Smarter Succession

Discover our Smarter Succession content series which uncovers some of the tensions surrounding wealth and business transfer, and how to overcome them.

20 November 2020

8 minute read

Family rifts often arise over the topic of succession. Yet, the generations are united in the belief that wealth should support positive global change. Could sustainable investing therefore align families for seamless wealth transfer?

Heraclitus, the pre-Socratic Greek philosopher, said ‘change is the only constant in life’. It's a saying that's particularly pertinent for families today as they grapple with change on an economic, political and social level, while seeking to ensure successful continuity for their wealth and legacy.

The transfer of wealth from one generation to the next is seldom an easy process. Older wealth owners are wary of change while inheritors - a generation of digital natives and at the forefront of shifting social norms - are keen to embrace new investment outlooks and business practices. As a result, a sense of mistrust and conflict during the wealth transfer process is common.

Our research, commissioned from leading intelligence agency Savanta, shows a large proportion of wealth owners (67%) are cautious about relinquishing control of their wealth to the next generation1. The most common issues creating barriers between generations include differences in attitudes, risk appetite and educational background.

The largest issue is differences in risk appetite. Almost 40% of wealth owners, according to our research, want to take less risk in a bid to preserve their wealth for future generations. This contrasts with 26% of Millennials who want to increase their wealth, and do so in line with their sustainable values. Learn more about our research findings.

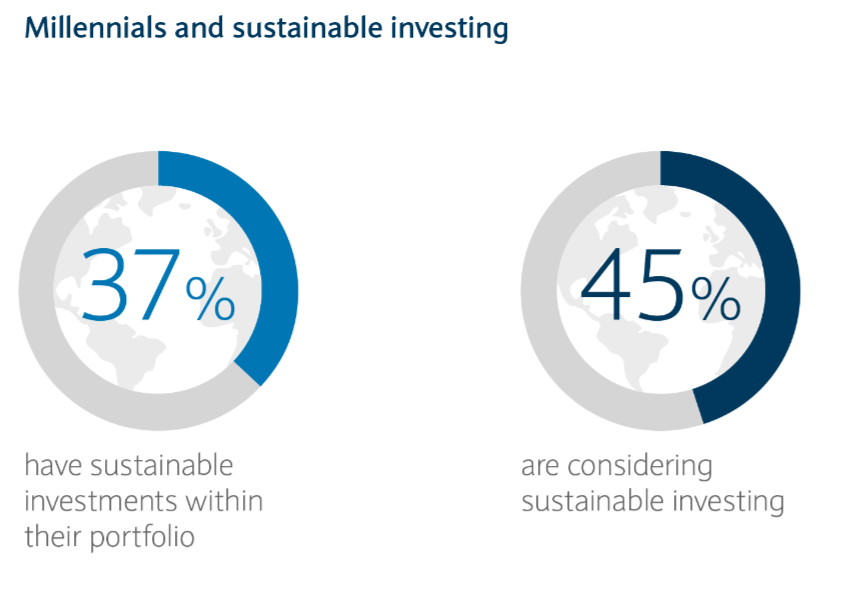

As the generations that will be the most affected by long-term issues such as climate change and discontent over social inequality, it’s unsurprising that Millennials and Generation Z are the most likely to invest sustainably. No longer seen as an investment fad, our research shows 37% have invested sustainably, and nearly half (45%) are considering it. These figures reflect a growing awareness that accompanies Millennials and Generation Z, of the challenges their generations face as they inherit wealth.

Source: Smarter Succession: The Challenges and Opportunities of Intergenerational Wealth Transfer, Barclays Private Bank, October 2020

This concept is not new. Every generation has a sense of responsibility to use their wealth appropriately and give back to the causes that matter to them the most. However, among the older generation (38%) this has traditionally been conducted through philanthropy or charity rather than their investments, our research shows. Yet the personal values that shape the older generation’s desire to give back are echoed in those of Millennials and Generation Z, who want to invest to create positive change.

As the narrative among inheritors begins to shift, sustainable investing can be a much-needed ‘bridge’ to help align family values and bring multiple generations closer together through a shared motivation to do good.

As one Barclays Private Bank UK-based client reflects: “I have enjoyed peace, freedom, and opportunity in my lifetime, but this is not guaranteed for my children and grandchildren’s future. I'm concerned about their world from an environmental and social perspective. Whatever I can do to help from the standpoint of my descendants, as well as the rest of the world, I feel I should.”

