The knowledge gap

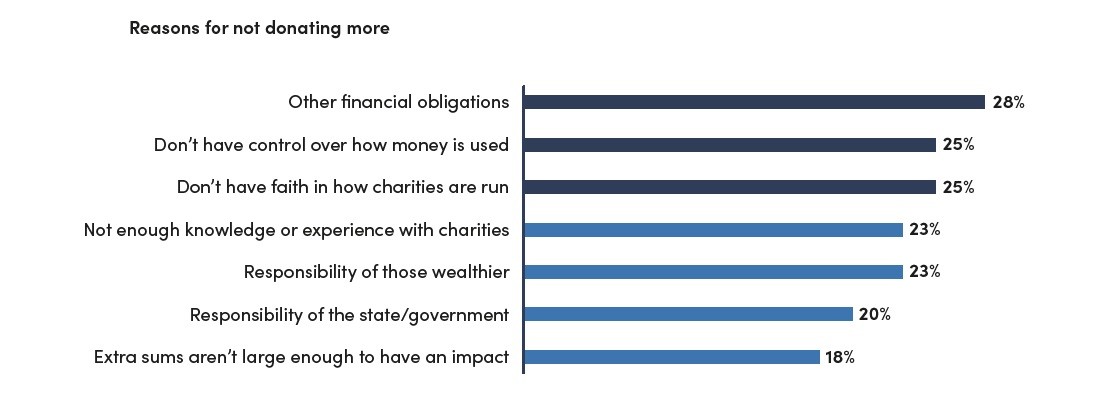

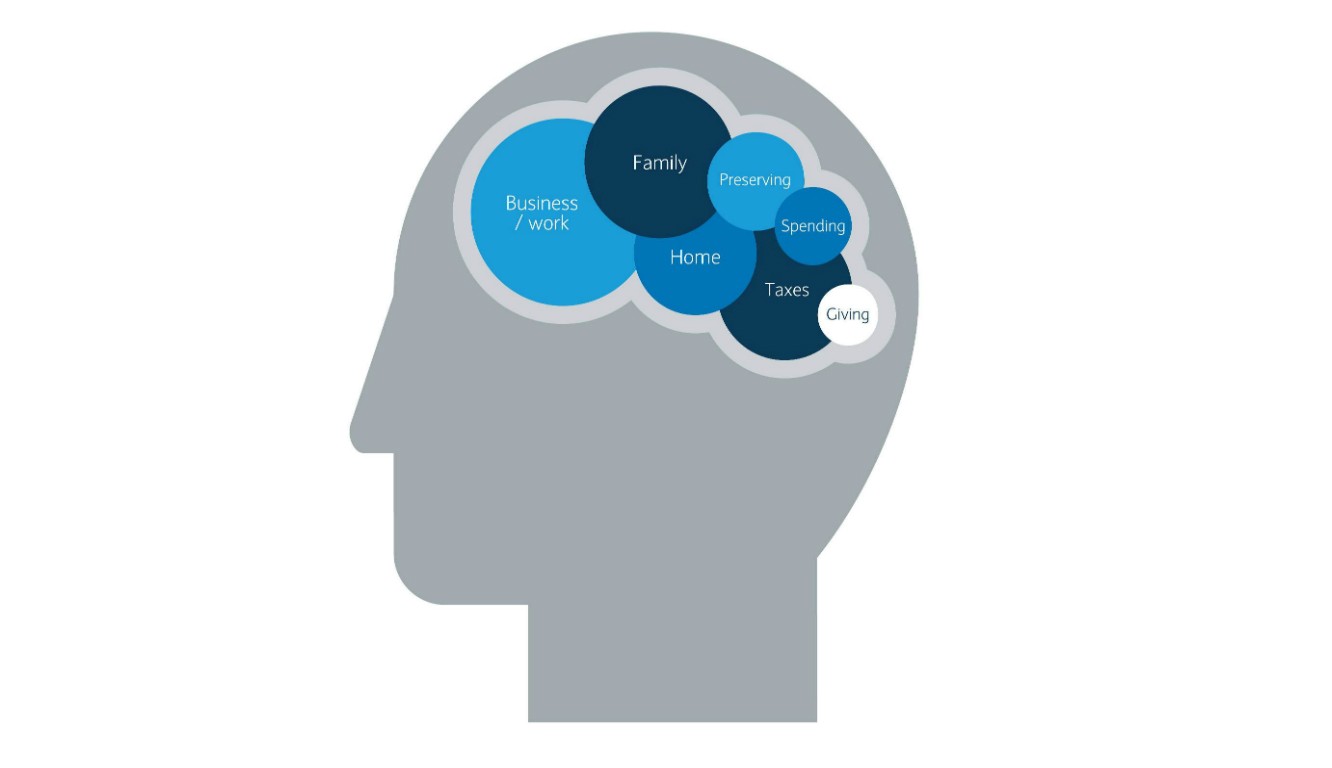

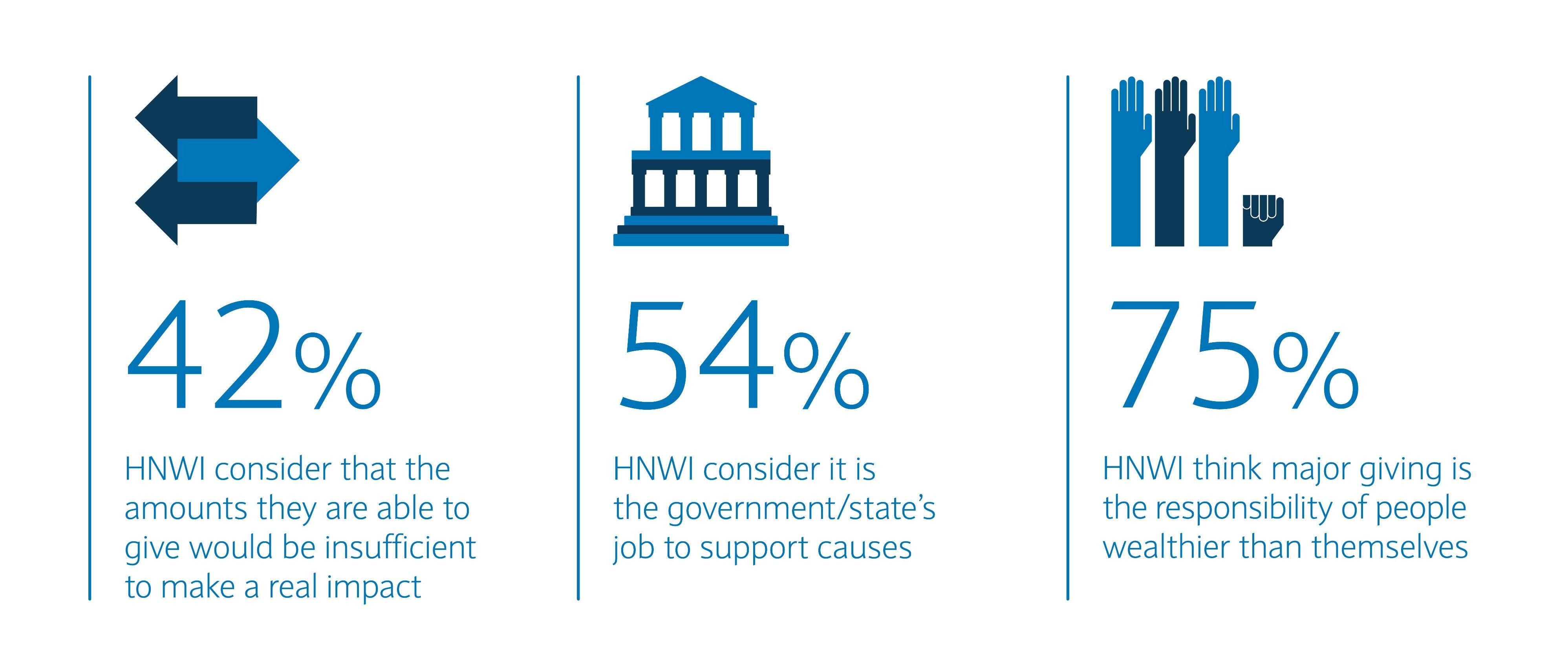

In recent times it’s not been difficult to find negative stories about charities in the media, fuelling worries about how they are run, and feeding mistrust. At the same time, around one in four wealthy givers say they don’t feel they have enough knowledge or experience when it comes to charities, which can also engender a lack of trust. Charities can make assumptions of their own: that wealthy individuals always have more to give, for example, or that they will always want to take more control over their giving.

In the US, where philanthropy among the wealthy is more commonplace and where wealth creation is generally celebrated, fundraisers are more likely to feel they understand what makes the wealthy tick. They therefore shape the relationship as being one of teamwork rather than merely extracting funding. For wealthy givers, having a sense of control – engendered through involvement and partnership – can be key.

Wider choices, greater transparency

The perceived lack of control between givers and charities can be overcome by demonstrating how donations have made a difference and communicating information that reassures that money is well spent, giving a sense of transparency to givers. Charities in particular could benefit from thinking of wealthy individuals not simply as money trees to be shaken but as repositories of many other benefits, including skills, knowledge and influence. Coupled with this, they could see the relationship as more of a hand-in-hand strategic partnership.

‘Restricted giving’ is one option that can help wealthy givers feel more in control of where their money is going. This is where donors designate the use of their donations to a particular purpose, for example, a gift to a special scholarship fund in education. In a world that has become increasingly personalised, offering a richer choice of giving options to donors can build engagement as it helps them feel like they are making a specific, actionable impact.

Transparency is also important. Allowing potential donors to conduct due diligence – not just studying the accounts and the cause but also getting to know the people involved in the organisation – can create reassurance. In general, the more a charity can show openness, the more a benefactor is likely to feel in control.