FX: is it time to be contrarian?

The US dollar went from strength to strength this August. US macroeconomic data prints indicate robust growth, while measure of prices and inflation point to a sustained trend for prices to rise as well.

This suggests the Federal Reserve can allow financial conditions to tighten.

On top of this the trade-war puts pressure on some currencies – mainly those of the emerging markets.

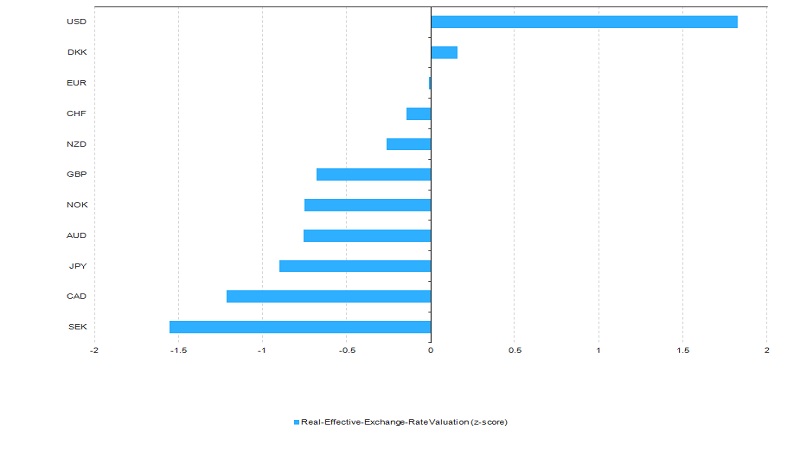

Source: BIS, Barclays

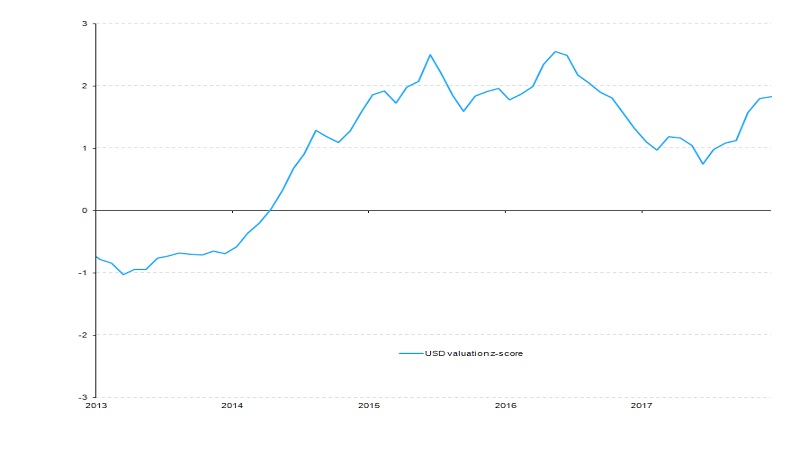

If we look at some valuation measures (for example, real effective exchange rates), we see that the US dollar is back to 2015 and 2016 levels (figures 1 and 2).

Source: BIS, Barclays

The magnitude, and in particular the pace, of sizeable currency trends is important for monetary policy, although admittedly more importantly for the more open economies.

Two related themes are emerging when looking across currencies.

First, the euro is under pressure and is now more than 8% lower versus the US dollar since the first quarter.

Recent headline news on the Turkish crisis and the exposure of a few euro zone banks to Turkish assets did not help. It is quite a contrast in terms of sentiment compared to earlier in the year.

Looking ahead, in September the ECB will update the quarterly staff projections, in the most recent updates they used an exchange rate of 1.20 EUR/USD for their 2018 forecasts and 1.18 EUR/USD for their 2019 forecasts.

As the exchange rate is currently about 5% lower, it will likely impact the inflation projections, although in this case it will likely offset the impact of recently weaker energy prices.

The Swiss franc: A safe haven?

Finally, the Swiss franc versus the euro is strengthening, reversing about half of its trend over 2017. The Swiss franc’s strength is a sign of safe-haven flows.

Swiss inflation is finally picking up (albeit slowly), after spending most of the time since 2009 in deflation. The Swiss National Bank (SNB) is most likely comfortable with a gradual depreciation versus the euro, like we have seen in 2017.

The SNB has a track-record of active exchange rate intervention via deposits. Therefore, the recent rapid appreciation may come under the attention of the SNB.

In terms of valuation, the Swiss franc is about 10% more expensive versus the Euro on a purchasing-power-parity (PPP) basis.

The euro versus Swiss franc is one the currency pairs flagged in our research, where recent price action and carry dynamics look favourable.