The price of holding cash

01 April 2021

By Alexander Joshi, London UK, Behavioural Finance Specialist

You’ll find a short briefing below. To read an in-depth analysis of this article, please select the ‘full article’ tab.

-

Summary

Key takeaways

- Investors should consider the price of holding cash

- Investors need to consider the tactical value of cash versus long-term value erosion

- Cash holdings can mean missing out on gains while also paying the price for inflation

- Taking an active approach to managing cash should pay off.

Inflation expectations last month hit their highest level since January 2014, as the US 10-year inflation breakeven rate rose to 2.31%.

The prospect of a sustained period of higher prices might attract much attention in respect of investment portfolios, yet a change in the outlook for inflation also has implications for assets outside portfolios, such as cash.

Holding substantial cash piles over long periods can be a drag on performance as inflation erodes its real value over time. Examining how much cash is not being deployed may be another sensible action for investors thinking about their positioning for stronger inflation.

Holding some cash usually has merits; investment managers typically hold a small proportion of managed assets in cash for diversification purposes, however, with rates so low, an investor could use leverage to get invested. It might pay to borrow cash rather than hold it as an asset in times when cash returns are significantly below the inflation rate.

Investors also turn to cash for safety in times of market turbulence. It is worth considering whether cash is being held for financial reasons or psychological ones.

Exiting and moving into cash can provide short-term comfort from volatile markets, but there are costs too.

