Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

7 minute read

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy,

As central banks cut ultra-low rates even further in response to the economic effects of the pandemic, is the era of higher yields soon to return? In the meantime, how might investors position portfolios in such odd times?

Yields may have started to decline in 2018, accelerated by a US Federal Reserve (Fed) policy U-turn. This year saw more action as the Fed cut the policy rate by another 150 basis points (bp), to 0.25%, in response to one of the biggest crises, on a medical, social and economic level, since World War Two. Global bond yields, whether for emerging market debt, investment grade or high yield, are all anchored around depressed central bank levels.

Are central banks increasing the fragility of global financial markets with their focus on ultra-low rate policy?

The massive accommodative measures adopted by leading central banks in response to the pandemic, including rate cuts and quantitative-easing programmes, delivered some much-needed medicine. The US high yield market, and emerging market US dollar-denominated bonds, recovered their losses, which peaked at 20% and 15% respectively, in only four months. In the process, are central banks increasing the fragility of global financial markets with their focus on ultra-low rate policy?

Aggregated G-4 central bank balance sheets surged by roughly 20% to 55% of gross domestic product (GDP) on average, which compares to an average of around 10% to 19% of GDP during 2008’s financial crisis. So what might investors expect next?

Yields of short and medium-term bonds usually follow the Fed’s policy and its anticipated rate path. Moves in two-year yields and even ten-year yields could be explained by the level of real fed fund rates by 91% and 72% respectively in the last 25 years, according to JP Morgan Investment Bank.

The Fed has limited ammunition left. The bank cut rates by 675bp in 1989, 550bp in 2000 and 500bp in 2008 as a response to each crisis. This time’s 150bp trim seems meagre, by comparison, in order to bring inflation back to the target level of 2%. What is left is to assure markets that ultra-low yields will remain until the target is reached, or beyond?

The Fed seems to be willing to let inflation rise beyond the 2% target to compensate for periods when inflation is below 2% under its average inflation target regime introduced in 2020. Applying the new framework to average inflation (three-year rolling) back to 1998, the Fed would have only needed to raise rates once (2006), suggesting that hikes in the foreseeable future are highly unlikely.

We acknowledge that the period since 1998 looks very different to the one since 1980, when inflation peaked at 10% and US 10-year yields hit 15%. Is this a scenario which could be repeated? While a return to a regime where prices are bound to each country’s gold stock is unlikely, the debate about inflation and bond yields is as intense as ever.

Could increasing fiscal deficits accompanied by unprecedented quantitative easing operations lead to higher inflation and richer rates eventually. US federal debt held by the public has doubled in the last eight years to $20 trillion, representing 106% of American GDP. On the other hand, money supply growth is at 20% compared to just 10% in 2008. Such figures were last seen in the 1970s. But as explained in September’s Market Perspectives, elevated debt and money supply alone does not necessarily lead to higher rates.

During 2000, 2008 and this crisis, rates have trended lower not higher with increasing debt levels. This time higher money supply has mainly been a result of higher money demand from corporates and money managers that required, or still require, cash to bridge a period of uncertain cash flows. Finally, money supply must flow into the economy through increased spending and lending in order for it to be inflationary.

The average interest rate in the last 20 years has been 4% and in the last 40 years was 6%. In that context yields below 2% can appear expensive.

