Mind over matter? Investing after a business exit

21 January 2022

You’ve successfully built a business and exited it, but what should you do with the proceeds? One option is to invest them in order to preserve and grow your wealth over the long term.

In this article, Alexander Joshi – Behavioural Finance Specialist at Barclays Private Bank – addresses some of the common behavioural challenges facing new investors, and explores how to adopt a mind-set for success.

1. Addressing common concerns

Taking the first step

When a business sale creates a large windfall event, the primary aim of many entrepreneurs is to safeguard the wealth they’ve worked so hard to build. They want to use it to fund their lifestyle and look after the next generation.

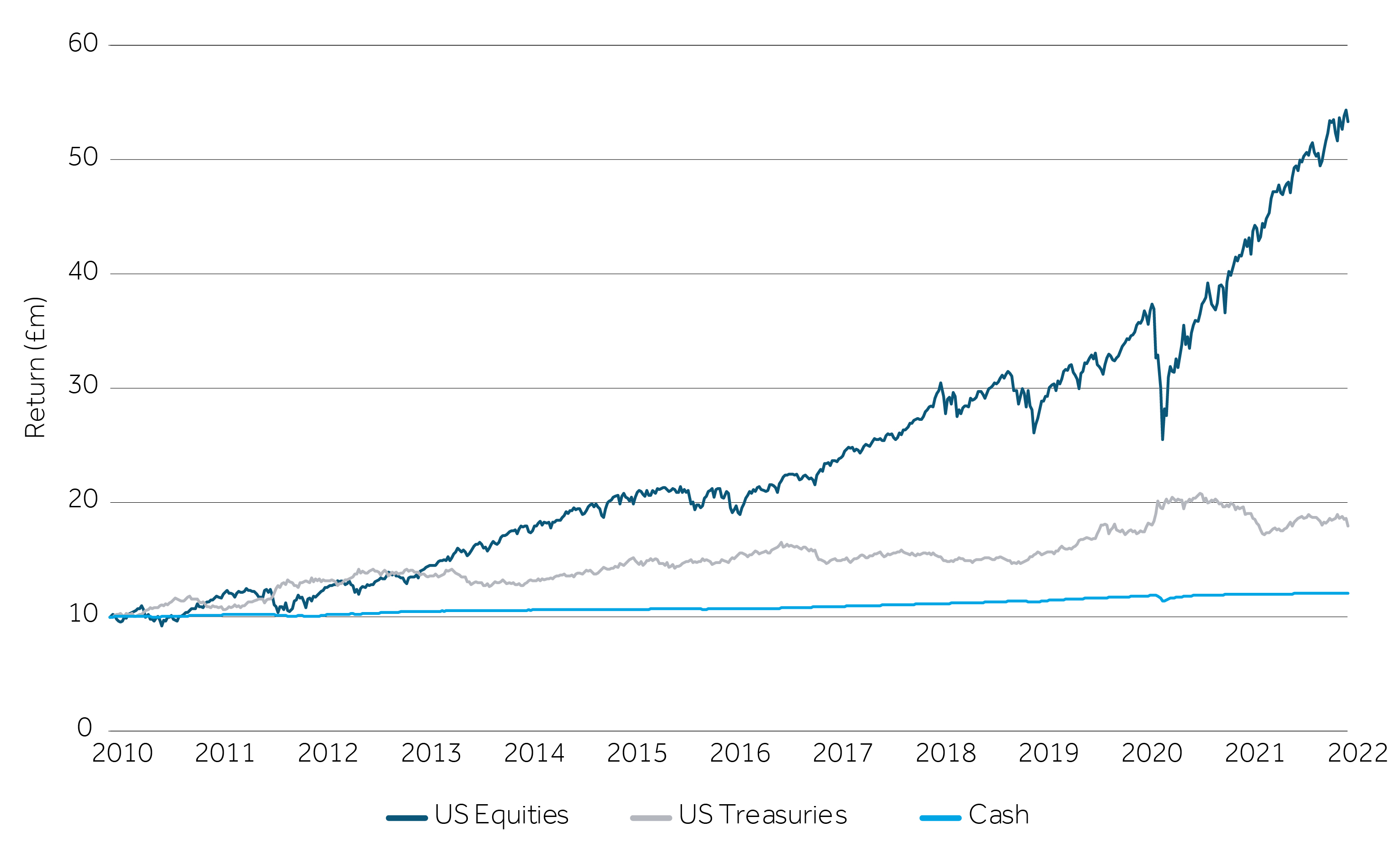

But you still need to put your wealth to work, even if you no longer do. In our view, investing provides one of the best ways to protect and grow wealth over the long term (see chart 1). Growth of financial markets are tied to human ingenuity and innovation, which fuels businesses and economies over time. Any growth will also benefit from the power of compounding, meaning that despite short-term ups and downs, investing is a means of providing firm, long-term foundations.