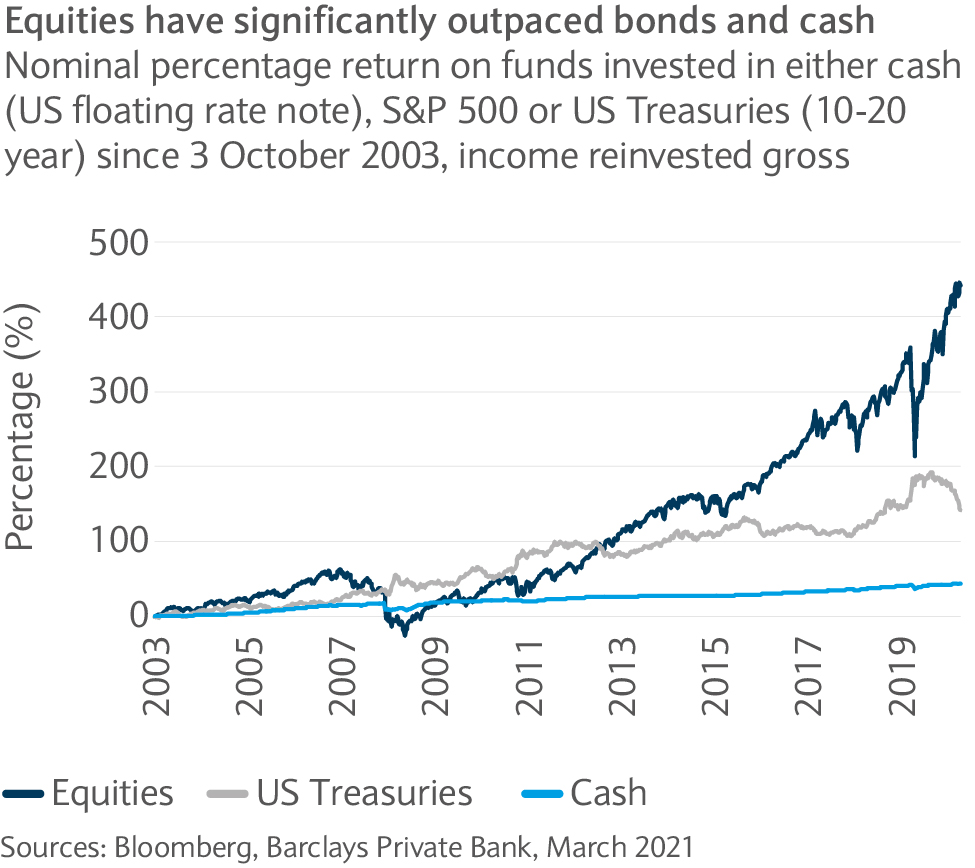

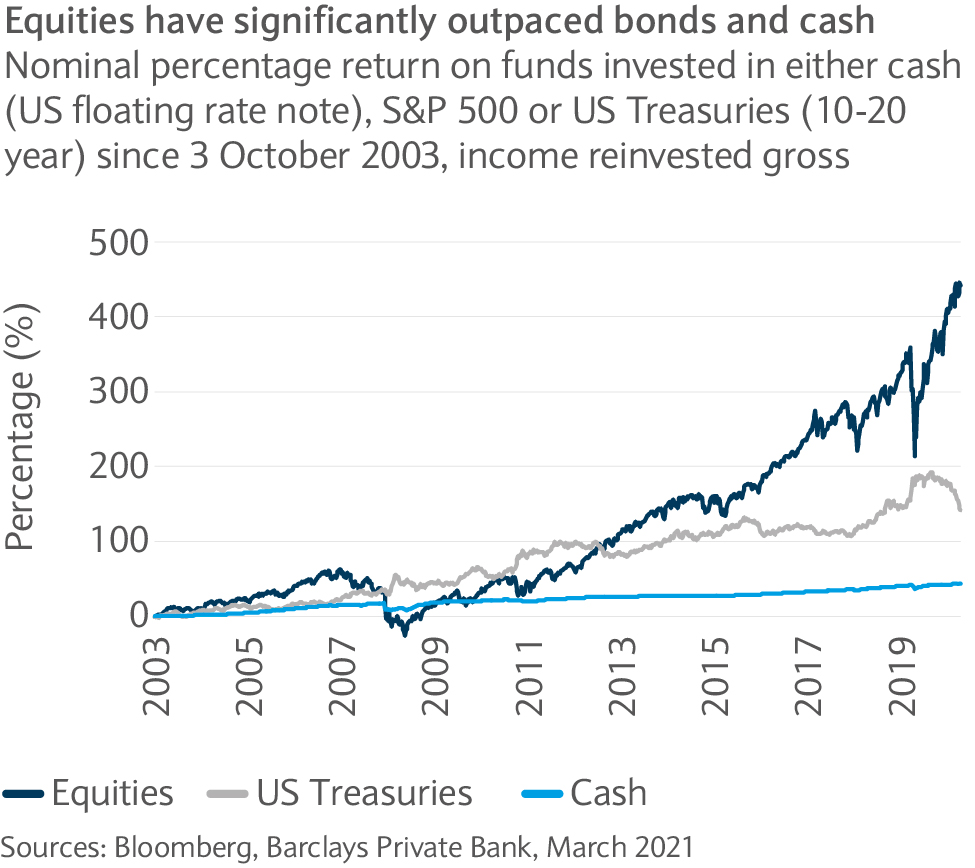

The first is the opportunity cost – the returns foregone from investing, which historically have outperformed cash (see chart). However, holding cash isn’t just about foregone gains, but also involves costs - the cost of inflation.

The table shows how a negative real yield at today’s rates would erode the value of $10m over different periods, and the larger and larger investment returns that would be required to regain the lost value. The amounts in the table are based on a real yield of -1.05% (or core inflation of 1.3% and a US Fed funds rate of 0.25%).

Inflation erodes cash over time Time Erosion of value Balance ($) Return required to regain purchasing power Initial amount - 10,000,000 2 years -2% 9,791,103 5% 5 years -5% 9,485,910 12% 10 years -10% 8,998,249 26% 25 years -23% 7,680,597 80% Holding cash may appear to be a passive choice but, for an investor already in the markets, it should be viewed as an active choice to be in cash, just like equities or bonds.

We expect a low rate environment to persist for some time, probably leading to lower returns than has been seen in recent years for a given level of risk. These challenges mean that a passive approach to investing, such as with cash, may see many clients’ portfolios disappoint. As such, being active seems as important as ever.

-

Full article

As vaccine rollouts go well in many countries, the potential for strong growth and inflation has become a major topic of conversation, especially for bond and equity investors. But what might this mean for cash holdings?

Inflation expectations last month hit their highest level since January 2014, as the US 10-year inflation breakeven rate rose to 2.31%. Despite this, monetary policy looks like remaining accommodative, with the US Federal Reserve reinforcing their forward guidance of no lift in rates through to 2023, despite upgrades to projected activity, unemployment and inflation.

