Market Perspectives July 2021

Investor sentiment remains upbeat as signs of inflationary pressures grow. Our investment experts highlight our main investment themes and examine prospects for the global economy.

02 July 2021

By Julien Lafargue, CFA, London UK, Chief Market Strategist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

A surge in earnings has led to a strong start to the year for equities. However, with the prospect of tighter monetary policy, the current optimism may be challenged and upside harder to come by. We remain constructive on equities but would increasingly rely on alpha as the main source of returns.

Global equities have returned 10% in 2021, a strong and somewhat unexpected performance. The road ahead will likely be bumpier as the narrative shifts from recovery to expansion (at best) or slowdown (at worst). We remain constructive on equities over the medium term but reiterate our view that the best is probably behind us.

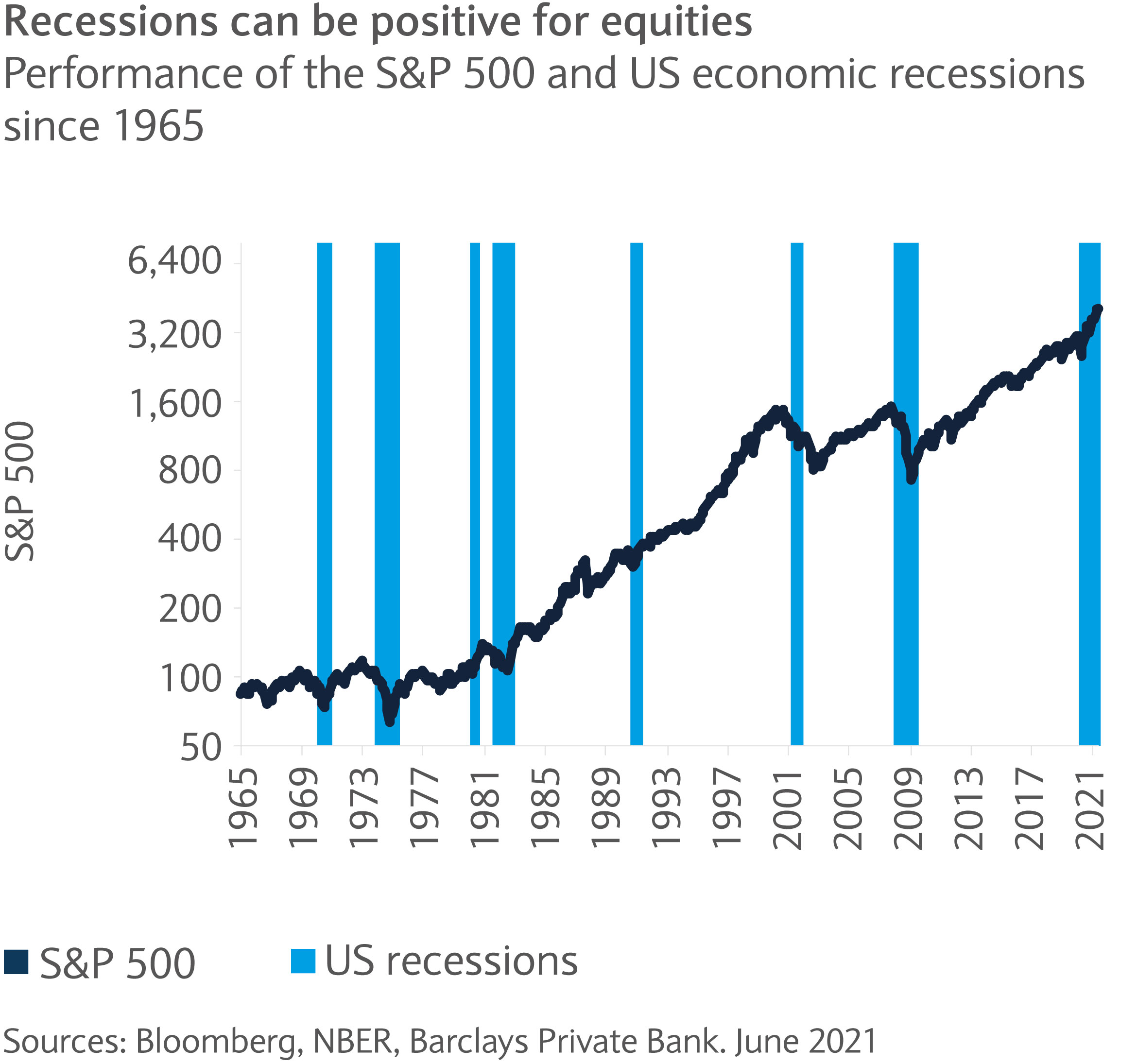

Recessions can be positive for equities

Everything about the COVID-19 crisis has been exceptional, chief among them being the human tragedy. For investors, this is the first time in 50 years that a recession has led to higher equities (see chart).