Damian Payiatakis, Head of Sustainable and Impact Investing at Barclays Private Bank, believes the research shows younger generations’ voices being heard more by their elders.

He explains: “Sustainable investing has always been most linked with younger generations. Most of the narrative around sustainable investing focuses on the benefits for your portfolio alongside people and planet. Now we can see its potential benefits for aligning your family around shared values and enabling intergenerational wealth transfer.”

Payiatakis believes sustainable investing can be a conversation enabler between generations. “A shared sense of purpose can drive a common investment outlook as well as a collective view of the family’s reputation and legacy” he says. “Discussions of what family members want to invest into, or not, define investment preferences that express the shared family values. This communication between generations alleviates trust issues or conflicts that often arise during the wealth transfer process.”

Payiatakis reflects on one Barclays Private Bank client - a three-generation strong South Asian family whose conglomerate held a large fossil fuel asset. The wealth originator had great pride in building a major energy producer that powered economic development in his home region. It was perhaps a surprise when his children did not share this same enthusiasm.

Payiatakis explains: “Through our discussion we were able to give voice to his children’s views, which contrasted heavily with his own. They were more concerned about the value of that asset in the future, and the family reputation for contributing to climate change. The next generation was focused on the stranded asset risks of the company. The youngest generation had very strong moral views about not wanting the family to hold, let alone eventually inherit, the asset.”

“The conversation was challenging but respectful and we ended the discussion with agreement to review all options, including further investment into renewable energy as an effort to diversify the business.”

Younger generations tend to manage wealth with a much more explicit emphasis on bringing their values into the investment process.

Global Head of Family Office at Barclays Private Bank

These tensions are not unusual. As issues such as climate change and social injustice rise in prominence, the need for action has become more urgent and it's Millennials and Generation Z who are most visibly championing the need for change. Therefore, it makes sense that they're not afraid of placing pressure on their families in the hope they will take sustainability into account when it comes to their business interests.

“Younger generations tend to manage wealth with a much more explicit emphasis on bringing their values into the investment process. They want their financial assets to reflect their values and beliefs,” explains Effie Datson, Global Head of Family Office at Barclays Private Bank. “Sustainability is much more important to them. It resonates at a much deeper level as they want to make a better world for themselves and future generations.”

Yet, investing sustainably and growing wealth are not standalone pieces of the wealth management puzzle. In fact, recognising other long-term themes - demographic shifts, smarter everything, the reversal of globalisation - are also are key to future-proofing family portfolios. This focus on long-term value creation and returns is a natural fit for families who want their wealth to reflect their personal aims and stand the test of time for generations to come.

