Smarter Succession

Discover our Smarter Succession content series which uncovers some of the tensions surrounding wealth and business transfer, and how to overcome them.

02 November 2020

12 minute read

Over the next decade, the world’s wealthiest individuals will collectively transfer more than $15 trillion to their families – a sum greater than China’s entire GDP1. If wealth transfer is not properly managed, underlying tensions may push families to breaking point. Financial decisions may be taken, which imperil the wealth for future generations.

Succession planning – transferring wealth and family business – is complex, because it brings together money, power and love. It’s emotional and there are powerful forces at play of which families are often unaware.

We commissioned leading intelligence agency Savanta to help us gain a deeper understanding of the hidden pressure points and deep-rooted behaviours that often cause conflict in families, hindering effective communication about succession planning.

By helping you to recognise these common patterns and by providing guidance on how to overcome these obstacles, we can help prepare your family for the future and lay the foundations for generations to come.

Trust is fundamental to succession planning. Yet all too often, as our survey of 400 global HNW families shows, it’s lacking. Our research found that more than half of wealth creators lack trust in the next generation’s ability to manage the family business2.

Sometimes a lack of interest or aptitude on the part of the younger generation can trouble founders. As Jan Rees, one of the clients we interviewed, says: “It’s in the genes. It’s all about knowing what a customer wants, providing it, selling it and making a profit. You need that very simple, basic understanding, and some people just don’t have it.”

In other cases, this perceived disinterest stems from the lack of opportunity afforded to the next generation to demonstrate their potential.

"The older generation worries that the younger generation may lose everything they have built,” says Mark Tucker, Global Head of Wealth Advisory at Barclays Private Bank. “If founders want to ensure the impact of their presence is felt in future generations, then establishing trust between the generations is the first step in that process. It’s important that the next generation is not only given the opportunity to prove their abilities but also the right tools and support. That way, they’ll not only gain the trust of the older generation, but also gain confidence in their own abilities.”

According to Nike Anani, founder and CEO of Nike Anani Practice and an expert on building resilient family enterprises, the process of building trust can be a gradual one.

“Allow the successor to have a teaser project perhaps with their siblings, where they can demonstrate their ability to work professionally as partners and their joint commitment to succeed,” she says. “This allows responsibility to be given in a controlled way, as responsibility should be earned not granted.”

Source: Smarter Succession: The Challenges and Opportunities of Intergenerational Wealth Transfer, Barclays Private Bank, October 2020

Closely linked with trust issues is a desire to retain control. More than two thirds of company founders questioned in our research said that they were cautious about handing over their business. "Transition can be difficult for the older generation and the loss of control can be very difficult,” says Tucker.

Transition can be difficult for the older generation and the loss of control can be very difficult

Global Head of Wealth Advisory, Barclays Private Bank

Furthermore, as humans we seek to actively avoid uncertainty, particularly around potential losses says Alexander Joshi, Behavioural Finance Specialist at Barclays Private Bank. People are more willing to take risks to avoid a loss than to make a gain due to loss aversion – the human behavioural tendency to prefer avoiding losses rather than acquiring equivalently-sized gains. This stems from evidence that losses have been shown to have as much as double the psychological impact as gains.

Joshi draws a comparison to investing in the stock market. “When a shock leads markets to start falling and red is flashing on the screens, in many cases a sensible short term response is to actually do nothing and stay invested,” he says. “Selling in a panic may help investors sleep better at night, but this can come at the expense of long-term investment returns. But generally people struggle with staying put because they want to have a sense of control over the future.

“It’s the same with delegating in business and passing on wealth to the next generation," he adds. "There’s that sense of uncertainty and people tend to favour the known over the unknown.”

For the older generation who have created the wealth, there may be a strong innate desire to avoid losing their accumulated assets. Giving up control of their wealth and their business may on some level feel like a ‘loss’, which intuitively they seek to avoid.

Joshi suggests helping wealth creators retain a feeling of psychological ownership of the money even after it has been passed on. “They need to feel comfortable that the transfer of wealth and business doesn’t mean they are ‘losing’ anything,” he says.

For example, one client we interviewed, Azeem Merchant, found that working with his father, who’d founded their India-based business, became much easier when a family office structure was put in place.

