European banks – economic tailwind

Updated October 2018

Overview

- The European economy continues to provide a helpful backdrop for the region’s banks

- Valuations are not demanding, providing room for re-rating

- Regulatory and other risks remain, but upside potential remains significant

Value or value trap?

Value shoppers have long eyed up the continental European banking sector. Whilst the same sector has soared at the other side of the pond, shares in Europe’s banks have mostly languished. Cost efficiency, non-performing loans and negative interest rates are just some of the factors which have weighed on banks’ profitability. However, with the European economy showing signs of a healthy revival, the fundamental outlook for European banks is likely to improve from here, in our opinion.

Cyclical tailwinds

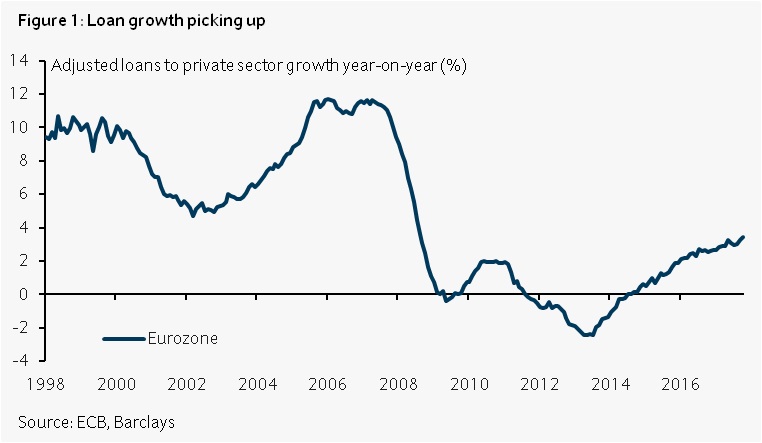

With the ECB in no hurry to raise rates, we are reliant on Europe’s cyclical upturn, rather than higher net interest margins, to drive bank profitability higher. As domestic growth stabilises, evidence trickles in of increased demand across corporate lending, mortgages and consumer credit. A robust macro backdrop should continue acting as a tailwind for loan growth – a key driver of bank profitability (Figure 1). Alongside this, the weight of non-performing loans, so long a burden on profitability, capital requirements and the ability to lend, should continue to lighten amidst this improved economic backdrop.

Meanwhile, banks’ capital positions have significantly improved in recent years, with the European sector’s core regulatory capital as a proportion of total risk-weighted assets having doubled in the last decade. On balance, European banks have been moving in the right direction, and their fundamental position has improved markedly compared to the last several years.

Take out

Investors will not need long memories to work out why this is not an investment for all risk appetites. Notwithstanding the aforementioned hurdles, the sector remains hostage to European political uncertainty, with the most recent example being Italian politics, which seemed to draw attention away from a marginally improving picture of underlying fundamentals. Meanwhile, risks of rising trade protectionism threaten to derail growth momentum, and the cyclical tailwinds for bank profitability with it. Turkey’s recent currency crisis has also weighed on sentiment, given fears regarding some of the bank’s exposure to Turkish assets.

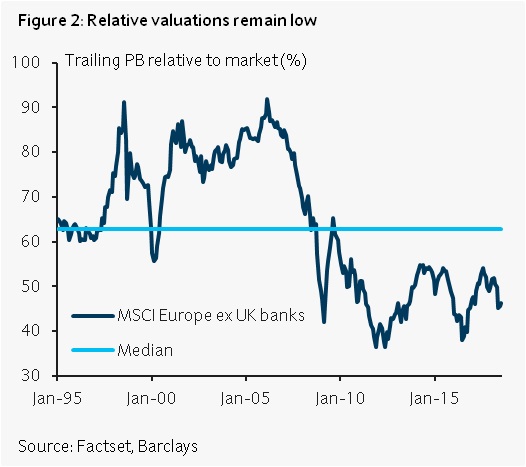

So far, estimates suggest minimal exposures to Turkey outside of a select few banks. A further deterioration in the Turkish situation isn’t implausible, but unlikely to pose a systemic solvency risk to the wider sector. Valuations are currently low relative to history (Figure 2), thus implying higher upside potential should our base scenario play out as expected. All in all, the sector remains an attractively priced, albeit risky, long-term play on European growth. Nerves of steel and patience are still required, but still likely to be rewarded in our view.

Please view a PDF version of the article [PDF, 198KB]

Investments can fall as well as rise in value. Your capital or the income generated from your capital may be at risk.

This communication is for Barclays Private Bank and Overseas Services customers.

This document is from the Investments division at Barclays Private Bank & Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates are given as of the date hereof and are subject to change.

No representation is made as to the accuracy of the assumptions made within, or completeness of, any modelling, scenario analysis or back-testing. Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services. Barclays is not offering to sell or seeking offers to buy any product or enter into any transaction.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modelling or scenario analysis contained herein is no indication as to future performance.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

The value of any investment may also fluctuate as a result of market changes. Barclays is not obliged to inform the recipients of this communication of any change to such opinions or estimates. THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

This document is not directed to, nor intended for distribution or use by, any person or entity in any jurisdiction or country where the publication or availability of this document or such distribution or use would be contrary to local law or regulation. It may not be reproduced or disclosed (in whole or in part) to any other person without prior written permission. You should not take notice of this document if you know that your access would contravene applicable local, national or international laws. The contents of this publication have not been reviewed or approved by any regulatory authority.

This document was drafted by and the views presented are those of Barclays Bank (Suisse) SA as of the date of the brochure and may be subject to change in the future. The information contained in this document is intended for general circulation only. This document shall not constitute advice or an offer by Barclays Bank (Suisse) SA to subscribe to any service or product or enter into any transaction.

All legal terms and conditions are to be found in the general account terms and conditions of Barclays Bank (Suisse) SA together with the legal terms and conditions of the product or service offered. Barclays Bank (Suisse) SA has made every effort to ensure that the information contained in this document is reliable, exhaustive and accurate.

This document is general in nature and does not take into account the specific investment objectives, financial situation, knowledge, experience or particular needs of any particular person. The products and services presented in this publication may not be appropriate or suitable for all investors. Advice should be sought from a financial adviser regarding the appropriateness and suitability of the investment products and services mentioned herein, taking into account your specific objectives, financial situation, knowledge, experience and particular needs before you make any commitment to purchase any such investment services or related products.

Neither Barclays Bank (Suisse) SA nor any of their respective officers, partners or employees accepts any liability whatsoever for any direct or consequential loss arising for any use of or reliance upon this publication or its contents, or for any omission.