (latter) was positive (negative) at the outset of our observation period, and has trended down (up) over the next 16 months, finishing with the opposite sign at the end of the sample.

This could mean that crypto enthusiasts and investors have searched for the term Bitcoin when trading activity in NFTs took off initially. Being a benchmark or reference cryptocurrency, Bitcoin could have been of interest to those who were seeking more information about NFTs (a version of the behavioural familiarity bias).

However, as mentioned above, a vast majority of NFTs operate on Etehreum blockchain. This is where the learning effect might have kicked in. It seems feasible that market participants have learned that Ethereum is more relevant than Bitcoin for NFTs. Ultimately, the correlation between the changes in trading volume have become positively correlated with Ethereum, and negatively correlated with Bitcoin.

NFT investing

We now take our likening of NFTs and other alternative investments such as wine, art, and classic cars one step further. Art and classic cars each offer investors more use than more traditional investments, like equities and bonds.

Ultimately, an investor can appreciate a beautiful Picasso painting or a scintillating ride in an Aston Martin DB5 car, with negligible effects on the assets’ value. Indeed, many owners of these assets regard appreciating value merely as a bonus to the joy of owning them.

We believe collectible NFTs should be regarded in a similar light to the alternative investments mentioned, and that investors should primarily focus on NFTs from which they could gain additional utility – such as enjoying them as artworks.

Over time, NFTs could become a valuable diversifier in a digital assets portfolio. However, as far as NFTs forming part of a strategic asset allocation policy, we believe that the market is too novel and volatile to be considered for now.

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Important information

-

2017’s biggest cryptocurrencies ranked by performance, Joon Ian Wong, April 2022Return to reference

-

Yearly NFT Market Report 2021: How NFTs Affect the World, Nonfungible.com, 2021Return to reference

-

CryptoPunks, Larva Labs, 12 April 2022Return to reference

-

Bored Ape Yacht Club, OpenSea, 12 April 2022Return to reference

-

Total sales involving non-fungible token in gaming, art, sports and other segments from 2018 to 2021, Statistica, 12 April 2022Return to reference

-

Bitcoin Electricity Consumption Index, Cambridge Centre for Alternative Finance, 12 April 2022Return to reference