It’s not just about what is in your portfolio

The prospect of persistent higher prices might attract much attention in respect of investment portfolios, particularly in light of rising yields for US Treasuries. However, a change in the outlook for inflation also has implications for assets outside of investment portfolios, such as cash holdings.

Inflation can be overlooked in day-to-day spending due to a tendency to view money in nominal rather than real terms, as nominal prices provide a convenient rule of thumb for determining value.

But, holding substantial cash piles over long periods can be a drag on performance as inflation erodes its real value over time. Examining how much cash is not being deployed may be another sensible action for investors thinking about their positioning for stronger inflation.

The reasons for holding cash reserves

There are common reasons why investors may be holding cash reserves aside from liquidity for short term needs or contingency. These could include wanting to hold cash back to deploy during a correction; reduced market exposure at the outset of the pandemic which remains on the sidelines due to the rapid recovery; and concern about capital preservation and traditional safe-haven assets.

Holding some cash usually has merits; investment managers typically hold a small proportion of managed assets in cash for diversification purposes or to tactically deploy when a short-term opportunity arises. As such, cash can play a role in maximising returns by allowing an investor to be opportunistic without having to liquidate positions.

However, with rates so low, an investor could use leverage to get invested. It might pay to borrow cash rather than hold it as an asset in times when cash returns are significantly below the inflation rate, reducing the size of the cash pile required. Structured products are another way of positioning for volatility and corrections without the risks associated with timing when to deploy cash.

Misplaced reasons

While holding some cash for opportunistic reasons may have merit, if used effectively, much of the success of timing entry to the market only comes with hindsight. Event risk is difficult to manage and markets can react differently to what is predicted in response to an event. In practice, cash can end up on the sidelines for much longer than an investor anticipates.

Investors also turn to cash for safety in times of market turbulence. It is worth considering whether cash is being held for financial reasons or psychological ones.

Exiting and moving into cash can provide short-term comfort from volatile markets, but there are costs too.

The costs of holding cash

The first is the opportunity cost – the foregone returns from investing, which historically have outperformed cash (see chart). However, holding cash isn’t just about foregone gains, but also involves costs – the cost of inflation. Whilst yields have been rising quite significantly in recent weeks, real rates of return have been negative and near historical lows in large parts of developed markets, creating a significant drag on overall portfolio returns for those holding excess cash.

Many investors hold cash because in the short term they have a fear of losses, which is understandable, but holding cash over the long term guarantees a loss as inflation erodes the value of the capital. This cost typically becomes larger the longer the holding period or the higher inflation is.

The table shows how a negative real yield at today’s rates would erode the value of $10m over different periods, and the larger and larger investment returns that would be required to regain the lost value and maintain the purchasing power of the capital. The amounts in the table are based on a real yield of -1.05% (or core inflation of 1.3% and a US Fed funds rate of 0.25%).

Inflation erodes cash over time Time Erosion of value Balance ($) Return required to regain purchasing power Initial amount - 10,000,000 2 years -2% 9,791,103 5% 5 years -5% 9,485,910 12% 10 years -10% 8,998,249 26% 25 years -23% 7,680,597 80% Rethinking cash

Holding cash can seem like a passive choice; it’s the status quo of not getting invested, and therefore is given less attention than the assets already invested. However, for an investor already in the markets it should be viewed as an active choice to be in cash, just like equities or bonds. It may be worth assessing cash in the same way, thinking about its place in a diversified portfolio of assets and additional dry powder (within reason).

We expect a low rate environment to persist for some time, probably leading to lower returns than has been seen in recent years for a given level of risk. These challenges mean that a passive approach to investing, such as with cash, may see many clients’ portfolios disappoint. As such, being active seems as important as ever.

Investors would be wise to keep in mind that there is a cost to not being invested. This cost usually widens at times of higher inflation, creating a drag on portfolio returns.

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This communication:

- Has been prepared by Barclays Private Bank and is provided for information purposes only

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department

- All opinions and estimates are given as of the date of this communication and are subject to change. Barclays Private Bank is not obliged to inform recipients of this communication of any change to such opinions or estimates

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays Private Bank

- Has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.