Market Perspectives May 2019

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

03 May 2019

By Michel Vernier, Head of Fixed Income Strategy

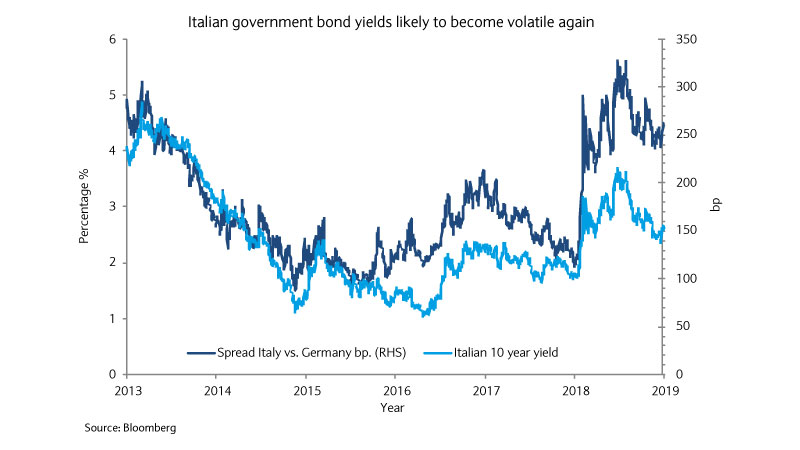

Spreads of Italian government bonds have retreated significantly since the highs of October 2018. We think upcoming renewed budget discussions and political uncertainty may lead to higher volatility again. Apart from the sovereigns, Italian bank bonds would be most affected by a resurgence in volatility.

Government bond auctions usually provide a good insight into investor sentiment towards the respective sovereign bond market.

On the 11 April Italy auctioned €2.5bn of 2022 bonds among others and investors offered to buy 1.62 times more the amount of that bond than sold (bid to cover ratio) at a yield of 1.08%.

The healthy demand was one of the reasons why the Italian 10-year bond yield marked an almost 12-month low at 2.37%.

Yields have fallen a long way since the 3.7% highs seen in October 2018 when Italy clashed with the EU on the back of budget discussions.

Furthermore, since then Italian bonds have been supported by Moody’s decision to maintain Italy’s BBB- rating with a stable outlook. However, sentiment can change quickly as seen in the past and we may witness this again in coming weeks or months.

Back in February, Italy avoided paying a penalty through the excessive deficit procedure, which is regulated by the EU. However, the presented budget lacks a solid foundation and given the political uncertainty faces implementation risks in Italy.

The initial budget targeted a deficit of 2% of gross domestic product (GDP) in 2019 and 1.8% and 1.5% in the years 2020/2021, based on lowering spending costs, pension reforms as well as value-added tax (VAT) hikes in 2020/2021.

The VAT hike is a very sensitive topic and has most recently been challenged publicly by the Five Star Movement leader and Italy Deputy Prime Minister Luigi Di Maio.

Without an increase in the VAT rate, the budget seems unsustainable and is likely to surge to 3.4% of GDP and breach EU budget rules according to the Bank of Italy. Italy has since revised the budget deficit to 2.4% of GDP for 2019, which still seems out of reach.

The path to debt reduction is based on a very optimistic growth assumption in our view. Although Italian growth has recovered from the technical recession it experienced in Q4 2018 and Q1 2019, the government’s growth assumption is very likely to be revised down from 1% of GDP closer to 0.6% of GDP as projected by the International Monetary Fund. Growth may even head towards the 0.2% of GDP projection of the EU for 2019.

The low volatility in spreads seems to reflect investor’s expectation that an agreement will be reached within the Italian parliament as well as between the EU and Italy, which we argue, seems overly optimistic.

Investors may also rely on a change in the government given the recent momentum of the League party which is perceived as more constructive and investor friendly than the current coalition.

Although the odds of an administration change look increasingly likely due to ongoing frictions between the two ruling parties and a wide range of coalition scenarios, trading on the back of the expectation of an investor-friendly government seems premature in our view.

…we rather expect investors to demand higher premiums soon for a country which runs record debt levels of 132% of GDP (2018).

Given that the debate about the budget will likely heat up again in the next two to three months, the overly optimistic growth assumption and the prevailing and increasing political uncertainty, we rather expect investors to demand higher premiums soon for a country which runs record debt levels of 132% of GDP (2018).

Italian bank bonds will likely feel the impact of a potential resurgence of volatility in Italian sovereign bonds. Profitability of Italian banks is disproportionally affected by sovereign spreads.

Firstly, Italian banks have the highest domestic sovereign exposure in Europe with €396bn making up 10.7% of the banks’ assets while Spain’s banks, for example, holds an average of 7.6%.

Under updated international financial reporting standards (specifically IFRS9), a large part of these holdings need to be booked at fair value which directly eats into the profitability and capital of the banks should spreads widen.

Secondly, higher funding costs restrict growth, which Italian banks require in order to reduce loss charges on their existing loan book.

The good news is that the large Italian banks were able to reduce the proportion of the non-performing loans significantly due to disposals and securitisation. Loan loss charges have declined by 12% in 2018.

However, recent securitisation deals indicate that the mark-to-market value of impaired loans sitting on banks’ balance sheets may still be too high. The European Central Bank (ECB) has so far not provided final details about the renewal of the Target Long Term Repurchase Operation (TLTRO III) bank funding operation and Italian banks, as the biggest beneficiaries, will hope that the ECB will be generous.

Investors may prefer to be selective and focus on higher quality within the Italian banking sector.

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.