What difference have our sustainable companies made this year?

21 April 2021

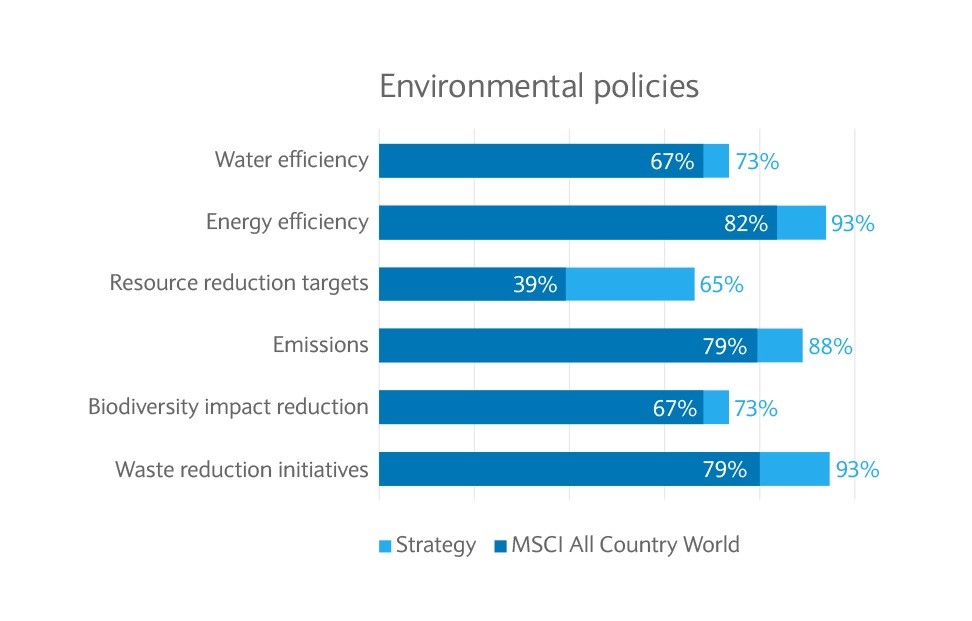

By creating relevant polices, companies take an important step in being able to assess and improve their Environmental, Social and Governance (ESG) risk management. These help to bring key operational areas and priorities to the attention of senior management. They also offer a framework for how to best manage the risks and opportunities that these areas present.

The existence of a policy does not in itself demonstrate the quality of the policy, nor its adherence. However, it does demonstrate that management have discussed and considered the area, viewing it as important for the ongoing success of the business. As such, for the relevant E, S and G policy to be effective we expect the board of directors to make sure they're successfully adhered to and monitored by board-level committees.

Across the strategy, our businesses on average have more ESG policies in place than the wider market, according to data determined by Refinitiv, an independent third-party provider. We believe this gives an insight into the quality of companies that have been selected and their ESG credentials. Browse this page to see how much difference our companies have made over the last year.

*Unless otherwise stated, companies referenced in this report were companies held by our Sustainable Total Return Strategy as of 31 December 2020 and may no longer form part of our portfolios. Reference to specific companies in this report is not an opinion as to their present or future value and should not be considered investment advice or a personal recommendation. They’re included in this report to demonstrate the positive impact companies can have.

