Market Perspectives March 2021

Encouraging hopes of a vaccine-driven recovery are keeping investors in good spirits.

05 March 2021

8 minute read

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

Rate spikes have already materialised this year. We take a closer look at the risk of further spikes in coming months and what this means for investors.

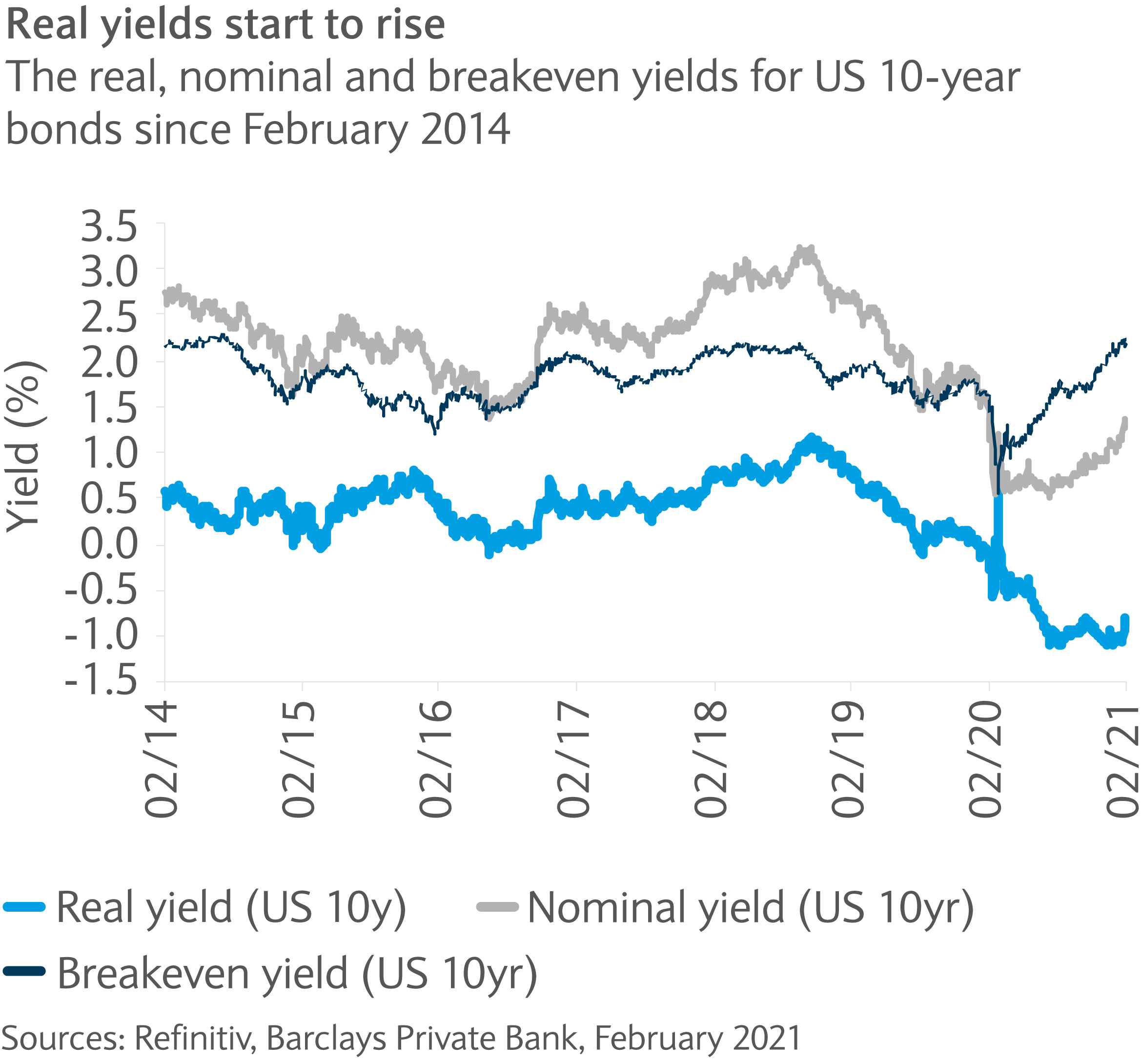

This year has seen bond sell-offs and rate spikes, as envisaged in our Outlook 2021 in November. At first, the rise in yields was down to higher breakeven yields, which reflects the market implied expectations for higher inflation. But most recently real yields (yields adjusted for inflation expectations) have also started to pick up.

What is the risk that both higher trending breakeven yields as well as higher real yields push yields well beyond pre- pandemic levels?

One of the potential drivers of inflation is the rise in debt. The US fiscal deficit has risen to over 16% of gross domestic product and is ultimately likely to be more than twice the deficit seen during the 2008 global financial crisis and the biggest seen since the second world war.

