Market Perspectives May 2021

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

07 May 2021

By Jai Lakhani, CFA, Investment Strategist, London, UK and Nikola Vasiljevic, Head of Quantitative Strategy, Zurich, Switzerland

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

With the recovery accelerating and consumers boosted by fiscal stimulus and accommodative monetary policy, inflation looks set to rise. While investors might alter traditional assets to protect against price pressures, could including real assets to portfolios be more effective?

An investor’s main goal is to grow portfolio assets. But achieving this goal could become more difficult for institutions with liabilities that are linked to inflation and expectations of higher inflation growing. Allocating to real assets may be part of the solution to this conundrum.

Macroeconomic backdrop

When reviewing the health of the global economy a year on from the pandemic, fiscal stimulus provided an essential boost, record-low interest rates prevented a tightening in financial conditions and quantitative easing injected further liquidity. All helped alleviate the worst economic effects of coronavirus.

As the consumer returns to the market, fuelled by stimulus payments and pent-up savings, demand looks set to drive growth. At the same time, supply chains seem to be moving away from a fully globalised model due to more domestic ones and supply bottlenecks are already evident.

The above trends suggest a period of suppressed inflation in the last decade could be ending soon. From an investor standpoint, preparing portfolios to manage higher inflation seems essential.

Preparing for higher inflation: the traditional approach

The traditional approach would be to focus equity selection on companies with strong pricing power, something highlighted in April’s Market Perspectives. However, this approach is likely to increase volatility, especially given stretched equity valuations.

On the fixed income side, the use of inflation-linked bonds and increased exposure to high yield debt, which tends to perform well in demand-pull inflationary periods, are potential options.