The impact our investments are making

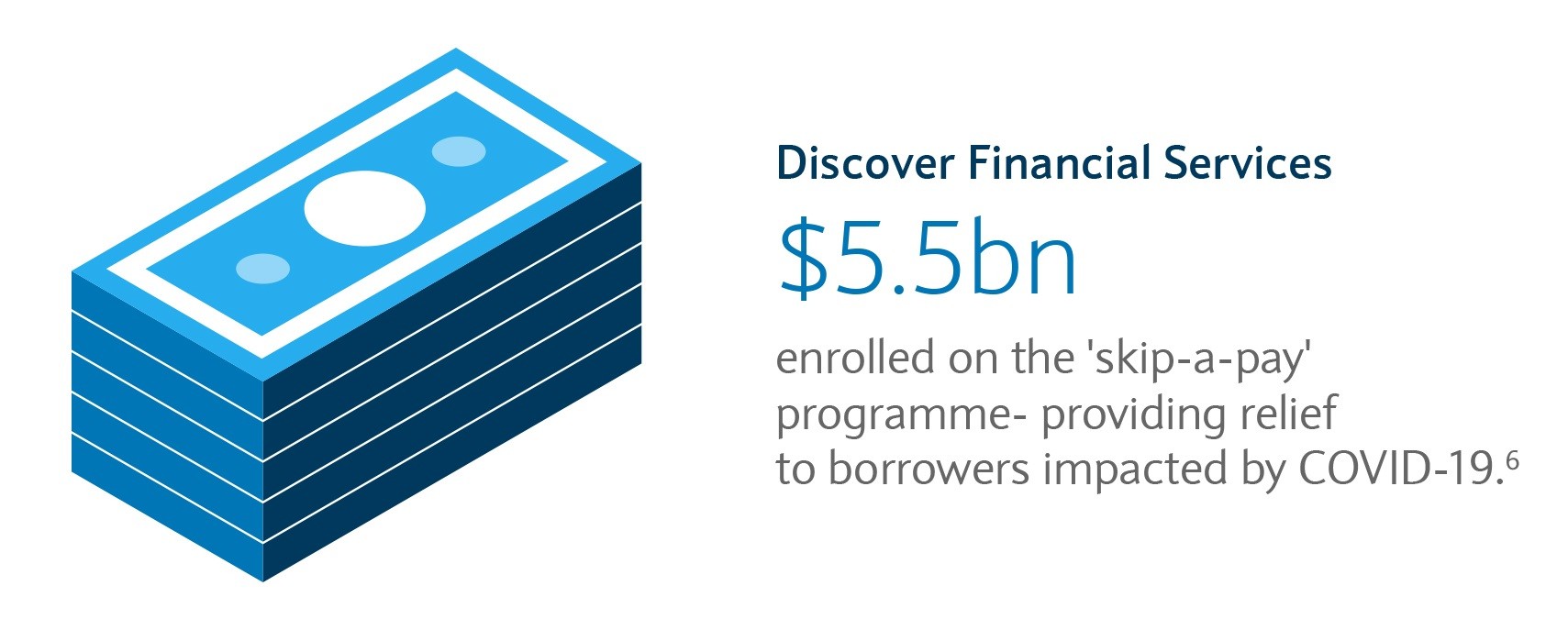

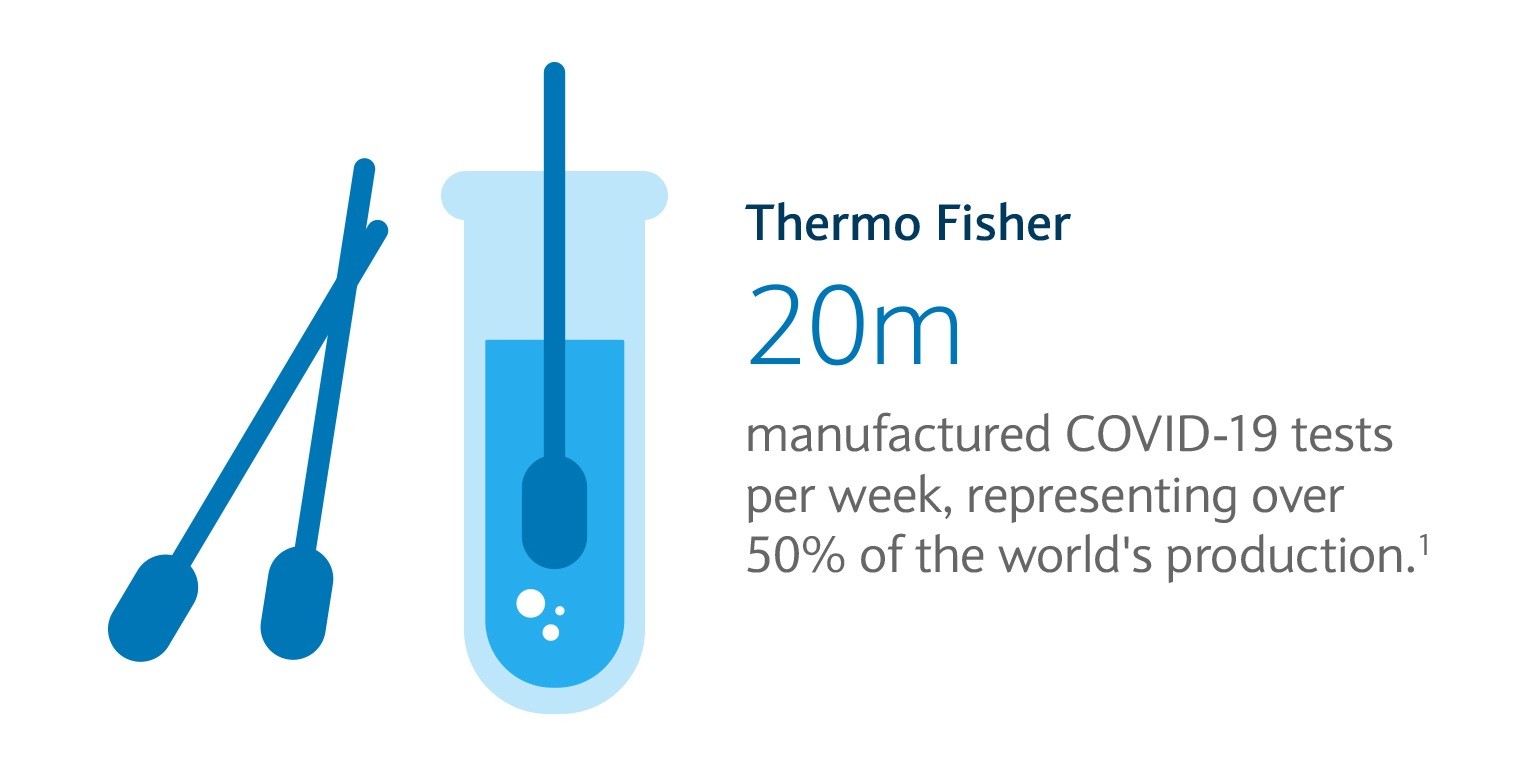

Given the impact that the COVID-19 pandemic has had on the world this year, we've highlighted some of the ways our investee companies have responded to the pandemic and the impact our investment in them has had.

| Company | Company Impact Metric | Strategy Impact |

|---|---|---|

| Thermo Fisher | 20,000,000 | 883 |

| Alphabet | 170,000,000 | 5,326 |

| Nike | 17,000,000 | 1,472 |

| L'Oreal | 100,000 | 6 |

| Unilever | 100,000,000 | 6,845 |

| Discover Financial Services | 5,500,000,000 | 1,711,986 |

| Amazon | 1,000,000 | 12 |

| Microsoft | 30,000,000,000 | 497,854 |

Strategy impact is calculated by multiplying the company impact metric by the proportion of the company held by the strategy, based on share count.

Strategy Impact = Company Impact Metric X

(Strategy Nominal Share Holding ÷ Total Company Share Count)

Source: Discover Financial 3Q20 Earnings

Source: L'Oreal

Source: Thermo Fisher

Source: Unilever