Market Perspectives May 2019

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

03 May 2019

By Gerald Moser, Chief Market Strategist

Between 23 and 26 May 2019, more than 500 million people in 28 countries will be voting to elect the 751 members of the European Parliament. That is, if the UK participates in the European election.

With the European Council agreeing to extend Article 50 to 31 October, it looks increasingly likely that the UK will be taking part in the coming European election as an agreement on a Brexit deal between the UK government and the UK parliament seems out of reach before the election date.

In that case, May’s European elections will test the latest state of the mood among UK voters. The latest polls suggest that Brexit will be a polarising topic and traditional political parties are getting under pressure from new movements seizing this opportunity.

But what is observable in the UK is also visible in a wider anti-EU sentiment that may influence continental politics.

The increasing popularity of anti-EU political parties in recent years, initially stoked by the political reaction to accommodate a surge of migrants to European shores in 2015, may further complicate policymaking.

The Rassemblement National in France, the UK’s newly created Brexit party and Germany’s Alternative fur Deutschland party are all polling strongly ahead of the European elections, with the former two at about 20% in the most recent polls.

Broadly speaking, Eurosceptic and anti-immigration parties look set to make the greatest gains. There is often much apathy among voters towards the election and turnout is generally low, which tends to favour more extreme political parties. A large coalition of EU-sceptics parties could influence EU foreign policy, budgets and eurozone reforms.

But for all the political gains made by more right-wing and nationalist parties in recent years, trust in the EU among its citizens has been at its highest since 2010, ahead of Europe’s sovereign debt crisis in 2011-13, over the last two years as per the latest Eurobarometer (November 2018). And the percentage of people with a positive image of the EU is at a 10-year high. Those contradictions highlight the increasing polarisation of the post-globalisation world.

The resurgence of populism in the eurozone is most visible in Italy. With the League party and the Five-Star Movement currently polling at 30-35% and 20-25% respectively, Italy is the only country where Eurosceptic parties are set to win the European elections.

The resurgence of populism in the eurozone is most visible in Italy.

In the aforementioned Eurobarometer survey, Italy was among the countries where the positive opinion on the EU was the lowest. However, this survey also highlighted that Italian citizens were mostly concerned with the economic situation and unemployment.

While immigration was the major preoccupation of respondents across almost all countries, in no other country within the EU was unemployment and the economic situation as important issues as in Italy.

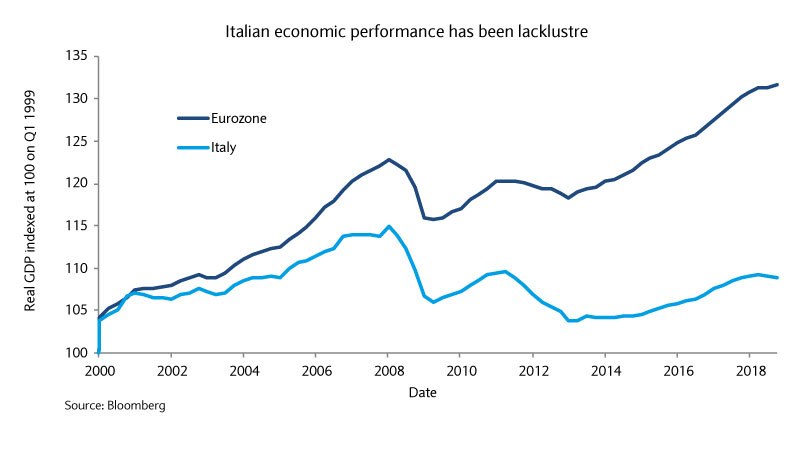

Looking at the performance of the Italian economy in the past 20 years, those worries are understandable. It has lagged the rest of the eurozone, with the gap growing ever so large since the European debt crisis in 2011-2013.

In the March 2018, Italian parliamentary elections, the Five-star Movement won the ballot with populist promises to improve Italians’ economic performance. But since then, Italy has gone through a short recession – the third one since 2009 – and unemployment is still above 10%, actually ticking up to 10.6% in Q4 2018.

The Five-star Movement has been blamed for this situation and the Lega is set to become the most popular party in the European election in May. This could upset the fragile balance in the current governing coalition and general elections later this year could not be ruled out.

Political instability and sluggish economic growth are likely to create renewed pressure at some point on Italian assets. We discuss in more details that topic in our fixed-income article, as this asset class is more exposed to the Italian risk than Italian equities which have a broader multinational exposure.

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.