Emerging Asia - Tech tigers

Overview

- Emerging (EM) Asia is a leveraged bet on global growth due to its highly cyclical composition

- The ongoing pick-up in global trade is set to continue to benefit EM Asian exporters

- Improving corporate profitability, allied to strong prospect top-line growth, suggests sustainable double digit annualised returns from the region’s stock markets from here

Broad-based growth

We think EM Asian equities are set to outperform this year,, driven by the interaction of an improving economic backdrop and rising corporate profitability. Since H2 2017, the he synchronised economic pep being enjoyed by both the global economy and the region’s economic powerhouses has spilled over into the smaller open economies like Korea, Taiwan, Malaysia and Thailand.

Looking forward, we believe the region should continue to benefit from the ongoing global recovery in manufacturing activity and a long awaited IT capex cycle. Encouragingly, investment indicators are starting to strengthen alongside domestic consumption, which should add more depth and durability to this ongoing upswing.

Global trade

Regional trade, as a relatively important source of demand for the region, has been supported by the pick-up in global economic activity. Korea, as the world’s fifth largest exporter, is one of the earliest to publish its trade data. Therefore, trends in Korean export growth provide a timely lead indicator for the direction of global trade.

The recent performance of Korean exports suggests that global trade volumes have further room to pick up – a positive sign for broader trends in regional exports. Within this, the continued pick-up in semiconductor trade should bode well for the prospects for the region’s tech exporters, as well as their respective currencies, which still benefit from a decent degree of carry.

Rising protectionism?

The imposition of import tariffs from the US, which is now being followed by retaliatory actions from its trading partners, has rekindled investors’ fears over trade protectionism. With the costs of such a conflict so high, and likely fairly immediate, our base outlook remains that economic self-interest would ultimately prevail, albeit with plenty of posturing from opposing parties.

Absent a further material rise in the prospects of a trade war, solid fundamentals lead us to retain a preference for the region. Aggregate valuations remain reasonable relative to developed markets, and trends in corporate profitability are still positive. The right type sector composition…

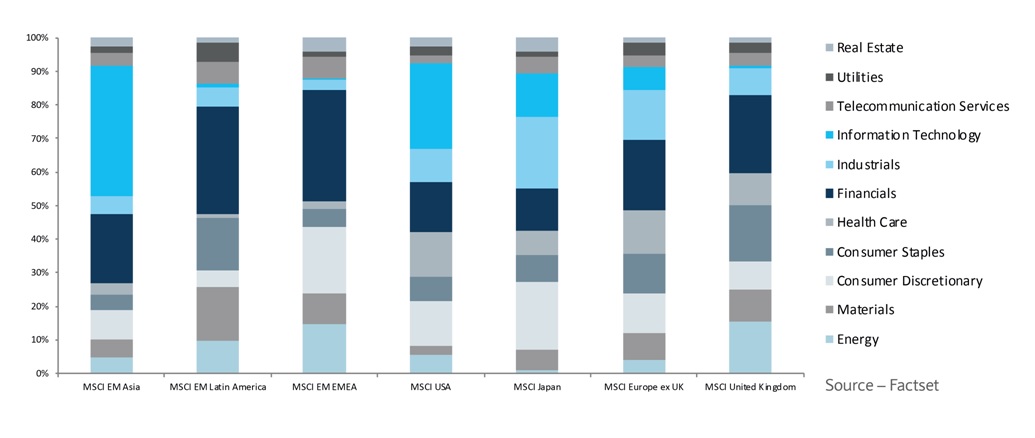

For those wanting to make the most out of this current growth phase, EM Asia would stand out as one of the most appropriate equity regions to be invested in. The regional index has a relatively large proportion of (non-commodity) pro-cyclical sectors levered to the global growth cycle.

Technology, financials, and industrials make up more than 65% of the overall index, the largest proportion among other EM regions like EM Latin America (which is heavily exposed to unpredictable movements in commodity.

*Source earnings per share (EPS) increase: FactSet

Please view a PDF version of the article [PDF, 1.4MB]

Investments can fall as well as rise in value. Your capital or the income generated from your capital may be at risk.

This communication is for Barclays Private Bank and Overseas Services customers.

This document is from the Investments division at Barclays Private Bank & Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates are given as of the date hereof and are subject to change.

No representation is made as to the accuracy of the assumptions made within, or completeness of, any modelling, scenario analysis or back-testing. Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services. Barclays is not offering to sell or seeking offers to buy any product or enter into any transaction.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modelling or scenario analysis contained herein is no indication as to future performance.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

The value of any investment may also fluctuate as a result of market changes. Barclays is not obliged to inform the recipients of this communication of any change to such opinions or estimates. THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

This document is not directed to, nor intended for distribution or use by, any person or entity in any jurisdiction or country where the publication or availability of this document or such distribution or use would be contrary to local law or regulation. It may not be reproduced or disclosed (in whole or in part) to any other person without prior written permission. You should not take notice of this document if you know that your access would contravene applicable local, national or international laws. The contents of this publication have not been reviewed or approved by any regulatory authority.

This document was drafted by and the views presented are those of Barclays Bank (Suisse) SA as of the date of the brochure and may be subject to change in the future. The information contained in this document is intended for general circulation only. This document shall not constitute advice or an offer by Barclays Bank (Suisse) SA to subscribe to any service or product or enter into any transaction.

All legal terms and conditions are to be found in the general account terms and conditions of Barclays Bank (Suisse) SA together with the legal terms and conditions of the product or service offered. Barclays Bank (Suisse) SA has made every effort to ensure that the information contained in this document is reliable, exhaustive and accurate.

This document is general in nature and does not take into account the specific investment objectives, financial situation, knowledge, experience or particular needs of any particular person. The products and services presented in this publication may not be appropriate or suitable for all investors. Advice should be sought from a financial adviser regarding the appropriateness and suitability of the investment products and services mentioned herein, taking into account your specific objectives, financial situation, knowledge, experience and particular needs before you make any commitment to purchase any such investment services or related products.

Neither Barclays Bank (Suisse) SA nor any of their respective officers, partners or employees accepts any liability whatsoever for any direct or consequential loss arising for any use of or reliance upon this publication or its contents, or for any omission.