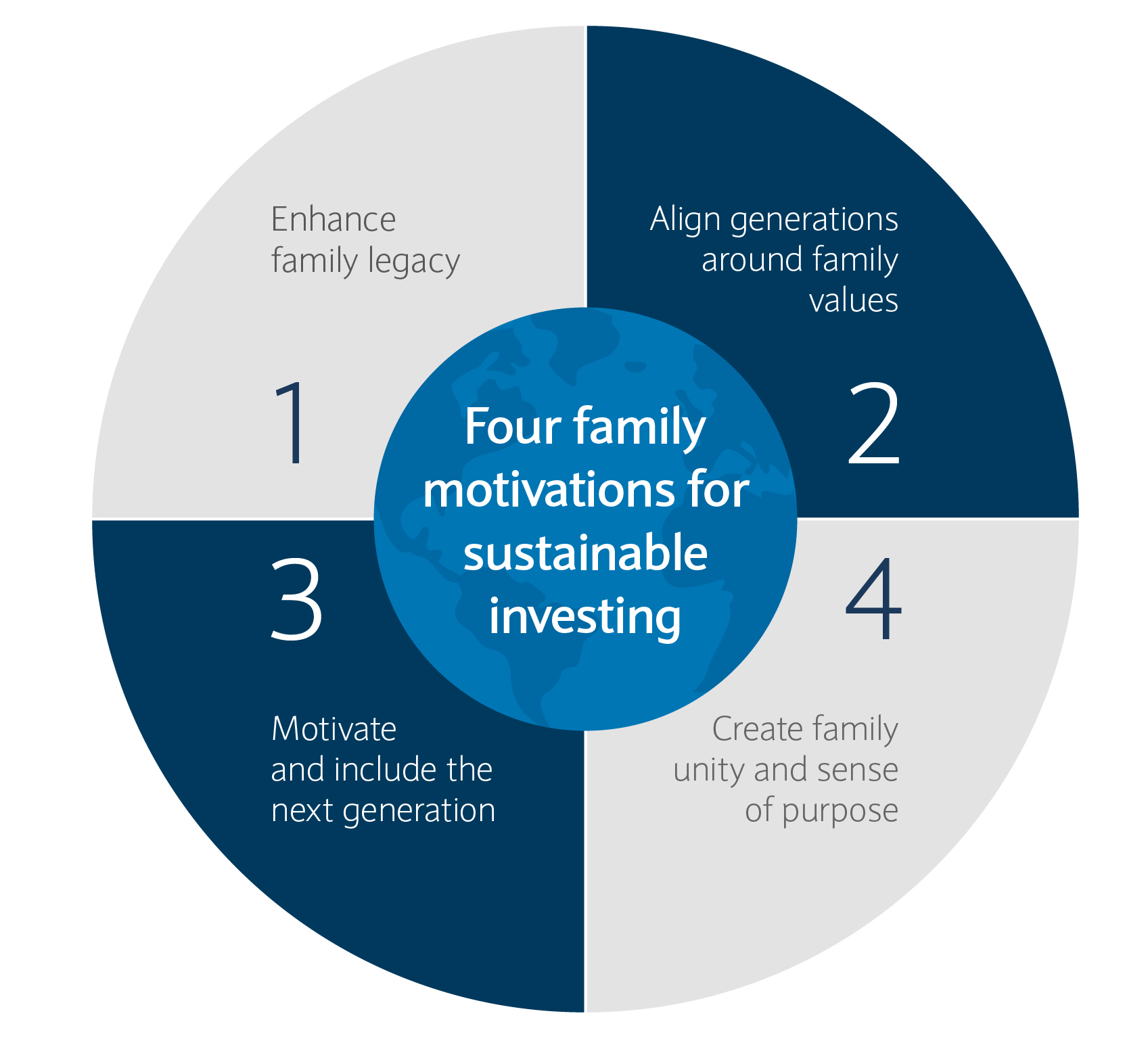

“In my experience, there are usually four motivations to use sustainable investing in the context of intergenerational wealth transfer,” explains Payiatakis. “Firstly, it’s a way to enhance the reputation and legacy of family wealth overall. Secondly, it helps ensure family values are always articulated, which does not always happen until much later in the wealth transfer process.

“It can also be used to motivate young inheritors of wealth to allow them to make more meaningful investments. This can be done by offering them an opportunity to invest from a young age or a ‘seat at the table’ to discuss sustainable causes. And finally, it can be used to create family unity and a sense of shared purpose.

“All of these motivations arise when I talk to families and ask them: what do you want to do with your wealth? Why are you interested in sustainable investing at a financial or personal level? They want to grow their money, of course, and they may see how the big societal challenges are impacting certain markets. But from a personal perspective, it comes back to their own values and motivations.”