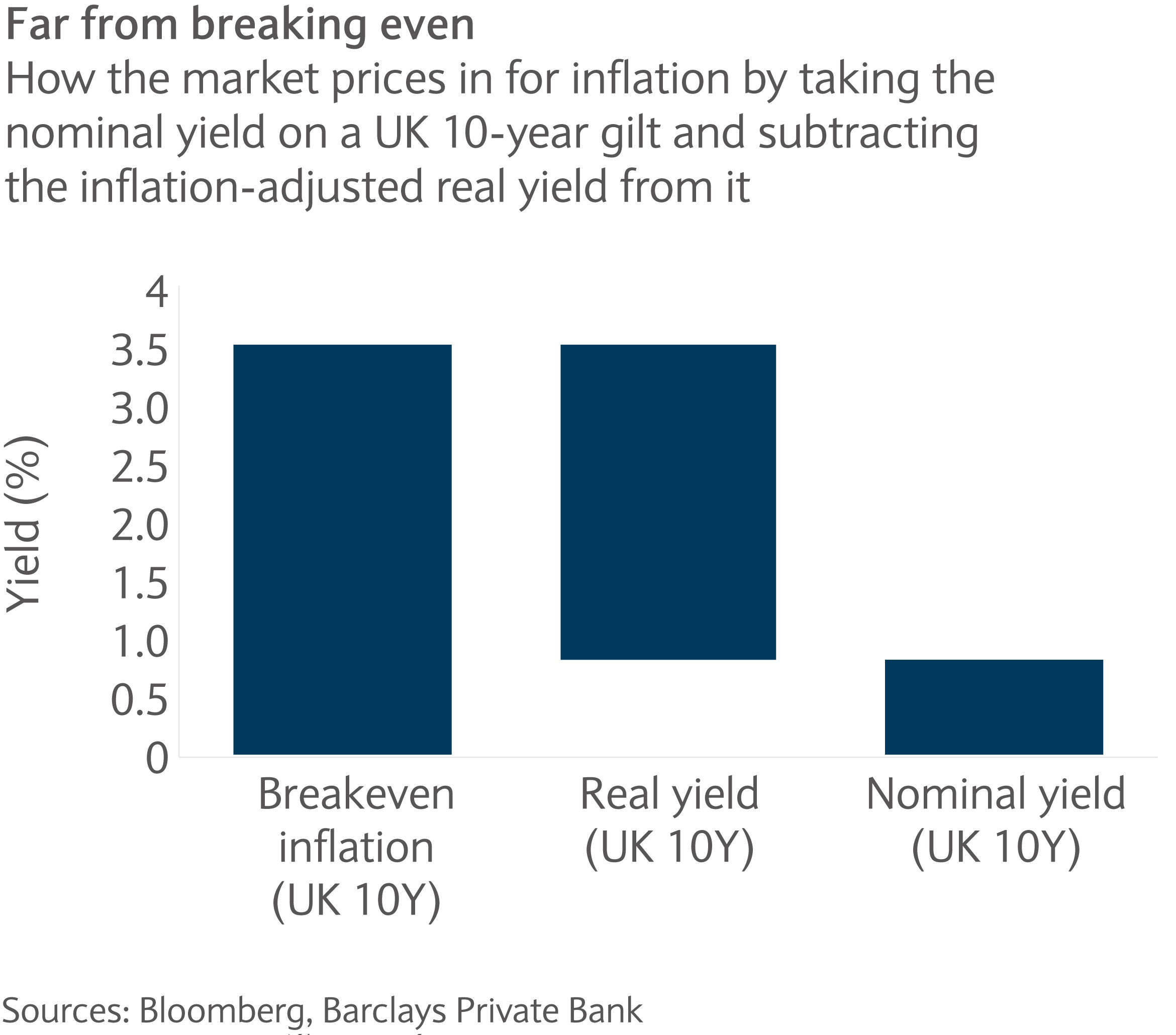

However, inflation-linked bonds are based on inflationary expectations. If financial markets already expect increased prices, realised inflation needs to be higher than these expectations to compensate investors. While this may be affordable in the US market, the UK breakeven rate of 3.5% is at the top of the range of the last seven years already (see chart).

When evaluating high yield bonds, spreads have been suppressed in the search for yield and are at historical lows in the CCC-rated market. Not only is there increased default risk in this sector, but investors may not be compensated accordingly for taking on the risk. Furthermore, many institutions have regulatory constraints preventing them accessing this market.

