Outlook 2021

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

19 November 2020

7 minute read

By Henk Potts, London UK, Market Strategist EMEA

The role of governments, central banks and companies may be radically reshaped by COVID-19 and the economic turmoil inflicted.

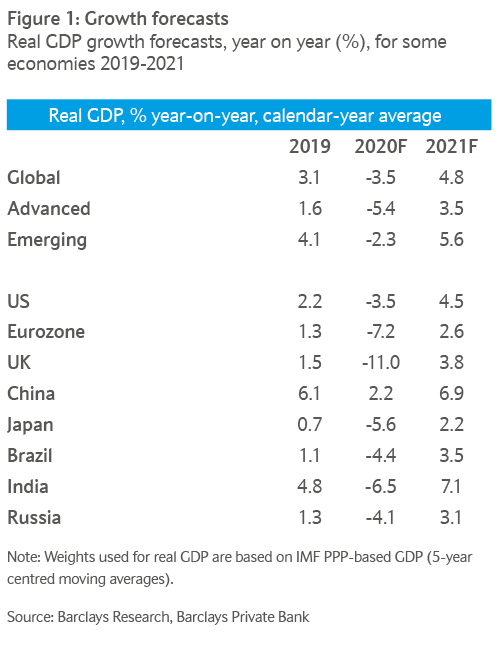

At the start of 2020, we, like the majority of forecasters, were cautiously optimistic about the economic prospects for the year. Many of 2019’s dark clouds, including the US- Sino trade war, political and social instability in Europe and Brexit, appeared diminished. The consumer looked in great shape, helped by historically low unemployment and above- inflation pay growth. Central banks were accommodative and policymakers promised fiscal support when required to extend the cycle. While geopolitical uncertainty remained, growth looked like being marginally higher compared to 2019 (see figure one).

However, as is often the case, it was a factor that resided relatively low down in our risk matrix that was to have the most profound effect on society since the Second World War. The COVID-19 pandemic has resulted in tens of millions of infections and more than a million deaths around the world.

The scale of the outbreak has placed enormous pressure on national health services. Governments have been forced to impose aggressive measures including social distancing, self-isolation and restrictions on travel in an effort to contain the spread of the disease. Meanwhile, the locking down of economies resulted in a record drop in activity, surging unemployment, permanent losses in output and temporarily slower potential growth. The damage to the world’s major economies is four times greater than the 2009 financial crisis, estimates the Organisation for Economic Cooperation and Development.

The controlled lifting of restrictions has helped to alleviate some of the economic pressures, with a number of economies registering a robust rebound in activity through the summer. However, activity is likely to be vulnerable to surges in infections triggering further restrictions. As a result, the global economy may shrink by 3.5% in 2020; the deepest contraction since the Great Depression.

The scale of the hit to the economy encouraged central banks to slash interest rates to new lows and inject unprecedented amounts of liquidity into the financial system. Governments have embarked on an extraordinary fiscal response such as allowing companies to furlough staff as well as pledging vast sums in loans, grants and credit guarantees.

In March, the leaders of leading economies, the G20, committed to do whatever it takes and use all available policy tools to minimise the impact from the pandemic. They promised to inject over $5 trillion1 into the global economy to counteract the social, economic and financial impacts of the pandemic. As the true impact of the crisis has developed, so has governments’ willingness to ramp up the measures to deal with the damage, with the International Monetary Fund (IMF) forecasting the total has surged closer to the $11.7 trillion mark, almost 12% of global output2.

While governments found innovative fiscal solutions, they have come at a price. The IMF estimates that sovereign debt in advanced economies will rise by a staggering 20 percentage points to 125% of GDP, and by more than 10 percentage points in emerging economies to 65% of GDP, by the end of 20213.

Future growth prospects will undoubtedly be determined by the lifespan, intensity and geographical spread of the virus. A true “normalisation” of activity will probably only occur when a vaccine has been developed. Given the time required to develop, test and distribute a safe and effective vaccine, it is unlikely to be widely available before the second half of 2021 at the earliest.

Recent clinical trial announcements have increased expectations of a vaccine early next year. When a vaccine has been approved, vaccine hesitancy (listed by WHO as one of the top ten medical threats in 2019) still may infringe upon the combined effort to arrest the disease.

Hopes of a vaccine have been boosted by the recent clinical trial results. When a vaccine has been approved, logistical challenges and vaccine hesitancy (listed by WHO as one of the top ten medical threats in 2019) still may infringe upon the combined effort to arrest the disease.

Given the size of the contraction this year…we project a significant recovery in 2021, with growth of 4.8%

As investors look beyond COVID-19, we think that there are likely to be permanent changes to the role of the state, working patterns and corporate responsibility.

Governments around the world have intervened in society, the economy and financial markets like never before. It’s implausible to think that they will be able to roll back from these positions in the near future. Elevated levels of state involvement and regulation are likely to be a long-term consequence. We would also expect weaker levels of globalisation as countries seek to establish independence in key strategic areas.

Technology continues to provide the solution to many of the challenges created by COVID-19 restrictions. Faster adoption rates have propelled the sector’s role in nearly every aspect of society. As both businesses and consumers embrace localisation, digitalisation and electrification, technology’s position looks set to become far more imbedded in life after the pandemic.

Environmental, Social and Governance (ESG) funds have seen strong inflows during the pandemic as investors seemingly expect companies to be rewarded for adopting a more balanced approach to their role and impact on society.

While coronavirus has had a distressing impact this year, the global economy and financial markets are incredibly resilient, with growth being the norm rather than the exception. Output will expand as demand from rising populations increases and improvements in human and physical capital and technology boosts productivity. The resulting long-term economic expansion should drive corporate earnings growth and asset appreciation over time.

Barclays Private Bank investment experts highlight our key investment themes and strategies for the coming twelve months.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.