“Over a period of time this has led to better communication between father and son, who work on defined objectives set by the investment team,” says Ashish Khanna, Director at Barclays Private Bank.

Our research identified that attitude to risk is often another cause of underlying tension, with two-thirds of those surveyed agreeing that this is a source of conflict.

The behavioural factors that make the older generation want to preserve wealth are likely to be intensified by a fear that the younger generation will take greater risks with it. This is borne out by figures showing that younger generations are more interested in growing wealth than maintaining it.

What’s important here, according to Joshi, is that each generation understands the motivations of the other.

“They’re at different stages in their lives,” he says. “The way they perceive risk is going to be different, and that’s completely natural. The older generation is likely to be thinking about wealth preservation, whereas, a 25-year-old, for example, has a completely different time horizon and will be thinking about wealth accumulation.”

Tucker believes that when families discuss risk, it’s important to see it from each other’s perspective. “The next generation can be more distanced from the source of wealth and often look for alternative approaches,” he says. “Whilst risk-taking at different life stages can cause tension, maintenance is often the consistent aim.”

Source: Smarter Succession: The Challenges and Opportunities of Intergenerational Wealth Transfer, Barclays Private Bank, October 2020

Millennials: Under 40’s; Gen X: 40-60 year-old’s; Early Boomers: Over 60’s

It's common for older and younger generations in global families to bring different outlooks and experiences to the table. The younger generation tends to have a more global outlook, partly due to the internet and social media, but also as a result of spending more time abroad, either studying, living or travelling.

More than half of the research respondents saw this distinction as a source of family conflict.

“The older generation tends to avoid change and prefers to stick with things and ideas with which they are familiar,” says Tucker. “It’s therefore important," he adds, "for the younger generation to communicate the potential positive impact of new business perspectives that can come from travelling abroad.”

Source: Smarter Succession: The Challenges and Opportunities of Intergenerational Wealth Transfer, Barclays Private Bank, October 2020

Our research found that 45% of the next generation who are already involved in managing the family business are worried about continuing the family legacy.

Nervous inheritors can be helped by establishing more dialogue across the generations, with the added support of experienced and impartial financial advisors.

On a more formal level, implementing a clear governance structure, with trustees whose capabilities span a breadth of diverse skill sets, will provide much needed expertise.

“It’s about getting everybody around the table”, says Antonio Risorto, Head of Wealth Advisory for Key Clients at Barclays Private Bank. “Different parties will come along with different objectives and agendas, and we can be an impartial referee, helping the family to evaluate options and agree a way forward. Aligning on values is often key to finding resolution.”

An inclusive approach to succession planning can bring multiple benefits. “Diversity of thought is good for decision-making,” says Joshi. “It’s important to stress that someone weighing in from a younger generation adds new perspectives about family wealth and business.”

Effie Datson, Global Head of Family Office at Barclays Private Bank, believes the younger generation can bring important new ideas about how to grow wealth. “These family members are digital natives and so may see different opportunities in the world and want to launch businesses in completely different industries that didn’t even exist 30 years ago,” she says. “For the family to retain its wealth and to prosper continuously, it has to be able to reinvent itself and learn about all the new technologies that are coming, such as biotech and AI.”

For the family to retain its wealth and to prosper continuously, it has to be able to reinvent itself

Global Head of Family Office, Barclays Private Bank

A diversity of both age and gender in the decision-making process will help drive new business ideas, says Dr Ylva Baeckstrom, a finance lecturer at King’s Business School.

“There is a huge business case for diversity,” she explains. “There’s no evidence that diversity limits business success, but lots of evidence that show it's beneficial to growth and profitability.”

Indeed, research shows that women tend to be more successful investors than men. According to a study by Warwick Business School, women’s returns on their investments were on average about 1.2% points higher than men’s3.

“Research has shown that in investing, men can be more overconfident in their abilities, which leads them to trade more excessively, which is detrimental to returns,” says Joshi. “These behaviours could naturally manifest themselves during wealth transfer and so having women involved in the decision-making could possibly mitigate some of the risks you might have if you just had a roomful of males.”

Despite their proven abilities, women tend to be less confident than men when it comes to making financial decisions, according to our research. In the context of wealth and business transfer, the answer to this comes down to empowerment.

