Ageing population: healthcare opportunities

23 May 2019

Over the next few weeks, we will introduce how the longevity and consumption power of a globally aging population provides opportunities for investors who can see beyond the demographic statistics.

In the first article we highlight demographic trends that will affect the healthcare sector.

One of our species’ greatest triumphs has been to extend our lifespans. Larger groups of people with more productive lives have accelerated economic and societal development over the last millennium.

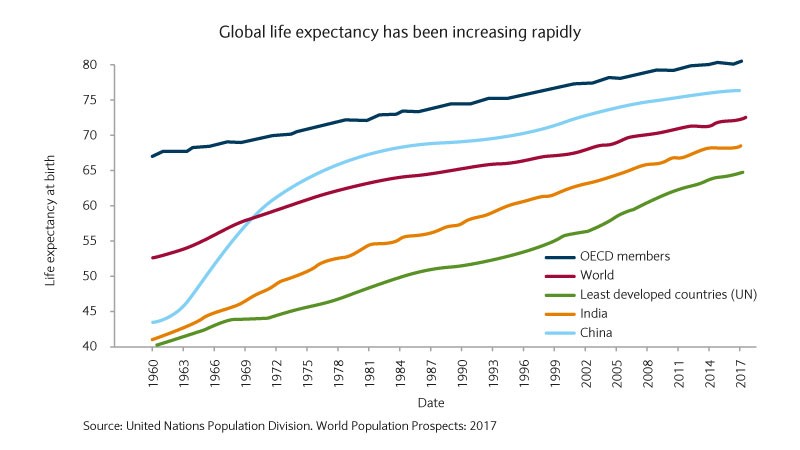

Yet, even since 1960, life expectancy has increased by twenty years across the globe – adding more than a quarter more lifetime onto the average individual. Even more dramatic increases have occurred in the world’s two most populous nations – 32.7 years in China and 27.6 in India.

Ageing populations are a global phenomenon

In 2017, the UN estimated there were 962m people aged 60 or over in the world, comprising 13% of the global population1. They also noted that this population was growing at 3% each year, faster than all other age groups. This means the number of older people is likely to double by 2050.

Contrary to common expectations, this demographic shift is not only in developed regions. The accelerating shift of the size and proportion of older generations is occurring across both emerging and developed markets.

As of 2017, Japan has the largest proportion of people over 60 and is the only country in the world where this crosses 30%. However, by 2050, all regions of the world except Africa are forecast to have nearly a quarter or more of their populations at ages 60 and above, including China, Thailand, Mexico, Brazil and Russia.

Longevity drivers

Thus far, increasing longevity has been due to primarily environmental factors. Improvements in sanitation, developments in antibiotics and vaccines, lower infant mortality and fewer births, and better working conditions have all contributed to global increases in life expectancy.

However, as we explored in our Beyond 100: Whitepaper, Video, and Podcast, the next phase of increasing longevity will be shaped more by our ability to modify the fundamental biology of the human body. Scientists are working on ways to re-engineer our biology, accelerated by the emergence of deep learning in clinical trial research to dramatically improve drug development. Within a couple of decades, this could mean widespread life expectancies well beyond 100 years.

Larger healthcare sector

For the global population to continue to extend lifespans requires more, and better, healthcare. All countries face major challenges to ensure that their healthcare systems can both cope with and best support this demographic shift. This is set to produce a double dose of market growth.

Firstly, achieving more widespread longevity will be due to increased spending on healthcare – most significantly as income levels and government spending rise in lower income countries.

Yet as we live longer, even more healthcare spending will be required. A majority of healthcare spending occurs in old age, and healthcare costs swell with older age, especially as chronic and age-related illnesses also increase.

Overall, a growing aging population will drive a multi-decade growth in the global healthcare market.

Investment ideas

So, how can investors position themselves to capture the health facet of the ageing populations theme.

Primarily, this can be achieved through exposure to companies producing the pharmaceuticals and using biotech to address ageing and rising levels of illness. Investing around health-related products and services that will support those living longer to lead comfortable and active lives is another avenue.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.