Impact Investing

Overview

- Investing for both financial returns and societal impact is becoming increasingly popular and possible

- Investors are using this approach to protect and grow their assets as much as to avoid or address societal issues with their wealth

A new perspective

Historically, we may have been unaware or agnostic about the impact our investments generate. Impact investing reframes our thinking to make it an important, additional consideration in our investment process.

Investors incorporating impact are seeing how to invest through a novel, and useful, perspective. On one hand, considering impact can help spot investments that carry less obvious risks – as we’ve seen in scandals that have hit a range of sectors in the last few years from energy to textiles to auto manufacturers.

On the other, such approaches can uncover investment opportunities that address social or environmental challenges – for example, serving the needs of aging populations in the developing world, or providing adaptation and mitigation solutions for climate change.

Proliferating options

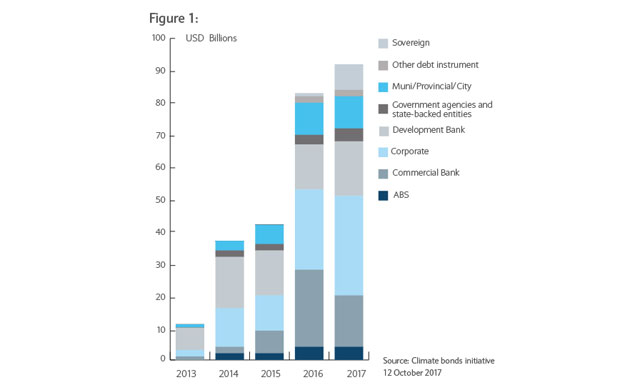

Across asset classes and sectors, investors have a variety of options to invest with impact. For example, green bonds are credits issued generally by supranationals and large corporations to fund projects that have positive environmental and/or climate benefits (Figure 1).

Private equity and debt funds are deploying longer-term capital for business models providing impact solutions in sectors like education, healthcare, sustainable cities, or agriculture. Even in traditional listed equities, including impact considerations will help reveal whether companies are effectively priced. Is the company in question managing risks due to climate change, or labour rights in their supply chain? Are they generating revenue through products and services that address trends such as the circular economy or healthy living and well-being?

Core not satellite...

A growing number of investors are making impact investing their primary approach when taking investment decisions. In the 2017 edition of the Financial Times Investing for Global Impact Report, a Barclays sponsored publication, 45% of the family offices active in impact investing reported using it as the “core portion of our investment portfolio” rather than simply a satellite investment or portfolio.

In the end, part of the concept of impact investing emerged from a recognition that global imbalances and environmental degradation need to be addressed. Capital markets have a role to play in either perpetuating or resolving some of these urgent challenges.

However, happily it is no longer just about trying to “do good”. Now proliferating investment options offer new possibilities to more effectively deploy capital for potential of both financial returns and positive outcomes.

Please view a PDF version of the article [PDF, 946KB]

Investments can fall as well as rise in value. Your capital or the income generated from your capital may be at risk.

This communication is for Barclays Private Bank and Overseas Services customers.

This document is from the Investments division at Barclays Private Bank & Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates are given as of the date hereof and are subject to change.

No representation is made as to the accuracy of the assumptions made within, or completeness of, any modelling, scenario analysis or back-testing. Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services. Barclays is not offering to sell or seeking offers to buy any product or enter into any transaction.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modelling or scenario analysis contained herein is no indication as to future performance.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

The value of any investment may also fluctuate as a result of market changes. Barclays is not obliged to inform the recipients of this communication of any change to such opinions or estimates. THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

This document is not directed to, nor intended for distribution or use by, any person or entity in any jurisdiction or country where the publication or availability of this document or such distribution or use would be contrary to local law or regulation. It may not be reproduced or disclosed (in whole or in part) to any other person without prior written permission. You should not take notice of this document if you know that your access would contravene applicable local, national or international laws. The contents of this publication have not been reviewed or approved by any regulatory authority.

This document was drafted by and the views presented are those of Barclays Bank (Suisse) SA as of the date of the brochure and may be subject to change in the future. The information contained in this document is intended for general circulation only. This document shall not constitute advice or an offer by Barclays Bank (Suisse) SA to subscribe to any service or product or enter into any transaction.

All legal terms and conditions are to be found in the general account terms and conditions of Barclays Bank (Suisse) SA together with the legal terms and conditions of the product or service offered. Barclays Bank (Suisse) SA has made every effort to ensure that the information contained in this document is reliable, exhaustive and accurate.

This document is general in nature and does not take into account the specific investment objectives, financial situation, knowledge, experience or particular needs of any particular person. The products and services presented in this publication may not be appropriate or suitable for all investors. Advice should be sought from a financial adviser regarding the appropriateness and suitability of the investment products and services mentioned herein, taking into account your specific objectives, financial situation, knowledge, experience and particular needs before you make any commitment to purchase any such investment services or related products.

Neither Barclays Bank (Suisse) SA nor any of their respective officers, partners or employees accepts any liability whatsoever for any direct or consequential loss arising for any use of or reliance upon this publication or its contents, or for any omission.