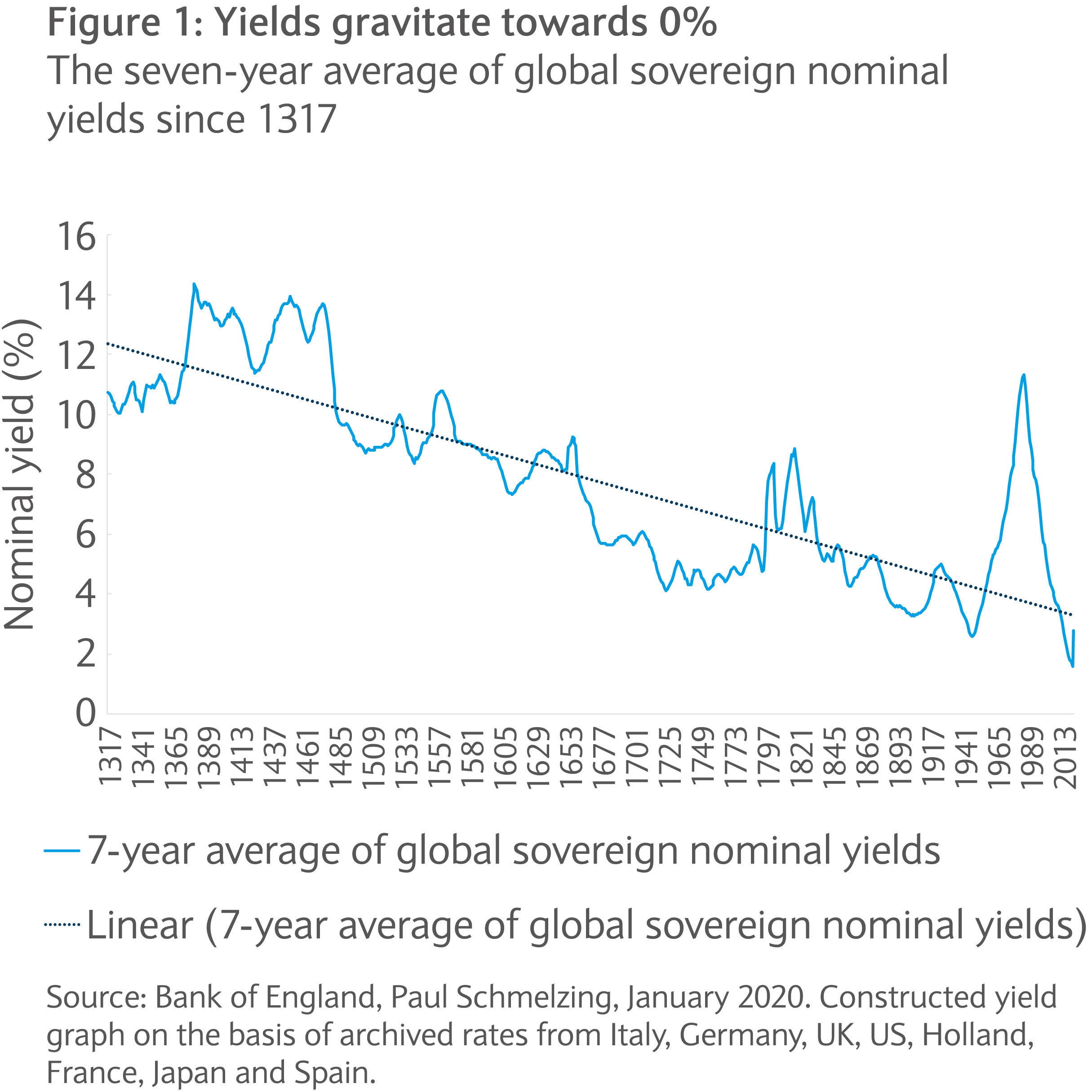

A recent Bank of England study written by Paul Schmelzing collated data going back to 1311 to reconstruct a global nominal and real yield safe-haven curve1. According to the economic historian, rates have been in decline for most of that period and have even been negative in 46 instances. The data includes phases of wars, crisis, high debt and pandemics like the Black Death.

According to the study, yields declined by 0.6-1.6bp per year in average. On the back of GDP and yield data, someone 400 years ago might have predicted that rates this century would finally approach 0%. Where does this leave bond investors in the search for income and safe-havens?

While a recovery in 2021 seems likely, the scope for a sudden surge in inflation, beyond 2%, appears highly unlikely. Higher unemployment rates, lower capacity utilisation and a little likelihood that output will reach pre- crisis levels suggests that yield levels above 2% are unlikely.

