The impact of Turkey’s currency crisis on the European economy

17 August 2018

Turkey is currently going through a classic emerging market currency crisis, with the lira currently down 70% year to date against the dollar.

Driven by the same vulnerabilities that triggered previous emerging market crises, the affect is being felt across investment assets, with the stock market down by 50% in US dollar terms and the yield on a 10-year Turkish bond jumping by 8% year-to-date.

Credit default swap spreads have also widened to their highest levels since the economic crash of 2008.

What’s behind the slump?

Despite growing by more than 7% this year, the Turkish economy suffers from an inflation rate three times higher than that of the central bank’s target. Its high trade and fiscal deficits makes it relatively reliant on foreign capital inflows and a sizeable proportion of its foreign debt exposure has a short maturity profile.

The imposition of US sanctions, in response to the Turkish detention of American pastor Andrew Brunson, were a catalyst for already-wary investors to dump Turkish assets en masse.

What does this mean for the European banking sector?

The recent crisis in Turkey has weighed on the European banking sector. As the Turkish lira nose dived, European banking stocks have been particularly hard hit, owing to worries that some of these banks have high exposure to Turkish assets and borrowers.

Overall, however, the sector has minimal exposure to Turkey outside of a select few banks: Spain’s BBVA, Italy’s UniCredit, the Netherlands’ ING, and France’s BNP Paribas.

Media reports indicate that the European Central Bank is aware of the risks, although the situation is cited as being “not yet critical”. Given these numbers, the sector-wide impact from a further deterioration in Turkish assets is limited, in our view. The price movements are indication that the market is already bracing for the negative impact on these banks’ equity and book values.

Source: Datastream

Are there opportunities here for investors?

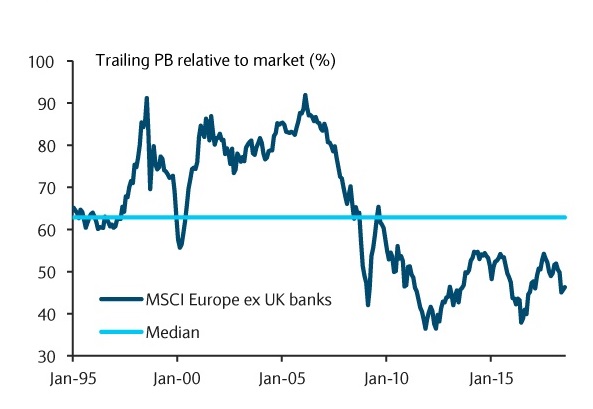

The European banking sector has long been a source of interest for value shoppers. Yet, whilst the same sector has soared at the other side of the pond, shares in Europe’s banks have mostly languished. Cost efficiency, non-performing loans and negative interest rates are just some of the factors which have weighed on banks’ profitability.

However, with the European economy showing signs of a healthy revival, the fundamental outlook for European banks is likely to improve from here.

What is being done to mitigate risks?

In response to this recent volatility, the Turkish central bank has reduced reserve requirement ratios (that is, the percentage of deposits banks are legally required to hold as cash), while also easing rules that govern how banks manage their lira and foreign-currency liquidity.

These, however, are merely short-term measures to improve banking system liquidity and bolster investor confidence. Given the severity of the crisis and the size of Turkey’s macroeconomic imbalances, it is likely that Turkey will ultimately require help from the International Monetary Fund.

Unfortunately, President Erdogan’s bellicose rhetoric suggests that Turkey may instead choose to go at it alone. Here, we think that there is a non-negligible risk of a Turkish default, and it is plausible that the situation may deteriorate further. This obviously translates into additional headline risks for the European banking sector, but a more serious systemic shock to the sector is unlikely for now.

