The Fourth Industrial Revolution

Overview

- Mankind is advancing into uncharted territory in materials science, robotics, artificial intelligence (AI) and genetic engineering to name just a few of the more high profile areas

- Picking the winners from such widespread technological advance is easier said than done

- Diversified investment in likely adopters and broader cyclical sectors can be a more effective way to profit

Broad-based disruption

As described by the famous engineer and economist, Klaus Schwab, the ‘Fourth Industrial Revolution’ is characterised by a fusion of technologies that are “blurring the lines between physical, digital and biological spheres”. It is hard to find a historical precedent for the velocity and scope of these breakthroughs and the degree of likely disruption across sectors. There will be few areas left untouched or unchanged. However, history tells us that we should be wary of our ability to perfectly pinpoint which companies will thrive or even survive amidst such tumultuous change. For every Google, there is a Yahoo.

Ever-changing benchmarks

The companies that will continue to dominate our investment portfolios are forged in the white heat of global competition. They have generally survived and flourished due to their ability to find a way to adapt and grow profits under a variety of political, technological and economic regimes.

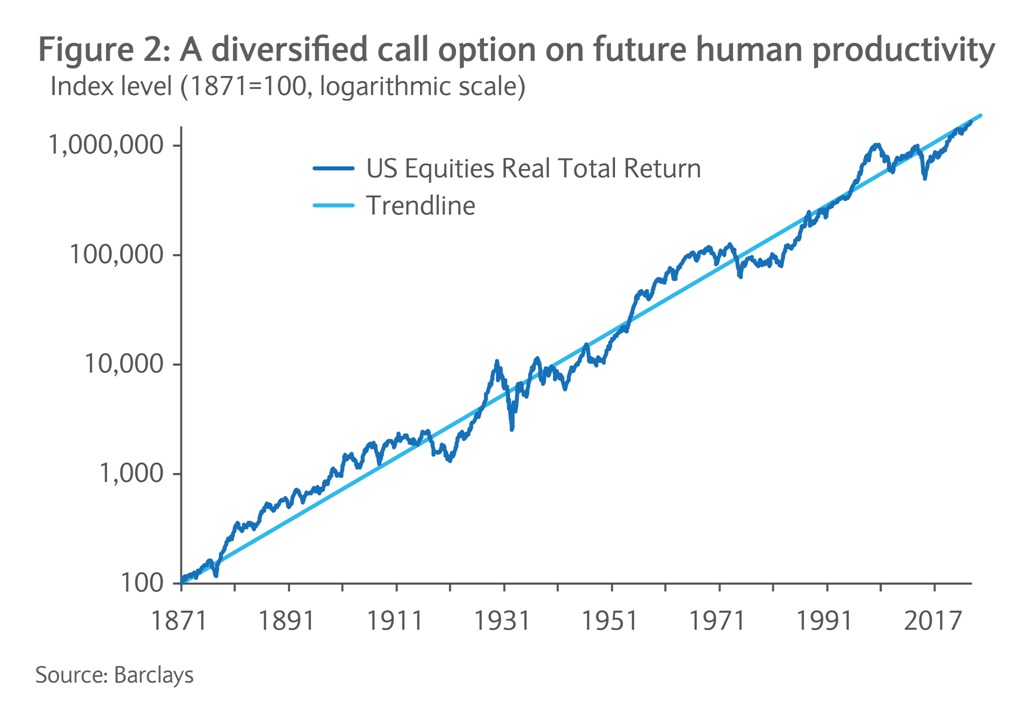

The exchanges on which these companies are quoted reflect this ever-changing world as it happens. A US index of stocks that was dominated by railroad barons at the end of the 19th century is now dominated by technology titans (Figure 1), selling products and services that would be unrecognisable to many of our ancestors.

A more focused bet

For investors looking to benefit from these widely feared advances, the global technology sector, in PBOS investments division’s view, represents a type of focused call option on future human productivity – one that we still feel is attractively priced at the moment. There is also significant secular attraction to the global industrial sector, which should, in whatever shape it evolves into, be one of the primary beneficiaries of these technological advances.

For example, the increasing use of algorithms that predict machine failure and dial in maintenance needs. Or artificial intelligence that uses historic data to optimise a plant and adjust to changing dynamics more quickly than humans could. These structural attractions are happily augmented by more cyclical appeal in the case of both industrials and technology, particularly as we finally seem to be amidst a long overdue upswing in investment and capital expenditure in much of the world.

Nonetheless, in our view, innovation and its adoption is the ultimate force that drives corporate profits higher in aggregate – essentially a bet on the inventors of new technology and its wider adoption. The stock market indices will adapt to the brave new world, and reward the faithful (Figure 2).

Please view a PDF version of the article [PDF, 1,017KB]

Investments can fall as well as rise in value. Your capital or the income generated from your capital may be at risk.

This communication is for Barclays Private Bank and Overseas Services customers.

This document is from the Investments division at Barclays Private Bank & Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates are given as of the date hereof and are subject to change.

No representation is made as to the accuracy of the assumptions made within, or completeness of, any modelling, scenario analysis or back-testing. Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services. Barclays is not offering to sell or seeking offers to buy any product or enter into any transaction.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modelling or scenario analysis contained herein is no indication as to future performance.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

The value of any investment may also fluctuate as a result of market changes. Barclays is not obliged to inform the recipients of this communication of any change to such opinions or estimates. THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

This document is not directed to, nor intended for distribution or use by, any person or entity in any jurisdiction or country where the publication or availability of this document or such distribution or use would be contrary to local law or regulation. It may not be reproduced or disclosed (in whole or in part) to any other person without prior written permission. You should not take notice of this document if you know that your access would contravene applicable local, national or international laws. The contents of this publication have not been reviewed or approved by any regulatory authority.

This document was drafted by and the views presented are those of Barclays Bank (Suisse) SA as of the date of the brochure and may be subject to change in the future. The information contained in this document is intended for general circulation only. This document shall not constitute advice or an offer by Barclays Bank (Suisse) SA to subscribe to any service or product or enter into any transaction.

All legal terms and conditions are to be found in the general account terms and conditions of Barclays Bank (Suisse) SA together with the legal terms and conditions of the product or service offered. Barclays Bank (Suisse) SA has made every effort to ensure that the information contained in this document is reliable, exhaustive and accurate.

This document is general in nature and does not take into account the specific investment objectives, financial situation, knowledge, experience or particular needs of any particular person. The products and services presented in this publication may not be appropriate or suitable for all investors. Advice should be sought from a financial adviser regarding the appropriateness and suitability of the investment products and services mentioned herein, taking into account your specific objectives, financial situation, knowledge, experience and particular needs before you make any commitment to purchase any such investment services or related products.

Neither Barclays Bank (Suisse) SA nor any of their respective officers, partners or employees accepts any liability whatsoever for any direct or consequential loss arising for any use of or reliance upon this publication or its contents, or for any omission.