Equity-bond correlation increases with inflation

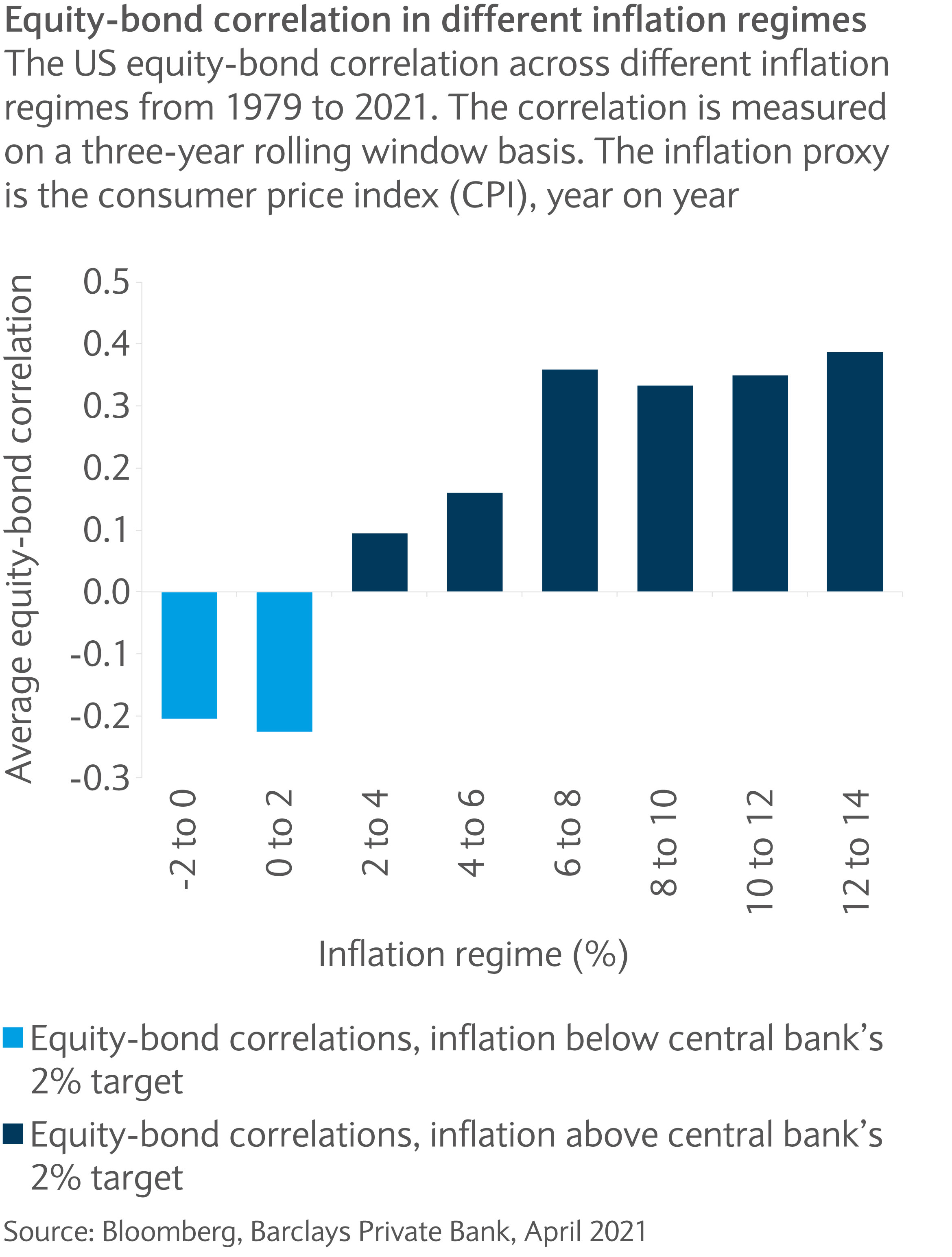

Another issue worth considering is the diversification profile of an equity and fixed income portfolio as inflation rises. Our research shows that the two asset classes become more correlated to each other as inflation rises, limiting the protection such a portfolio provides (see chart).

Getting real

A solution which can be incorporated with traditional assets is the addition of real assets. Real assets are tangible physical assets that have inherent worth rather than intangible contractual rights. They range from commodities and infrastructure investments to real estate and tend to provide a store of value and are linked to inflation. Commodities comprise of raw metals, energy and agriculture. These components are key to input costs and it is no surprise they make up a significant weighting in consumer price indexes.

What’s more is that they are pro-cyclical, furthering the rationale for considering commodities portfolio allocations. Commodity prices have already performed strongly this year as the economy recovers (particular in China, a commodity- intensive region). Furthermore, aggressive infrastructure investment, the climate change agenda and food shortages provide the perfect cocktail for raw metals, energy and agriculture prices to do well.

The data shows that since 1981, the Bloomberg spot commodity index has returned on average 6.2% year on year when US consumer price index (CPI) exceeded 3%. Thus, commodities seem a useful inflation hedge and their pro-cyclicality provides further reasoning for adding them to a portfolio.