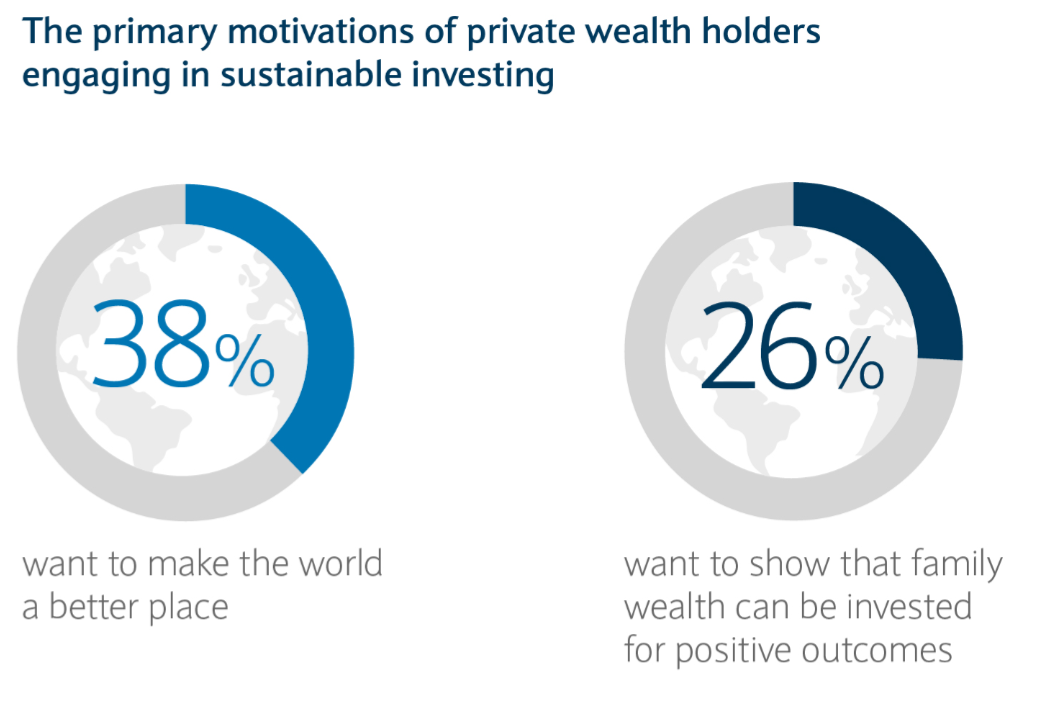

High-net-worth individuals tend to agree, according to the 2020 Investing for Global Impact report produced by Barclays Private Bank in partnership with Campden Wealth and Global Impact Solutions Today2. The report notes the number one priority for 38% of respondents engaging in sustainable investing relates to their sense of responsibility to make the world a better place. A further 26% want to show that family wealth can be invested for positive outcomes.

Source: Investing for Global Impact: A Power For Good 2020, October 2020

“There's such a thing as altruism and recognising the role of good fortune in becoming wealthy,” explains one Barclays Private Bank client.

I feel much better that the portfolio our money is invested in can stand up to any scrutiny because it is invested sustainably.

He has consciously structured the set-up of his family investment company to allow sustainable and social outcome-based investing to be a focal point for their wealth. This reflects his own desires to both invest his money in ‘good’ companies, and help ensure his wealth continues to grow for his children:

“To have a centre ground that blends investing with social outcomes – which is exactly what the world of sustainable investing does – means there is a touchpoint and point of interest for everybody involved in the transition process. I feel much better that the portfolio our money is invested in can stand up to any scrutiny because it is invested sustainably.”

COVID-19’s impact on economies and markets makes these conversations are more important than ever before. Recent figures suggest sustainable funds weathered the recessionary impact of coronavirus on markets in the first half of the year much better than non-ESG focused portfolios3.

Payiatakis agrees the pandemic has accelerated the momentum for the sector, and generations controlling family wealth are becoming aware of the benefits of investing sustainably: “COVID-19 has been the first live test of sustainable investing at a systemic level. Having seen the difference, older generations have been impressed. They are increasingly asking what options they have and how to find the high-quality sustainable investments,” he says.

At a deeper level, the pandemic has seen many families reflect on the legacy they will leave behind. It has refocused their long-term outlook and the importance of a succession plan that appropriately reflects collective family values.

Grégoire Imfeld, founder of ONE Family Governance, believes wealth creators have got to trust that their successors know how to handle their wealth and future challenges, particularly as it is impossible to predict how the world might change in the next decade and beyond. “That trust comes from the educative value you give the next generation to secure the wealth over generations,” he says.

To this end, many families may choose to create a family charter to plan how their wealth is passed on and ensure it is managed with core principles in mind. The inclusion of sustainable investing in a charter can be very important to the next generation and is a means by which the family can establish long-term objectives for their wealth.

Perhaps more importantly, by joining younger generations in their outlook on sustainable investing, there's an opportunity to approach succession planning through a new lens. This is a lens that preserves wealth in the long-term and contributes to a more sustainable planet for future generations.

Discover our Smarter Succession content series which uncovers some of the tensions surrounding wealth and business transfer, and how to overcome them.

Find out how our experts can help to protect your wealth and support your succession planning, structuring and investment needs.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays does not and will not provide tax or legal advice. Any planning must be in line with our own internal tax principles. Please note that the tax treatment depends on your personal circumstances and may be subject to change in the future.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

The Challenges and Opportunities of Intergenerational Wealth Transfer, October 2020, Barclays Private BankReturn to reference

Investing for Global Impact: A Power For Good 2020, October 2020, Barclays Private BankReturn to reference

Sustainable Reality: 2020 Update, September 2020, Morgan Stanley [PDF, 900KB]Return to reference