Ageing population: living longer or better?

30 May 2019

Last week we showed how increased life expectancy is creating a significant population of older individuals – currently there are nearly a billion people over sixty years old, which is set to double in the next thirty years.

This demographic trend will boost the global healthcare sector; injecting a double dose of growth as spending increases first to extend longevity more widely and then as more people living longer incur higher healthcare costs.

Here, we look at how investors can position themselves in healthcare – more specifically through companies providing solutions to address chronic and age-related illnesses.

The growing burden of chronic diseases

Historically the leading causes of death were infectious diseases and acute illness – which unfortunately still remain dominant in many developing countries. However, age-related and chronic diseases are becoming the primary driver of both mortality and healthcare costs globally.

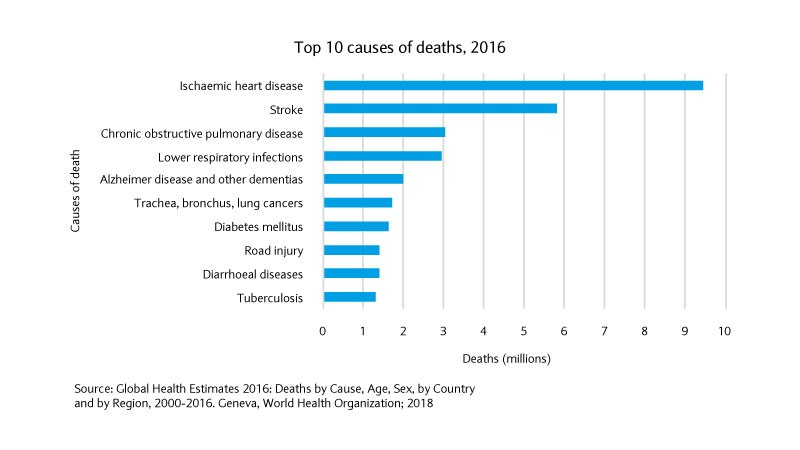

The World Health Organisation estimated, of the 56.9m deaths in 2016, heart disease, stroke and pulmonary disease were the world’s biggest killers. Combined these account for about one in three deaths1.

Moreover, the next set of non-communicable causes of death include dementia, cancer and diabetes. All these chronic diseases are age-related and more prevalent in the elderly.

These diseases, as well as many other illnesses – such as osteoporosis, arthritis, hearing loss, dental care, incontinence – will all contribute to healthcare costs.

Healthcare spending is set to soar to 12% of gross domestic product (GDP) in 2060 in developed economies from 6% of GDP in 2006-2010, and to triple in emerging markets2. Spending on medication alone in the US is expected to double to $900bn by 20503.

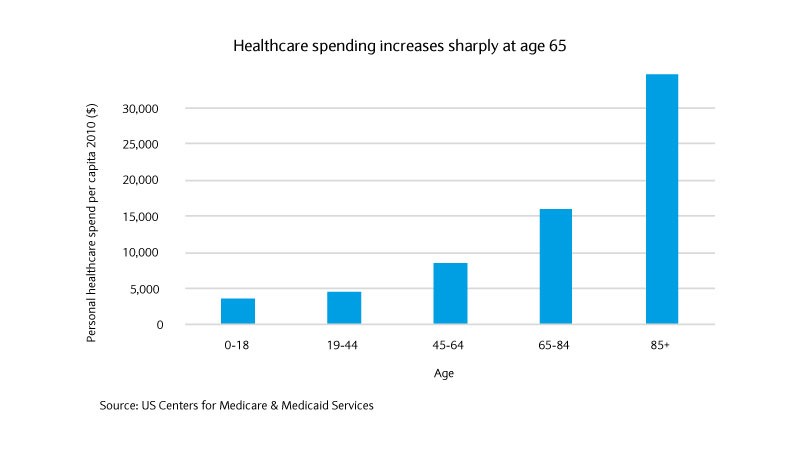

This is most acutely evident in developed countries, such the US, where healthcare spending per person roughly doubles after the age of 65, and then more than doubles again in those over 85.

Predicting, preventing and treating chronic diseases is key to ensure we are not just living longer, but better.

Investment opportunities

Companies that can provide solutions to age-related and chronic diseases will be well-positioned to benefit from rising life expectancy trends – either directly providing the medications or developing tools and technologies for these medicines.

Pharma and biotech

Pharmaceutical and biotech industries produce the medicines that treat these chronic and age-related diseases. Their market is globally set to exceed $1.5tn by 2023 ($1.2tn in 2018). This growth is driven both by the developed, notably the US, and so-called “pharmerging markets”, developing countries where pharmaceutical use is growing rapidly. The largest market is China which is forecast to spend $140-170bn by 20234.

While there is significant overlap between pharma and biotech, there are notable differences in these industries beyond how medicines are produced5. Investors should consider how the structure and risks of these industries operate.

Generally, biotech companies engage solely in research and development (R&D) of medicines, using biotechnology to recreate complex cellular functions for a specific treatment purpose. This requires high operating costs for research, development, and many years of testing to complete. The result tends to be a blockbuster or blowout; so these companies have a high risk-return profile.

In contrast, pharmaceutical companies tend to engage across a full array of activities from R&D to manufacturing and marketing medicines. They aim to have a steady flow of income from current drugs while maintaining R&D to produce similar or new products. For investors, successful pharma companies can offer more stable return profiles as long as the pipeline has the right line-up of new products.

Firms that have strong pipelines of drugs, particularly at the commercial stage, in areas such as diabetes, oncology and cardiovascular will be the ones best positioned to benefit from ageing population trends.

Drug development

Companies providing the tools and technology to support the discovery and development of drugs are another notable investment opportunity. Here, the burgeoning field of artificial intelligence (AI) has the potential to accelerate drug discovery, trial and testing – which is the longest and costliest component of the R&D process.

The AI health market is already seeing explosive growth. The market is expected to reach $6.6bn by 2021, up tenfold on its $600m level in 2014. Additionally, Accenture predicts that AI healthcare applications may result in annual savings of $150bn by 20266. More than one-third of senior executives at healthcare providers reported they were investing in AI, machine learning and predictive analytics going into 20187.

For investors, diagnostic specialists capitalising on increased patient testing will provide exposure to this growing market. As well, technology companies, with their vast data and AI capabilities, are investing significant resources in the healthcare sector. As pioneers of deep learning in medical research, they are using significant financial and technical capabilities to enter this market – often targeting ageing itself rather than diseases related to ageing.

Improving health span, not just lifespan

In the end, people don’t just want a longer life, they want a healthier one. The companies offering this elixir will be well-placed to benefit from the megatrend of an ageing world that spends more on healthcare that helps prevent, diagnose, and treat chronic illnesses and diseases. This can benefit both society and investors.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.