Inflation-hedging - real estate

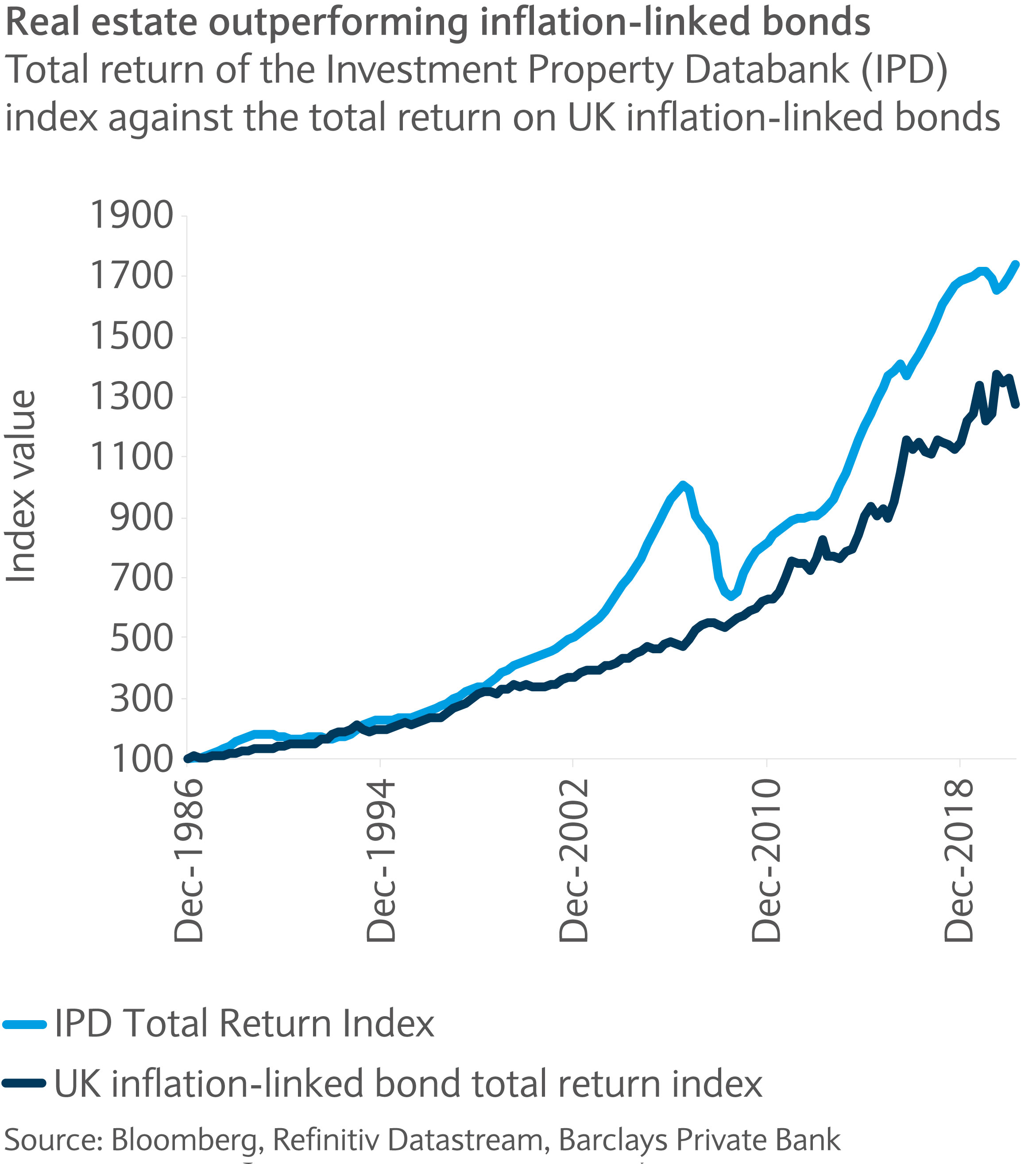

Taking a look at real estate and infrastructure in more detail, rental income in general is tied to inflation, providing a hedge. Indeed, UK real estate has significantly outperformed UK inflation-linked bonds since 1986 (see chart).

Furthermore, the return profile of real estate provides almost a hybrid between equity and fixed income in terms of the capital appreciation of the asset and cash flows through rental income.

Illiquidity risk

One of the key concerns with real assets, such as real estate and infrastructure, is illiquidity. Once investors inject capital into chosen funds or projects, there tends to be lock-up periods where investors cannot get their money back. Valuations are also reported on a less frequent basis than assets like equities and bonds, meaning that investors withdrawing early don’t receive the true value of the investment.

As such, liquidity premiums need to reflect this inherent risk. On average, investors receive a compensation of one to four percent for bearing the liquidity risk.