“You need to empower a woman in that circumstance with skills, with confidence and with examples – which means a network of other people who are doing it successfully and are willing to impart their knowledge,” says Datson, who has a long record of promoting female representation in the financial sector, having founded '100 Women in Hedge Funds' nearly two decades ago. “From that they can draw the confidence to participate,” she concludes.

Wealth creators often feel that family wealth should be used first to either benefit the family or the causes that matter to them. They tend to feel a strong responsibility to preserve the wealth they have created or are passing along. Future inheritors, on the other hand, are increasingly looking to use their wealth as a force for good from the outset.

This is typically driven by the younger generation’s strong and vocal interest in social and ecological issues.

While wealth can generate tension within families, actively discussing how the family is invested can bring them closer together

Head of Sustainable and Impact Investing, Barclays Private Bank

According to Damian Payiatakis, Head of Sustainable and Impact Investing at Barclays Private Bank, these two desires merge within sustainable investing, which is increasingly becoming a means to coalesce a family’s core values.

“While wealth can generate tension within families, actively discussing how the family is invested can bring them closer together,” he says. “Sustainable investing can connect multiple generations because investment returns and investment outcomes matter across the entire family.”

He adds that this form of investing isn’t an either/or choice: “There’s a perception that there’s a trade-off between ‘Shall we make a difference, or shall we make money?’ It’s becoming more obvious that there are opportunities to make money by investing in solutions to our biggest social and environmental challenges."

“Some families don’t start with investing, but giving as a way to connect around values and building a sense of responsibility, especially with younger children. It can also be used as a great way to provide early money management skills,” says Emma Turner, Director of Philanthropy Service at Barclays Private Bank.

“It can also build a lot of practical skills in terms of running an organisation: having a governance structure in place, achieving goals and so on,” agrees Datson. “All of that can be done in the philanthropic realm, starting from a very young age.”

Source: Smarter Succession: The Challenges and Opportunities of Intergenerational Wealth Transfer, Barclays Private Bank, October 2020

