Investment grade credit – skews me

As the hysteria that gripped investors toward the end of last year fades into memory, capital markets have seen a broad recovery, from stocks to corporate credit.

Within the latter, this u-turn is best illustrated through credit spreads (the extra compensation investors demand for lending to companies over the government) retracing half of their recent widening (figure 1).

However, despite this impressive recovery, concerns over excessive corporate leverage and deteriorating fundamentals linger.

Within the investment grade (IG) market, it is the growth of BBB rated debt (the lowest rating within the IG universe) which seems to furrow most brows.

The BBB debt market has now swollen to more than twice the size of the entire US high yield market.

What happens if the ratings agencies decide in their wisdom that even a BBB rating is too generous for this debt?

The constrained nature of a lot of credit demand, where buyers are mandated to stay above a certain quality, would perhaps result in a more chaotic mismatch between buyers and sellers.

Some reassurance can be taken from the fact that a large proportion of businesses in this BBB segment operate in more defensive industries.

Such businesses may have more scope to act (such as reducing dividends, decreasing capital spending or selling assets) to avoid being downgraded.

More importantly though, solely looking at leverage ignores other factors; the ability to service that debt, term to maturity and refinancing risk to name but a few.

A first glimpse of recession?

Over recent years, we have seen profits soar, average maturities lengthen, and interest coverage ratios rise.

The IG credit market is unlikely to be immune to the next downturn, but perhaps underlying fundamentals aren’t as gloomy as a quick glance at the level of outstanding debt would imply.

If corporate fundamentals aren’t as ominous as feared and a recession isn’t yet visible, why are we tactically underweight IG credit in portfolios?

As with all our tactical asset allocation decisions, the answer circles back to an assessment of risk versus reward.

Broadly speaking, total returns for IG credit come from bearing two types of risk; interest rate risk and credit risk.

As outlined in previous publications, we see scope for interest rates to climb from here which would be a headwind for IG.

The risk/reward profile of the credit component also highlights the importance in our view of the health of the economy.

A negative skew

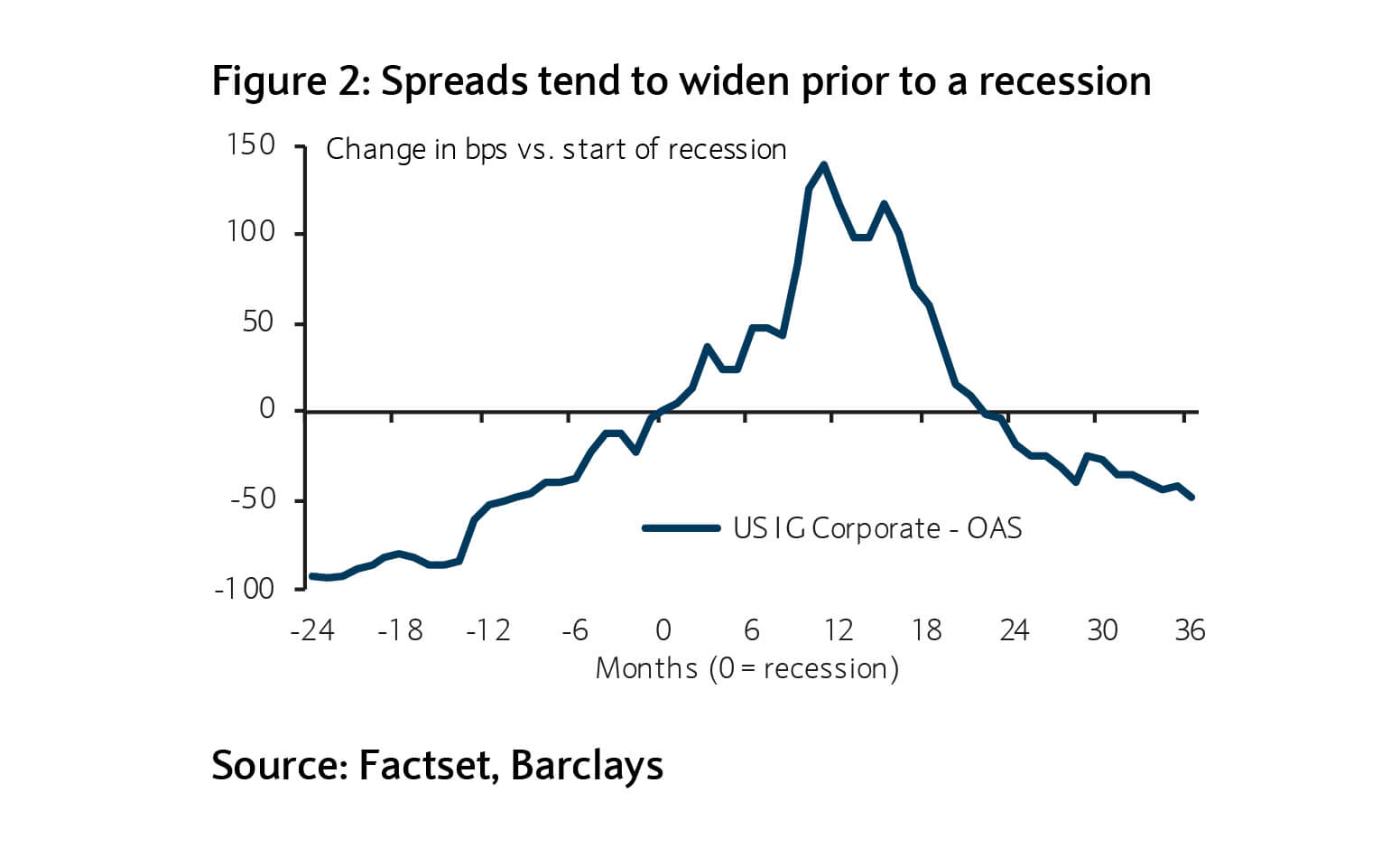

We observe that credit spreads typically begin widening as early as two years preceding an economic peak (the price of an asset drops as risk premia increase), followed by recovery in asset prices as the central bank steps in to provide countercyclical monetary policy, and investors start to anticipate the end of the recession (figure 2).

Unless valuations are favourable, your downside is often disproportionate to the upside, as credit spreads tend to narrow more gradually over time, providing modest returns to investors, while widening faster in a short space of time.

In technical jargon, credit returns are negatively skewed, an asymmetry meaning that disproportionately large losses tend to be more frequent than sizeable gains.

In the context of deteriorating macroeconomic data, current valuations on offer for this asset class aren’t yet enticing enough to bear the associated credit risk.

Given current mediocre valuations and some expected headwind from a pick-up in interest rates, we prefer to shy away from credit exposure in portfolios.