However, we recognise that while capital markets may have helped you build and grow your business, deploying the proceeds into financial markets can be daunting – even when you ask your private bank to manage things for you.

Chart 1: Performance of equities versus bonds and cash

Evolution of £10 million invested in the S&P 500 Total Return index (equities), US 10-20 year Treasuries (bonds) or US floating rate notes (cash), since 1 January 2010

Source: Bloomberg, Barclays Private Bank. January 2022.

Having known a business inside out, and had control over decisions and their outcomes, it’s not uncommon for us to hear entrepreneur clients talk about financial markets feeling out of their control.

If that’s the case, you may wish to consider seeking advice from investment professionals. In the same way that trusted advisors play a key role during the sale of the business, they can help break down the complexity of investing, allowing you to focus on what your wealth can do for you, and enjoying it.

Understanding the risk of loss

A common concern about investing is the risk of losing the wealth you’ve worked so hard to create. However, one way to erode wealth over time is to hold it in cash. With inflation rates higher than interest rates, the purchasing power of cash falls over time. This inflation cost is in addition to the opportunity cost – the foregone returns from investing, which historically have outperformed cash, as shown above.

Some investors may want to wait for a market correction, hoping to invest when prices are more favourable. While holding some cash for opportunistic reasons may have merit, if used effectively, timing the market is notoriously tricky. The success of timing market entry can often only be gauged with hindsight. Event risk is difficult to manage and markets can react unpredictably, as we’ve seen during the COVID-19 pandemic. In practice, cash can remain un-invested for much longer than anticipated.

2. Making better decisions

While some business owners may see the value in investing, they may also be reluctant to relinquish control over their wealth to others. Delegating can be difficult if you are used to being the decision-maker and trusting your instincts, and it can be tempting to go it alone.

Business experience can be an asset when investing, but it can also create challenges. Some aspects of decision-making that can make a business owner successful – checking in daily, making changes on the fly – can be unhelpful to a long-term investor. Behavioural studies show that performance usually suffers through overtrading.

Before making any choices, it’s important to recognise that behavioural biases can creep into investment decisions, and potentially drag on returns. The prospect of losses can have an outsized (adverse) impact on our decision-making. Our natural aversion to losses can induce us to make decisions to stem them that may not be in our long-term interest, such as selling out in a downturn, despite having sufficient liquidity to see it through.

The investment journey can be an emotional ride, particularly during periods of market turbulence, when investors’ time horizons can feel shortened, which increases the perceived riskiness of investing. It is when markets look most precarious that our behavioural proclivities can lead us astray.

3. Handing over the keys

Enlisting the experts can reduce the impact of behavioural biases.

For example, building a robust investment process that prioritises long-term thinking to generate core growth, whilst balancing it against opportunistic short-term positioning, can temper an investor’s tendency to act during extreme market events, where a fear of doing nothing can induce actions more harmful than the status quo.

Holding a well-diversified portfolio remains one of the best ways to protect and growth wealth across market conditions, due to imperfect correlations between assets, which can help reduce risk and smooth returns. This in turn may lessen the emotional impact of volatility for you. An investment professional can help you build one that’s tailored to your goals, circumstances and risk appetite.

4. Adopting a mind-set for success

By now you may see the value in investing and be ready to begin. Here we discuss ways to think about investing as you progress along your investment journey, to make it more comfortable, particularly during challenging periods.

Stay focused on your long-term goals

Markets can seem very volatile, particularly in the short term. Looking through a short-term lens can make the market seem random or irrational. One way to keep a longer-term perspective is to stay focused on your goals.

Having clarity around your overall objectives, ideally agreed with or communicated to an advisor, can make it easier to align investment decisions to them. An advisor can help you decipher market noise, by looking beyond the headlines to how market events are likely to affect your ability to reach your goals. Much of the news will not be material to a well-diversified portfolio held for the long term.

Think of your portfolio like a business

Navigating market turbulence is a concern for many investors. Those new to investing often think in terms of “the market”, as is commonly referred to in general conversation, and assume that their wealth is tied to its gyrations.

It’s important for investors holding a well-diversified portfolio to keep in mind that you are not invested in the market, you’re investing in companies. When picking investments, you are typically looking for the best companies you can find from across the world. Focusing on this can help during periods of market stress or changes in macroeconomic landscape. You wouldn’t sell your own business because of changes in interest rates for example, so why would you sell your investment portfolio?

Is now the right time?

As the world moves from pandemic to endemic, we expect a combination of post-lockdown optimism and short-term economic challenges, which will likely raise volatility, but we believe the long-term case for investing certainly remains robust (see our Investment Outlook 2022).