But as pointed out in our recent publications, higher debt does not necessarily lead to higher inflation. In fact, during recent debt surges, as witnessed in 2000 or 2008 for example, a rise in debt was followed by lower trending inflation. This time, the record growth in money supply may also be a factor.

Money supply, as shown by the indicator M2, has surged by over 26% year on year, the largest spike since World War Two. The US Federal Reserve (Fed) has provided abundant liquidity by absorbing the surge in US debt on its balance sheet, creating a huge supply of liquidity.

During the 1980s, the growth rate in the money supply jumped to 13.5% of GDP, leading to excessive inflation. But according to Nobel Prize economists Milton Friedman and Anna Schwartz, there can be a large lack of response of economic growth and inflation to money supply expansion and the outcome can be variable (see chart).

In order for money supply to become inflationary, money velocity (or the turnover of money in the economy) must remain relatively stable. But rather than being used in exchange for goods and services, cash is being held on deposits by households and companies alike. This has seen a collapse, of the already multi-year declining velocity, to a multiple of 1.2 times turnover. By contrast, during the 1980s the multiple remained relatively stable at around 1.75 times.

The chances of a surge in money velocity are high. The US consumer, given unprecedented government support, seems to be in a relatively healthy state. Debt as a percentage of household income is at its lowest since 2000 at 93%, while the personal savings ratio is the highest seen since 1975.

Recent strong US retail sales underpinned the potential for a consumer revival which could be reinforced by the vaccine rollout. However, labour market uncertainty is likely to prevail. Chief economist of the International Monetary Fund, Gita Gopinath, believes that the slack in the global economy is significant and is likely to remain so in many countries in 2021.

Another important factor to the outlook for inflation is the recovery being experienced in commodity prices. A higher oil price is likely to push inflation higher soon due to base effects. The recent surge in US producer prices year on year, which was the strongest reading since 2009, illustrates the building pressure facing retail prices.

At least in the US and Germany, for example, rental prices play a large part in the consumer price index (CPI) basket (over 30% and over 20% respectively). So far rental prices have not recovered, but should they recover in the coming quarters this could place upward pressure on inflation.

Not everything leads to inflation

The earlier sections cover monetary and cyclical aspects. Investors also consider secular trends, like potential disruptions or a new shape to global supply chains for example. While this may have the potential to be inflationary, new supply chains and consumer behaviour may equally lead to disinflationary pressures in the longer run.

Increasing automation, an additional secular trend, could potentially improve productivity levels, easing price pressures. At the same time automation can increase unemployment and lead to a dramatic transition process in the labour market, which would likely be disinflationary.

Tell me what I don’t know

Looking forward, our base case expects US inflation to peak at short of 3% before moderating at 2.2% during this year. However, the risk of higher inflation in the medium or long- term remains.

Implied expected inflation, as shown by 10-year breakeven yields, has reached 2.15% and is at the highest since 2014 and already above the 30-year average. While breakeven yields may climb further, the risk of a significant surge in breakeven yields seems limited from here.

Watch out for real rates

Rather than inflation expectations, a further rise in nominal yields could be driven by real yields, which have started to rise of late (see chart). Real yields are not affected by inflation expectations as they are adjusted for inflation expectation. Instead real yields are impacted by uncertainty over the actual inflation outcome, supply and demand environment and anticipated central bank actions among other factors.

The two potential driving forces for real yields are likely to be the outlook for the Fed’s monetary policy as well as the supply and demand outlook. The market by now has embraced the central bank’s commitment to keep policy rates low for a long period.

The Fed articulates the above commitment through the average inflation target (AIT) approach, which tolerates temporary inflation overshooting as well as the aim to target full employment. As such, the risk that higher short- term rates drive the entire yield curve seems unlikely. But targets are evolving and while the risk seems low, the rate market could be surprised by potential policy change at a later stage.

Don’t fight the Fed

The US central bank is very much aware of the consequences of paring back bond purchases. Back in 2013, the surprise announcement of asset-purchase tapering caused real yields to rise by roughly 140bp. This is a scenario that the Fed would like to avoid and so the risk of a repeat this time seems significantly lower.

Biden’s growth agenda increases rate risk

A factor worth looking out for from the supply side is the planned infrastructure spending by the US administration over the next four years and potentially beyond. While the amount and funding is still to be determined, we believe it may have the potential to add roughly 30bp to the current US rate path.

Taking the various factors into consideration it seems likely that bond yields may trend slightly higher from here. Especially the long-term infrastructure plan by the US may provide some pressure for rates to move higher. Levels beyond pre-pandemic levels seem less likely. The market seems heavily focused on upside risk, which could lead to further yield spikes. At the same time potential economic uncertainty as well as the Fed’s policy commitment should not be ignored.

Encouraging hopes of a vaccine-driven recovery are keeping investors in good spirits.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.