Real assets in a portfolio context

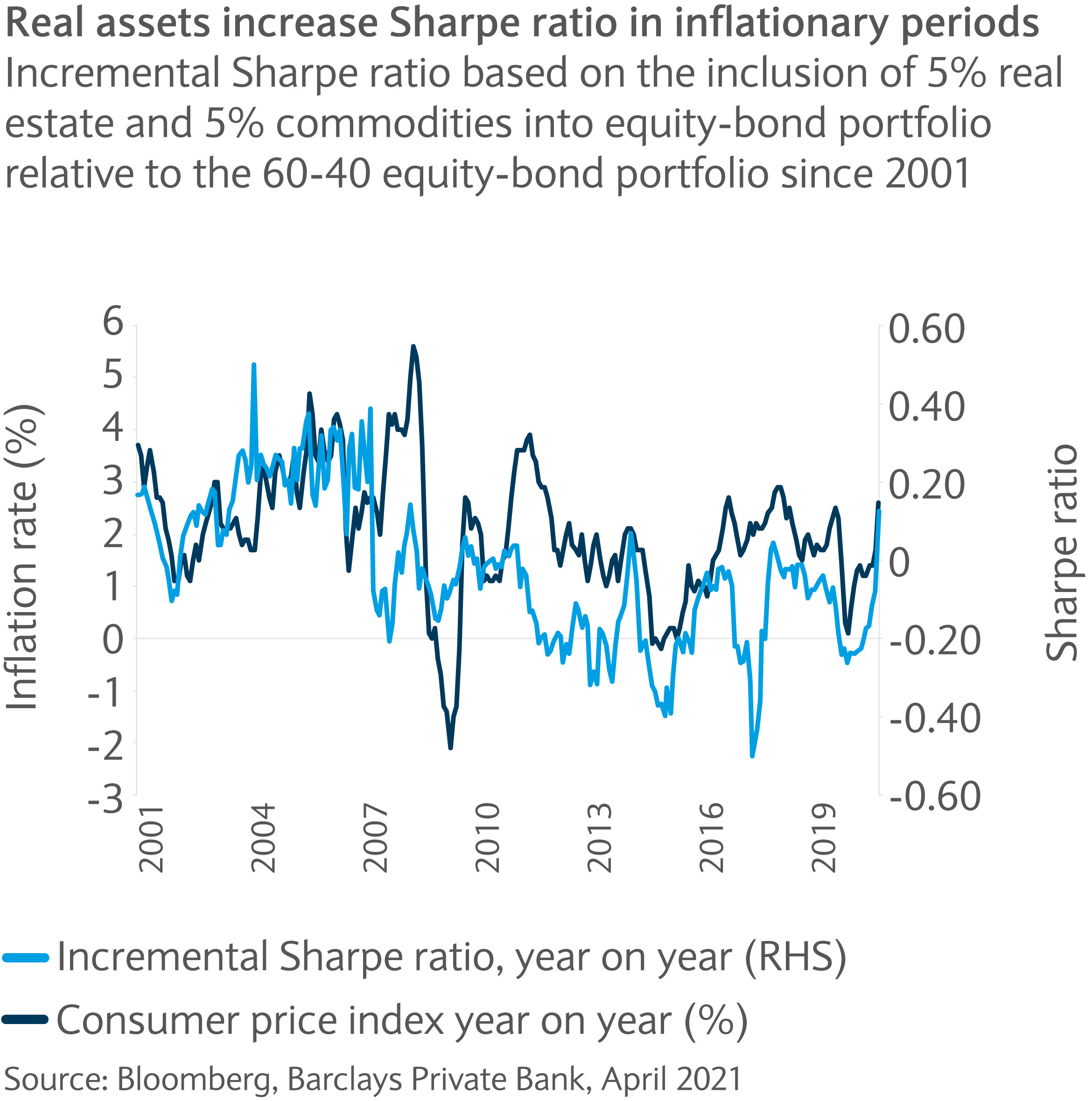

Incorporating real assets to a portfolio comprised of equities and fixed income appears to enhance the risk/return profile in times of rising inflation. Before (after) the global financial crisis, CPI was 2.9% (1.5%) year on year on average. The inclusion of real estate and commodities in an equity-bond portfolio can enhance risk-adjusted returns in inflationary periods.

Although the incremental Sharpe ratio has been negative since 2008, the outlook for real assets in a portfolio has steadily improved over the past twelve months. In particular, with March’s CPI reading of 2.6%, real assets have improved the Sharpe ratio by 0.12, the largest monthly increase since June 2008 (see chart).

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.