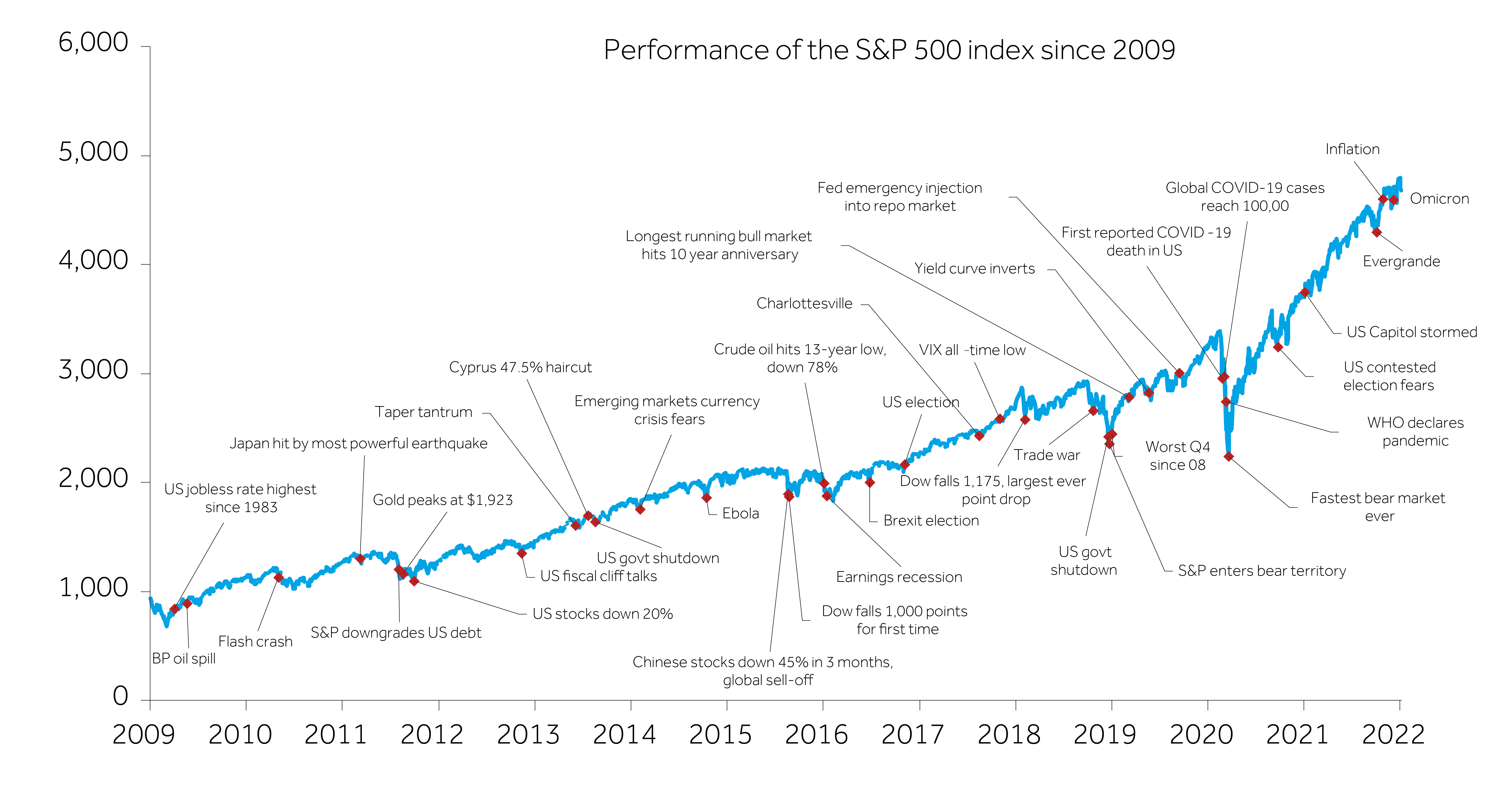

There is never a perfect time to invest. There are always reasons to not invest or sell out, but history shows that the market continues along its growth trend over the long term (see chart 2). We believe that time in the market, rather than market timing, is the most important aspect of long-term investment success.

For those who want to wait for a more opportune moment, it’s important to reflect on what drives economic growth, expectations of which in turn drive financial markets. The engines of economic growth and market performance will not stop functioning simply because they have been running smoothly, and without interruption, for an extended period.

Chart 2: Temptations to sell

Source: Bloomberg, Barclays Private Bank. January 2022.

Related articles

Past performance is not a reliable indicator of future performance. The value of investments can fall as well as rise and you may get back less than you invested.

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

The communication is:

- not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

- not an offer, an invitation or a recommendation to enter into any product or service and do not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

- is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

- has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.