Source: factsheet

Take-outs

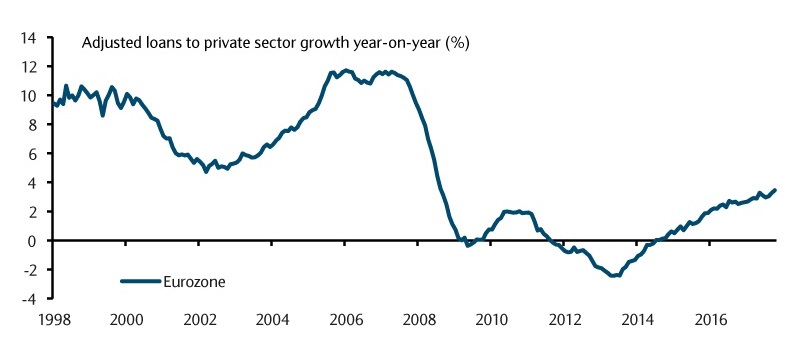

The fundamentals underlying our positive view on European banks remain intact. As domestic growth stabilises, evidence trickles in of increased demand across corporate lending, mortgages and consumer credit.

A further deterioration in the Turkish situation isn’t implausible, but unlikely to pose a systemic solvency risk to the wider sector. Valuations are currently low relative to history. This implies higher upside potential, should our base scenario play out as expected.

The sector is likely to remain hostage to European political uncertainty, but this can often draw attention away from a marginally improving picture of underlying fundamentals. Robust growth should continue acting as a tailwind for loan growth – a key driver of bank profitability. Alongside this, the weight of non-performing loans, so long a burden on profitability, capital requirements and the ability to lend, should continue to lighten amidst this improved economic backdrop.

Meanwhile, banks’ capital positions have significantly improved in recent years, with the European sector’s core regulatory capital as a proportion of total risk-weighted assets having doubled in the last decade. All in all, the sector remains an attractively priced, albeit risky, long-term play on European growth.

Nerves of steel and patience are still required, but still likely to be rewarded in our view.

Investments can fall as well as rise in value. Your capital or the income generated from your capital may be at risk.

This communication is for Barclays Private Bank and Overseas Services customers.

This document is from the Investments division at Barclays Private Bank & Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates are given as of the date hereof and are subject to change.

No representation is made as to the accuracy of the assumptions made within, or completeness of, any modelling, scenario analysis or back-testing. Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services. Barclays is not offering to sell or seeking offers to buy any product or enter into any transaction.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modelling or scenario analysis contained herein is no indication as to future performance.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

The value of any investment may also fluctuate as a result of market changes. Barclays is not obliged to inform the recipients of this communication of any change to such opinions or estimates. THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

This document is not directed to, nor intended for distribution or use by, any person or entity in any jurisdiction or country where the publication or availability of this document or such distribution or use would be contrary to local law or regulation. It may not be reproduced or disclosed (in whole or in part) to any other person without prior written permission. You should not take notice of this document if you know that your access would contravene applicable local, national or international laws. The contents of this publication have not been reviewed or approved by any regulatory authority.

This document was drafted by and the views presented are those of Barclays Bank (Suisse) SA as of the date of the brochure and may be subject to change in the future. The information contained in this document is intended for general circulation only. This document shall not constitute advice or an offer by Barclays Bank (Suisse) SA to subscribe to any service or product or enter into any transaction.

All legal terms and conditions are to be found in the general account terms and conditions of Barclays Bank (Suisse) SA together with the legal terms and conditions of the product or service offered. Barclays Bank (Suisse) SA has made every effort to ensure that the information contained in this document is reliable, exhaustive and accurate.

This document is general in nature and does not take into account the specific investment objectives, financial situation, knowledge, experience or particular needs of any particular person. The products and services presented in this publication may not be appropriate or suitable for all investors. Advice should be sought from a financial adviser regarding the appropriateness and suitability of the investment products and services mentioned herein, taking into account your specific objectives, financial situation, knowledge, experience and particular needs before you make any commitment to purchase any such investment services or related products.

Neither Barclays Bank (Suisse) SA nor any of their respective officers, partners or employees accepts any liability whatsoever for any direct or consequential loss arising for any use of or reliance upon this publication or its contents, or for any omission.