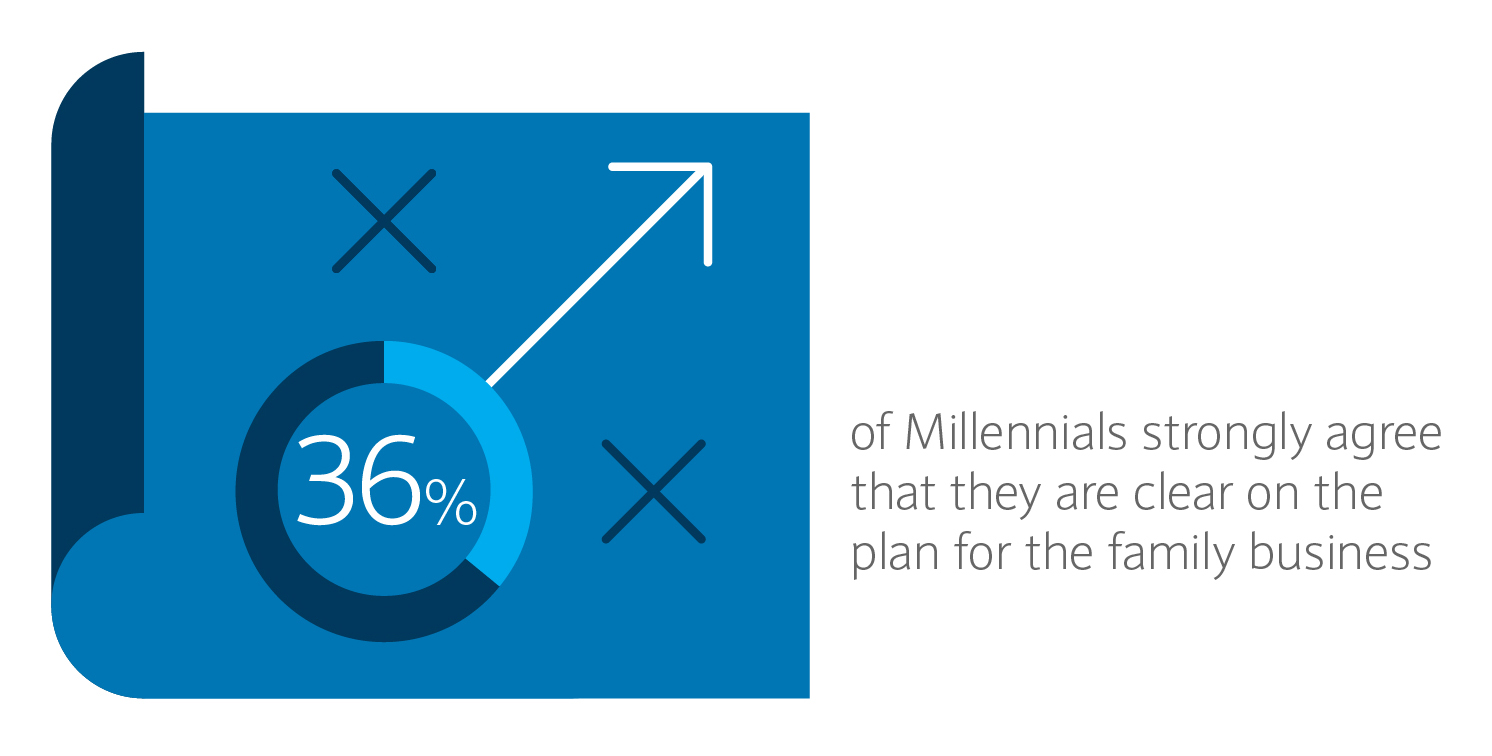

Conflicting aims and values between the generations can prove challenging when planning for the future. Only around half of those surveyed said they were clear on the plan for the family business and this figure fell to around a third for millennials. Understanding other family members' perspectives, engaging in regular communication and identifying the right support network are again key.

“Sometimes we’ll find members of different generations making plans in isolation from each other,” says Risorto. “So one of the things we do is break down those barriers and get a single plan in place and make sure that everyone is on the same page.”

A family charter has become an increasingly popular way of planning for the future and these can be a powerful unifying force.

“Family charters and family constitutions are important, but in many instances the content is not the most important aspect,” says Tucker. “Drafting such a governance framework should be viewed as a success because it’s an acknowledgment that the family has overcome the behavioural dynamics at play and communicated effectively.”

“It’s never too early to start those educative conversations,” says Datson. “Succession planning is a long-term and often iterative process. We want to deliver the whole Barclays Group’s capabilities to families. It’s about defining each family’s needs, understanding those needs and then meeting them. We want them to have a high-quality, curated experience that will mean not just their children, but their grandchildren and great-grandchildren remain wealthy and purposeful.”

Source: Smarter Succession: The Challenges and Opportunities of Intergenerational Wealth Transfer, Barclays Private Bank, October 2020

Succession planning is an emotional and highly personal subject, particularly when a family business is involved. That’s why we provide unique, practical insights that enable you to better understand and navigate challenging family dynamics. We also surround you with a team of Wealth Advisors who have a proven track record assisting clients with their complex multi-jurisdictional needs.

The quality of our people and stability of the team is what sets us apart. Our global network of specialists have over 250 years’ combined experience across a broad range of industry practices. Our Wealth Advisors are experts in their field with extensive knowledge across multiple international markets. They work alongside your current advisors, to help protect your wealth and support your planning, structuring and investment needs. We leverage our network to connect you to partners for requirements such as legal and tax advice.

Underpinned by solid foundations across banking, credit and investments, our experts are on hand to support you with a variety of interests such as philanthropy, impact and sustainable investing, and progressing ambitions for your Global Family Office.

Discover our Smarter Succession content series which uncovers some of the tensions surrounding wealth and business transfer, and how to overcome them.

Harmonious wealth transfer has become more difficult. Could a family charter be the key to successful intergenerational wealth transfer?

Find out how our experts can help to protect your wealth and support your succession planning, structuring and investment needs.

This communication:

Barclays does not and will not provide tax or legal advice. Any planning must be in line with our own internal tax principles. Please note that the tax treatment depends on your personal circumstances and may be subject to change in the future.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

IQ-EQ White Paper: The Great Global Wealth Transfer, July 2020Return to reference

Barclays Private Bank, Smarter Succession: The Challenges and Opportunities of Intergenerational Wealth Transfer, October 2020Return to reference

Are women better investors than men?, June 2018, Warwick Business SchoolReturn to reference