What's in the price?

A flurry of policy meetings were undertaken in the main central banks throughout August. Despite the noise, the Federal Open Market Committee (FOMC) kept policy rates the same, but managed expectations for a September hike.

Meanwhile, the Bank of England (BoE) raised the policy rate by 25 basis points, in line with expectations, but reiterated that it’s walking a very gradual path. Interestingly, in these uncertain times with some mixed UK macroeconomic data, the vote for this was unanimous.

The Bank of Japan stepped a little bit away from their yield-curve-control policy, as they widened the band for interest to be set by markets, although they telegraphed that tightening is not on the cards for some time.

Interest rates in Japan have since been range-bound at a slightly higher level. To us, this suggests the divergence in monetary policy is set to continue, and therefore we choose to remain underweight US Treasuries in context of a diversified portfolio.

With respect to the eurozone, with German 10-year benchmark bund yields at 0.3%, a fair bit of yield compression has now been priced-in. Compared to the first quarter of this year, bund yields are now 0.4% lower, in contrast to US Treasuries, which have been more-or-less been range-bound since Q2.

What happens in Turkey, stays in Turkey?

Financial markets have more recently shifted their attention to the evolving crisis in Turkey. In terms of our asset allocation, we have little direct exposure as most indices have relatively few holdings in Turkish assets.

We view the Turkish economy as a relatively isolated, and increasingly tragic, case, rather than being symptomatic of the wider emerging market (EM) space.

Potential contagion through indiscriminate selling or a temporary shock to investor sentiment is a risk that we are actively monitoring.

The most vulnerable economies are Turkey, Argentina, South Africa and Poland, our research indicates, whereas Russia, Brazil, Korea, China and India rank as the least vulnerable.

Re-pricing: a value opportunity?

In addition to Turkey, sanctions have also been imposed on Russia and China.

As a result, one area where we do currently see some re-pricing is Emerging Market Debt (USD) holdings, particularly in the context of the wider credit universe.

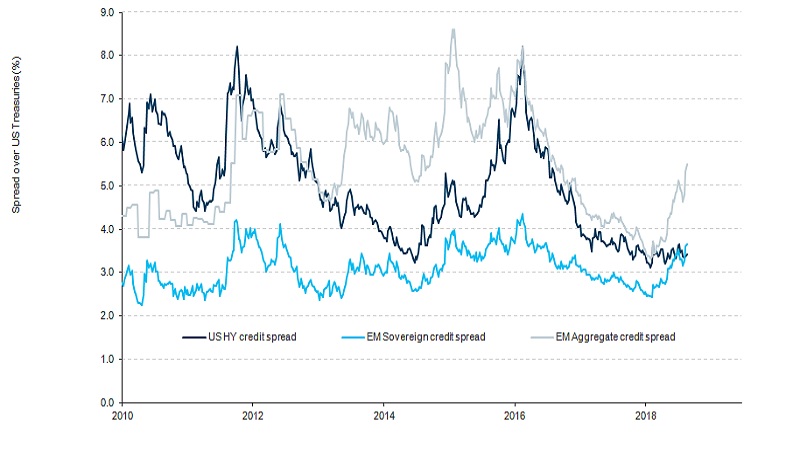

For hard currency EM corporate debt and to a lesser extent EM sovereigns, credit spreads have widened, whereas example US high yield credit spreads have been fairly stable (Figure 1).

Source: Bloomerberg, Barclays

This may potentially present a relative value asset allocation opportunity, but given the catalyst for this divergence may carry on for a little longer, we continue to monitor the developments closely.

Most likely, it would require either sufficient comfort in a de-escalation or a clear valuation case, in our assessment we are not there yet.