Gains have not been limited to equities. House prices too rose in most developed markets, another unlikely development when global gross domestic product (GDP) shrank by 3.3% in 2020.

The unprecedented amount of monetary or fiscal support has certainly contributed to this anomaly. Unfortunately, this support will soon stop and the monetary impulse may in fact turn negative as central banks look to normalise policies and governments try and find ways to reverse expanding budget deficits.

The haves and the have-nots

Although global equities have performed surprisingly well at the headline level this year, this masks wide discrepancies. Staples are up 4% since January while energy is up some 27%, as of 22 June. Over the last 18 months, though, energy shares are still down 12% while the MSCI AC World index is up 25% and technology is 57% higher.

From a factors’ perspective, value has done slightly better than growth (+5% on a relative basis this year) but much of these gains took place in the last two weeks of February. Quality, our preferred factor, trails value by just 2%.

With global growth returning to more normal levels and interest rates trending higher, we continue to favour quality over both growth and value.

Europe ahead, emerging markets lagging

For once, European indices have outperformed, at least on a year-to-date basis. However, the outperformance remains marginal. The French CAC 40, our preferred European index and the best performing so far in 2021, is up 19%. By contrast, Germany’s DAX, Spain’s IBEX or Italy’s FTSE MIB have all produced similar returns to the S&P 500.

The real stand out is emerging markets, which have lagged significantly, dragged down by poor performance of Chinese markets. Although the world’s second largest economy was quick to overcome COVID-19, growth has slowed recently (see “Is China’s roaring revival on its last legs”).

While this may be cause for some concern, both locally and globally given the importance of China, we believe any slowdown will be temporary and remain constructive on Asian emerging market equities over the medium term. It’s all about earnings.

As we highlighted in our Outlook 2021, published in November, any equity upside would have to come from earnings as valuation multiples had little room to expand further. Since then, the MSCI AC World 12-month forward earnings multiple has fallen to 18.7 times earnings from 19.8 times. While this is still significantly above the twenty years’ average (14.7 times) and we expect further compression, equities remain attractively valued on a relative basis with the risk premium above 300 basis points (bp).

Earnings, on the other hand, have surprised to the upside with very strong earnings in the last three months of 2020 (Q4) and in Q1. Courtesy of favourable base effects from a year previously, the upcoming second quarter results are likely to deliver the highest earnings growth in decades. Consensus anticipates an increase of more than 60% year-over-year in the US for the quarter.

Upbeat earnings should provide support to equity markets and could force us to formally convert our original bull case scenario into our new base case. However, this would still result in only modest upside as once we’ve past this peak for earnings growth, we would expect the consensus to revert to its usual 10-12% earnings growth forecast.

The Fed is key

We remain convinced that rates will dictate what happens in equity markets. With the US Federal Reserve (Fed) looking to take away the punch bowl and planning to reduce its monthly purchases by the beginning of 2022, there is a risk that equity multiples’ compression accelerates if the central bank fails to prevent a rapid increase in interest rates.

As a rule of thumb, and assuming no change in either earnings expectations or the equity-risk premium (320bp), each 25bp move in the US 10-year Treasury yields is worth about one multiple turn on the S&P 500.

Bearing that in mind, we would expect the Fed to proceed with the utmost caution when it comes to monetary policy normalisation. With the era of unlimited accommodation from central banks about to end (for now), we expect greater volatility ahead.

No change for now

Despite this lingering uncertainty, equities remain well positioned, in our view. Not only do they still offer more upside potential than bonds in an ultra-low (and rising) interest rates environment, they also offer decent protection against higher inflation.

As such, and while we’ve been arguing that investors should trim cyclical exposure, we maintain our overall preferences within equities. We continue to like quality, and the US and emerging markets over Europe and Japan.

Yet, we see alpha (in respect of sector and stock selection) rather than beta as the main driver of returns. At the sector level, we remain most constructive on broad technology, healthcare, consumer discretionary and parts of the industrials complex.

We also believe that investors might favour uncorrelated strategies as a way to maximise diversification benefits.

Investor sentiment remains upbeat as signs of inflationary pressures grow. Our investment experts highlight our main investment themes and examine prospects for the global economy.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.