However, next year may produce a COVID-19 vaccine or more fiscal commitments that put upward pressure on yields.

Opportunities could occur in higher rate volatility that allow investors to lock into higher yields. At the same time investment grade and high yield bonds offer some income. Two strategies which look appealing in 2021 are:

A healthy mix of timing the market and time in the market seems attractive. Bond yields may start to react on early signs of a recovery, a marginal increase in inflation and supply risk which is likely to culminate in rate volatility. These may offer opportunities to lock in higher yields (timing) as a basis to provide income in the subsequent period (time in the market).

The approach of locking in yields and accruing can be more effective in the corporate bond market or with emerging market bonds where more spread opportunities are likely to arise during 2021. Back in April we turned more positive on high yield bonds for example when spread levels traded almost at 800bp. just after shortly peaking at over 1,000bp. Investors would have locked in almost 8.5%.

Spreads are generally mean reverting as traded spread premiums can at times exaggerate implied credit losses. This is often observed during periods of distressed selling (selling at any cost). By applying the described strategy investors might avoid “buying at all costs” (or chasing yields) and “selling at any costs” (or panic selling). Phases of higher volatility in the rates and spread segment are likely to happen again in 2021, even if not to the same extent as seen this year.

Phases of higher volatility in the rates and spread segment are likely to happen again in 2021

A diversified set up which includes corporate bonds, high yield bonds, sovereign bonds, emerging market bonds and inflation-linked bonds is key for a more robust income. At the same time, avoiding issuers and segments of the markets likely to create losses, either because of negative rates or potential distress, will be key.

While predicting future losses is difficult, some areas of the bond market suggest more caution may be called for given some market trends: such as higher default rates in lower-rated buckets (B-rated bonds and the like) or specific sectors (for example energy and leisure). Below we outline areas that appear unattractive along with those that appear attractive when looking at 2021 and beyond.

| Attractive | Our take | Unattractive | Our take |

|---|---|---|---|

| BB-rated bonds of selected sectors | While spreads have tightened, many are trading well above pre-crisis levels. Specifically in telecoms. That said, higher quality car manufacturers may also offer carry opportunities. | Core European sovereign yields | Although the inflation outlook is depressed and the asset class may show some relative appeal from a real yield perspective, negative yields, even for longer durations, make the segment seem unattractive. |

| Bank senior and bank capital bonds | Fluctuating bank loan provisions and lower profitability are a general negative but bank balance sheets look robust. Despite higher structural risk selected bank capital bonds offer higher return. | UK gilts | Part of the curve is already yielding negative. While gilts have potential to perform should the BOE have to implement negative rates there is at the same time potential that a more positive outcome in Brexit trade negotiations could lead to a yield surge at the longer end. |

| US inflation linked bonds | While UK linkers (expensive) and EU linkers (lack upside catalyst) do not seem attractive, US inflation-linked bonds combine safe-haven and inflation-hedge attributes. | Emerging market regions with weak credit profiles | For countries like Argentina, Turkey and to some extent India or Oman, the pandemic-induced growth shock is likely to increase their respective vulnerabilities. |

| Duration in selected high grade bonds | A large part of sovereign bonds fall away as safe-haven investments due to negative rates and we view medium to higher duration bonds in high quality bonds (A- or better) as an appropriate proxy. | US high yield energy sector | Almost half of distressed US BB-rated bonds are found in energy. The default rate within the sector stands at 25% and still seems to be rising. Potential higher volatility in oil could lead to further distress. |

| EM corporates from stronger regions | We are more cautious within emerging markets but selective carry opportunities seem to exist among corporate bonds in Brazil, Abu Dhabi or Russia, for example. | Leisure and hospitality issuers | Beside energy and transportation, the leisure and hospitality sector has been hit severely. Even with a possible vaccine a return to normal if ever seems challenging. |

| Single B and lower rated bonds | Many highly leveraged issuers, especially from consumer discretionary or highly cyclical sectors like car suppliers, may not have sufficient cash to withstand further lockdowns. |

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.